|

市场调查报告书

商品编码

1408566

日本资料中心伺服器市场:份额分析、产业趋势与统计、2024年至2030年成长预测Japan Data Center Server - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

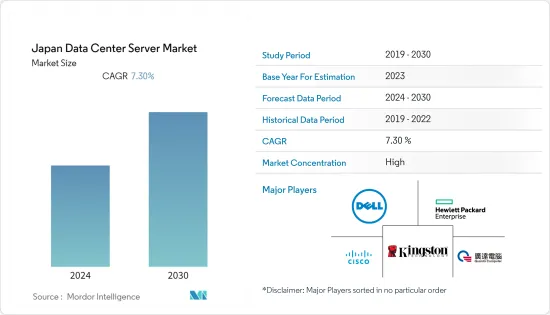

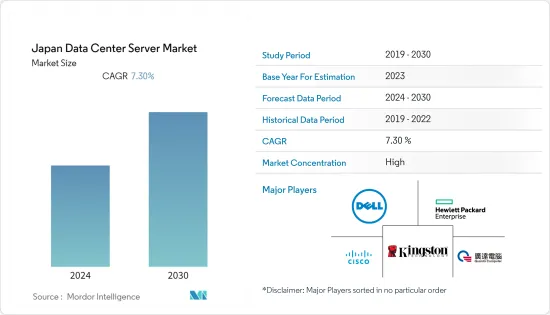

上年度,日本资料中心伺服器市场规模达到 40 亿美元,预计在预测期内复合年增长率为 7.3%。

中小企业对云端运算的需求增加、政府有关资料安全的法规以及国内企业投资的增加是推动日本资料中心需求的关键因素。

在建IT负载容量:日本资料中心市场未来IT负载容量预计到2029年将达到2,100MW。

在建面积:预计到 2029 年日本将增加到 1,000 万平方英尺。

规划的机架:到2029年,全国安装的机架总数预计将达到51.2万个。预计到 2029 年,约翰尼斯堡将拥有最多的机架数量。

规划中的海底电缆:连接日本的海底电缆有近26条,目前有6条正在兴建中。

日本资料中心伺服器市场趋势

刀锋伺服器未来几年将快速成长

- 资料中心的刀锋伺服器受益于降低的功耗和高处理能力。

- 可以插入或移除单个或多个伺服器刀片,而不会影响其他运作中的系统。这将降低硬体成本,从而鼓励行业参与者采用该技术并推动市场成长。此外,由于每个刀锋伺服器不包含单独的基础设施或底盘,因此与其他解决方案相比相对便宜。

- 为了满足最终用户的需求,顶级公司正在将重点放在资料中心的刀锋伺服器上。

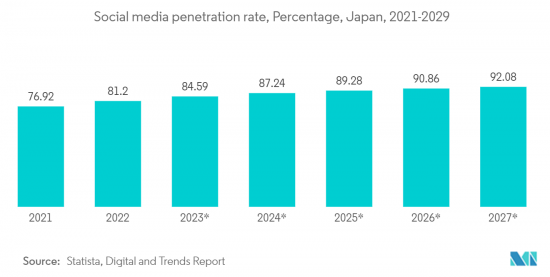

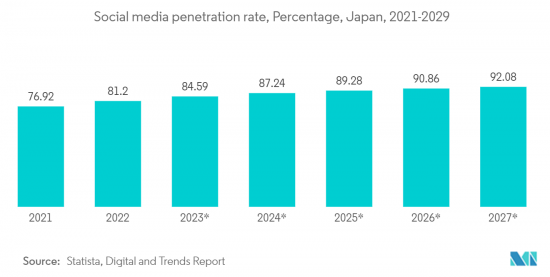

- 企业越来越多地采用云端运算、人工智慧和 IT 服务等技术,网路的普及以及社群媒体的兴起正在推动资料中心伺服器的使用。

- 展望未来,医疗保健的发展将集中在围绕数位健康、资料即时使用和分析来重组临床护理。实现这样的结果需要储存大量资料,这可能会增加预测期内对资料中心刀锋伺服器的需求。

从市场区隔来看,IT和通讯领域预计将占据较大份额。

- 随着网路流量的增加,IT 和通讯业对资料中心伺服器的需求也不断增加。通讯资料中心负责管理vRAN和5G封包核心网路等网路资源,而IT资料中心则负责管理通讯服务中所使用的IT应用。

- 2019 年 4 月,日本政府将 5G 频率分配给三家日本行动通讯业者: NTT Docomo、KDDI au 和 oftbank,以及新进业者乐天移动。未来几年,日本四通讯业者预计将花费超过140亿美元的资本投资建设5G网络,包括基地台、伺服器和光纤的投资。

- 日本高度发达的基础设施意味着其公民始终保持联繫。 2021 年至 2022 年,日本网路使用者数量增加了 844,000 人(成长 0.7%)。与 2019 年 COVID-19 之前的水平相比,随着家庭视讯会议、远距学习和视讯串流的增加,2020 年网路流量增加了 1.6 倍。

- 日本正在建立自己的国内网路和技术基础设施。日本政府计划投资数十亿美元加速超高速通讯的发展。日本设备製造商NEC和富士通以及芬兰设备製造商诺基亚宣布计划对新的行动通讯技术进行实验性试验,目标是到2030年实现6G服务的商业化。

- COVID-19 的疫情对日本经济产生了重大影响。采用数位技术对于日本在大流行期间和之后变得更具弹性至关重要。技术和应用程式可以帮助企业及其员工与客户建立联繫、开展数位业务、恢復业务营运以及部署技术以缓解物流瓶颈,从而帮助企业及其员工管理 COVID-19 的经济影响。

日本资料中心伺服器产业概况

日本资料中心伺服器市场的竞争相对较低。主要参与者包括戴尔公司、惠普企业公司、思科系统、金士顿科技公司和广达电脑公司。这些大公司都专注于扩大国内基本客群。这些公司正在利用策略合作计划来提高市场占有率和盈利。

2023 年 5 月,思科发布了 UCS X 伺服器,可将资料中心的能源使用量减少一半。透过将 Cisco Intersight 基础架构管理平台与统一运算系统 (UCS) X 系列伺服器结合,以 4:1 的伺服器整合比将资料中心消费量降低高达 52%。

2023 年 8 月,慧与宣布 phoenixNAP 将透过采用 AmpereComputing 节能处理器的云端原生 HPE ProLiant RL300 Gen11 伺服器扩展其裸机云端平台。这项扩展服务支援人工智慧推理、云端游戏和其他云端原生工作负载,并提高了效能和能源效率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 加大新资料中心建置与网际网路基础建设力度

- 更多采用云端和物联网服务

- 市场抑制因素

- 初始投资高

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 影响评估

第五章市场区隔

- 构成因素

- 刀锋伺服器

- 机架式伺服器

- 直立式伺服器

- 最终用户

- 资讯科技/通讯

- BFSI

- 政府机关

- 媒体与娱乐

- 其他最终用户

第六章 竞争形势

- 公司简介

- Dell Inc.

- Hewlett Packard Enterprise

- Cisco Systems Inc.

- Kingston Technology Company Inc.

- Quanta Computer Inc.

- Super Micro Computer Inc.

- Huawei Technologies Co. Ltd.

- Fujitsu Limited

- NEC Corporation

- Inspur Group

第七章 投资分析

第八章 市场机会及未来趋势

The Japan data center server market reached a value of USD 4.0 billion in the previous year, and it is further projected to register a CAGR of 7.3% during the forecast period. The increasing demand for cloud computing among small and medium-sized enterprises (SMEs), government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in the country.

Under Construction IT Load Capacity: The upcoming IT load capacity of the Japan data center rack market is expected to reach 2100 MW by 2029.

Under Construction Raised Floor Space: The country's construction of raised floor area is expected to increase to 10 million sq. ft by 2029.

Planned Racks: The country's total number of racks to be installed is expected to reach 512,000 units by 2029. Johannesburg is expected to house the maximum number of racks by 2029.

Planned Submarine Cables: There are close to 26 submarine cable systems connecting Japan, and currently 6 submarine cable are under construction.

Japan Data Center Server Market Trends

Blade Servers to Grow At A Faster Pace In The Coming Years

- Reduced power consumption and high processing power contribute to the blade servers in data centers.

- Single or multiple server blades can be inserted or removed without distressing another running system. It reduces hardware costs, which is likely to entice industry players to adopt the technology, thereby fueling market growth. Additionally, each server blade does not consist of a distinct infrastructure and chassis, owing to which the product is relatively cheaper as compared to other solutions.

- To cater to end-user needs, the top companies are focusing on blade servers in data centers.

- The growing adoption of technologies such as cloud computing, AI, and IT services by businesses, Internet penetration, and an increase in social media are propelling the use of servers in data centers.

- In the coming future, the evolution of healthcare focuses on the reengineering of clinical care around digital health, real-time use of data and analytics. Such achievements require a large amount of data to be stored, which would drive the need for data center blade servers over the forecast period.

IT & Telecommunication Segment To Hold Major Share In The Market

- The demand for data center servers in the IT and telecom industry is rising with increasing network traffic. Telecom data centers are responsible for managing network resources, such as vRAN and 5G packet core, while IT data centers are responsible for the IT applications used by the telecom service.

- The Japanese government assigned the three mobile operators in Japan - NTT Docomo, KDDI au, and Softbank, as well as the new arrival Rakuten Mobile, with 5G spectrum in April 2019. In the coming years, the four Japanese carriers are expected to spend more than USD 14 billion in capital expenditures, including investments in base stations, servers, and fiber optics, to build their 5G networks.

- Japan has a highly developed infrastructure that allows its people to be constantly connected. Internet users in Japan increased by 844 thousand (+0.7%) between 2021 and 2022. Compared to pre-COVID-19 levels in 2019, Internet traffic climbed 1.6 times in 2020 as the pandemic led to an increase in at-home videoconferencing, distance learning, and video streaming.

- Japan is establishing its own domestic network and technology foundation. The Japanese government plans to invest billions of dollars in promoting the development of ultra-high-speed communication. Japanese equipment manufacturers NEC and Fujitsu, as well as Finnish equipment manufacturer Nokia, announced plans to conduct experimental trials of new mobile communications technologies for the targeted commercial launch of 6G services by 2030.

- The COVID-19 outbreak significantly impacted the Japanese economy. The adoption of digital technology was essential for the nation to become more resilient during and after the pandemic. Technology applications can help businesses and their employees manage the financial effects of COVID-19 by assisting them in contacting clients and conducting business digitally, restarting business operations, and implementing technologies that reduce logistical bottlenecks.

Japan Data Center Server Industry Overview

The Japan data center server market is relatively low in terms of competition. It has some players in the market, such as Dell Inc., Hewlett Packard Enterprise, Cisco Systems Inc., Kingston Technology Company Inc., and Quanta Computer Inc. These major players focus on expanding their customer base in the country. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

In May 2023, Cisco introduced UCS X servers that cut data center energy use in half. The combination of the Cisco Intersight infrastructure management platform and Unified Computing System (UCS) X-Series servers reduces data center energy consumption by up to 52% at a 4:1 server consolidation rate.

In August 2023, Hewlett Packard Enterprise announced that phoenixNAP is expanding its Bare Metal Cloud platform with cloud-native HPE ProLiant RL300 Gen11 servers, using energy-efficient processors from Ampere Computing. The expanded services support AI inferencing, cloud gaming, and other cloud-native workloads with improved performance and energy efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in construction of new data centers, development of internet infrastructure

- 4.2.2 Increasing adoption of cloud and IoT services

- 4.3 Market Restraints

- 4.3.1 High Initial Investments

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 Form Factor

- 5.1.1 Blade Server

- 5.1.2 Rack Server

- 5.1.3 Tower Server

- 5.2 End-User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End-User

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Dell Inc.

- 6.1.2 Hewlett Packard Enterprise

- 6.1.3 Cisco Systems Inc.

- 6.1.4 Kingston Technology Company Inc.

- 6.1.5 Quanta Computer Inc.

- 6.1.6 Super Micro Computer Inc.

- 6.1.7 Huawei Technologies Co. Ltd.

- 6.1.8 Fujitsu Limited

- 6.1.9 NEC Corporation

- 6.1.10 Inspur Group