|

市场调查报告书

商品编码

1408573

自由职业平台 -市场占有率分析、产业趋势/统计、2024-2029 年成长预测Freelance Platforms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

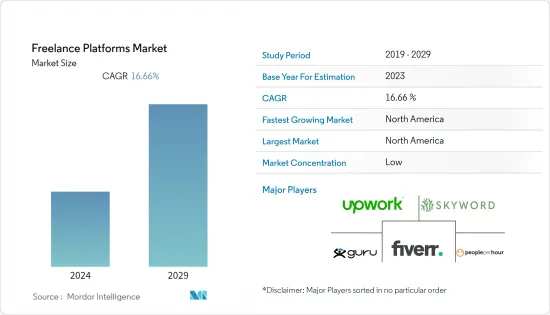

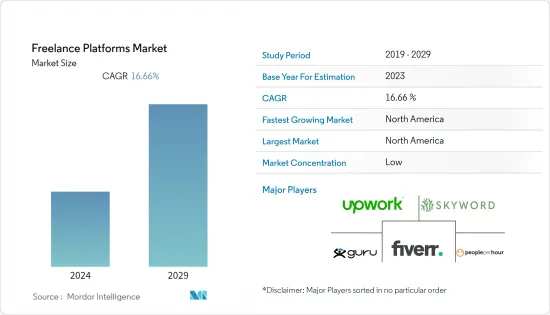

预计 2024 年自由职业平台市场规模为 65.6 亿美元,预计到 2029 年将达到 141.7 亿美元,预测期内(2024-2029 年)复合年增长率为 16.66%。

主要亮点

- 推动市场成长的关键因素是零工经济的成长、对弹性劳动力解决方案的需求不断增加以及成本效益。

- 自由职业的成长是由全球经济的快速变化所推动的。数位工作平台和线上人才市场的兴起最初使顶尖人才的取得变得商品化,而远距工作的兴起让雇主和员工都相信他们可以在任何地方工作。这种转变正在创造全球自由职业平台市场的需求。

- 零工经济的成长是推动自由职业平台市场需求的关键因素之一。以短期自由职业为特征的零工经济近年来经历了显着增长。随着远距工作的趋势,越来越多的人和企业连接到自由职业平台来寻找客户和计划。

- 在印度等国家,随着科技、专业服务、医疗保健、银行和金融服务等行业的公司僱用零工来满足他们的人才需求,对自由工作者的需求达到了新的高峰。我就是。专业人士自由职业和独立工作的趋势正在不断增加,并可能促进自由职业平台的成长。

- 然而,缺乏信任和付款方面的不确定性往往会导致自由工作者和客户之间的纠纷,从而损害平台的可信度。由于担心支付安全和交货的工作质量,客户不愿意使用自由职业平台,这对市场成长构成挑战,并影响对这些平台的信任和用户信心。

- 这场大流行迫使许多企业关闭,而那些留下来的企业则必须适应新的工作方式。因此,公司需要聘请自由工作者远距执行各种任务,对自由工作者人才的需求激增。因此,自由职业平台市场在疫情期间呈现爆炸性成长。

- 此外,疫情也加速了各类企业对自由业平台的采用。以前从未使用过自由职业平台的公司被迫这样做,并很快意识到使用自由职业人才的好处。 COVID-19 大流行让专业人士对工作和职业有了不同的观点,并激发许多人考虑自由职业。

自由职业平台市场趋势

服务业可能会以更快的速度成长

- 对专业技能不断增长的需求导致公司转向自由职业平台作为策略解决方案。自由工作者平台提供了一个市场,公司可以在其中找到具有完成短期计划各种业务所需技能的专业人员。随着产业随着不同的业务需求不断发展,自由职业平台的角色对于这些企业来说变得至关重要。

- 在不断变化的数位世界中竞争对多样化技能的需求不断增长,导致公司转向自由职业平台寻找专家。

- 自由职业市场Upwork World Co., Ltd.预测,2023年企业最需要的专业人才技能主要是技术、行销、客户服务和行政支援、会计和咨询以及设计。它与创新等有关。许多专业人士也在重新评估他们的优先事项,探索新的工作方式,并重新定义他们如何能够过着充实的职业生涯,特别是考虑到劳动力市场的差异。

- 自由职业平台使公司能够接触到由利基专家组成的多元化人才库,适应数位转型,并为其计划找到具有成本效益的解决方案,从而提高专业技能。不断增长的需求正在推动世界各地自由职业平台的增长。随着各行业对专业知识的需求持续增长,自由职业平台市场预计将透过将公司与其发展所需的精确技能联繫起来而增长。

预计北美将占据主要市场份额

- 由于不断变化的工作文化、商务策略和平衡的工作文化等因素,预计北美将占据主要市场占有率。北美的工作文化与时薪保持平衡。它提供了许多好处,包括自由选择计划、定价、弹性以及在任何地方工作的能力,让工人有更多的时间从事自由计划,而不是月薪。

- Upwork 对 3000 名专业自由工作者进行的「自由工作者前景调查」显示,到 2022 年,39% 的美国劳动力(约 6,000 万美国人)将以自由工作者身分工作,比 2021 年增加 13%。在经济和劳动市场仍不确定的情况下,Upwork估计,2022年美国自由工作者的年薪将约为1.34兆美元,比2021年增加500亿美元。这一增长主要是由寻求传统就业模式替代方案的专业人士推动的。

- 由于自由职业形势的不断发展以及该地区人们对自由职业工作的兴趣日益增长,多家主要供应商正在推出自由职业平台解决方案。例如,2023 年 8 月,Fiverr International Ltd. 发布了全新的 Fiverr。宣布推出全新 Fiverr Pro,这是一套针对中型和大型企业的新业务解决方案,并首次推出由神经网路支援的 Fiverr Neo,以解决人才与客户匹配的复杂任务。除了与Fiverr Enterprise、Fiverr Certified、Amazon Ads 和Stripe 等品牌的合作之外,这些产品的推出都支持人们在日益互联的世界中进行协作,在这个世界中,与世界级人才的联繫是企业的当务之急。这是Fiverr 努力改变的一部分我们的工作方式。

- 自由职业是美国专业人士越来越受欢迎的职业选择,尤其是那些寻求更大灵活性和自由度的人。这也是一个好征兆,表明年轻一代越来越多地接受自由职业。到 2022 年,43% 的 Z 世代专业人士和 46% 的千禧世代专业人士将成为自由工作者。影响者内容的兴起也吸引了年轻人从事自由业。美国专业人士自由职业的成长正在推动该地区的市场成长。

自由职业平台产业概况

自由职业平台市场的特点是分散,众多参与企业在全球范围内运作。市场主要企业包括Upwork Global Inc.、Fiverr International Ltd.、People Per Hour Ltd.、Skyword Inc.等。这些公司面临激烈的竞争,并积极推行合併、收购和联盟等无机策略。

2023 年7 月阿联酋自由工作者Dynamic Freelancer 是一个为个人提供签证和支援解决方案的平台,是一个将各种规模的组织与顶级自由工作者和独立顾问联繫起来的端到端市场。我们与领先的自由工作者Malt 建立了策略合作伙伴关係公司在该合作伙伴关係旨在彻底改变自由职业人才的获取方式,并为自由工作者提供在阿联酋获得广泛商业机会的机会。

2023 年 6 月,自由职业会员平台 Pollen 成功从 ANIMO VC、Founder Collective、XYZ Venture Capital、Precursor Ventures 以及知名天使投资联盟等多元化投资者资金筹措。 Pollen 的使命是使自营业民主化,最近向公众开放了其平台。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对灵活劳动力的需求不断增长

- 对专业技能的需求不断增长

- 市场挑战

- 支付方面缺乏信任和不确定性

第六章市场区隔

- 按成分

- 平台

- 服务

- 按用途

- 计划管理

- 销售与行销

- IT

- 网页与平面设计

- 其他的

- 按最终用户

- 雇主

- 自由工作者

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Upwork Global Inc.

- Fiverr International Ltd.

- Skyword, Inc.

- Guru.com

- Freelancer Technology Pty Limited

- People Per Hour Ltd.

- DesignCrowd

- Contently, Inc.

- WorkGenius

- WorkMarket, Inc.

第八章投资分析

第九章 市场未来展望

The freelance platforms market size is estimated at USD 6.56 billion in 2024 and is expected to reach USD 14.17 billion by 2029, registering a CAGR of 16.66 % during the forecast period (2024-2029).

Key Highlights

- The key drivers driving the market's growth are the gig economy's growth, the increasing need for flexible workforce solutions, and cost-effectiveness.

- Freelancing is growing because of the rapid shifts that have taken place in the global economy. The rise of digital work platforms and online talent marketplaces have initially commoditized access to top-caliber talent, and the growth in remote work has also convinced employers and employees alike that work can be done from anywhere. Such shifts are creating demand for freelance platforms market worldwide.

- The gig economy's growth is among the key drivers of demand for the freelance platforms market. The gig economy, characterized by short-term and freelance work arrangements, has experienced remarkable growth in recent years. As the remote work trend is growing, more people and businesses are increasingly connecting to freelance platforms to find clients and projects.

- In a country like India, the need for freelancers has reached a new peak as companies from various industries, such as Technology, Professional Services, Healthcare, Banking, and Financial Services, are hiring gig workers to fulfill their talent requirements. The trend of freelancing and independent work among professionals has been increasing continuously, likely contributing to the growth of freelance platforms.

- However, lack of trust and uncertainty about payments often lead to disputes between freelancers and clients, undermining the platform's reliability. Client's hesitation to use freelance platforms due to concerns about payment security and the quality of work delivered is challenging the growth of the market, impacting trust and user confidence on these platforms.

- The pandemic resulted in many business closures, and those that remained open had to adapt to new ways of working. This led to a surge in demand for freelance talent as businesses were required to hire freelancers to complete various tasks remotely. As a result, the freelance platforms market proliferated during the pandemic.

- Furthermore, the pandemic also accelerated the adoption of freelancing platforms by all types of businesses. Businesses that have never used freelancing platforms before were compelled to do so, and they quickly realized the benefits of using freelance talent. The COVID-19 pandemic offered professionals a different perspective on work and careers, leading many to pursue freelancing.

Freelance Platforms Market Trends

Services segment is likely to grow at a higher pace

- The increasing demand for specialized skills is driving businesses to turn to freelance platforms as a strategic solution, which provides a marketplace where companies can find skilled professionals required for various business functions for short-term projects. As industries continuously evolve with different business needs, the role of freelance platforms becomes essential for these businesses.

- The increasing need for a diversified set of skills to compete in the ever-changing digital world is prompting businesses to seek out experts using freelance platforms, where a global pool of professionals with the most demanding skills, including web development, programming, graphic design, content writing, etc., are available.

- Upwork Global Inc., a freelance marketplace, reported the most in-demand skills that businesses are expected to seek from skilled professionals in 2023 are primarily related to technology, marketing, customer service & admin support, accounting & consulting, design & creative, and others. Also, many professionals are re-evaluating their priorities, exploring new ways of working, and redefining ways to have a fulfilling career, especially in light of variability across the labor market.

- As freelance platforms are empowering businesses to access a diverse talent pool of niche experts, adapt to digital transformation, and find cost-effective solutions for projects, the increasing demand for specialized skills is driving the growth of freelance platforms worldwide. As the need for specialized expertise continues to rise across industries, freelance platforms market growth is anticipated to grow, connecting businesses with the precise skills required for growth.

North America Expected Dominate Market with Major Share

- North America is expected to hold a major market share due to factors like changes in work culture, business strategies, balanced work culture, etc. The work culture in North America is balanced with hourly rates. It provides the workers with more time to work on freelance projects than the monthly salary with many advantages, such as the freedom to choose the projects, quote their prices, flexibility, and the ability to work from anywhere.

- According to Upwork's Freelance Forward Survey, a study of 3,000 professional freelancers, 39% of America's workforce (roughly 60 million Americans) did freelance work in 2022, an increase of 13% compared to 2021. At a time when the economy and labor market are as uncertain as ever, Upwork found that in 2022, American freelancers accounted for roughly USD 1.34 trillion in annual wages, an increase of USD 50 billion over 2021. This increase was primarily driven by professionals seeking alternative options to the traditional job model.

- With the continuously evolving freelance landscape and the rising inclination of people towards freelance work in the region, several key vendors are introducing freelance platform solutions. For instance, in August 2023, Fiverr International Ltd. Introduced the all-new Fiverr Pro, a new business solutions suite for mid and large-size businesses, the debut of its neural network-powered Fiverr Neo to tackle the complex task of matching talent with customers. These launches, in addition to Fiverr Enterprise, Fiverr Certified, and partnerships with brands such as Amazon Ads and Stripe, are all part of an effort by Fiverr to change the way people collaborate in an increasingly connected world where connecting with world-class talent is a business imperative.

- Freelancing is becoming more and more popular as a career option for U.S. professionals, particularly those seeking more flexibility and control. It's also a good sign that younger generations are embracing freelance work increasingly. In 2022, 43% of all Gen-Z professionals and 46% of millennial professionals freelanced. The rise of influencer content is also attracting younger people to freelance. Such growth in freelance activities by professionals in the United States is driving market growth in the region.

Freelance Platforms Industry Overview

The freelance platforms market is characterized by fragmentation, with numerous players operating globally. Key players in the market include Upwork Global Inc., Fiverr International Ltd., People Per Hour Ltd., Skyword Inc., and others. These companies face intense competition and are actively pursuing inorganic strategies such as mergers, acquisitions, and partnerships.

In July 2023, Dynamic Freelancer, a platform empowering individuals with freelancer visas and support solutions in the UAE, established a strategic partnership with Malt, one of the leading end-to-end marketplaces connecting organizations of all sizes with top freelancers and independent consultants. This partnership aims to revolutionize the freelance talent acquisition landscape, offering freelancers unprecedented access to a wide range of opportunities in the UAE.

In June 2023, Pollen, a freelance membership platform, successfully secured USD 4 million in funding from a diverse group of investors, including ANIMO VC, Founder Collective, XYZ Venture Capital, Precursor Ventures, and a consortium of prominent angel investors. Pollen's mission is to democratize self-employment, and it recently launched its platform to the public.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need for Flexible Workforce

- 5.1.2 Increasing Demand for Specialized Skills

- 5.2 Market Challenges

- 5.2.1 Lack of Trust and Uncertainty about Payments

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Platfrom

- 6.1.2 Services

- 6.2 By Application

- 6.2.1 Project Management

- 6.2.2 Sales & Marketing

- 6.2.3 IT

- 6.2.4 Web and Graphic Design

- 6.2.5 Other Applications

- 6.3 By End-user

- 6.3.1 Employers

- 6.3.2 Freelancers

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Upwork Global Inc.

- 7.1.2 Fiverr International Ltd.

- 7.1.3 Skyword, Inc.

- 7.1.4 Guru.com

- 7.1.5 Freelancer Technology Pty Limited

- 7.1.6 People Per Hour Ltd.

- 7.1.7 DesignCrowd

- 7.1.8 Contently, Inc.

- 7.1.9 WorkGenius

- 7.1.10 WorkMarket, Inc.