|

市场调查报告书

商品编码

1408743

通讯业半导体元件:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Semiconductor Device In Communication Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

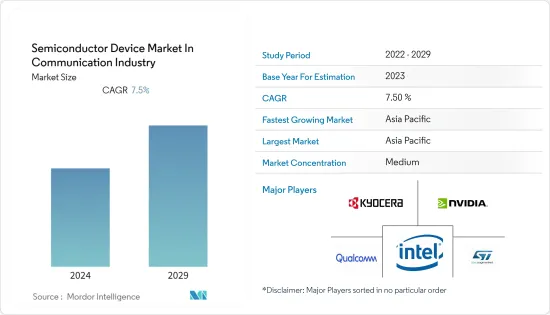

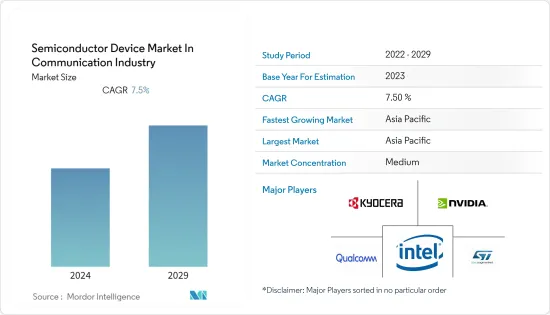

通讯业的半导体装置市场目前估值为 2,079 亿美元,预计未来五年将成长至 2,995 亿美元,预测期内复合年增长率为 7.5%。

主要亮点

- 有线或无线半导体构成了通讯技术的重要组成部分,从网路连接、基地台和路由器到电话、笔记型电脑和其他连接设备。

- 近年来,无线技术彻底改变了通讯业,全球行动用户数量正在快速成长。最熟悉的无线应用是行动电话,智慧型手机在全球行动用户数量中占据很大份额。目前大多数行动电话采用4G无线通讯系统。 4G资料通讯标准速度极快,目前正在开发的5G系统将会更快。

- 地方政府正在采取倡议支持5G的全球推广,推动通讯业半导体装置市场的成长。例如,欧盟委员会为5G技术的开发建立了官民合作关係。因此,欧盟委员会宣布提供超过 7 亿英镑(约 8.895 亿美元)的公共资金,以支持透过 Horizon 2020 计划在欧洲推出 5G。

- 此外, IT基础设施投资不断扩大,以支援数位技术的普及和网路使用者数量的增加。例如,在印度,到2025年将新建约45个资料中心,预计从2020年起投资约100亿美元。这些发展对于预测期内的市场成长来说是个好兆头。

- 然而,由于小型化是半导体行业最重要的趋势之一,对较小晶片的需求不断增加预计将阻碍市场成长,因为晶片尺寸的减小显着增加了设计和製造的复杂性。

- 此外,由于 5G 部署、数位转型和远距工作文化,疫情增加了对高速网路连线的需求。通讯通讯业受到了很大影响,因为它对于医疗保健、政府和私营部门等各个行业的高效运作至关重要。

半导体装置市场趋势

扩大 5G 技术的采用

- 随着5G引入的进展,对智慧型手机等5G相容设备的需求显着增加,这推动了通讯业半导体设备市场的需求。

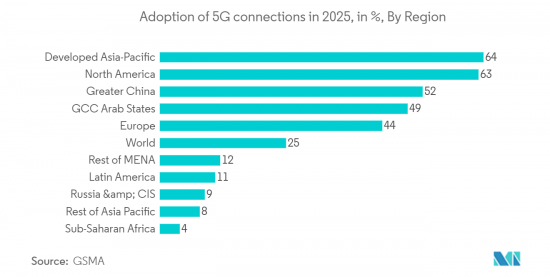

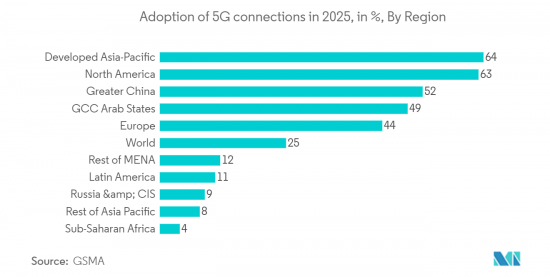

- 爱立信预计,到年终,全球5G用户数将达到44亿,占所有行动用户数的48%。该公司表示,5G 用户数达到 10 亿,比 2009 年推出的 4G 快,比 4G 早两年。

- 关键因素包括多家供应商的设备及时上市、价格下降速度快于4G,以及中国大规模且较早采用5G。爱立信表示,到 2027 年,5G 将成为用户数量占主导地位的行动接取技术。

- 改进的 5G 网路和无限资料方案可能会吸引全球更多的 5G用户。基于影片的应用程式、虚拟实境/扩增实境和游戏会产生大量资料流量。根据GSMA的数据,北美的5G签约率超过90%,是所有地区中最高的。

- 此外,5G 网路的推出也增加了对资料中心的需求。 5G网路需要大量资料处理和储存能力,以便为最终用户提供高速、低延迟的连线。

- 此外,2023 年 2 月,GSMA 报告称,5G 连线预计在未来两年内翻倍。 GSMA 还报告称,成长将来自亚太地区和拉丁美洲地区的主要市场,例如巴西和印度,这些市场最近推出了 5G 网路。印度尤其重要,Jio 和 Airtel 在 2023 年扩大服务预计将成为继续普及该地区的关键。此外,根据GSMA的数据,预计年终,印度5G保有量将达到1.45亿台。

亚太地区占主要市场占有率份额

- 随着智慧型手机、平板设备等各种技术的出现,以及各种云端基础的服务的引入,对更快、更广泛的个人行动通讯系统的需求正在稳步增长。因此,在行动装置和主要有线网路之间建立连接点的无线电基地台(BTS) 的引入变得越来越多样化。

- IT产业的快速成长和工业化也推动了亚太地区通讯业对半导体元件市场的需求。这些领域将极大地鼓励外国投资,并增加该地区对已开发国家和新技术的接触。私营和公共部门继续大力投资该地区通讯业的发展,因为使用快速且有效率的通讯网路对于这些部门的发展至关重要。

- 就销售额而言,日本的通讯业是世界上最大的电信业之一。过去二十年来,儘管整体市场是由经济和人口成长放缓推动的,但很少有大型固定和行动网路营运商对铁塔和IT基础设施进行了大量投资。印度的5G普及也不断进步,日本的目标是到年终几乎实现5G完全覆盖。

- 此外,在用户基础不断扩大以及政府对该行业采取的自由和改革态度的推动下,印度通讯业正在经历快速成长。例如,根据 IBEF 的数据,印度是全球第二大通讯市场之一,到 2022 年 4 月用户数将达到 11.6 亿。此外,2022年4月至6月,印度网路用户总数达8.3686亿。此外,到2022年6月,无线部门将占电话用户总数的95.4%。

- 此外,印度政府已开始专注于开拓数位化强劲经济,并采取了多项倡议来加速数位技术的采用。这正在推动该地区通讯半导体装置市场的成长。

- 资料中心数量的增加也可能为通讯业半导体设备市场的公司提供重大机会。例如,2023 年 3 月,OVH Cloud 宣布将在印度开设第一个资料中心,作为其亚太扩张计画的一部分。该公司还计划明年在澳洲和新加坡再部署两个资料中心。同样,2022 年 6 月,ST Telemedia 全球资料中心 (STT GDC) 宣布计划在韩国建造新的资料中心站点。

半导体装置产业概况

由于整合不断加强、技术快速进步和地缘政治动态变化等因素,通讯业的半导体装置市场波动较大。在永续竞争优势来自于创新的市场中,竞争日益激烈。在此背景下,鑑于最终用户对半导体製造的高品质期望,必须解决品牌识别的重要性。

几家主要公司主导了这个市场,包括英特尔公司、英伟达公司、京瓷公司、高通技术公司和意法半导体公司,导致市场渗透率很高。

2023 年 4 月,京瓷公司宣布取得突破性进展。它是一款新型 EIA 0201 尺寸电容器 (MLCC),拥有业界最高的 10 微法电容。京瓷的KGM03系列广泛应用于穿戴式装置和智慧型手机。这种紧凑型 MLCC 容量的增加使设计人员能够以更少的组件和最小的空间满足系统要求。

2022 年 6 月,德克萨斯) 推出了一款新型无线微控制器(MCU),扩展了其连接产品组合,该微控制器可提供高品质蓝牙低功耗(LE),而成本仅为竞争产品的一小部分。 SimpleLink 蓝牙 LE CC2340 系列利用该公司在无线通讯领域的丰富经验,提供一流的待机电流和射频 (RF) 性能。

2022 年 3 月,ADI 宣布推出毫米波 (mmW) 5G 前端晶片组,旨在涵盖所需频宽。这项创新使设计人员能够简化设计,并更快地将更小、更通用的 5G 无线电推向市场。该晶片组由四个高度整合的 IC 组成,提供全面的解决方案,可显着减少 24 至 47GHz 5G 无线电所需的组件数量。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 宏观趋势对产业的影响

第五章市场动态

- 市场驱动因素

- 扩大 5G 技术的采用

- 市场挑战

- 半导体晶片短缺

第六章市场区隔

- 依设备类型

- 离散半导体

- 光电子学

- 感应器

- 积体电路

- 模拟

- 逻辑

- 记忆

- 微

- 微处理器 (MPU)

- 微控制器(MCU)

- 数位讯号处理器(DSP)

- 按地区

- 美国

- 欧洲

- 日本

- 中国

- 韩国

- 台湾

- 世界其他地区

第七章 竞争形势

- 公司简介

- Intel Corporation

- Nvidia Corporation

- Kyocera Corporation

- Qualcomm Incorporated

- STMicroelectronics

- Micron Technology Inc.

- Xilinx Inc.

- NXP Semiconductors NV

- Toshiba Corporation

- Texas Instruments Inc.

- Taiwan Semiconductor Manufacturing Company(TSMC)Limited

- SK Hynix Inc.

- Samsung electronics co. ltd

- Fujitsu Semiconductor Ltd

- Rohm Co. Ltd

- Infineon Technologies AG

- Renesas Electronics Corporation

- Advanced Semiconductor Engineering Inc.

- Broadcom Inc.

- ON Semiconductor Corporation

第八章投资分析

第9章市场的未来

The semiconductor device market in the communication industry is valued at USD 207.9 billion in the current year and is expected to register a CAGR of 7.5% during the forecast period to become USD 299.5 billion by the next five years.

Key Highlights

- Wired or wireless semiconductors form an important part of communications technology, from network connectivity, base stations, and routers to phones, laptops, and other connected devices.

- In recent years, wireless technology has revolutionized the communication industry, with mobile subscriptions across the world growing at a rapid rate. The most familiar wireless application is the mobile phone, where smartphones account for a major share of all mobile subscriptions globally. Today's cell phones mostly use 4G wireless communications systems. The data transmission standards for 4G are extremely fast, and 5G systems currently in development will be even faster.

- The regional governments are taking initiatives to support the global rollout of 5G and are driving the growth of the semiconductor device market in the communication industry. For instance, the European Commission has established a public-private partnership to develop 5G technology. As a result, the European Commission has announced over GBP 700 million (~USD 889.5 million) in public funding to support the rollout of 5G across Europe through its Horizon 2020 program.

- Furthermore, investments in supporting IT infrastructure have also been growing to support the growing penetration of digital technologies and a growing number of internet users. For instance, by 2025, about 45 new data centers will come up in India, attracting investment of nearly USD 10 billion since 2020. Such trends generate a favorable outlook for the studied market's growth during the projected timeline.

- However, as miniaturization is one of the high-priority trends in the semiconductor industry, the increasing demand for smaller chips is expected to hinder the market's growth, as shrinking chip size significantly increases design and manufacturing complexity.

- Moreover, the pandemic increased the 5G deployment, digital transformation, and demand for high-speed network connectivity due to the remote work culture. The communication industry has been greatly impacted because communications are crucial to the efficient running of various industries, including the medical, governmental, and private sectors.

Semiconductor Device Market Trends

Growing Adoption of 5G Technology

- The increasing implementation of 5G has resulted in a significant demand for 5G-enabled devices like smartphones, which, in turn, drives the demand for the semiconductor device market in the communication industry.

- Ericsson forecasts that there will be 4.4 billion 5G subscriptions across the globe by the end of 2027, accounting for 48% of all mobile subscriptions. As per the company, 5G subscription uptake is faster than that of 4G following its launch in 2009, reaching 1 billion subscriptions two years earlier than 4G did.

- Key factors include the timely availability of devices from several vendors, with prices falling faster than 4G, and China's large, early 5G deployments. According to Ericsson, 5G will become the dominant mobile access technology by subscriptions in 2027.

- The improved 5G network and unlimited data plans will attract more 5G subscribers across the globe. Video-based apps, virtual/augmented reality, and gaming generate huge data traffic. According to GSMA, 5G subscriptions in North America will be more than 90%, the highest among all regions.

- Moreover, the deployment of 5G networks is increasing the demand for data centers. This is because 5G networks require a significant amount of data processing and storage capabilities to provide high-speed, low-latency connections to end users.

- Furthermore, in February 2023, GSMA reported that 5G connections are anticipated to double over the upcoming two years. In addition, GSMA also reported that the growth would come from key markets within APAC and LATAM, like Brazil and India, which have recently launched 5G networks. India will be particularly significant, with the expansion of services from Jio and Airtel in 2023 expected to be key to continued adoption in the region. Moreover, as per GSMA, 5G is anticipated to account for 145 million in India by the end of 2025.

Asia-Pacific to Hold Significant Market Share

- The emergence of different technologies, including the introduction of smartphones, tablets, and a variety of cloud-based services, has driven a steady increase in demand for faster and more pervasive personal mobile communication systems. This, in turn, has resulted in the introduction of a growing variety of wireless base stations (BTS), creating the connection points between the mobile terminals and the main wired network.

- The rapid growth of the IT sector and industrialization are also driving the demand for the semiconductor device market in the communications industry in the Asia-Pacific region. These sectors will greatly facilitate foreign investment, increasing the region's exposure to developed countries and new technologies. The private and public sectors are continuously investing heavily in developing the region's telecommunications industry, as the availability of high-speed and efficient telecommunications networks is essential for the growth of these sectors.

- The Japanese telecommunications industry is among the largest in the world in terms of revenue. Few major fixed and mobile network operators have invested heavily in towers and IT infrastructure over the past two decades despite the overall market being fueled by slow economic and demographic growth. 5G adoption is also gaining traction in the country, and Japan aims to reach almost full 5G coverage by the end of 2030.

- Moreover, the Indian communication industry has been witnessing sharp growth driven by a growing subscriber base and the liberal and reformist government approach towards the industry. For instance, according to IBEF, India is among the world's second-largest telecommunications markets, with a subscriber base of 1.16 billion until April 2022. Furthermore, in April-June 2022, the total number of internet subscribers in India reached 836.86 million. Additionally, the wireless segment accounted for 95.4% of the total telephone subscriptions In June 2022.

- Additionally, the Indian government has started to focus significantly on developing a solid digitized economy and is taking several initiatives to promote the adoption of digital technologies; this, in turn, is aiding the growth of the semiconductor device market in the communication industry in the region.

- Increasing the number of data centers may also offer massive opportunities for companies operating in the semiconductor device market in the communication industry. For instance, in March 2023, OVH Cloud announced the launch of its first data center in India as a part of its Asia Pacific expansion plan. The company will also deploy two additional data centers in Australia and Singapore by next year. Similarly, in June 2022, ST Telemedia Global Data Centers (STT GDC) announced its plans for a new data center site in South Korea.

Semiconductor Device Industry Overview

The semiconductor device market in the Communication Industry is experiencing fluctuations due to factors such as increased consolidation, rapid technological advancements, and shifting geopolitical dynamics. In a market where sustainable competitive advantages are driven by innovation, competition is on the rise. In this context, the importance of brand identity must be addressed, given the high-quality expectations of end-users when it comes to semiconductor manufacturing.

Several major players dominate this market, including Intel Corporation, Nvidia Corporation, Kyocera Corporation, Qualcomm Technologies Inc., and STMicroelectronics NV, leading to high levels of market penetration.

In April 2023, Kyocera Corporation announced a groundbreaking development - a new capacitor (MLCC) in the EIA 0201 size category, boasting the industry's highest capacitance at 10 microfarads. The KGM03 series from Kyocera is widely used in wearable devices and smartphones. The increased capacity of these compact MLCCs empowers designers to meet system requirements with fewer components and minimal space utilization.

In June 2022, Texas Instruments extended its connectivity portfolio by introducing new wireless microcontrollers (MCUs) that offer high-quality Bluetooth Low Energy (LE) at a fraction of the cost of competitors. The SimpleLink Bluetooth LE CC2340 series leverages the company's extensive experience in wireless communication and delivers best-in-class standby current and radio-frequency (RF) performance.

March 2022 saw Analog Devices Inc. introduce a millimeter-wave (mmW) 5G front-end chipset designed to cover the necessary frequency bands. This innovation enables designers to simplify their designs and bring smaller and more versatile 5G radios to the market faster. The chipset consists of four highly integrated ICs, offering a comprehensive solution that significantly reduces the number of components required for 24 to 47GHz 5G radios.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macro Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of 5G Technology

- 5.2 Market Challenges

- 5.2.1 Semiconductor Chip Shortage

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Discrete Semiconductors

- 6.1.2 Optoelectronics

- 6.1.3 Sensors

- 6.1.4 Integrated Circuits

- 6.1.4.1 Analog

- 6.1.4.2 Logic

- 6.1.4.3 Memory

- 6.1.4.4 Micro

- 6.1.4.4.1 Microprocessors (MPU)

- 6.1.4.4.2 Microcontrollers (MCU)

- 6.1.4.4.3 Digital Signal Processor

- 6.2 By Geography

- 6.2.1 United States

- 6.2.2 Europe

- 6.2.3 Japan

- 6.2.4 China

- 6.2.5 Korea

- 6.2.6 Taiwan

- 6.2.7 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Nvidia Corporation

- 7.1.3 Kyocera Corporation

- 7.1.4 Qualcomm Incorporated

- 7.1.5 STMicroelectronics

- 7.1.6 Micron Technology Inc.

- 7.1.7 Xilinx Inc.

- 7.1.8 NXP Semiconductors NV

- 7.1.9 Toshiba Corporation

- 7.1.10 Texas Instruments Inc.

- 7.1.11 Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- 7.1.12 SK Hynix Inc.

- 7.1.13 Samsung electronics co. ltd

- 7.1.14 Fujitsu Semiconductor Ltd

- 7.1.15 Rohm Co. Ltd

- 7.1.16 Infineon Technologies AG

- 7.1.17 Renesas Electronics Corporation

- 7.1.18 Advanced Semiconductor Engineering Inc.

- 7.1.19 Broadcom Inc.

- 7.1.20 ON Semiconductor Corporation