|

市场调查报告书

商品编码

1630382

光敏半导体元件:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Photosensitive Semiconductor Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

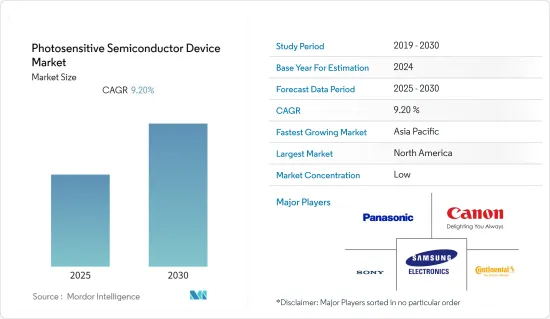

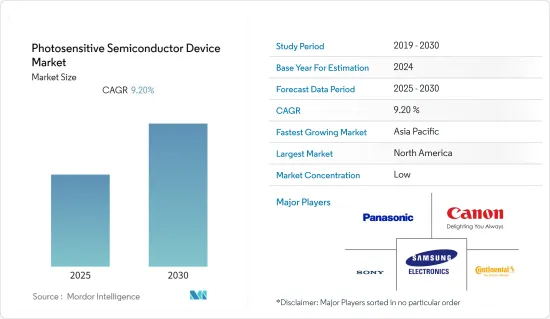

光敏半导体装置市场预计在预测期内复合年增长率为 9.2%。

主要亮点

- 光电二极体感测器广泛应用于医疗设备和科学设备,包括医学成像、光谱学和脉搏血氧饱和度,预计将推动该市场的成长。

- 此外,用于影像感测器的光敏半导体装置正在显着扩展其应用领域。例如,CMOS 技术提供了许多优势,电子製造商可以利用这些优势来改进设备设计、在市场上区分产品并满足特定的消费者需求。因此,影像感测器的成长将推动光敏半导体元件市场的成长。

- 中国、印度、韩国、台湾和日本等亚洲国家拥有大量此类设备製造商,并且在新冠肺炎 (COVID-19) 期间经历了封锁和生产计划中断。由于全球大部分经济体处于封锁状态,交货仅限于必需品,且企业收益目标也被修改,导致这段期间的销售额下降。在此期间,由于病毒传播,世界各国政府下令关闭和暂停消费性电子产品製造流程,光敏半导体装置市场受到负面影响。然而,各行业、组织、学校和大学对医疗保健设备的使用以及线上工作和学习导致了市场的稳定成长。

光敏半导体装置市场趋势

家用电子电器领域预计将占据最大市场占有率

- 光敏半导体装置主要用作许多影像设备和数位相机中的影像感测器,以提高影像消融和储存的品质。这些影像应用在工业、媒体、医疗和消费应用中享有很高的采用率。

- 由于智慧型手机、保全摄影机、高解析度相机和摄影机的需求不断增加,光敏半导体装置市场预计在预测期内将进一步成长。世界各地的製造商都在努力提高解析度、性能和像素尺寸等关键参数。

- 此外,CMOS 感光元件中越来越多地使用光敏半导体元件,透过提供更多片上功能来简化相机设计,从而在消费市场的低成本端占据一席之地。例如,SONY新推出的IMX686 Exmor RS 64MP CMOS感测器应用于三星、华为、一加、小米等众多中阶智慧型手机。

- 然而,由于各行各业的公司都经历了严重的景气衰退,员工的薪资也有所减少。这可以直接影响采用光敏半导体装置设计的消费性电子产品的购买决策,并影响短期的市场成长。

亚太地区预计成长最快

- 在整个全部区域,中阶在智慧型手机、平板电脑和电视等消费性电子产品上的支出不断增加,推动了消费性电子市场的成长,并带动了该地区光敏半导体装置的成长。

- 许多公司正在采用新技术并在该地区进行市场领先的开发。例如,2022年5月,三菱电机公司宣布,该公司已开发出一种在轨积层製造,利用光敏树脂和太阳紫外线在太空真空中3D列印卫星天线。

- 此外,2022 年 1 月。东丽宣布开发出负型感光聚酰亚胺材料。这种新产品保持了聚酰亚胺特有的耐热性、机械性能和附着力,同时提高了分辨率并能够在 100微米和其他厚膜上实现高清图案化。这可能是市场的主要驱动力。

- 该地区军事基础设施发展的高投资也推动了市场成长。例如,根据官方文件和军方资讯来源,印度将在2022-23年在国防和军事上花费187.6亿美元,并将在未来继续投资,预计将进一步增加。此类投资将增加对监控设备的需求,进而支持该地区光敏半导体元件的成长。

光敏半导体元件产业概况

全球光敏半导体装置市场高度分散,有多家製造商提供产品。公司不断投资于产品和技术,以更低的价格为消费者提供更好的产品。此外,公司正在收购专门经营这些产品的公司,以增加其市场占有率。

- 2022 年 9 月 -FUJIFILM株式会社宣布推出无反光镜数位相机「FUJIFILM X-H2」。该公司将其称为紧凑型轻量相机的最新阵容“X系列”。据称还配备了新开发的背照式40.2MP X-Trans CMOS 5 HR感测器和高速X-Processor 5,可以拍摄高解析度静态影像和高清8K/30P影片。

- 2021 年 12 月 -Canon Inc.宣布将于 2022 年开始批量生产用于保全摄影机的 3.2MP SPAD 感测器。据该公司介绍,SPAD感测器是一款设计独特的影像感测器,每个像素都有一个电子元件。对于 CMOS 感测器,所储存的电子电荷的读出包含电子噪声,这会降低影像质量,具体取决于所储存的光的测量方式。另一方面,使用SPAD感测器,杂讯不会以电讯号形式干扰读取光,因此可以在没有讯号杂讯的情况下捕捉清晰的拍摄对象,并且具有拍摄时的高灵敏度和高精度距离测量等优点。能

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 对改进成像和光学感测解决方案的需求

- 长寿命、低功耗

- 市场限制因素

- 物价压力加大

- 评估 COVID-19 对产业的影响

第五章市场区隔

- 按设备

- 光电管

- 光电二极体

- 光电电晶体

- 光敏电阻

- 光电IC

- 按最终用户

- 汽车/运输设备

- 家用电子电器

- 航太/国防

- 卫生保健

- 产业

- 安全与安全

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- Sony Corporation

- Samsung Electronics Co. Ltd

- Canon Inc.

- SK Hynix Inc.

- Fujifilm

- Panasonic Corporation

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Teledyne Technologies Inc.

- Hamamatsu Photonics KK

第七章 投资分析

第八章 市场机会及未来趋势

简介目录

Product Code: 70354

The Photosensitive Semiconductor Device Market is expected to register a CAGR of 9.2% during the forecast period.

Key Highlights

- The extensive use of photodiode sensors in medical products for medical imaging, spectroscopy, and pulse oximetry, among other medical and scientific instrumentations, is expected to drive the growth of the photodiode in the market.

- Moreover, photosensitive semiconductor devices in image sensors have immensely increased their application area. For instance, CMOS technology offers plenty of benefits that electronics manufacturers leverage to improve device design, differentiate their products in the marketplace, and meet specific consumer needs. Therefore, the growth of image sensors will boost the growth of photosensitive semiconductor devices in the market.

- Asian countries like China, India, South Korea, Taiwan, and Japan have a significant presence of manufacturers of these devices and had experience lockdowns and disrupted production schedules during Covid-19. The sales went down during that period as the lockdown in most global economies had resulted in deliveries limited to essentials and companies revising their revenue targets. Amid the spread of viruses, governments worldwide mandated the lockdown and halt of consumer electronics manufacturing processes, negatively impacting the photosensitive semiconductor device market during that period. However, the use of healthcare devices and online working and study opted by various industries, organizations, schools, and colleges led to a steady growth in the market.

Photosensitive Semiconductor Device Market Trends

Consumer Electronic Segment is Expected to Hold Largest Market Share

- Photosensitive semiconductor devices are primarily used as image sensors in many imaging devices and digital cameras to enhance the quality of cauterization and storage of images. These imaging applications have high adoption in industrial, media, medical, and consumer applications.

- Due to the increasing demand for smartphones, security cameras, high-definition cameras, and camcorders, the photosensitive semiconductor device market is expected to grow more during the forecast period. Manufacturers worldwide strive to enhance main parameters, such as resolution, performance, and pixel size.

- Additionally, the increase in the use of photosensitive semiconductor devices in CMOS sensors is providing a foothold at the low-cost end of the consumer market by offering more functions on-chip that simplify camera design. For instance, Sony's newly launched IMX686 Exmor RS 64MP CMOS sensors are being used in many mid-range phones of Samsung, Huawei, OnePlus, Xiaomi, etc.

- However, due to the vast economic downturn experienced by companies across industries, employees are also witnessing salary cuts. This may directly impact the purchase decision for consumer electronics designed with photosensitive semiconductor devices and affect the growth of the market on a short-term basis.

Asia Pacific is Expected to be the Fastest growing Region

- Across the region, there is an increase in spending by the middle class on consumer electronics products such as smartphones, tablets, televisions, etc., which is driving the consumer electronics market growth and guiding the growth of photosensitive semiconductor devices in the region.

- Many companies are using new technologies and development in the region that can drive the market. For instance, in May 2022, Mitsubishi Electric Corporation announced that the company had developed an on-orbit additive-manufacturing technology that uses photosensitive resin and solar ultraviolet light for the 3D printing of satellite antennas in the vacuum of outer space.

- Additionally, in January 2022. Toray Industries, Inc. announced that the company had developed a negative photosensitive polyimide material. This new offering maintains polyimides' characteristic thermal resistance, mechanical properties, and adhesiveness while increasing resolutions and enabling high-definition pattern formation on 100-micrometer and other thick films. And that will drive the market significantly.

- The high investments in developing the infrastructure of armed forces in the region have boosted the market's growth. For instance, according to an official document and military sources, India has spent USD 18.76 billion in the year 2022-23 on its defense and armed forces, which is expected to increase more in the future to update the armed forces and reinforce their combat capacities over regional rivals. These investments will increase the demand for surveillance equipment, which will, in turn, boost the growth of photosensitive semiconductor devices in the area.

Photosensitive Semiconductor Device Industry Overview

The Global Photosensitive Semiconductor Device Market is highly fragmented, having multiple manufacturers providing the product. Companies continuously invest in products and technology to encourage better products at lower prices for their consumers. The companies are also acquiring companies that specifically deal with these products to boost their market share.

- September 2022 - FUJIFILM Corporation announced the launch of the mirrorless digital camera 'FUJIFILM X-H2'. The company stated it as the latest addition to the X Series of compact, lightweight cameras lineup. Moreover, they also said that the camera features the new back-illuminated 40.2MP X-Trans CMOS 5 HR sensor and the high-speed X-Processor 5 capable of capturing high-resolution stills and high-definition 8K/30P video.

- December 2021 - Canon Inc. announced to start of mass production of the 3.2MP SPAD sensor for security cameras in 2022. As per the company, the SPAD sensor is a uniquely designed image sensor with each pixel possessing an electronic element. With CMOS sensors, the readout of the accumulated electronic charge contains electronic noise, which diminishes image quality due to how accumulated light is measured. Meanwhile, with SPAD sensors, noise does not interfere with the readout of light as electrical signals, which enables clear image capture of subjects free from signal noise and provides advantages such as greater sensitivity during image capture and high-precision distance measurement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Demand for Improved Imaging and Optical Sensing Solutions

- 4.4.2 Long Life and Low Power Consumption

- 4.5 Market Restraints

- 4.5.1 Increasing Price Pressure

- 4.6 Assessment of Impact of Covid-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Device

- 5.1.1 Photocell

- 5.1.2 Photodiode

- 5.1.3 Phototransistor

- 5.1.4 Photoresistor

- 5.1.5 Photo IC

- 5.2 End User

- 5.2.1 Automotive and Transportation

- 5.2.2 Consumer Electronics

- 5.2.3 Aerospace and Defence

- 5.2.4 Healthcare

- 5.2.5 Industrial

- 5.2.6 Security and Survelliance

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Sony Corporation

- 6.1.2 Samsung Electronics Co. Ltd

- 6.1.3 Canon Inc.

- 6.1.4 SK Hynix Inc.

- 6.1.5 Fujifilm

- 6.1.6 Panasonic Corporation

- 6.1.7 Continental AG

- 6.1.8 Robert Bosch GmbH

- 6.1.9 Denso Corporation

- 6.1.10 Teledyne Technologies Inc.

- 6.1.11 Hamamatsu Photonics K.K.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219