|

市场调查报告书

商品编码

1408750

有机基板包装材料:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Organic Substrate Packaging Material - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

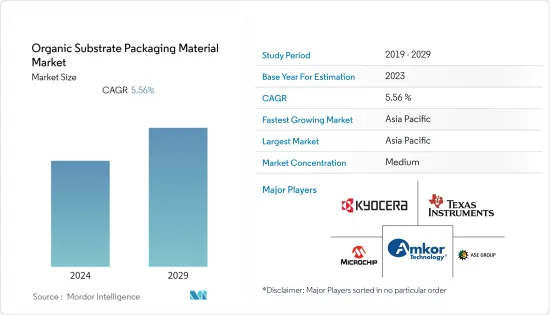

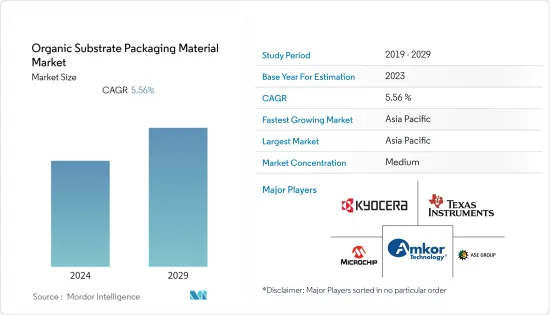

目前有机基板封装市场规模为138.7亿美元。

预计未来五年将达到 181.8 亿美元,预测期内复合年增长率为 5.56%。

主要亮点

- 在预测期内,对 ADAS(高级驾驶辅助系统)的需求不断增长将推动有机基板封装材料的需求。根据英特尔预测,2030年国际汽车销售量预计将达到约1.014亿辆,而自动驾驶汽车预计到2030年将占车辆登记量的约12%。

- 使用有机基板使印刷基板製造商能够采用增材筛选製程而不是边缘去除蚀刻方法,最终结果是几乎完全有机的 PCB 设计。

- 科技互联网 (IoT) 技术应用于多种产业。由于其快速成长,印刷基板(PCB) 製造商正在引入各种变革和创新来满足客户需求。从智慧型手机和健身追踪器到创新的工厂设备,行动装置的空间管理至关重要。随着企业寻求建立数位足迹以及人们依靠物联网来支援他们的日常生活功能,这种需求预计会在接受调查的市场中成长。

- 2022年6月,代表欧洲整个电子製造和设计供应链的组织SEMI Europe呼吁儘早通过《欧洲晶片法》,并敦促欧盟委员会、成员国和议会参与该法案的辩论。叫出来。该法律旨在增强欧洲在半导体技术和应用方面的竞争力和弹性,同时支持该地区向数位和绿色经济转型。

- 此外,汽车电子产品需要能够承受高温的有效封装解决方案。如此恶劣的条件需要基于对所用有机基板材料的热机械行为的详细了解的新方法。此外,由于现代车辆更加依赖电子元件,将基板PCB 纳入某些新应用中变得越来越普遍。它们用于汽车行业的各种应用,包括电源管理、驾驶员辅助系统、照明控制、车内娱乐系统和其他电子控制。据 OICA 称,2022 年全球汽车产量将达到约 8,500 万辆。这个数字比与前一年同期比较增加了约6%。

- 此外,电动车和混合动力汽车在沿岸地区普及,特别是在以色列、阿曼、沙乌地阿拉伯、约旦和阿拉伯联合大公国。例如,透过杜拜计程车管理局的2021-2023年战略计划,杜拜道路和运输管理局(RTA)宣布签署采购2,219辆新车的合同,以补充杜拜计程车管理局的车队。此次采购包括1,775辆混合动力汽车,使车辆总数达到4,105辆。电动车的扩张可能会进一步刺激所研究市场的需求。

- 各国政府正在进行大量投资以支持先进技术的普及,从而增加了对有机基板封装的半导体封装的需求。根据 WSTS 数据,2022 年 10 月美洲半导体销售额为 122.9 亿美元,高于上月的 120.3 亿美元。

- 此外,市场参与者正在开拓新产品来满足广泛的客户需求。例如,2022 年 6 月,PCB Technologies 宣布推出 iNPACK,这是一家先进的系统级封装(SiP) 解决方案异质整合提供者。 iNPACK 专注于提高讯号完整性并减少不必要的电感效应的高端技术。 iNPACK应用于许多要求最严苛的产业,包括航太、国防、医疗、消费性电子、汽车、能源、通讯、SiP、半导体封装、有机基板(25微米线、25微米间距)、3D、2.5D、提供2D包装解决方案。

- 此外,俄罗斯和乌克兰之间持续的衝突预计将对电子产业产生重大影响。这场衝突已经加剧了已经影响该行业的半导体供应链问题和晶片短缺问题。这种干扰可能会表现为镍、钯、铜、钛、铝和铁矿石等关键原料的价格波动,从而导致材料短缺。这可能会扰乱所研究市场的製造业。

有机基板封装材料市场趋势

消费性电子产品占据主要市场份额

- 有机构装基板(例如家用电子电器中的小型薄型封装)近年来大幅成长,因为它们能够提高设备性能和功能,同时减少尺寸和重量。此外,由于系统处理的资料量增加,5G 网路将需要智慧型手机更大的电池容量。正因为如此,其他部分也需要更加緻密并压缩尺寸。基板PCB 是高密度印刷电路基板(PCB),需要高达 30X30 的微迹间距。

- 此外,随着向 5G 的转变,智慧型手机目标商标产品製造商 (OEM) 正在增加这种有机基板技术的采用,这是市场成长的关键驱动力。爱立信预计,截至2022年,全球5G活跃用户数将达到10.5亿,几乎是前一年的两倍。预计未来几年将快速成长,到 2028 年订阅数量预计将达到近 50 亿。 5G 合约数量的大幅增加可能会推动研究市场的需求。

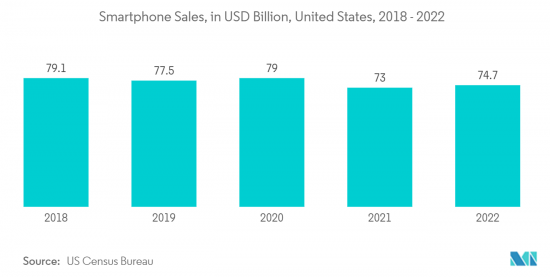

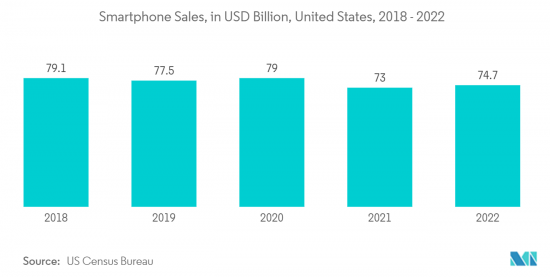

- 根据美国人口普查局数据,2022年1月美国行动电话销量成长17亿美元,达到747亿美元销售额。此外,根据 5G Americas 的数据,截至 2023 年,全球第五代 (5G) 用户数价值达 19 亿。预计到 2024 年,这一数字将增至 28 亿,到 2027 年将增至 59 亿。

- 此外,研究部门正大力投资有机基板包装材料市场。智慧型手机的成长、穿戴式装置和智慧型装置的普及不断提高,以及消费者物联网 (IoT) 装置在智慧家庭等应用中的普及不断提高,是影响该细分市场成长的一些因素。爱立信预计,2022年全球智慧型手机行动网路用户数量预计将达到约66亿,2028年将超过78亿人。

- 例如,华为计划于2023年3月推出一款电池大幅升级的折迭式智慧型手机。据传该设备将进行电池升级并命名为「Mate X3」。此外,华为还计划采用高硅负极材料来增强智慧型手机的电池容量,预计电池容量将达到5060mAh。

- 2022年6月,英特尔公司与伦敦大学学院(UCL)联合发布了一款新型非接触式计算机,可以透过手、头、脸和全身的手势进行操作和控制。电子市场不断要求更高的功耗、更快的速度、更多的引脚数、更小的占地面积和更薄的设计。半导体的小型化和整合化正在创造更轻、更小、更便携的消费性电子产品,例如智慧型手机、平板电脑和新兴的物联网 (IoT) 设备。

- 消费性电子产业正在不断成长,考虑到该产业最近的重大发展,预计未来几年将大幅扩张。消费性电子产品的成熟可能会进一步推动研究市场的需求。

亚太地区预计将占据主要市场占有率

- 推动亚太地区研究市场成长的关键因素包括智慧型手机普及的提高、网路用户数量的增加以及能够吸引新客户并扩大其在新兴市场的影响力的新功能和技术的推出。此外,该地区在全球印刷基板市场的主导地位也促进了有机基板印刷电路板的成长。

- 全球主要构装基板製造商集中在台湾、韩国、日本。正处于有机封装基板发展「新兴期」的日本,在积体电路(IC)封装基板的开发和应用方面处于世界领先地位。

- 亚太地区汽车需求的不断增长促使各国政府制定主动和被动车辆安全措施,推动该地区汽车印刷基板(PCB)市场的成长。各国政府正在向消费者提供补贴,以鼓励该地区购买电动车。例如,日本政府的目标是到2050年在该国停止使用内燃机汽车,并已开始提供临时补贴以帮助实现这一目标。该国已开始向电动车购买者提供临时补贴。

- 根据印度品牌股权基金会(IBEF)介绍,印度几年前启动了FAME-II计划,预算为13亿美元,目标是生产100万辆E- 二轮车和50万辆E-3轮车。汽车、55,000 辆电动小客车和 7,000 辆电动巴士。正如 2022-23 年联邦预算中所宣布的,政府已将该计划延长至 2024 年。

- 此外,由于国内晶片需求的增加,预计中国将取代美国成为全球领先的半导体产业强国。根据半导体产业协会(SIA)预测,到2030年,半导体市场规模将翻一番,达到1兆美元以上,其中中国贡献了60%以上的成长。预计这种快速增长将增加对有机基板半导体的需求。

- 市场参与者正在推出新工厂,以满足对 PCB 不断增长的需求。例如,2022年1月,韩国印刷基板和半导体构装基板製造商Simtek在马来西亚槟城峇都加湾工业的第一座大型PCB工厂即将完工。该工厂是该公司在东南亚韩国、日本和中国现有PCB工厂网路的一部分。该工厂将专门生产 DRAM/NAND 记忆体晶片的第一批构装基板以及记忆体模组/SSD 的 HDI PCB。

- 此外,2023 年 2 月,LG Innotek 宣布推出 XR 装置必不可少的 2 金属薄膜晶片 (COF)。在LG Innotek的元宇宙专区,这款产品引起了参观者的兴趣。 COF是连接柔性印刷电路基板和显示器的半导体构装基板。它有助于缩小智慧型手机、笔记型电脑、电视和显示器等设备的模组外形尺寸和显示边框。在极薄的薄膜上形成微电路需要先进的技术。又称替代FPCB的超薄柔性PCB。 2 金属 COF 在技术上优于标准单面 COF。双金属COF的最大优点是透过在两侧形成电路来实现超集成,而不是传统COF仅在一侧形成电路。

有机基板包装材料产业概况

有机基板封装材料市场竞争激烈,Amkor Technology Inc、Competitive Technology、Kyocera 等大公司占据了很大的市场占有率,同时积极扩大全球基本客群。这些公司正在采取策略合作措施来提高市场占有率和盈利。然而,技术进步和产品创新也使中小企业能够赢得独特的合约并拓展新市场。

2023年6月,美国晶片製造商美光科技计划在古吉拉突邦开设半导体组装和测试工厂,并计划最快于2024年开始生产。这项发展将极大推动印度晶片製造的野心。该工厂的主要业务是晶片封装,将晶圆转换成球栅阵列积体电路封装、记忆体模组和固态驱动器。

2022年1月,韩国PCB和半导体构装基板製造商Simtek宣布,其位于马来西亚槟城占地18英亩的第一座大型PCB製造工厂即将即将完工。该工厂补充了 Simtech 在东南亚(特别是韩国、日本和中国)现有的 PCB 业务。该工厂专门生产动态随机存取记忆体 (DRAM)/NAND 记忆体晶片的构装基板,以及记忆体模组和固态硬碟 (SSD) 装置的高密度互连 (HDI) PCB。这就是我的意思。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 宏观经济走势对市场的影响

第五章市场动态

- 市场驱动因素

- 自动驾驶汽车的普及

- 行动装置的使用增加

- 市场挑战

- 与 PCB 等基板相关的设定成本增加

第六章市场区隔

- 依技术

- 小薄型封装

- 引脚栅格阵列 (PGA) 封装

- 扁平无铅封装

- 四方扁平封装 (QFP)

- 双列直插式封装 (DIP)

- 其他技术

- 按申请

- 家用电子电器

- 车

- 製造业

- 工业的

- 卫生保健

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Amkor Technology Inc

- Kyocera Corporation

- Microchip Technology Inc.

- Texas Instruments Incorporated

- ASE Kaohsiung

- Simmtech Co., Ltd

- Shinko Electric Industries Co. Ltd

- LG Innotek Co.Ltd

- At&s

- Daeduck Electronics Co.,Ltd

第八章投资分析

第9章市场的未来

The organic substrate packaging material market is valued at USD 13.87 billion in the current year. It is expected to register a CAGR of 5.56% during the forecast period to become USD 18.18 billion by the next five years.

Key Highlights

- The increasing demand for advanced driver assistance systems (ADAS) would drive the demand for organic substrate packaging material in the forecasted period. According to Intel, international car sales are predicted to reach around 101.4 million units in 2030, and autonomous motorcars are expected to account for about 12% of car registrations by 2030.

- An organic substrate allows the printed circuit board manufacturer to employ an additive screen process instead of an edge-removal, etched method, and the end result is a PCB design that is nearly entirely organic.

- The Internet of Technology (IoT) technologies are being used across various industries. Because of their rapid growth, printed circuit board (PCB) manufacturers have introduced various changes and innovations to meet their clients' demands. From smartphones and fitness trackers to innovative factory equipment, managing space on mobile devices is highly important. With businesses trying to establish their digital footprint and people relying on IoT to drive their routine life functions, this demand is expected to grow in the studied market.

- In June 2022, SEMI Europe, the organization representing the entire European electronics manufacturing and design supply chain, immediately called for the quick passage of the European Chips Act and invited the European Commission, Member States, and Parliament to participate in discussions about the proposed legislation. The Act intends to support the region's transition to a digital and green economy while enhancing Europe's competitiveness and resilience in semiconductor technologies and applications.

- Moreover, electronics for automotive applications require effective packaging solutions that can withstand high temperatures. For these extreme conditions, a new attempt is necessary based on detailed knowledge about the thermo-mechanical behavior of the utilized organic substrate materials. In addition, with the increasing reliance on electronic components in modern automobiles, incorporating substrate PCBs into specific novel applications is becoming more common. They are used for various applications in the automotive industry, including power management, driver assistance systems, lighting control, in-car entertainment systems, and other electronic controls. According to OICA, in 2022, around 85 million automobiles will be produced worldwide. This figure represents an increase of about 6% over the previous year.

- Further, electric and hybrid modes of transport are gaining traction in the Gulf region, especially in Israel, Oman, Saudi Arabia, Jordan, and the United Arab Emirates. For example, through the Dubai Taxi Corporation's Strategic Plan 2021-2023, the Roads and Transport Authority (RTA) of Dubai has declared the signing of a contract to procure 2,219 new vehicles to supplement the fleet of the Dubai Taxi Corporation. The latest batch includes 1,775 hybrid vehicles, bringing the fleet's total number to 4,105. Such expansion in electric vehicles may further drive the studied market demand.

- Various government has significantly invested in boosting the penetration of advanced technologies, bolstering the demand for organic substrate packaging semiconductor packaging. According to WSTS, in October 2022, semiconductor sales in the Americas amounted to USD 12.29 billion, an increase from the USD 12.03 billion recorded for the previous month.

- Furthermore, the players in the market are developing new products to cater to customers' wide range of needs. For instance, in June 2022, PCB Technologies introduced iNPACK, an advanced heterogeneous integration provider of system-in-package (SiP) solutions. iNPACK focuses on high-end technology that improves signal integrity and reduces unwanted inductance effects. This is accomplished through powerful components that increase functionality and utilize embedded coins for heat dissipation. iNPACK provides SiP, semiconductor packaging, organic substrates (25-micron lines and 25-micron spacing), and 3D, 2.5D, and 2D packaging solutions to many of the most demanding industries, including aerospace, defense, medical, consumer electronics, automotive, energy and communications.

- Moreover, the ongoing conflict between Russia and Ukraine is expected to impact the electronics industry significantly. The conflict has already exacerbated the semiconductor supply chain issues and the chip shortage that have affected the industry for some time. The disruption may come in the form of volatile pricing for critical raw materials such as nickel, palladium, copper, titanium, aluminum, and iron ore, resulting in material shortages. This would obstruct manufacturing in the studied market.

Organic Substrate Packaging Material Market Trends

Consumer Electronics holds Significant Share in the Market

- Organic packaging substrates such as small, thin outline packages in consumer electronics have grown significantly in recent years due to their ability to improve devices' performance and functionality while reducing their size and weight. Additionally, with a 5G network, the amount of data processed by the system is propitiating, resulting in a need for more battery space in a smartphone. This leads to a need for other components to be of compressed size with higher density. Substrate PCBs are high-density printed circuit boards (PCBs) that require a maximum of 30X30 µmtrace spacing.

- Further, Smartphone original equipment manufacturers (OEMs) increasingly use this organic substrate technology with a shift toward 5G, which is the primary driver for the market's growth. According to Ericsson, as of 2022, there were a reported 1.05 billion active 5G subscriptions worldwide, almost twice as many as the previous year. Rapid growth is expected over the coming years, with subscriptions forecasted to reach nearly 5 billion by 2028. Such a massive rise in the 5g subscriptions would propel the demand for the studied market.

- According to the US Census Bureau, in January 2022, a USD 1.7 billion increase in the sales value of mobile phones sold in the United States, for a count of USD 74.7 billion in sales. In addition, as per 5G Americas, as of 2023, there are an evaluated 1.9 billion fifth-generation (5G) subscriptions worldwide. This figure is forecast to increase to 2.8 billion by 2024 and 5.9 billion by 2027.

- Moreover, the studied segment significantly invests in the organic substrate packaging material market. Growth of the smartphone, rising wearable and smart device adoption, and increasing consumer Internet of Things (IoT) device penetration in applications like smart homes are a few of the influential factors influencing the segment's growth. According to Ericsson, smartphone mobile network subscriptions worldwide reached nearly 6.6 billion in 2022 and are predicted to exceed 7.8 billion by 2028.

- For instance, in March 2023, Huawei plans to launch its foldable smartphone with a significant battery upgrade in the coming years. The device will feature an upgrade to its battery, and it is rumored to be named the Mate X3. Further, Huawei will use the high-silicon anode material to enhance the smartphone's battery capacity, which is expected to be 5060mAh.

- Intel Corporation and the University College London (UCL) collaborated in June 2022 to introduce a new touchless computer that can be operated and controlled by gesturing the hands, head, face, and entire body. Higher power dissipation, faster speeds, higher pin counts, smaller footprints, and lower profiles are all constant demands in the electronics market. Semiconductor miniaturization and integration have resulted in lighter, smaller, and more portable appliances such as smartphones, tablets, and emerging Internet of Things (IoT) devices.

- The consumer electronics industry is constantly growing and is projected to expand significantly in the coming years, considering the recent critical developments in the industry. Such maturation in consumer electronics may further propel the demand in the studied market.

Asia Pacific is Expected to Hold the Significant Market Share

- The primary factors bolstering the growth of the studied market in the Asia-Pacific region contain the increasing adoption of smartphones, the rising number of Internet users, and the introduction of new features and technologies that can attract new customers and expand footprints in emerging markets. Additionally, the region's dominance in the global printed circuit board market contributes to the growth of the organic substrate PCBs.

- The major global packaging substrate manufacturers are concentrated in Taiwan, South Korea, and Japan. In the "emergent stage" of the development of organic packaging substrates, Japan is at the forefront of developing and applying integrated circuit (IC) packaging substrates worldwide.

- The rising demand for automobiles in Asia-Pacific prompted regional governments to legislate a few active and passive vehicle safety measures, boosting the region's automotive printed circuit boards (PCBs) market growth. Governments are providing subsidies to customers to encourage the purchase of electric vehicles in the area. For instance, Japan's government has set a goal of stopping the use of internal combustion engine automobiles in the country by 2050, and to help achieve this goal. The country has started granting one-time subsidies to buyers of electric cars.

- According to the India Brand Equity Foundation (IBEF), the FAME-II scheme was launched in India a few years ago with a budget outlay of USD 1.3 billion to support 1 million e-two-wheelers, 0.5 million e-three-wheelers, 55,000 e-passenger vehicles, and 7,000 e-buses. The government extended the scheme until 2024, as announced in the Union Budget 2022-23.

- In addition, it is anticipated that China will surpass the United States as the world's significant semiconductor industry powerhouse due to its growing domestic chip demand. According to the Semiconductor Industry Association (SIA), the semiconductor market will double in size to reach more than USD 1 trillion by 2030, with China accounting for more than 60% of that growth. Such exponential growth is anticipated to increase demand for organic substrate semiconductors.

- The players in the market are commissioning new factories to cater to the rising demand of the PCB. For instance, in January 2022, Simmtech, a South Korean maker of Printed Circuit Boards and packaging substrates for semiconductors, has almost finished constructing its first large-scale PCB factory in Batu Kawan Industrial Park, Penang, Malaysia. This factory is part of its existing network of PCB factories in South Korea, Japan, and China, located in Southeast Asia. It will specialize in producing the first packaging substrates for DRAM/ NAND memory chips and HDI PCBs for memory modules/ SSDs.

- Further, in February 2023, LG Innotek introduced a 2-metal chip on film (COF), an essential product for XR devices. At LG Innotek's metaverse zone, the product piqued visitors' interest. A semiconductor package substrate, COF, connects flexible PCBs and displays. It helps reduce the form factor of modules and reduces the display bezels on devices like smartphones, notebook computers, televisions, and monitors. It requires advanced technology because it produces microcircuits on a very thin film. It is also known as the FPCB, or ultra-thin flexible PCB, which takes the place of the FPCB. 2-Metal COF is technically superior to standard one-side COF. The most significant advantage of a 2-metal COF is that it is super integrated by forming circuits on both sides, in contrast to a conventional COF, which only implements circuits on one side.

Organic Substrate Packaging Material Industry Overview

The organic substrate packaging material market is highly competitive and is dominated by major players, including Amkor Technology Inc, Compass Technology Co. Ltd., Kyocera Corporation, among others, who hold a significant market share while actively expanding their customer base globally. These companies employ strategic collaborative initiatives to enhance their market share and profitability. Nevertheless, due to technological advancements and product innovations, smaller and mid-sized companies are making inroads into new markets by securing unique contracts.

In June 2023, US chipmaker Micron Technology is set to launch its semiconductor assembly and test facility in Gujarat, with plans to commence production as early as 2024. This development will significantly bolster India's chip-making aspirations. The primary focus of the plant will be packaging chips, where it will convert wafers into ball grid array integrated circuit packages, memory modules, and solid-state drives.

In January 2022, Simmtech, a South Korean manufacturer of PCBs and semiconductor packaging substrates, announced the near completion of its first large-scale PCB manufacturing facility located on an 18-acre site in Penang, Malaysia. This facility complements Simmtech's existing PCB operations in Southeast Asia, particularly in South Korea, Japan, and China. It specializes in producing packaging substrates for dynamic random-access memory (DRAM) / NAND memory chips, as well as high-density interconnect (HDI) PCBs for memory modules and solid-state drive (SSD) devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Self-Driving Vehicles

- 5.1.2 Increasing Use of Portable Devices

- 5.2 Market Challenges

- 5.2.1 Higher Setup Cost Associated with Substrate like PCBs

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Small Thin Outline Packages

- 6.1.2 Pin Grid Array (PGA) Packages

- 6.1.3 Flat no-leads Packages

- 6.1.4 Quad Flat Package (QFP)

- 6.1.5 Dual inline Package (DIP)

- 6.1.6 Other Technologies

- 6.2 By Application

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 Manufacturing

- 6.2.4 Industrial

- 6.2.5 Healthcare

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amkor Technology Inc

- 7.1.2 Kyocera Corporation

- 7.1.3 Microchip Technology Inc.

- 7.1.4 Texas Instruments Incorporated

- 7.1.5 ASE Kaohsiung

- 7.1.6 Simmtech Co., Ltd

- 7.1.7 Shinko Electric Industries Co. Ltd

- 7.1.8 LG Innotek Co.Ltd

- 7.1.9 At&s

- 7.1.10 Daeduck Electronics Co.,Ltd