|

市场调查报告书

商品编码

1408768

消费性半导体元件:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Semiconductor Device In Consumer Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

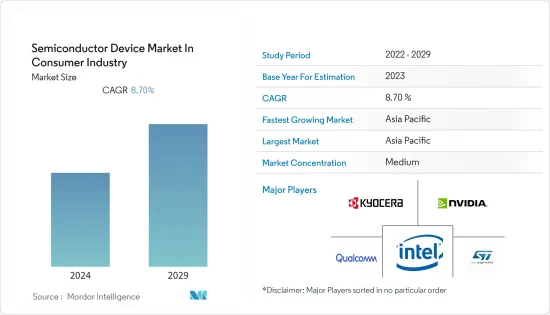

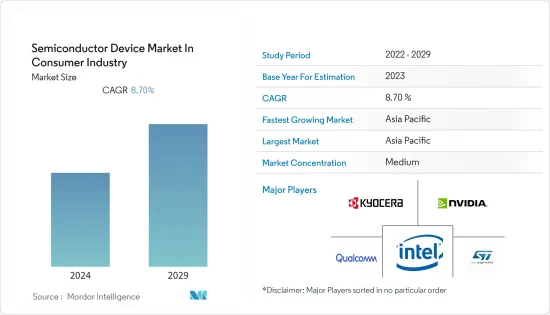

本财年消费性半导体元件市场价值为 834 亿美元,预计将达到 1,269 亿美元,预测期内复合年增长率为 8.7%。

主要亮点

- 大多数家用电子电器,例如行动电话电脑、游戏机、微波炉和冰箱,均由整合式晶片、二极体和电晶体等半导体供电。对此类设备的高需求是推动市场成长的主要因素。

- 积体电路广泛普及微处理器控制的家用电子电器中,从行动电话和可携式音乐播放器到游戏系统、个人电脑和其他数位装置。积体电路 (IC) 或晶片是一种高度复杂的设备,它将许多电子元件(例如电容器、电晶体和电阻器)封装到硅晶圆上几平方公分的区域中。

- 此外,消费物联网 (IoT) 等趋势的出现正在推动消费半导体设备市场的需求。消费者物联网的一个理想范例是智慧家居,其中电子设备、照明、暖通空调系统和家用电器均由中央集线器控制和监控。所有物联网设备都需要半导体,因为物联网应用如果没有积体电路和感测器就无法运行,这为所研究的市场创造了巨大的成长潜力。

- 此外,近年来市场上智慧型手机和智慧家居设备的爆炸性成长正在推动消费半导体设备市场的需求。数位设备中越来越多地采用第五代(5G)无线技术也是连网型设备和智慧产品需求不断增长、支持市场成长的关键因素之一。

- 俄罗斯和乌克兰之间的战争对半导体产业的供应链产生了负面影响。据SEMI称,乌克兰和中国供应约80%的氙气和氪气。这些气体大量用于半导体製造,主要用于钢铁製造并藉助空气分离设备。

- 随着战争的爆发以及其他地区缺乏专用空气分离设备,半导体製造的交货时间增加,导致所研究行业的晶片短缺。

半导体装置市场趋势

智慧型手机和智慧型穿戴装置的普及提高

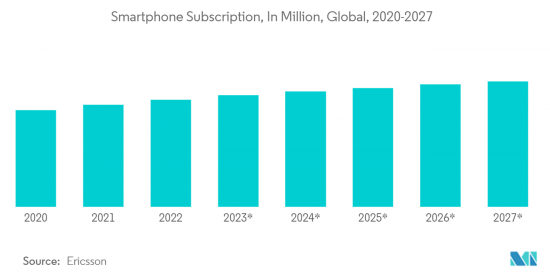

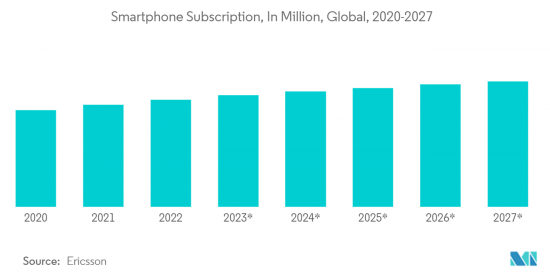

- 人口成长和都市化正在提高智慧型手机的普及,尤其是在开发中国家,这正在推动消费半导体设备市场的需求。例如,根据 GSMA 的数据,到 2025 年,智慧型手机预计将占 5 个连线中的 4 个,高于 2019 年的 65%。

- 此外,根据BankMyCell的数据,截至2022年9月,全球智慧型手机用户数为66.48亿,这意味着全球83.04%的人口拥有智慧型手机。拥有智慧型手机或功能手机的人数为72.6亿,占全球人口的91.08%。

- 此外,随着5G普及的普及以及相容5G的智慧型手机的需求增加,消费产业的半导体装置市场预计将经历高速成长。例如,根据 GSMA 的数据,到 2025 年,5G 网路可能覆盖全球三分之一的人口。在 5G 无线蜂巢式网路中,智慧型手机电池效率和最佳电力利用率已成为促进半导体装置成长的关键因素。

- 智慧型手錶环、健身追踪器、活动追踪器、运动手錶、虚拟实境(VR)耳机等智慧穿戴装置与人工智慧(AI)、物联网(IoT)等先进技术相结合。大量感测器和积体电路(IC)。例如,Fitbit、智慧型手錶和脉动式血氧监测仪系统等穿戴式系统采用光学感测器,为即时追踪患者健康状况提供解决方案。因此,随着这些设备的使用不断增加,整个消费半导体设备市场受到了积极影响,并呈现稳定成长。

- 许多供应商也专注于新产品开发,以满足不断增长的需求并扩大基本客群。例如,2023年1月,221e srl和意法半导体合作,基于221e的感测AI软体和意法半导体的微控制器和智慧型感测器,为穿戴式装置、物联网和其他消费应用提供人工智慧解决方案。

亚太地区主导市场

- 由于领先的消费电子製造商的存在,预计消费半导体设备市场将由亚太地区主导。预计该市场将受到智慧型手机普及、5G普及和智慧家电增加的推动。

- 多家跨国公司将亚太地区视为其未来成长的关键市场之一。亚太地区消费市场的成长主要受到有利的人口趋势和可支配收入增加的推动。

- 由于大型製造商的存在,该地区是最大的消费性电子市场之一。随着多个国家消费性电子产业的扩张,消费产业对半导体元件市场的需求预计将会增加。例如,印度是世界领先的消费品和尖端技术市场之一。印度品牌资产基金会 (IBEF) 预测,印度家用电子电器(ACE) 市场将以 9% 的复合年增长率成长,到 2025 年将达到 211.8 亿美元。据估计,这些数字将推动该地区产品发布的成长。

- 此外,由于能源成本不断上升,对智慧家庭的需求不断增长,预计将导致恆温器、照明和智慧插座采用能源效率和节省成本的解决方案。这些市场对智慧家庭设备和智慧电源管理设备的需求不断增长,预计将推动该地区消费产业半导体设备市场的需求成长。

- 此外,该行业的领先公司正致力于扩大其区域业务以击败竞争对手。例如,2023年3月,三星宣布将投资2,280亿美元在韩国兴建新的半导体工厂。

半导体装置产业概况

由于持续整合、技术进步和地缘政治因素,消费产业半导体元件市场目前正在经历显着波动。市场竞争持续加剧,透过创新获得永续竞争优势至关重要。在这种动态环境下,品牌形像是一个至关重要的因素,特别是考虑到半导体製造业最终用户对品质的高期望。

该市场由市场渗透率较高的大公司主导,例如英特尔公司、英伟达公司、京瓷公司、高通技术公司和意法半导体公司。在这种竞争形势中,创新、上市时间和性能成为产业参与者的关键差异化因素。总体而言,竞争公司之间的敌对行动在预测期内稳定增加。

2023 年 4 月,瑞萨电子宣布推出首款基于先进 22 奈米製程技术的微控制器 (MCU)。这项创新产品的推出旨在为客户提供卓越的性能,同时透过降低核心电压来降低功耗。

2023年3月,意法半导体与华邦电子公司建立策略合作伙伴关係,将高效能记忆体整合到面向消费和智慧工业应用的STM32设备中。此次合作的目的是将华邦的DDR3动态RAM与ST的STM32M P1 MPU结合。这些 MPU 整合了多达两个 Cortex-A7 内核,并提供先进的周边、物联网安全硬体和高效晶载电源转换积体电路。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 宏观趋势对产业的影响

第五章市场动态

- 市场驱动因素

- 智慧科技在家电领域的普及

- 5G的普及和5G智慧型手机需求的增加

- 市场挑战

- 供应链中断

第六章市场区隔

- 依设备类型

- 离散半导体

- 光电子学

- 感应器

- 积体电路

- 模拟

- 逻辑

- 记忆

- 微

- 微处理器 (MPU)

- 微控制器(MCU)

- 数位讯号处理器

- 按地区

- 美国

- 欧洲

- 日本

- 中国

- 韩国

- 台湾

- 世界其他地区

第七章 竞争形势

- 公司简介

- Intel Corporation

- Nvidia Corporation

- Kyocera Corporation

- Qualcomm Incorporated

- STMicroelectronics

- Micron Technology Inc.

- Xilinx Inc.

- NXP Semiconductors NV

- Toshiba Corporation

- Texas Instruments Inc.

- Taiwan Semiconductor Manufacturing Company(TSMC)Limited

- SK Hynix Inc.

- Samsung Electronics co. ltd

- Fujitsu Semiconductor Ltd

- Rohm Co. Ltd

- Infineon Technologies AG

- Renesas Electronics Corporation

- Advanced Semiconductor Engineering Inc.

- Broadcom Inc.

- ON Semiconductor Corporation

第八章投资分析

第9章市场的未来

The semiconductor device market in the consumer industry was valued at USD 83.4 billion in the current year and is expected to register a CAGR of 8.7%, reaching USD 126.9 billion over the forecast period.

Key Highlights

- Most consumer electronics, like mobile phones, laptops, game consoles, microwaves, and refrigerators, operate with semiconductors, such as integrated chips, diodes, and transistors. The high demand for these devices is a key factor contributing to the market growth.

- The use of integrated circuits is widespread in consumer electronics with microprocessor control, from cell phones and portable music players to gaming systems, PCs, and other digital devices. An integrated circuit (IC) or chip is an extremely sophisticated device that packs up many electronic components like capacitors, transistors, and resistors into an area of a few square centimeters on a silicon wafer.

- Further, the emergence of trends, such as consumer Internet of Things (IoT), has fueled the demand for the semiconductor devices market in the consumer industry. An ideal example of consumer IoT is the smart home, where electronic equipment, lighting, HVAC systems, and appliances are all controlled and monitored from a central hub. IoT applications cannot work without integrated circuits and sensors, so all IoT devices require semiconductors, which creates a huge growth potential for the market studied.

- Moreover, the explosive growth of smartphones and smart home devices in the markets in recent years has fueled the demand for the semiconductor device market in the consumer industry. The increasing adoption of the fifth-generation (5G) wireless technology for digital devices is also one of the major contributing factors to the rising demand for connected devices and smart products, thereby supporting the market's growth.

- The Russia and Ukraine war negatively impacted the supply chain in the semiconductor Industry. According to SEMI, Ukraine and China supply about 80% of Xenon and krypton gasses. These gasses are highly used in semiconductor manufacturing, and they can be obtained mainly through steel manufacturing and with the help of Air Separation units.

- With the war in place and no dedicated Air Separation Units elsewhere, the lead time for semiconductor manufacturing is increasing, leading to chip shortages across the industries studied.

Semiconductor Device Market Trends

Increase Penetration of Smartphones and Smart Wearable Devices

- Due to the increasing population and urbanization, smartphone adoption rates are increasing, particularly in developing countries, which has fueled the demand for the semiconductor device market in the consumer industry. For instance, as per GSMA, by 2025, smartphones are expected to account for four of every five connections, up from 65% in 2019.

- Moreover, as per BankMyCell, as of September 2022, smartphone users worldwide are 6.648 billion, translating to 83.04% of the world's population owning a smartphone. The number of people owning a smart and feature phone is 7.26 billion, making up 91.08% of the world's population.

- Further, the semiconductor device market in the consumer industry will witness high growth due to the growing penetration of 5G technology, which drives the demand for 5G-enabled smartphones. For instance, as per GSMA, by 2025, 5G networks will likely cover one-third of the world's population. In the 5G wireless cellular networks, smartphone battery efficiency and optimal power utilization have emerged as important factors contributing to the growth of semiconductor devices.

- Additionally, several smartphone manufacturers are focusing on launching technologically advanced phones to gain a competitive edge, further supporting the market growth. For instance, in May 2023, Poco announced the launch of Poco F5 in India and global markets. The company is also launching the Poco F5 Pro simultaneously globally.

- Smart wearable devices, such as smartwatches, smart wristbands, fitness trackers, activity trackers, sports watches, and virtual realty (VR) headsets, are integrated with advanced technologies such as artificial intelligence (AI) and the Internet of Things (IoT), which employ a huge number of sensors and integrated circuits (ICs). For instance, fit bits, smartwatches, and pulse oximeters are among the wearable systems incorporated with optical sensors to provide real-time patient health tracking solutions. Therefore, with the increased use of these devices, the overall semiconductor device market in the consumer industry is impacted positively, exhibiting steady growth.

- Many vendors are also focusing on developing new products to meet the growing demands and increase customer base. For instance, in January 2023, 221e srl and STMicroelectronics joined forces to enhance artificial intelligence solutions for wearable, IoT, and other consumer applications based on 221e's sensing AI software and STMicroelectronics's microcontrollers and intelligent sensors.

Asia-Pacific to Dominate the Market

- The semiconductor device market in the consumer industry is projected to be dominated by Asia-Pacific owing to the presence of leading consumer electronics manufacturers. The market is expected to be driven by increasing smartphone penetration, 5G penetration, and smart home appliances.

- Several global companies see the Asia-Pacific region as one of the key markets likely to generate future growth. The growth of the Asia-Pacific consumer market is mainly driven by favorable demographics and increasing disposable income.

- With the presence of significant manufacturers, the region is among the biggest consumer electronics markets. The demand for the semiconductor devices market in the consumer industry is anticipated to increase as the consumer electronics industry expands in several countries. India, for instance, is one of the major global markets for consumer goods and the newest technology. India Brand Equity Foundation (IBEF) predicted that the market for Indian appliances and consumer electronics (ACE) will grow at a 9% CAGR to reach USD 21.18 billion by 2025. Such numbers are estimated to drive the growth of product launches in the region.

- Moreover, the demand growth for smart homes is expected to be driven by rising energy costs, which has led to the adoption of energy-efficient and cost-saving solutions for thermostats, lighting, and smart outlets. Such an increase in the demand for smart home devices and smart power management devices in the market is expected to fuel the demand growth of the semiconductor device market in the consumer industry in the region.

- Furthermore, major industry players focus on expanding their regional operations to stay ahead of the competition. For instance, in March 2023, Samsung announced to build a new semiconductor facility in South Korea by investing USD 228 billion.

Semiconductor Device Industry Overview

The semiconductor device market in the consumer industry is currently experiencing significant fluctuations due to ongoing consolidation, technological advancements, and geopolitical factors. In a market where gaining a sustainable competitive advantage through innovation is of paramount importance, competition is poised to escalate. Given this dynamic environment, brand identity becomes a crucial factor, especially considering the high expectations of quality from end-users in the semiconductor manufacturing sector.

The market is dominated by established giants, including Intel Corporation, Nvidia Corporation, Kyocera Corporation, Qualcomm Technologies Inc., and STMicroelectronics NV, which have achieved substantial market penetration. In this competitive landscape, innovation, time-to-market, and performance stand out as the key differentiators for industry players. Overall, the competitive rivalry is steadily increasing over the forecast period.

April 2023 witnessed Renesas Electronics Corporation's milestone announcement, as they introduced their first microcontroller (MCU) based on advanced 22-nm process technology. This innovative product launch aims to provide customers with superior performance while reducing power consumption through lower core voltages.

In March 2023, STMicroelectronics and Winbond Electronic Corporation entered into a strategic partnership to amalgamate high-performance memory with STM32 devices for consumer and smart industrial applications. The partnership's goal is to combine Winbond's DDR3 dynamic RAM with ST's STM32M P1 MPUs. These MPUs incorporate up to two Cortex-A7 cores and offer advanced peripherals, IoT security hardware, and highly efficient on-chip power conversion integrated circuits.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macro Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Smart Technologies in the Consumer Electronics Sector

- 5.1.2 Increased Deployment of 5G and Rising Demand for 5G Smartphones

- 5.2 Market Challenges

- 5.2.1 Supply Chain Disruptions

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Discrete Semiconductors

- 6.1.2 Optoelectronics

- 6.1.3 Sensors

- 6.1.4 Integrated Circuits

- 6.1.4.1 Analog

- 6.1.4.2 Logic

- 6.1.4.3 Memory

- 6.1.4.4 Micro

- 6.1.4.4.1 Microprocessors (MPU)

- 6.1.4.4.2 Microcontrollers (MCU)

- 6.1.4.4.3 Digital Signal Processor

- 6.2 By Geography

- 6.2.1 United States

- 6.2.2 Europe

- 6.2.3 Japan

- 6.2.4 China

- 6.2.5 Korea

- 6.2.6 Taiwan

- 6.2.7 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Nvidia Corporation

- 7.1.3 Kyocera Corporation

- 7.1.4 Qualcomm Incorporated

- 7.1.5 STMicroelectronics

- 7.1.6 Micron Technology Inc.

- 7.1.7 Xilinx Inc.

- 7.1.8 NXP Semiconductors NV

- 7.1.9 Toshiba Corporation

- 7.1.10 Texas Instruments Inc.

- 7.1.11 Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- 7.1.12 SK Hynix Inc.

- 7.1.13 Samsung Electronics co. ltd

- 7.1.14 Fujitsu Semiconductor Ltd

- 7.1.15 Rohm Co. Ltd

- 7.1.16 Infineon Technologies AG

- 7.1.17 Renesas Electronics Corporation

- 7.1.18 Advanced Semiconductor Engineering Inc.

- 7.1.19 Broadcom Inc.

- 7.1.20 ON Semiconductor Corporation