|

市场调查报告书

商品编码

1408827

汽车贷款:市场占有率分析、产业趋势/统计、成长预测,2024-2029Auto Loan - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

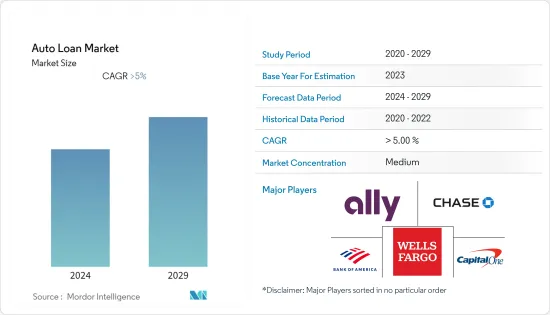

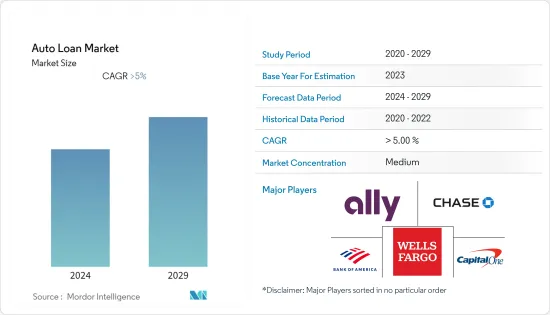

本财年汽车贷款市场贷款余额预计将达4.12兆美元,预测期内复合年增长率将超过5%。

近年来,全球销售的汽车数量稳步增长,随着购买汽车数量的增加,用于为其资金筹措的汽车贷款数量也随之增加。长期贷款涉及较高风险,因此贷款提供者会随着时间的推移提高利率。已开发国家和发展中国家购买的汽车类型不同,因此汽车贷款销售也不同。在印度等开发中国家,摩托车在汽车销售中占比较大,而在美国等已开发国家,四轮车(轻型卡车)在汽车销售中占比较大。小客车占全球汽车销售量的60%以上,商用车占剩余份额。自COVID-19以来,小客车价格基本上保持稳定,而商用车价格上涨了10-12%。

汽车贷款市场多种多样,各国对其产品的需求也各不相同。贷款提供者不断推出新的贷款产品,让购车变得更轻鬆、更方便。在汽车贷款提供者中,银行、专属式金融和信用合作社占据了 70% 左右的很大份额,利率根据国家/地区从 4% 到 10% 不等。

为了鼓励电动车的普及,汽车贷款提供者为这些汽车贷款提供低长期利率。自 COVID-19 以来,中国、美国和印度已成为全球最大的汽车市场,为该地区的汽车贷款提供者带来了更多的商机。

汽车贷款市场趋势

小客车销量增加

小客车市场包括摩托车、四轮车和其他主要用于客运的车辆的销售。小客车的全球平均价格约为28,000美元,存在地区差异。在四轮小客车销量中,SUV和中型车是销量最高的细分市场,全球销量超过3000万辆。随着销量与前一年同期比较增长,这两个小客车细分市场占据了小客车销售份额的50%以上,汽车贷款提供商正在寻求增加小客车销量以享受现有福利并增加汽车贷款销量。我们针对特定细分市场的产品。去年美国小客车价格上涨,汽车贷款价格上涨导致购车者负债累累。小客车价格上涨正在增加汽车贷款提供者的业务。随着收入和生活水准的提高,小客车正在成为汽车融资的机会。

信用合作社增加汽车贷款

信用合作社是向其使用者提供传统银行服务的金融合作机构。随着世界各国央行收紧货币政策,银行机构利率持续上升。因此,在新冠肺炎 (COVID-19) 疫情之后,随着人们储蓄下降,信用合作社已成为高效的汽车贷款提供者。在美国汽车贷款的供应商分布中,信用合作社的份额在冠状病毒爆发后增长了 7% 以上。在购买二手车的贷款中,信用合作社的份额从 COVID-19 期间的 25% 增加到去年的 31%。由于汽车价格上涨和贷款利率上升,信用合作社正在成为对汽车购买者有吸引力的融资解决方案。

汽车贷款产业概况

目前汽车贷款市场较为型态,参与者众多。寻求以最低手续费获得低利率贷款的公司之间的竞争日益激烈,导致更具竞争力的公司进行投资以获得更大的客户份额。数位贷款和银行应用程式的创新正在提高借款人的汽车贷款效率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 小客车需求增加

- 透过更快的贷款处理来增加汽车贷款销售

- 市场抑制因素

- 银行升息

- 汽车市场价格上涨

- 市场机会

- 新兴电动车市场扩大汽车贷款市场

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 汽车贷款市场的技术创新

- COVID-19 对市场的影响

第五章市场区隔

- 按车型分类

- 小客车

- 商用车

- 按所有权

- 新车

- 二手车

- 按最终用户

- 个人

- 公司

- 按贷款提供者

- 银行

- OEM

- 信用合作社

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 德国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 南美洲

- 巴西

- 秘鲁

- 南美洲其他地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 其他地区

- 北美洲

第六章 竞争形势

- 市场集中度概览

- 公司简介

- Ally Financial

- Wells Fargo

- Chase

- Capital One

- Bank of America

- BNP Paribas Financial Service

- Credit Agricole

- HDFC Bank

- ICICI Bank

- Mashreq Bank

第七章 市场未来趋势

第 8 章 免责声明与出版商讯息

The auto loan market has a loan outstanding of USD 4.12 trillion in the current year and is poised to register a CAGR of more than 5% for the forecast period.

Automobile sales globally have observed a continuous increase over the years, increasing the number of vehicles purchased with a rise in rise in number of auto loans taken by people for financing them. Based on the duration, loan providers globally are increasing their rate of interest as long-term loans are associated with higher risk. With differences in the types of vehicles purchased between developed and developing countries, sales of auto loans category also vary. As developing countries such as India exist with a major share of two-wheelers in automobile sales, developed countries such as the United States exist with a major share of four vehicles (Light Truck) in their automobile sales. In terms of global motor vehicle sales, passenger cars have emerged with a share of more than 60%, and the remaining share is occupied by commercial vehicles. Post-COVID-19 price of passenger vehicles has almost stabilized, with commercial vehicles observing a price rise of 10-12%, resulting in a decline in their sales and their associated loan business.

The Auto loan market exists with a varied demand for its products, having intra-country differences. Loan providers are continuously emerging with new loan products for making the purchase of automobiles easy and more convenient. Among the Automobile loan providers, Banks, Captive finance, and credit unions exist with a major share of around 70%, with the rate of interest varying between 4% to 10% in different countries.

To promote the adoption of Electric vehicles, Auto loan providers are coming with low and long-term interest rates on these vehicle loans. Post-COVID-19, China, the United States, and India have emerged as the world's largest auto market, resulting in rising opportunities for Auto loan providers in the regions.

Auto Loan Market Trends

Rising Sales Of Passenger Vehicles

The passenger vehicles market includes sales of two-wheeler, four-wheeler vehicles, and other vehicles mostly used for passenger transportation. Globally average passenger vehicle price is around USD 28,000, with regional variation. Among the sales of four-wheeler passenger vehicles, SUVs and medium cars are among the segments with the largest sales of more than 30 Million vehicles globally. With an increase in y-o-y sales, these two segments of passenger vehicles are occupying more than 50% of the passenger vehicle sales share and leading Automobile loan providers to focus their products on specific segments of passenger vehicles to reap the existing benefits and increase their automobile loan sales. Last year United States observed an increase in the price of passenger vehicles, with rising vehicle loan prices leading to more automobile buyers entering into debt. The rise in price of passenger vehicles is increasing the business of Automobile loan providers. With the increase in income and standard of living, passenger vehicles are becoming an opportunistic segment of Auto loans.

Increasing Vehicle Loan By Credit Union

Credit Unions are financial cooperative institutions providing users with traditional banking services. With the global tightening of monetary policy by central banks, interest rate by banking institutions is observing a continuous increase, making their loan products more expensive to the borrowers. Credit unions exist with comparatively lower interest rates and processing fees than banks for borrowing loans, as a result of which, post-COVID-19, with a decline in the savings of people, credit unions have emerged as an efficient automobile loan provider. In terms of the distribution of vehicle loans by sources in the United States, Credit unions have observed an increase in the share of more than 7% post coronavirus. For loans in the used vehicles market purchase, the share of credit unions observed an increase to 31% last year from a level of 25% during COVID-19. As a result of the rising price of automobiles with increasing interest rates on loans, credit unions are emerging as an attractive financing solution for automobile buyers.

Auto Loan Industry Overview

The auto loan market currently exists in a fragmented form, with the existence of a large number of players. Rising competition among firms for lower interest rates on loans with minimization of processing fees is leading to more competitive firms investing to occupy a large share of the customers. The technological innovation of digital loans and banking apps is further making Auto loans more efficient for borrowers. Some of the existing players in the Auto Loan Industry are Ally Financial, Wells Fargo, Chase, Capital One, and Bank of America.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in Demand for Passenger Vehicles

- 4.2.2 Quick Processing of Loan Increasing Automobile Loan Sales

- 4.3 Market Restraints

- 4.3.1 Rising of Interest Rates by Banks

- 4.3.2 Rising Price in Automobile Market

- 4.4 Market Opportunities

- 4.4.1 Emerging Market of Electric Vehicles Expanding the Auto Loan Market

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in Auto Loan Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Vehicle

- 5.1.2 Commercial Vehicle

- 5.2 By Ownership

- 5.2.1 New Vehicle

- 5.2.2 Used Vehicle

- 5.3 By End-User

- 5.3.1 Individual

- 5.3.2 Enterprise

- 5.4 By Loan Provider

- 5.4.1 Banks

- 5.4.2 OEM

- 5.4.3 Credit Unions

- 5.4.4 Other Loan Providers

- 5.5 By Region

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Peru

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arad Emirates

- 5.5.5.3 Rest of Middle East

- 5.5.6 Rest of the World

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profile

- 6.2.1 Ally Financial

- 6.2.2 Wells Fargo

- 6.2.3 Chase

- 6.2.4 Capital One

- 6.2.5 Bank of America

- 6.2.6 BNP Paribas Financial Service

- 6.2.7 Credit Agricole

- 6.2.8 HDFC Bank

- 6.2.9 ICICI Bank

- 6.2.10 Mashreq Bank*