|

市场调查报告书

商品编码

1408871

Buoy Beacon:市场占有率分析、产业趋势/统计、成长预测,2024-2029 年Buoys And Beacon - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

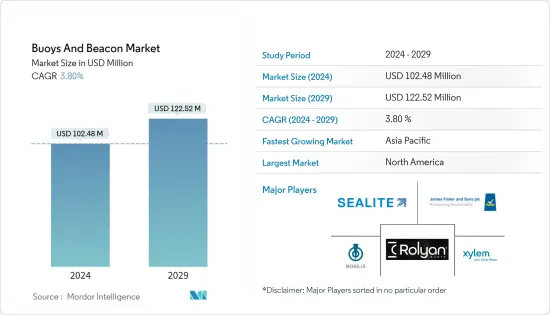

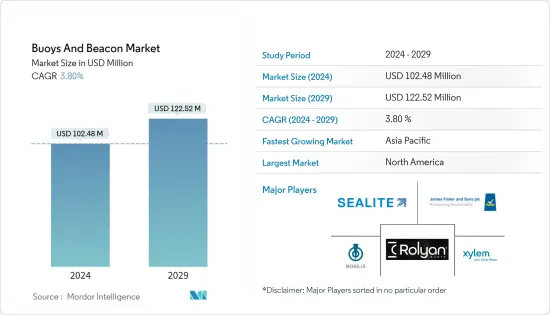

浮标信标市场规模预计到2024年为1.0248亿美元,预计到2029年将达到1.2252亿美元,在预测期内(2024-2029年)复合年增长率预计为3.80%。

主要亮点

- 新兴国家海洋产业的快速发展带动了海上贸易的大幅成长。浮标和信标是海洋导航生态系统不可或缺的一部分,可保护船舶和货物集装箱免受危险的水下地形和可能下沉或损坏的区域的影响,从而导致生命和财产损失。这导致对用于持续监测海上交通和天气变化等自然现象的浮标和信标的需求持续增加。

- 浮标和信标市场预计将受到未来一段时间内新技术采用的影响,例如远端监控和控制系统、太阳能浮标的使用以及智慧浮标系统的开发。

浮标和信标市场趋势

预计海上业务将在预测期内实现最高成长

- 预计海上业务在预测期内将显着成长。国际海上贸易的成长是采用海上浮标信标的主要驱动力之一,以保护船舶免受迫在眉睫的威胁,并在发生大规模自然事件时提供早期预警。这可归因于此外,浮标信标越来越多地被用作导航辅助设备,这推动了它们在海上领域的采用。

- 近年来,航运业贸易量整体呈现成长趋势。工业化程度的提高和国民经济的自由化正在促进自由贸易并增加对消费品的需求。科技的进步也使航运成为一种日益高效、快速的运输方式。因此,航运业的成长也导致世界各国政府与不同製造商合作开发先进的海上浮标和信标系统。

- 根据国际航运公会(ICS)2022年发布的资料,超过5万艘商船进行国际贸易并运输各类货物。目前,近年来越来越多地使用近海浮标来告知海员洋流的变化,并提供重要且安全的助航设施,引导海员远离岩石和礁石。此外,世界各国使用五种类型的浮标:基本浮标、横向浮标、孤立危险浮标、特殊浮标和安全浮水印。此外,颜色和形状统一的海上浮标指示安全的航行路线。

- 由于深海帆船的增加,世界各地的各个製造商都在投资研发,生产先进的海上浮标系统。这带来了积极的前景,预计也将导致预测期内海上应用的浮标和信标系统的成长。

北美在预测期内占据市场占有率主导地位

- 预计北美在预测期内将主导市场占有率。该地区生产浮标和信标系统的各公司的研发支出增加以及海上安全需求的增加将导致未来市场的成长。

- 近年来,随着海上威胁的增加和国际海上贸易重要性的增加,海上安全变得极为重要。海事安全解决方案和服务在北美非常有效,因为各种海事安全设备製造公司对提供擅长检测深海各种危险的先进技术的需求不断增长。

- 北美製造先进海洋浮标的公司包括 Rolyan Buoys、Whitecap Industries 和 JFC Marine。该公司产品的设计和製造符合并超越美国法规。

- 现在正在为各种应用製造先进的浮标和信标,包括科学研究、海洋和天气预报、季节性预报、海洋生物保护、极端天气保护以及航运业。

- 例如,2022年5月,美国马萨诸塞州伍兹霍尔海洋研究所的一个实验室与法国航运巨头达飞海运集团合作,透过即时记录鲸鱼在水下的声音来确定鲸鱼的位置,并宣布开发出一种机器人浮标保护鲸鱼免受船隻碰撞的技术。

浮标和信标产业概述

浮标信标市场是分散的,其特征是存在多个市场参与者在国内和国际层面竞争以获得市场占有率。浮标信标市场的知名参与者包括 James Fisher and Sons plc (Fendercare)、Sealite Pty Ltd、Mobilis、Rolyan Buoys (Performance Health Holding, Inc.) 和 Xylem。

此外,市场上的主要参与者正在专注于开发安装在世界各地的先进浮标和信标系统。增加製造先进浮标和信标系统的研发支出可能会在不久的将来带来更好的机会。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场抑制因素

- 波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 类型

- 金属浮标

- 塑胶浮标

- 目的

- 离岸

- 海岸/港口

- 内陆水面

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 义大利

- 德国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 马来西亚

- 新加坡

- 其他亚太地区

- 拉丁美洲

- 哥伦比亚

- 智利

- 阿根廷

- 其他拉丁美洲

- 中东/非洲

- 以色列

- 埃及

- 沙乌地阿拉伯

- 其他中东/非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- James Fisher and Sons plc(Fendercare)

- Xylem

- Rolyan Buoys

- Sealite Pty Ltd

- RESINEX TRADING Srl

- RYOKUSEISHA CORPORATION

- Almarin

- Mobilis

- Carmanah Technologies Corp

- Woori Marine Co. Ltd.

第七章 市场机会及未来趋势

The Buoys And Beacon Market size is estimated at USD 102.48 million in 2024, and is expected to reach USD 122.52 million by 2029, growing at a CAGR of 3.80% during the forecast period (2024-2029).

Key Highlights

- The rapid growth in terms of the marine industry in emerging nations has led to a considerable increase in terms of marine trade. Buoys and beacons form an essential part of the marine navigation ecosystem to safeguard the naval vessels and cargo containers against dangerous submerged landforms and areas that can sink or damage them and lead to potential loss of life and property. This has led to a sustained increase in the demand for buoys and beacons for continuous monitoring of sea-based trade traffic and other natural phenomena, such as weather changes, etc.

- The buoys and beacon market is anticipated to be affected by the adoption of new technologies during the upcoming period, such as remote monitoring and control systems, the use of solar-powered buoys, and the development of smart buoy systems.

Buoys And Beacon Market Trends

The Offshore Segment is Anticipated to Register Highest Growth During the Forecast Period

- The offshore segment is expected to show significant growth during the forecast period. The growth in international marine trade can be attributed as one of the major driving factors for the adoption of offshore buoys and beacons to protect naval vessels from imminent threats and provide an early warning in case of any major incoming natural phenomenon. Furthermore, buoys and beacons are also being increasingly used as navigation aids, which drives their adoption in the offshore segment.

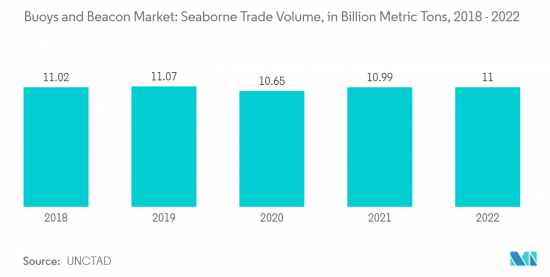

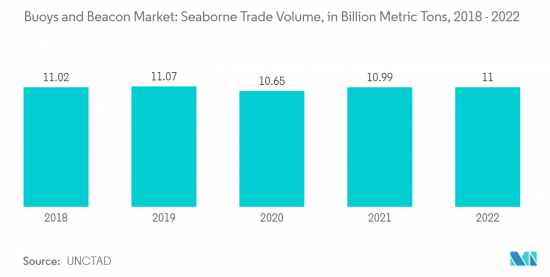

- Since the past few years, the shipping industry has seen a general trend of increases in total trade volume. Increasing industrialization and the liberalization of national economies have fueled free trade and a growing demand for consumer products. Advances in technology have also made shipping an increasingly efficient and swift method of transportation. Thus, the growth in the shipping industry has also led to various governments across the world partnering with various manufacturers in order to develop advanced offshore buoys and beacon systems.

- According to the data presented by the International Chamber of Shipping (ICS) in 2022, over 50,000 merchant ships were trading internationally, transporting every kind of cargo. Currently, marine offshore buoys have been used increasingly for the past few years in order to alert the sailors with regards to changes in ocean currents and also help in terms of critical and safe navigation in order to guide the mariner away from rocks and reefs. Moreover, countries globally make use of five different types of buoys, namely cardinal, lateral, isolated danger, special, and safe water marks. In addition, offshore buoys of standardized colors and shapes indicate safe passageways.

- The growth in the number of deep-sea sailing ships has led to various manufacturers worldwide investing in research and development in order to manufacture advanced offshore buoy systems. This, in turn, is expected to create a positive outlook and will also lead to a growth of buoys and beacon systems in offshore applications during the forecast period.

North America to Dominate Market Share During the Forecast Period

- North America is projected to dominate market share during the forecast period. Increasing expenditure in terms of research and development by various companies present in the region that manufacture buoys and beacon systems, coupled with the growing need for maritime safety, will lead to the growth of the market in the future.

- Maritime safety has become crucial in recent years owing to the increasing number of maritime threats as well as the increasing importance of international trade by sea. In North America, maritime safety solutions and services are highly effective due to the increasing need by various maritime safety equipment manufacturing companies which are engaged in providing superior and advanced technology for the detection of various hazards in deep waters.

- Several established companies in the North American region, such as Rolyan Buoys, Whitecap Industries Inc., as well as JFC Marine amongst others, are engaged in the production of advanced maritime buoys. The products of the company have been designed and manufactured in order to meet/exceed US regulations.

- Advanced buoys and beacons are now being manufactured not just for the shipping industry but also for several other applications such as scientific research, marine and weather forecasting, seasonal forecasting, protection of marine life, and planning for extreme weather events, amongst others.

- For instance, in May 2022, a lab at Woods Hole Oceanographic Institution in Massachusetts, the US, announced that they have partnered with French shipping giant CMA CGM and have developed a robotic buoy technology that will be used to record underwater whale sounds in real-time thereby tapping on the whale position and protecting the whales from collision against ships. Thus, such developments are expected to lead to a positive outlook and also lead to significant growth of buoys and beacons within the North American market during the forecast period.

Buoys And Beacon Industry Overview

The buoys and beacon market is fragmented and marked by the presence of several market players competing on both national and international levels to gain market share. Some of the prominent players in the buoys and beacon market are James Fisher and Sons plc (Fendercare), Sealite Pty Ltd, Mobilis, Rolyan Buoys (Performance Health Holding, Inc.), and Xylem, amongst others.

Moreover, the key players in the market are focused on the development of advanced buoys and beacon systems, which will be installed at various locations around the world. Growing expenditure on research and development towards manufacturing advanced buoys and beacon systems will lead to creating better opportunities in the near future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Metal Buoys

- 5.1.2 Plastic Buoys

- 5.2 Application

- 5.2.1 Offshore

- 5.2.2 Coastal and harbor

- 5.2.3 Inland Waters

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Italy

- 5.3.2.4 Germany

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Malaysia

- 5.3.3.4 Singapore

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Colombia

- 5.3.4.2 Chile

- 5.3.4.3 Argentina

- 5.3.4.4 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Israel

- 5.3.5.2 Egypt

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 James Fisher and Sons plc (Fendercare)

- 6.2.2 Xylem

- 6.2.3 Rolyan Buoys

- 6.2.4 Sealite Pty Ltd

- 6.2.5 RESINEX TRADING S.r.l.

- 6.2.6 RYOKUSEISHA CORPORATION

- 6.2.7 Almarin

- 6.2.8 Mobilis

- 6.2.9 Carmanah Technologies Corp

- 6.2.10 Woori Marine Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Incorporation of strategies for increasing product adoption to help companies grow