|

市场调查报告书

商品编码

1429479

生物分解性聚合物:市场占有率分析、产业趋势、成长预测(2024-2029)Bio-degradable Polymers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

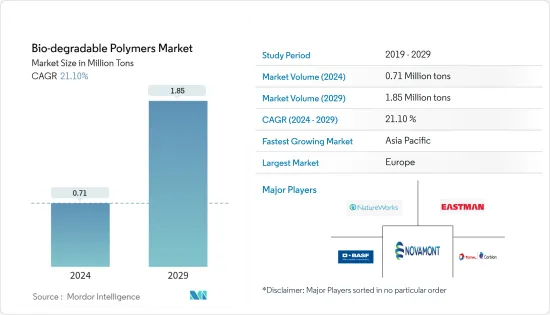

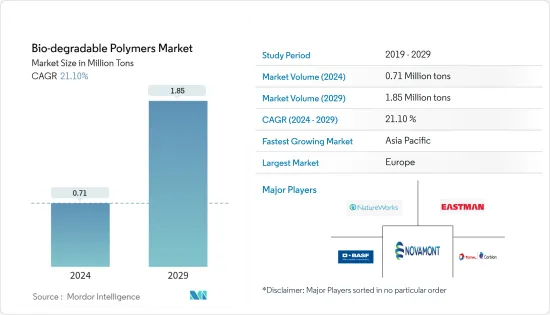

生物分解性聚合物市场规模预估2024年为71万吨,预估2029年将达185万吨,预测期内(2024-2029年)复合年增长率为21.10%。

生物分解性聚合物相对于非生物分解降解聚合物的优点在于毒性较低、副作用较少、提高病患依从性、并能维持药物稳定性。因此,全球工业和消费品生产的暂时停止不仅影响了需求,也影响了生物分解性聚合物的生产。这样的市场情境将在2020年出现,预计当年全球经济成长将下降3%至6%。

主要亮点

- 推动市场的主要因素是政府推广生质塑胶的政策。此外,其在软包装中的大量使用可能有利于市场成长。

- 另一方面,与石油基聚合物相比,生物分解性聚合物的价格较高,预计将阻碍市场成长。

- 生物分解性塑胶越来越多地用于利基应用,例如页岩气工业(在水力压裂过程中使用)、卫生产品和渔具,这可能代表着未来的市场机会。

生物分解性聚合物市场趋势

包装产业需求增加

- 可生物分解性聚合物用于软包装和硬包装应用。可生物分解性聚合物用于有机食品包装以及具有特殊要求的奢侈品和品牌产品。

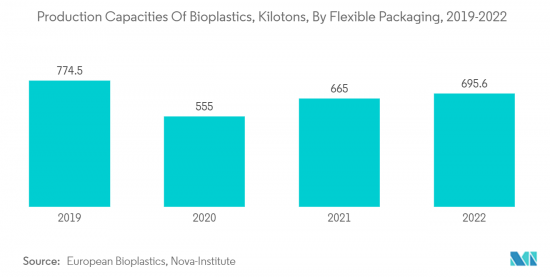

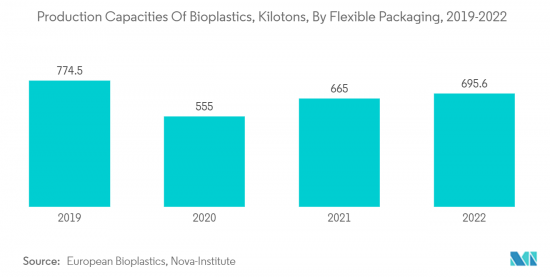

- 根据欧洲生物塑胶协会的数据,全球生质塑胶(其中生物分解性聚合物约占市场的40%)产能预计将从2022年的220万吨增加到2027年的630万吨。其中约 50% 用于包装市场,使其成为生质塑胶行业中最大的细分市场。

- 在硬包装应用中,可生物分解性聚合物用于包装乳霜和口红等化妆品以及饮料瓶。 PLA 广泛用于硬质包装应用。

- 生物分解性是易腐食品包装的关键要素。薄膜和托盘等软包装解决方案特别适合水果和蔬菜等生鲜食品,因为它们可以延长保质期。

- 由于严格的政府法规禁止使用石油基塑胶以及这些地区瓶子硬包装中生物分解性生物分解性的使用增加,欧洲和北美的生物可降解聚合物的消费量正在增加。

- 由于亚太地区、南美洲和中东等发展中地区各食品和安全机构食品包装标准的提高,预计在预测期内这些地区的包装产业成长将会增加。反过来,预计在预测期内也将推动生物分解性聚合物市场的成长。

- 由于上述因素,在预测期内,生物分解性聚合物市场预计将随着包装产业需求的增加而成长。

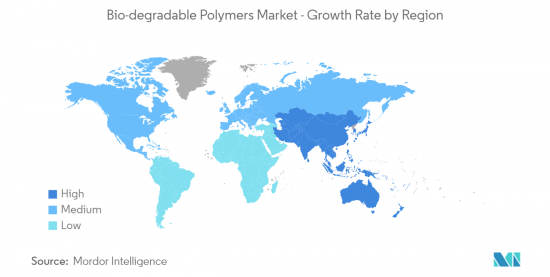

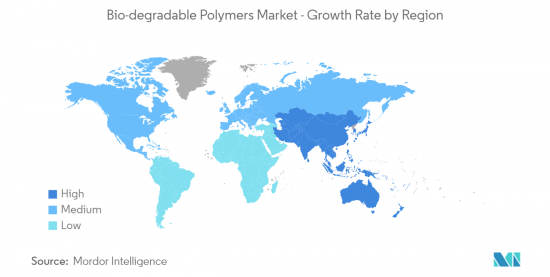

中国是亚太地区成长最快的国家

- 在亚太地区,中国是GDP最大的经济体。占全球塑胶产量近29%的中国塑胶製造商表示,对环境污染的担忧促使北京发出指令,减少刀叉餐具、塑胶袋和包装等传统一次性、非生物分解塑胶的使用。部分原因是由于禁令的前景,我们正在重点扩大玉米、砂糖和其他作物的使用,以开发生物分解性塑胶。

- 根据Interpak 2023的数据,中国在全球软包装市场中占有很大份额。至2022年,该国软包装市场的复合年增长率约为8%,而全球复合年增长率约为4.3%。包装产业的成长主要是由经济的强劲发展、都市化的加速以及人们生活品质的提高所推动的。消费者正在转向更安全、更方便、独特和环保的包装。

- 消费者越来越关注包装中使用的材料及其对健康和环境的影响。这就是为什么公司专注于改造生物分解性塑胶包装。

- 食品和饮料包装是推动生物分解性聚合物需求的主要因素。根据Interpak 2023统计,2023年中国食品包装零售贸易总量达4,470.66亿件。

- 中国也生产大量塑料,透过贸易出口为企业带来收益,从而为各种包装公司创造了巨大的产能。根据国际贸易中心(ITC)统计,2021年,中国塑胶及模压製品出口额约1,310.7亿美元,较上年(约963.8亿美元)成长36%。

- 地膜覆盖在中国农业中发挥重要作用,因为它能有效保持土壤温暖、保湿和控制杂草。塑胶薄膜的使用标准不断完善,相应的技术也得到了发展,如塑胶薄膜的多功能化、废渣回收技术的机械化以及用生物分解性的聚合物薄膜取代聚乙烯等。这种生物分解性塑胶覆盖技术已帮助粮食产量20-50%,为保障国家农产品供应发挥了重要作用。

- 因此,由于终端用户产业的上述趋势,中国生物分解性聚合物市场预计将在预测期内成长。

生物分解性聚合物产业概况

全球可生物分解性聚合物市场已部分一体化,各个产品领域的市场领导公司占据了大部分市场。拥有重要市场占有率的主要企业(排名不分先后)包括 NatureWorks LLC、Novamont SpA、 BASF SE、Total Corbion PLA 和 Eastman Chemical Company。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 政府利多政策促进生质塑胶发展

- 增加软包装的使用

- 其他司机

- 抑制因素

- 价格高于石油基聚合物

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(基于数量的市场规模)

- 种类

- 淀粉基塑料

- 聚乳酸(PLA)

- 聚羟基烷酯(PHA)

- 聚酯(PBS、PBAT、PCL)

- 纤维素衍生物

- 最终用户产业

- 农业

- 纤维

- 消费品(家用电器)

- 包装

- 卫生保健

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Biome Technologies plc

- BIOTEC Biologische Naturverpackungen GmbH & Co. KG

- Cardia Bioplastics

- Danimer Scientific

- DuPont

- Eastman Chemical Company

- FKuR

- Merck KGaA

- Mitsubishi Chemical Group Corporation

- NatureWorks LLC

- Novamont SpA

- TEIJIN LIMITED

- Total Corbion PLA

第七章 市场机会及未来趋势

- 扩大在电子产业的应用

- 扩大在医疗产业的应用

The Bio-degradable Polymers Market size is estimated at 0.71 Million tons in 2024, and is expected to reach 1.85 Million tons by 2029, growing at a CAGR of 21.10% during the forecast period (2024-2029).

Bio-degradable polymers are advantageous over non-bio-degradable polymers as they are less toxic, have lesser side effects, help to improve patient compliance, and maintains the stabilization of the drug. Therefore, temporary halt in the global production of industrial and consumer goods had repercussion not only on the demand, but also production of bio-degradable polymers. Such market scenario being witnessed in 2020 is indicated to trim the global economic growth by 3% to 6% during the year.

Key Highlights

- A major factor driving the market studied is the favorable government policies which promote bio-plastics. Additionally, tremendous usage in flexible packaging is likely to favor the market growth.

- On the flipside, the higher price of bio-degradable polymers compared to petroleum-based polymers is expected to hinder the market growth.

- Bio-degradable plastics are increasingly finding usage in niche applications, such as in shale gas industry (where they are used during hydro-fracking), hygiene products, and in fishing gears, among other applications, these are projected to act as an opportunity for the market in future.

Bio-degradable Polymers Market Trends

Increasing Demand from the Packaging Industry

- Bio-degradable polymers are used in both flexible and rigid packaging applications. Bio-degradable polymers are used for wrapping organic food, as well as for premium and branded products with particular requirements.

- According to European Bioplastics, global production capacities of bioplastics (of which bio-degradable polymers accounted for around 40% of the market) are expected to increase from 2.2 million tons in 2022 to 6.3 million tons in 2027. Around 50% of the volume is used for the packaging market, which is the biggest market segment within the bioplastics industry.

- In rigid packaging applications, bio-degradable polymers are used in cosmetics packaging, such as creams and lipsticks, as well as beverage bottles and many more. PLA is widely used in rigid packaging applications.

- Biodegradability is an important component of food packaging for perishables. Flexible packaging solutions, such as films and trays, are particularly suitable for fresh produce, such as fruit and vegetables, as they enable longer shelf life.

- In Europe and North America, the consumption of bio-degradable polymers is increasing, owing to stringent regulations by the government to ban the usage of petroleum-based plastics, coupled with the increasing usage of bio-degradable polymers in rigid packaging for bottles in these regions.

- The growth in the packaging industry in developing regions, such as Asia-Pacific, South America, and the Middle East, is expected to increase over the forecast period due to the improving food packaging standards of various food and safety organizations in these regions. In turn, it is expected to propel the growth of the bio-degradable polymers market during the forecast period.

- Owing to the aforementioned factors, the bio-degradable polymers market is expected to grow with the increasing demand from the packaging industry during the forecast period.

China to Grow at a Fastest Rate in Asia Pacific Region

- In Asia-Pacific, China is the largest economy in terms of GDP. Chinese plastics manufacturers that account for almost 29% of the global plastic production are focusing on the increased use of corn, sugar, and other crops to develop biodegradable plastics as concerns about environmental pollution have encouraged directives from Beijing and the prospects of a ban on conventional plastics single-use non-biodegradable plastics, such as cutlery, plastic bags, and packaging.

- According to Interpak 2023, China holds a significant share of the global flexible packaging market. The average annual growth of the flexible packaging market in the country until 2022 was around 8%, whereas the global annual average growth rate was around 4.3%. This growth in the packaging industry is mainly driven by dynamic economic development, accelerating urbanization, as well as improvement in people's quality of life. Consumers are shifting toward more safe, convenient, unique, and eco-friendly packaging.

- Consumers take more interest in the materials used for packaging and the impact on their health and environment. Therefore, companies are focusing on transforming biodegradable plastic packaging.

- Food and beverage packaging is the major driver boosting the demand for bio-degradable polymers. As per Interpak 2023, the Chinese total retail trade of foodstuff packaging in 2023 reached 447,066 million units.

- Also, China has a significant presence in producing considerable quantities of plastics, generating revenues from trade exports, thereby creating significant production capacities for various packaging companies. According to International Trade Center (ITC), in 2021, China exported plastics and articles valued at about USD 131.07 billion, a 36% rise in exports from the previous year, valued at around USD 96.38 billion.

- Plastic film mulching in the Chinese agriculture industry has played a vital role, owing to its effects on soil warming, moisture conservation, and weed control. Standards for using plastic films have been improved, and appropriate techniques are being developed for multipurpose plastic film, mechanization of residue recycling technology, and the replacement of polythene with biodegradable polymer films. This biodegradable plastic film mulching technology has helped in increasing 20-50% of grain crop yields and plays a key role in ensuring the supply of agricultural goods in the country.

- Thus, the market for biodegradable polymers in China is expected to experience growth during the forecast period owing to such trends in the end-user industries.

Bio-degradable Polymers Industry Overview

The global market for biodegradable polymers is partly consolidated, with a chunk of the market in the hands of the market leader in each product segment. Major companies holding a significant market share (not in any particular order) are NatureWorks LLC, Novamont S.p.A, BASF SE, Total Corbion PLA, and Eastman Chemical Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Favorable Government Policies Promoting Bio-plastics

- 4.1.2 Increasing Usage in Flexible Packaging

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Higher Price Compared to Petroleum-based polymers

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Starch-based Plastics

- 5.1.2 Polylactic Acid (PLA)

- 5.1.3 Polyhydroxy Alkanoates (PHA)

- 5.1.4 Polyesters (PBS, PBAT, and PCL)

- 5.1.5 Cellulose Derivatives

- 5.2 End-User Industry

- 5.2.1 Agriculture

- 5.2.2 Textile

- 5.2.3 Consumer Goods (Consumer Electronics)

- 5.2.4 Packaging

- 5.2.5 Healthcare

- 5.2.6 Other End-User Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Biome Technologies plc

- 6.4.3 BIOTEC Biologische Naturverpackungen GmbH & Co. KG

- 6.4.4 Cardia Bioplastics

- 6.4.5 Danimer Scientific

- 6.4.6 DuPont

- 6.4.7 Eastman Chemical Company

- 6.4.8 FKuR

- 6.4.9 Merck KGaA

- 6.4.10 Mitsubishi Chemical Group Corporation

- 6.4.11 NatureWorks LLC

- 6.4.12 Novamont S.p.A.

- 6.4.13 TEIJIN LIMITED

- 6.4.14 Total Corbion PLA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Use in the Electronics Industry

- 7.2 Increasing Applications in the Medical Industry