|

市场调查报告书

商品编码

1435200

聚合物包膜尿素:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Polymer Coated Urea - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

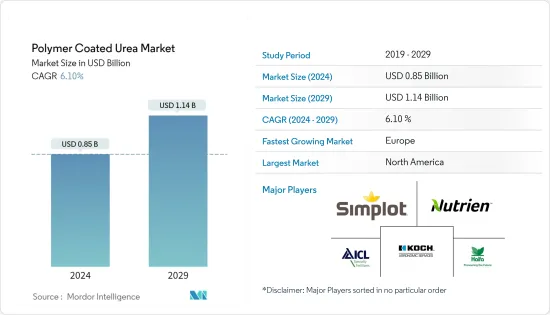

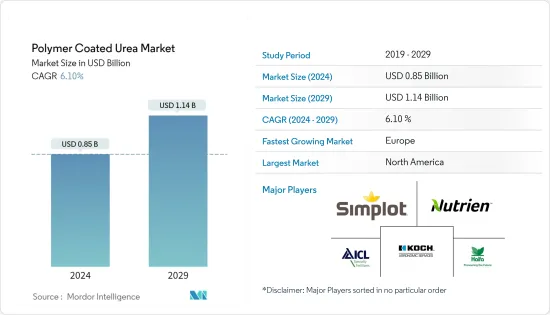

聚合物包膜尿素市场规模预计到2024年为8.5亿美元,预计到2029年将达到11.4亿美元,在预测期内(2024-2029年)增长6.10%,复合年增长率增长。

主要亮点

- 2019年,北美市场占最大份额,全年总额达2.6亿美元。大豆种植造成的氮素损失是对该国环境的主要威胁,进一步增加了对聚合物包膜尿素肥料的需求。此外,北美各地的高尔夫球场数量不断增加,从 2017 年的 18,145 个增加到 2019 年的 19,826 个,近年来对高尔夫球场的需求也在增加。

- 欧洲是2019年成长最快的新兴市场。欧盟委员会于2018年初推出循环经济行动计划,提案限制人工草皮等产品中微塑胶的使用。这将推动该地区对天然草的需求,进而推动对聚合物涂层尿素肥料的需求,因为肥料类型有助于保持草的颜色和活力。

- 市场占有率分析市场占有率分析显示,聚合物包膜尿素市场已巩固,全球领导者占据了更大的市场占有率。 Nutrien Ltd、JRSimplot Company、Koch Agronomic Service、Haifa Group、ICL Specialty Fertilizers、DeltaChem GmbH 是市场上一些主要企业。

聚合物包膜尿素的市场趋势

北美市场占据主导地位

根据 USDA-NASS 统计,儘管 2019 年天气条件不利(春季潮湿,随后 6 月凉爽),美国玉米农民 2019 年收穫玉米 9,170 英亩,与前一年同期比较增长 3%。这是由于越来越多地采用先进肥料,例如涂层肥料,这些肥料甚至是生物分解性的。棉花是主要经济作物之一,北美地区对棉花的需求量呈上升趋势,施肥对于提高棉纤维品质有重要作用。依照「适肥源、适时、适地、适量」的4R养分管理,聚膜肥显着提升棉花养分利用效率。此外,2019年,加拿大农业、农业和食品部(AAFC)宣布国内小麦和菜籽产量正在增加。这种主要种植作物的产量增加预计将进一步影响国内聚合物包膜尿素肥料市场。

欧洲是聚合物包膜尿素肥料成长最快的市场

根据 2018 年在芬兰进行的一项研究,控制释放或缓释肥料可确保整个作物週期中氮的可用性。研究也发现,由于谷物蛋白质含量低,该地区的小麦批次不适合製粉。这个问题可以透过使用生物分解性的聚合物包膜尿素肥料来解决。英国PLOS 2015年发表的研究论文显示,使用控制释放肥料使国内氨挥发量减少了51.3%,同时也提高了玉米的光合作用速率。这可以促进未来控制释放肥料的使用,例如可生物分解性的聚合物包膜尿素肥料。此外,苹果生产是高度集中的,涉及栽培(包括散布)、修剪和收穫。西欧农业劳动力短缺,人事费用高。因此,需要用生物分解性的聚合物包膜尿素肥料代替传统肥料,因为较短的施肥週期减少了对劳动力的需求。

聚合物包膜尿素产业概况

聚合物包膜尿素肥料市场已经整合,导致全球参与者主导市场。 Nutrien Ltd、JRSimplot Company、Koch Agronomic Service、Haifa Group、ICL Specialty Fertilizers、DeltaChem GmbH 是市场上一些主要企业。对一些公司来说,併购是关键策略之一,并采用合作伙伴策略来提供研发支援以及财务和行销支援。例如,2018年Grupa Azoty收购了波兰最大的化学公司Compo Expert。 Grupa Azoty 计划透过此次收购扩大其生产和市场范围。提高产能也是化肥企业满足日益增长的需求的关键途径之一。海法集团于 2016 年在萨凡纳开设了 CRF 生产工厂。该装置每年将生产20,000吨多层包膜和包膜肥料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章 产品概述

- 农地部分

- 园艺部分

第五章市场动态

- 市场驱动因素

- 市场限制因素

第六章市场区隔

- 作物类型

- 谷物/谷类

- 豆类和油籽

- 经济作物

- 水果和蔬菜

- 草坪/观叶植物

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 荷兰

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美洲

第七章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Nutrien Ltd

- JRSimplot Company

- Koch Agronomic Service

- Haifa Group

- ICL Specialty Fertilizers

- DeltaChem GmbH

- Florikan ESA LLC

- Pursell agritech

- Ekompany International BV

- Knox Fertilizer Company Inc.

- Compo Expert

第八章 市场机会及未来趋势

The Polymer Coated Urea Market size is estimated at USD 0.85 billion in 2024, and is expected to reach USD 1.14 billion by 2029, growing at a CAGR of 6.10% during the forecast period (2024-2029).

Key Highlights

- North America occupied the largest share in the market in 2019, reaching a total value of USD 260.0 million during the year. Nitrogen losses from soybean cultivation are a major threat to the environment in the country, which has further augmented the demand for polymer-coated urea fertilizer. Additionally, the increasing number of golf courses across North America, which were at 19,826 in 2019, as compared to 18,145 in 2017, has driven the demand for the same in recent years.

- Europe was the fastest-emerging market in 2019. The European Commission launched a Circular Economy Action Plan in early 2018, which proposed to restrict the usage of microplastics in products such as artificial turfs. This, in turn, will push forward the demand for natural grass, and subsequently, the demand for polymer-coated urea fertilizers in the region, as the fertilizer variety helps maintain grass color and vigor.

- The market share analysis market share analysis indicated a consolidated polymer-coated urea market with global leaders occupying a larger market share. Nutrien Ltd, J.R.Simplot Company, Koch Agronomic Service, Haifa Group, ICL Specialty Fertilizers, and DeltaChem GmbH, are some of the major players in the market.

Polymer Coated Urea Market Trends

North America Dominates the Market

According to USDA-NASS, 2019, despite the weather conditions being unfavorable (wet spring followed by cool June), the American corn farmers increased the area harvested under maize to 91.7 million in 2019, which was up by 3% from the previous year. This was owing to the increased adoption rate of cutting-edge fertilizers like poly-coated fertilizers, which are even biodegradable. The demand for cotton is on the rise in North America, as cotton is one of the major commercial crops, where fertilization plays a vital role in improving the quality of fiber. In accordance with 4R nutrient stewardship, which includes the right fertilizer source, at the right time, right place, and with right rate, poly-coated fertilizers have been noted to enhance nutrient-use efficiency in cotton. Further in 2019, Agriculture and Agri-Food Canada (AAFC) stated that wheat and canola production in the country is on the rise. This increase in the production of the majorly grown crops is further expected to the market for polymer-coated urea fertilizers in the country.

Europe is the Fastest-growing Market for Polymer-coated Urea Fertilizers

According to a research conducted in Finland in 2018, controlled release or slow-release fertilizers ensure nitrogen availability for the entire crop cycle. It was also noticed that due to low grain protein content, wheat lots were not suitable for milling in the region. This can be overcome by the application of biodegradable polymer-coated urea fertilizers. According to a research article published by PLOS UK in 2015, the use of controlled-release fertilizers has reduced ammonia volatilization by 51.3% in the country, and also enhanced the photosynthetic rate of maize. This is likely to boost the use of controlled-release fertilizers, including biodegradable polymer-coated urea fertilizers in the future. Furthermore, apple production is highly labor-intensive with operations involving growing (also includes fertilizer application to soil), pruning, and harvesting. There is a shortage of farm labor in the Western Europe region and labor costs are high. Hence, there is a need to replace conventional fertilizers with biodegradable polymer-coated urea fertilizers owing to fewer labor requirements due to reduced fertilizer application cycles.

Polymer Coated Urea Industry Overview

The polymer-coated urea fertilizer market is consolidated, resulting in the dominance of the global players over the market. Nutrien Ltd, J.R.Simplot Company, Koch Agronomic Service, Haifa Group, ICL Specialty Fertilizers, and DeltaChem GmbH, are some of the major players in the market. Mergers and acquisitions are one of the prime strategies followed by some companies, along with adopted partnership strategies for R&D support, and financial and marketing support. For instance, in 2018, Grupa Azoty acquired Compo Expert, which is the largest chemical company in Poland. With this acquisition, Grupa Azoty planned to increase its production and market outreach. An increase in the production capacity is also one of the key approaches observed among the fertilizer companies to meet the growing demand. Haifa Group started its CRF production facility at Savannah in 2016. This unit is expected to produce 20,000 metric ton of Multicote and Cote fertilizer, annually.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 PRODUCT OVERVIEW

- 4.1 Broad Acre Segment

- 4.2 Horticulture Segment

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

6 MARKET SEGMENTATION

- 6.1 Crop Type

- 6.1.1 Grains and Cereals

- 6.1.2 Pulses and Oilseeds

- 6.1.3 Commercial Crops

- 6.1.4 Fruits and Vegetables

- 6.1.5 Turf and Ornamentals

- 6.2 Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.1.3 Mexico

- 6.2.1.4 Rest of North America

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Netherlands

- 6.2.2.5 Russia

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 Australia

- 6.2.3.4 Rest of Asia-Pacific

- 6.2.4 South America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Rest of South America

- 6.2.5 Africa

- 6.2.5.1 South Africa

- 6.2.5.2 Rest of Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Most Adopted Strategies

- 7.2 Market Share Analysis

- 7.3 Company Profiles

- 7.3.1 Nutrien Ltd

- 7.3.2 J.R.Simplot Company

- 7.3.3 Koch Agronomic Service

- 7.3.4 Haifa Group

- 7.3.5 ICL Specialty Fertilizers

- 7.3.6 DeltaChem GmbH

- 7.3.7 Florikan ESA LLC

- 7.3.8 Pursell agritech

- 7.3.9 Ekompany International BV

- 7.3.10 Knox Fertilizer Company Inc.

- 7.3.11 Compo Expert