|

市场调查报告书

商品编码

1849915

生物降解聚合物:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Bio-degradable Polymers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

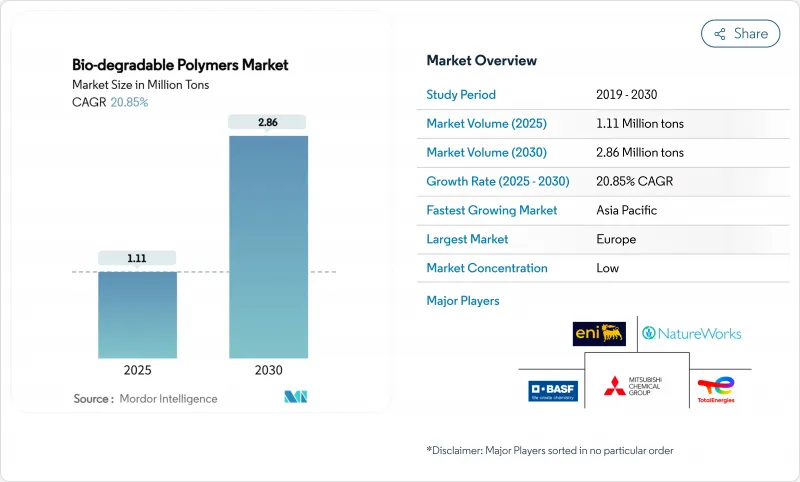

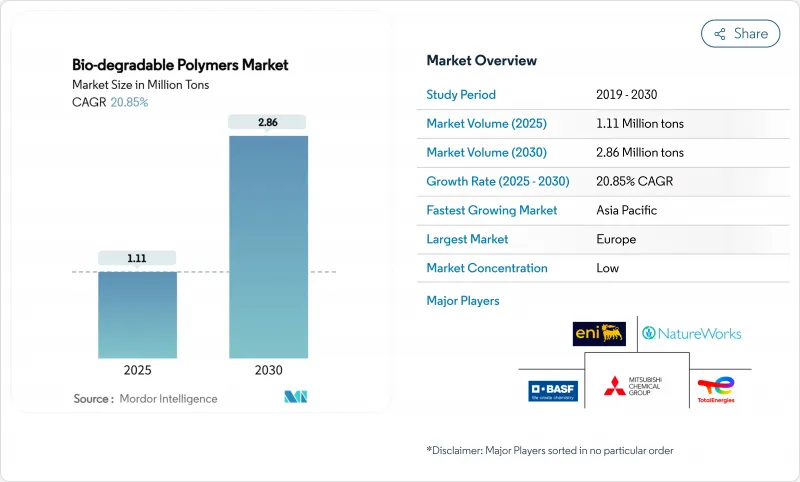

预计到 2025 年,可生物降解聚合物市场规模将达到 111 万吨,到 2030 年将达到 286 万吨,在预测期(2025-2030 年)内复合年增长率将达到 20.85%。

日益增长的监管压力、不断扩大的企业永续性目标以及微生物生产技术的快速发展,正在推动市场对高性能、低碳材料的需求。儘管欧洲仍是该地区最大的消费市场,但由于产业规模的扩大和相关法规的支持,亚太地区的发展速度最为快速。目前,产品创新主要集中在海洋可降解等级和经济高效的聚羟基脂肪酸酯(PHAs)上,随着大型石化企业、特种生质塑胶公司和新兴企业同时增加对产能和研发的投资,市场竞争日益激烈。

全球可生物降解聚合物市场趋势及洞察

政府对一次性塑胶製品的限制

全球法规正在重塑物质流动格局。欧盟的《包装及包装废弃物条例》将于2024年最终定稿,该条例将强制要求在欧盟境内销售的所有包装必须可回收利用,并设定分阶段的废弃物减量目标,引导加工商使用经认证的可立即堆肥或回收的等级产品。英国将于2024年4月生效的塑胶湿纸巾禁令将进一步拓展卫生用品市场的机会。香港将于2024年禁止使用一次性吸管和EPS容器等物品,预示亚洲也将出现类似的趋势。这些措施共同缩短了新建聚合物工厂的投资回收期,促进了承购协议的达成,并鼓励下游品牌采用这些产品。

对永续包装的需求日益增长

品牌所有者如今将永续性视为成长的驱动力,而非法规。高端食品和饮料製造商正转向使用聚乳酸(PLA)、聚羟基脂肪酸酯(PHA)和涂布纸等材料,以减少使用后的排放。朴茨茅斯大学实验室的研究表明,PLA在海水和阳光照射下排放的微塑胶比传统聚丙烯(PP)少九倍,这有助于提升品牌在具有海洋意识的消费者中的声誉。可回收设计指南和电子商务的兴起,正在创造对薄膜、托盘和硬质容器的巨大需求。

高昂的生产成本

设备摊销、特殊原料以及工厂规模有限等因素导致平均售价高于普通聚乙烯(PE)和聚丙烯(PP)产品。丹尼默科学公司(Danimer Scientific)于2025年申请破产,凸显了即使是技术领导企业也面临着盈利的挑战。儘管产能扩张和製程强化正在推动成本降低,但许多加工商仍对进入大众市场包装领域持谨慎态度。

细分市场分析

由于原料丰富且与现有吹膜和热成型生产线相容,淀粉基聚合物占据了可生物降解聚合物市场41.05%的份额。 PLA在硬质包装和医疗设备领域保持着强劲的地位。 PHA可生物降解聚合物市场规模预计将以23.49%的复合年增长率成长,这主要得益于其快速的海洋降解特性和不断提高的微生物发酵产量。聚酯基材料,例如PBS和PBAT,在捲边膜和卫生背衬材料领域正不断扩大市场份额,而纤维素基材料则被用于涂料和纸杯的生产。

成本平衡尚未实现。淀粉混合物享有农业补贴和简化的配方,而PHA开发商则受益于碳捕获额度和高利润的医药销售。可以预见,混合体系的趋势可能会出现,从而实现更均衡的成本效益比。

区域分析

欧洲在环保领域领先39.19%,这主要归功于政策的清晰性和消费者环保意识的增强。欧盟将于2024年最终确定的法规强制要求使用可回收或可堆肥包装,而像芬兰富腾公司(Fortum)的二氧化碳聚合物工厂这样的开创性计划则展示瞭如何将碳捕获技术与生物基生产相结合。

亚太地区是成长最快的地区,复合年增长率达29.44%。中国正在加紧建设PHA和PBAT工厂,以满足国家塑胶禁令的最后期限并供应农用薄膜。日本创新研发出含有二硫键的海洋可降解PBS,用于海洋浮标应用。

在北美,技术创新与企业自愿目标之间保持平衡。陶氏化学与新能源蓝公司(New Energy Blue)的协议将利用玉米秸秆生产生物乙烯,用于聚乙烯资产,从而为低碳替代能源铺平道路。南美和中东仍在发展中,但已对可生物降解的覆盖物表现出兴趣,以减少露天焚烧。工业堆肥设施的缺乏限制了其短期应用,但也预示着长期基础设施建设的机会。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 政府对一次性塑胶製品的使用进行限制

- 对永续和环保包装的需求日益增长

- 医疗保健产业对生物分解性塑胶的采用率不断提高

- 农业中可生物降解薄膜的使用激增

- 生物降解聚合物製造製程的技术创新及其产量提升

- 市场限制

- 与传统塑胶相比,生产成本更高

- 限制车辆油耗的机械性质限制

- 缺乏工业堆肥设施

- 价值链分析

- 监理展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- 淀粉基塑料

- 聚乳酸(PLA)

- 聚羟基烷酯(PHA)

- 聚酯(PBS、PBAT、PCL)

- 纤维素衍生物

- 按原料

- 甘蔗和甜菜

- 玉米和其他淀粉作物

- 纤维素和木质生物质

- 废弃植物油

- 藻类和微生物生物质

- 按最终用户行业划分

- 包裹

- 消费品

- 纺织品

- 农业

- 卫生保健

- 其他行业(汽车、建筑等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- BASF

- Biome Bioplastics

- BIOTEC Biologische Naturverpackungen GmbH & Co. KG.

- Braskem

- CJ CheilJedang Corp

- Danimer Scientific

- DuPont

- Evonik Industries AG

- FKuR

- GENECIS

- Mitsubishi Chemical Group Corporation

- NatureWorks LLC

- Eni SpA(Novamont)

- Plantic

- PTT MCC Biochem Co., Ltd.

- BEWI

- TEIJIN LIMITED

- TORAY INDUSTRIES, INC.

- TotalEnergies(Total Corbion)

- Zhejiang Hisun Biomaterials Co., Ltd.

第七章 市场机会与未来展望

The Bio-degradable Polymers Market size is estimated at 1.11 Million tons in 2025, and is expected to reach 2.86 Million tons by 2030, at a CAGR of 20.85% during the forecast period (2025-2030).

Heightened regulatory pressure, widening corporate sustainability goals, and rapid progress in microbial production technologies steer demand toward high-performance, low-carbon materials. Europe remains the largest regional consumer, while Asia-Pacific is advancing fastest due to industrial scale-up and supportive legislation. Product innovation now centers on marine-degradable grades and cost-efficient PHA, and competition is intensifying as petrochemical majors, specialty bioplastic firms, and start-ups invest simultaneously in capacity and research and development.

Global Bio-degradable Polymers Market Trends and Insights

Government Regulations Against Single-Use Plastics

Global rulemaking is reshaping material flows. The European Union's Packaging and Packaging Waste Regulation, finalized in 2024, obliges all packaging sold in the bloc to be recyclable and sets stepwise waste-reduction targets, immediately directing converters toward certified compostable or recyclable grades. The UK's ban on wet wipes containing plastic, introduced in April 2024, further enlarges the hygiene-product opportunity. Hong Kong's 2024 prohibition on single-use items such as straws and EPS containers signals similar momentum in Asia. Together, these measures are shortening payback periods for new polymer plants, accelerating off-take agreements, and incentivizing downstream brand adoption.

Growing Demand for Sustainable Packaging

Brand owners now treat sustainability as a growth driver rather than a compliance exercise. Premium food and beverage producers are shifting to PLA, PHA, and coated paper structures that lower end-of-life emissions. Laboratory evidence from the University of Portsmouth shows PLA emits nine times fewer microplastics under seawater-sunlight exposure than conventional PP, improving brand reputations among ocean-minded consumers. Design-for-recyclability guidelines and e-commerce expansion add to the pull, creating high-volume demand pockets for films, trays, and rigid containers.

High Production Cost

Equipment amortization, specialty feedstocks, and modest plant scales keep average selling prices above commodity PE and PP. The bankruptcy filing of Danimer Scientific in 2025 underscores profitability headwinds even for technology leaders. While increased capacity and process intensification are driving costs down, many converters still hesitate to commit to mass-market packaging segments.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption in the Healthcare Industry

- Surge in Agricultural Films Usage

- Limited Mechanical Performance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Starch-based grades hold 41.05% of the bio-degradable polymers market share due to abundant feedstock and compatibility with existing blown-film and thermoforming lines. PLA maintains a robust position in rigid packaging and medical devices. The bio-degradable polymers market size for PHA is projected to grow at a 23.49% CAGR, aided by its rapid marine degradation profile and improvements in microbial fermentation yields. Polyester families such as PBS and PBAT are gaining share in cling films and hygiene backsheets, while cellulosic derivatives serve coatings and paper cups.

Cost parity remains elusive. Starch blends enjoy agricultural subsidies and simpler compounding, but PHA developers benefit from carbon-capture credits and high-margin medical sales. A foreseeable convergence toward blended systems may deliver balanced cost-performance.

The Biodegradable Polymers Market Report Segments the Industry by Type (Starch-Based Plastics, Polylactic Acid (PLA), Polyhydroxy Alkanoates (PHA), and More), Feedstock (Sugarcane and Sugar Beets, Corn and Other Starch Crops, and More), End-User Industry (Packaging, Consumer Goods, Textile, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Europe's 39.19% leadership stems from policy clarity and consumer eco-awareness. The EU regulation finalized in 2024 forces recyclable or compostable packaging, and landmark projects such as Fortum's CO2-to-polymer plant in Finland illustrate how carbon capture integrates with bio-based production.

Asia-Pacific is the fastest-growing region at 29.44% CAGR. China ramps up PHA and PBAT plants to meet national plastic-ban deadlines and to supply agriculture films. Japan innovates marine-degradable PBS incorporating disulfide bonds for ocean buoy applications.

North America combines technological innovation with voluntary corporate targets. Dow's agreement with New Energy Blue uses corn stover to make bio-ethylene for PE assets, opening a low-carbon drop-in path. South America and the Middle East remain nascent but show interest in biodegradable mulch to reduce field-burning. Lack of industrial composting facilities curbs immediate uptake yet signals long-term infrastructure opportunities.

- BASF

- Biome Bioplastics

- BIOTEC Biologische Naturverpackungen GmbH & Co. KG.

- Braskem

- CJ CheilJedang Corp

- Danimer Scientific

- DuPont

- Evonik Industries AG

- FKuR

- GENECIS

- Mitsubishi Chemical Group Corporation

- NatureWorks LLC

- Eni S.p.A. (Novamont)

- Plantic

- PTT MCC Biochem Co., Ltd.

- BEWI

- TEIJIN LIMITED

- TORAY INDUSTRIES, INC.

- TotalEnergies (Total Corbion)

- Zhejiang Hisun Biomaterials Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Regulations Againts the usage of SingleUse Plastics

- 4.2.2 Growing Demand for Sustainable and Eco-Friendly Packaging

- 4.2.3 Increasing Adoption of Bio Degradable Plastics in the Healthcare Industry

- 4.2.4 Surge in the Usage of Bio-Degradable Films in the Agricultural Industry

- 4.2.5 Growing Innovations in the Manufacturing Processes of Bio-Degradable Polymers Improving its Yield

- 4.3 Market Restraints

- 4.3.1 High Production Cost with Respect to Conventional Plastics

- 4.3.2 Limited Mechanical Performance Restricting Consumption in Automotive

- 4.3.3 Lack of Industrial Composting Facilities

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Starch-Based Plastics

- 5.1.2 Polylactic Acid (PLA)

- 5.1.3 Polyhydroxyalkanoates (PHA)

- 5.1.4 Polyesters (PBS, PBAT and PCL)

- 5.1.5 Cellulosic Derivatives

- 5.2 By Feedstock

- 5.2.1 Sugarcane and Sugar Beets

- 5.2.2 Corn and Other Starch Crops

- 5.2.3 Cellulose and Wood Biomass

- 5.2.4 Waste Vegetable Oils and Fats

- 5.2.5 Algal and Microbial Biomass

- 5.3 By End-user Industry

- 5.3.1 Packaging

- 5.3.2 Consumer Goods

- 5.3.3 Textile

- 5.3.4 Agriculture

- 5.3.5 Healthcare

- 5.3.6 Others (Automotive, Construction, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)}

- 6.4.1 BASF

- 6.4.2 Biome Bioplastics

- 6.4.3 BIOTEC Biologische Naturverpackungen GmbH & Co. KG.

- 6.4.4 Braskem

- 6.4.5 CJ CheilJedang Corp

- 6.4.6 Danimer Scientific

- 6.4.7 DuPont

- 6.4.8 Evonik Industries AG

- 6.4.9 FKuR

- 6.4.10 GENECIS

- 6.4.11 Mitsubishi Chemical Group Corporation

- 6.4.12 NatureWorks LLC

- 6.4.13 Eni S.p.A. (Novamont)

- 6.4.14 Plantic

- 6.4.15 PTT MCC Biochem Co., Ltd.

- 6.4.16 BEWI

- 6.4.17 TEIJIN LIMITED

- 6.4.18 TORAY INDUSTRIES, INC.

- 6.4.19 TotalEnergies (Total Corbion)

- 6.4.20 Zhejiang Hisun Biomaterials Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Growing Inclination for Marine Degradable Polymers for Ocean Cleanups