|

市场调查报告书

商品编码

1430579

安防领域的人工智慧 -市场占有率分析、产业趋势与统计、成长预测(2024-2029)AI In Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

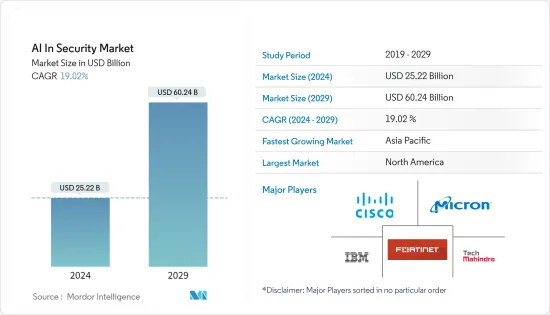

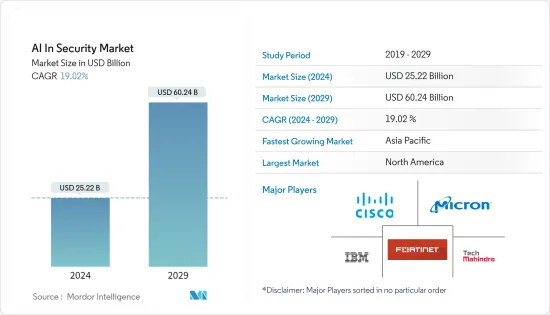

2024年安全领域人工智慧市场规模预计为252.2亿美元,预计到2029年将达到602.4亿美元,在预测期内(2024-2029年)复合年增长率为19.02%。

主要亮点

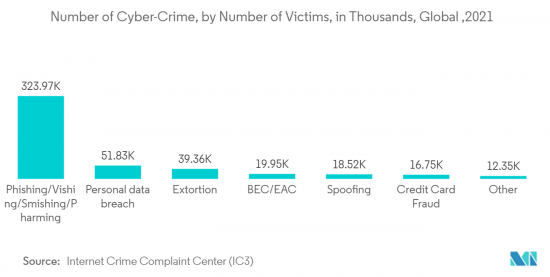

- 随着互联企业、设备和应用程式数量的增加,企业连接到大量独立端点,增加了其漏洞。因此,安全领域的人工智慧为持续监控和适应现代数位化经济面临的多方面安全漏洞所需的主动威胁缓解能力提供了一个有吸引力的提案。

- 人工智慧及其应用程式可以透过提供降低风险的即时警报来保护任何系统。组织内可用的资料用于训练这些系统。今年 2 月,国防部设立了一个新职位“首席资料和人工智慧官办公室”,取代 2018 年成立的 JAIC(综合人工智慧中心),作为该部门的执行官,负责加强和人工智慧整合数据、人工智慧和数位解决方案。已经推出。

- 透过引入使用人工智慧的机器学习,不仅可以检测威胁和恶意软体,还可以防止它们的发生。预计这将在预测期内为安防市场中的人工智慧创造巨大的市场机会。 2022年5月,美国参议院军事委员会网路小组委员会就在电脑网路空间利用人工智慧和机器学习的重要性举行了国会听证会。谷歌和乔治城大学安全与新兴技术中心的代表也参加了听证会。

- 对更多熟练人工智慧专业人员的需求和缺乏意识预计将在预测期内抑制市场。根据 IBM Security 的报告,在完全实施人工智慧 (AI) 时,与没有 AI 的组织相比,拥有 AI 的组织可节省高达 305 万美元。今年资料外洩的平均成本为 435 万美元,比去年的 424 万美元成长了 2.6%。

云端领域预计将以更快的速度成长

防毒/反恶意软体提供成长潜力

- 恶意软体变得越来越智能,需要人工智慧和机器学习技术来对抗恶意软体。防毒软体和反恶意软体都属于更广泛的网路安全范畴。从企业主管到成为网路钓鱼诈骗和试图存取敏感资讯的骇客攻击目标的日常消费者,网路安全越来越令每个人头痛。

- 现代网路攻击者的策略、技术和程序变得更快、更多产,勒索软体、网路钓鱼和软体供应链攻击等高级威胁正在爆炸式增长。此外,为了应对这些挑战,公司正在开发、维护并不断更新其网路安全策略和解决方案。例如,2022年8月,安全技术领导者Prosegur Security和视觉AI领导者Everseen宣布计画利用人性化的人工智慧解决方案重新构想零售和其他产业的实体安全,我们已经合作。这种伙伴关係加强了安全流程,并专注于创新。

- 根据消费者技术协会的数据,全球 44% 的组织已部署人工智慧应用程式来侦测和阻止安全入侵。网路安全中的人工智慧提高了系统的效率和准确性,以观察对组织策略的任何潜在威胁。澳洲信号局助理国防部长安德鲁·哈斯蒂表示,澳洲政府将在未来10年花费68亿美元来发展澳洲信号局(ASD)的攻防网路和情报能力。我们计划采取措施来加强这一点。

- 随着公司逐渐转向采用互联网进行大部分业务,员工被迫长时间在线并创建大量资料,增加了网络攻击和黑客攻击的风险。Masu。因此,透过利用机器学习和人工智慧,可以在短时间内减少大量资料,帮助企业识别安全威胁并从中恢復。

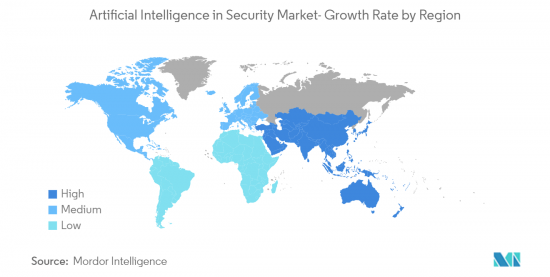

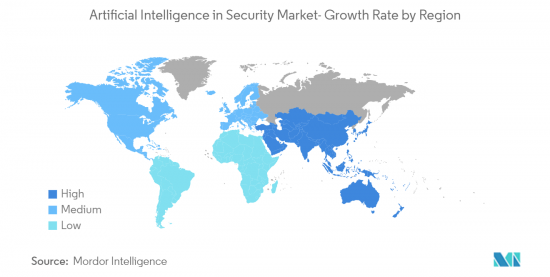

亚太地区将经历最高成长

- 亚太地区数位经济快速发展。然而,它也增加了与威胁相关的机会。据思科称,亚太地区的企业每分钟就会收到 6 个威胁,所有网路攻击中有 51% 造成 100 万美元或以上的损失。

- 互联网的普及和内部流程数位化的转变正在帮助推动云端基础的服务的采用。在亚太地区数位转型的同时,无效的网路法律和缺乏网路安全意识意味着亚太地区的企业成为骇客攻击目标的可能性比其他地区高出80%。今年7月,韩国FSC(金融服务委员会)和FSS(金融监督院)公布了金融服务人工智慧指南。这些指南将在人工智慧安全系统的责任、准确性、安全性、透明度、公平性和消费者权利方面指导产业。

- 此外,许多国家/地区已通过法规并制定了独立计划,以创建「单一事实资讯来源」并向银行和零售商提供检验的数位客户 ID。马来西亚的「MyKad」、新加坡的「MyInfo」和泰国的「数位身分证」都旨在促进和加快身分验证。这为人工智慧在安全市场创造了巨大的潜力。

- 所有上述因素预计将在预测期内支援人工智慧在区域安全市场的成长。例如,今年 2 月,IBM 宣布对其资源进行数百万美元投资,帮助企业应对和管理全部区域组织日益增长的网路攻击威胁。此次收购还包括一个新的安全营运中心 (SOC),该中心将为亚洲客户提供 24x7 安全回应服务,作为 IBM 现有全球 SOC 广泛网路的一部分。

人工智慧在安全领域的概述

由于近年来网路攻击的增加,随着许多新公司正在开发创新技术,安全市场中的人工智慧变得竞争激烈且分散。人工智慧(AI)是一个快速发展的技术领域,吸引了商业投资者、国防知识分子、政策制定者和国际竞争对手的注意。因此,这个市场的竞争正在加剧。参与者包括 IBM 和Cisco。

- 2023 年 11 月,Palo Alto Networks 宣布在安全性方面增加新的人工智慧相关功能。该功能已添加到该公司的 Cortex 安全自动化智慧产品线中。这一添加遵循了发现和消除威胁和漏洞的自动化趋势。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 安全诈骗和技术渗透率增加

- 整个云端运算生态系统中恶意软体攻击(勒索软体)的增加

- 市场限制因素

- 缺乏熟练的人工智慧专家

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按安全类型

- 网路安全

- 应用程式安全

- 云端安全

- 按服务

- 专业服务

- 管理服务

- 按发展

- 本地

- 云

- 按最终用户产业

- 政府/国防

- 零售

- BFSI

- 製造业

- 卫生保健

- 汽车与运输

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第六章 竞争形势

- 公司简介

- IBM Corporation

- Facebook Inc

- F-Secure Corporation

- Tech Mahindra Limited

- Cisco Systems Inc

- Nvidia Corporation

- Samsung Electronics Co., Ltd

- Xilinx, Inc

- ThreatMetrix Inc(RELX Group)

- Broadcom Inc.(Symantec Corporation)

- Fortinet, Inc

- Juniper Network, Inc

- Micron Technology, Inc

第七章 市场机会及未来趋势

第八章投资分析

The AI In Security Market size is estimated at USD 25.22 billion in 2024, and is expected to reach USD 60.24 billion by 2029, growing at a CAGR of 19.02% during the forecast period (2024-2029).

Key Highlights

- With the rise in connected enterprises, devices, and applications, businesses are becoming more vulnerable as they are connected to a mass of independent endpoints. Therefore, AI in security provides an enticing proposition with its proactive threat mitigation capabilities, which are needed for constant supervision and adaptation to the multifaceted security vulnerabilities faced by the modern digitalized economy.

- AI and its applications allow users to protect any system by providing alerts to them in real-time to mitigate risk. The data available within the organizations are being used to train these systems. In February of the current year, DOD stood up the new position of the Office of the Chief Digital and AI Officer to serve as the department's senior official responsible for strengthening and integrating data, AI, and digital solutions and replacing the JAIC (Joint Artificial Intelligence Center) established in 2018.

- Implementing machine learning with AI enables threats and malware to be proactively prevented rather than only detected. This is expected to help create a huge market opportunity for artificial intelligence in the security market during the forecast period. In May 2022, the US Senate Armed Forces Committee's Subcommittee on Cyber held a congressional hearing on the importance of leveraging artificial intelligence and machine learning within cyberspace. This hearing included representatives from Google and the Center for Security and Emerging Technology at Georgetown University.

- The need for more skilled AI professionals and lack of awareness are expected to restrain the market during the forecast period. According to a report by IBM Security, artificial intelligence (AI), when fully deployed, provided the most significant cost mitigation, up to USD 3.05 million less at organizations with AI than organizations without AI. Data breach average cost increased by 2.6% from USD 4.24 million in the last year to USD 4.35 million in the current year.

Cloud segment is expected to grow at a higher pace

Antivirus/Anti-malware Offers Potential Growth

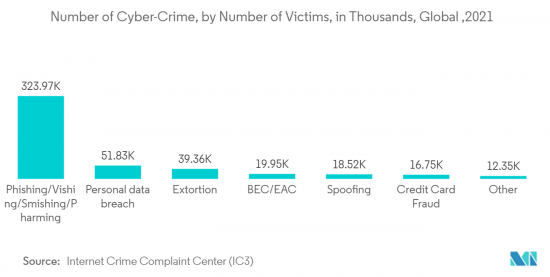

- Artificial intelligence and machine learning techniques are needed to counter-attack malicious software, with the malware getting more intelligent daily. Both antivirus and anti-malware fall under the broader term of cybersecurity. Cybersecurity is increasingly becoming a headache for everyone, from corporate executives to regular consumers, who are targeted by phishing scams and hackers attempting to access sensitive information.

- Modern cyber attackers' tactics, techniques, and procedures have become both rapid and abundant, while advanced threats such as ransomware, phishing, and software supply chain attacks are explosive. Further, to stand up to these challenges, businesses are developing, maintaining, and constantly updating their cybersecurity strategies and solutions. For instance, in August 2022, Prosegur Security, a leader in security technology, and Everseen, the leader in visual AI, partnered to reimagine physical security in retail and other industries using human-centric artificial intelligence solutions. The partnership will enhance security processes through a shared focus on innovation.

- According to the Consumer Technology Association, 44% of organizations across the globe are implementing AI applications to detect and deter security intrusions. Artificial intelligence in cybersecurity increases the efficiency and precision of the system to observe any potential threat in the organization's strategy. According to the Australian Signals Directorate, Andrew Hastie, assistant minister for defense, the Australian government is expected to spend USD 6.8 billion over the coming decade on measures to enhance the offensive and defensive cyber and intelligence capabilities of the Australian Signals Directorate (ASD).

- The gradual shift of enterprises toward adopting the internet to perform most tasks is compelling employees to remain online for a longer time and create a lot of data, thus increasing the risks for cyber-attacks and hacking. Thus with machine learning and AI, that peak of data could be carved down in a fraction of the time, helping the enterprise to identify and recover from the security threat.

Asia-Pacific to Witness the Highest Growth

- In Asia-pacific, great strides are being made in the digital economy. But it is also causing more threat-related opportunities. According to Cisco, companies receive six threats every minute in APAC, and 51% of all cyber-attacks result in a loss of more than USD 1 million.

- The growing penetration of the internet and the shift toward digitization of internal processes have been instrumental in driving the adoption of cloud-based services. Alongside the digital transformation in the region, owing to ineffective cyber laws and lack of cybersecurity awareness, companies in Asia-Pacific are 80% more likely to be targeted by hackers than in other regions. In July this year, Korea FSC (Financial Services Committee) and FSS (Financial Supervisory Service) announced AI Guidelines in Financial Services, which guide the industry on the responsibility, accuracy, safety, transparency, fairness, and consumer rights relating to AI security systems.

- Moreover, many countries have passed regulations and created independent programs to create a "single source of truth" and provide banks and retailers with verified digital customer identities. Malaysia's MyKad, Singapore's MyInfo, and Thailand's Digital ID are all designed to facilitate and speed up identity verification. This creates a huge scope for AI in the security market.

- All the above factors are expected to support the growth of artificial intelligence in the security market in this region during the forecast period. For instance, in February this year, IBM announced a multi-million dollar investment in its resources to help businesses prepare for and manage the growing threat of cyberattacks to organizations across the APAC region. The acquisition also includes a new Security Operation Center (SOC), part of IBM's vast network of existing global SOCs providing 24X7 security response services to clients around the region.

Artificial Intelligence (AI) in Security Industry Overview

Artificial intelligence in the security market is highly competitive and fragmented as many new companies are developing innovative technologies due to the rise in cyber attacks over the years. Artificial intelligence (AI) is a rapidly growing field of technology that is capturing the attention of commercial investors, defense intellectuals, policymakers, and international competitors. This is making this market more competitive. A few players are IBM Corporation, Cisco Systems Inc., etc.

- In November 2023, Palo Alto Networks Inc. announced the addition of fresh features that are artificial intelligence-related to security. The features are added to its Cortex security automation and intelligence product line. The addition is made following the automation trend in finding and eliminating threats and exploits.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number of Security Frauds and Technology Penetration

- 4.2.2 Increasing Number of Malware Attacks (Ransomware) across Cloud Computing Ecosystem

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled AI Professionals

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Security Type

- 5.1.1 Network Security

- 5.1.2 Application Security

- 5.1.3 Cloud Security

- 5.2 By Service

- 5.2.1 Professional Services

- 5.2.2 Managed Services

- 5.3 By Deployment

- 5.3.1 On-premise

- 5.3.2 Cloud

- 5.4 By End-user Industry

- 5.4.1 Government & Defense

- 5.4.2 Retail

- 5.4.3 BFSI

- 5.4.4 Manufacturing

- 5.4.5 Healthcare

- 5.4.6 Automotive & Transportation

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Latin America

- 5.5.4.2 Middle-East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Facebook Inc

- 6.1.3 F-Secure Corporation

- 6.1.4 Tech Mahindra Limited

- 6.1.5 Cisco Systems Inc

- 6.1.6 Nvidia Corporation

- 6.1.7 Samsung Electronics Co., Ltd

- 6.1.8 Xilinx, Inc

- 6.1.9 ThreatMetrix Inc (RELX Group)

- 6.1.10 Broadcom Inc. (Symantec Corporation)

- 6.1.11 Fortinet, Inc

- 6.1.12 Juniper Network, Inc

- 6.1.13 Micron Technology, Inc