|

市场调查报告书

商品编码

1430603

大豆杀菌剂种子处理:市场占有率分析、产业趋势、成长预测(2024-2029)Soybean Fungicide Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

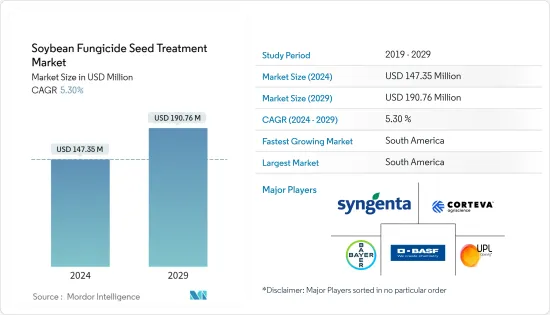

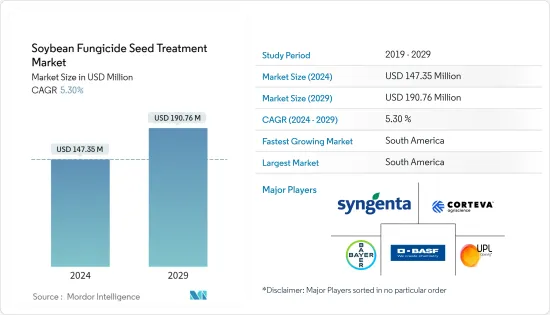

预计2024年大豆杀菌剂种子处理市场规模为1.4735亿美元,预计2029年将达到1.9076亿美元,在预测期内(2024-2029年)复合年增长率为5.30%。

由于 COVID-19 的影响,市场受到部分影响,世界各地的物流和供应都受到限制。据观察,出货限制以及空运、海运和陆运运费上涨是扰乱种子处理杀菌剂业务的关键因素。

从长远来看,粮食需求的增加、作物保护技术创新的不断增加、生物种子处理需求的增加以及政府支持的加强将推动全球大豆杀菌剂种子处理市场的发展。近年来,我们看到对生物种子处理产品的需求不断增加。认识到这一需求,公司正在积极将新的生物种子处理产品推向市场。 2021 年,Ceradis BV 生产的一种新型生物种子处理剂 Ceramax 在 EPA 註册,用于保护大豆作物免受猝死症候群 (SDS) 的影响。

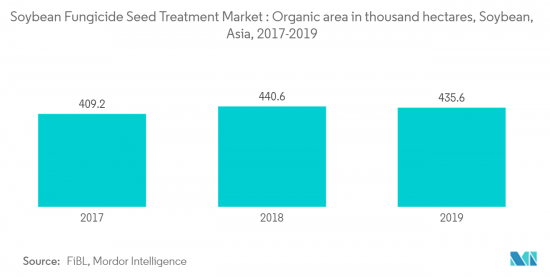

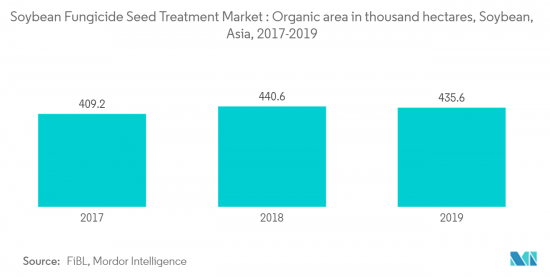

此外,消费量的快速产量导致对高产量的需求不断增长,推动了北美和南美种子处理剂市场的需求。然而,田间种植的大豆容易受到疫霉根腐病和茎腐病的影响,随着人们对种子品质和安全性的认识不断提高,以防止疾病入侵,亚太地区的种子处理实践也在不断增加,且进展迅速。

因此,处理种子的重要性,加上参与者采取的市场扩张和新技术创新等策略,可能会导致大豆杀菌剂种子处理市场的成长。

大豆杀菌剂种子处理市场趋势

生物种子处理需求快速成长

日益严重的环境问题,特别是在许多新兴市场,正在增加对生物种子处理的需求,从而推动预测期内的市场开拓。因此,越来越多的化学公司开始提供生物种子处理剂并试图抓住市场需求。主要公司向美国生产商出售经过生物製药和化学品组合处理的大豆种子。例如,在北美销售的一些先锋大豆种子产品经过生物种子处理,以提高生长、活力和产量。

生物种子处理使用活性成分,包括活微生物、发酵产物、植物抽取物、植物激素,甚至硬化学物质,对植物产生正面影响。生物种子处理剂的需求正在增加,因为它们能够透过增强植物遗传潜力来优化植物生长、最大限度地减少压力并提高产量。

认识到潜力,越来越多的公司正在进入生物种子处理市场。 2021年,FMC与先正达作物保护公司签订了分销协议,将Draco(一种玉米和大豆生物种子处理剂)在加拿大商业化。本产品具有独特的作用方式,结合了地衣芽孢桿菌和枯草芽孢桿菌,为加拿大农民提供保护,防止根瘤菌和线虫等夺取产量的根部害虫的侵害。

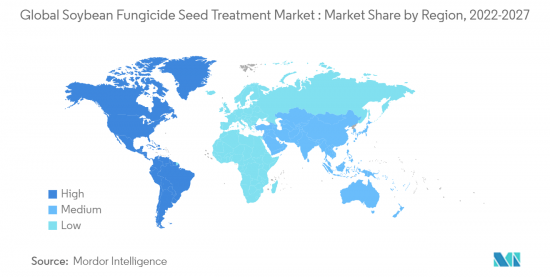

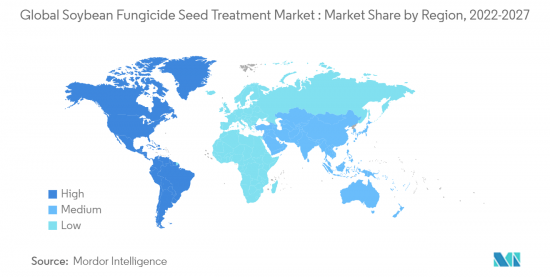

南美洲市场占据主导地位

根据联合国粮食及农业组织(FAO)的数据,巴西于2020年成为世界主要大豆生产国。再加上真菌病害的增加,导致种子处理杀菌剂的散布增加,预计未来几年还会增加。由豆薯层銹菌引起的大豆銹病是该国主要的真菌感染疾病。然而,与其他害虫相比,大豆受到昆虫的损害更大。

农业规模的扩大和作物轮作的减少以及生物农产品意识的增强是巴西种子产业持续发展的因素,从而导致高价值种子的快速普及。巴西的作物生产主要集中在大豆和玉米,因此几乎所有种子都经过处理,通常在播种前经过多次处理。

近年来,农业中越来越多地采用先进技术和管理实践,例如生物种子处理,可显着改善植入并降低成本。对此,2018年,先正达在阿根廷市场推出了大豆种子处理剂Vibrance Maxx。因此,作为大豆的主要生产国和出口国,加上创新技术的不断采用和参与企业的积极参与,大豆杀菌剂种子处理市场将在预测期内增长。

大豆杀菌剂种子处理产业概况

全球大豆杀菌剂种子处理市场由先正达国际公司、BASF、拜耳作物科学公司、科迪华农业科学公司、UPL、吴羽公司等主要企业高度整合。先正达国际股份公司拥有最大的市场占有率,其次是BASF股份公司和拜耳作物科学股份公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 类型

- 化学

- 非化学/生物

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 泰国

- 越南

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Kureha Corporation

- Syngenta International AG

- Bayer CropScience AG

- BASF SE

- Bioworks Inc.

- UPL

- Corteva Agriscience

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Andermatt Group AG

第七章 市场机会及未来趋势

第 8 章 COVID-19 市场影响评估

The Soybean Fungicide Seed Treatment Market size is estimated at USD 147.35 million in 2024, and is expected to reach USD 190.76 million by 2029, growing at a CAGR of 5.30% during the forecast period (2024-2029).

The market studied has been partially affected due to the COVID-19 pandemic, due to the logistics and supply constraints observed across the world. The restriction in movements of shipments and high air, sea, or land freight was observed to be a major factor disrupting the businesses, including seed treatment fungicides.

In the long run, increasing food demand, the rising innovation in crop protection technology, the increasing demand for biological seed treatments, and increasing government support would drive the global market of soybean fungicide seed treatment. Rising demand for biological seed treatment products has been observed in recent years. Recognizing this demand, the players are actively launching new biological seed treatment products in the market. In 2021, a new biological seed treatment, CeraMax, was registered under EPA to protect soybean crops from sudden death syndrome(SDS) produced by Ceradis BV.

Furthermore, the rising demand for higher yield due to the rapid increase in the consumption of crops has increased the demand for the seed treatment market in north America and South America. However, as as soybean plants grown in fields are highly prone to phytophthora root and stem rot and increasing awareness about the quality and safety of the seeds to protect from disease infestation, seed treatment practice in Asia-Pacific is also advancing at a faster rate.

Thus, the importance of treated seed, coupled with the strategies adopted by players, such as expanding market and innovating new technologies, is bound to lead to the growth of the soybean fungicide seed treatment market.

Soybean Fungicide Seed Treatment Market Trends

Rapidating Demand for Biological Seed Treatment

The rising environmental concerns, especially in many developed regions, the demand for biological seed treatment is rising, fueling the market's growth during the forecast period. Hence, more chemical companies are offering biological seed treatments to capture the market demand. Major players are selling soybean seeds treated with a combination of biologicals and chemicals to the growers in the United States. For instance, several pioneer soybean seed products sold in North America are treated with biological seed treatments to improve stand, plant vigor, and yield.

Biological seed treatments use active ingredients, including living microbes, fermentation products, plant extracts, phytohormones, and even hard chemistry, to have a favorable impact on plants. Owing to their ability to optimize plant growth, minimize stress, and boost overall yield by empowering the genetic potential of the plant, biological seed treatments are witnessing increasing demand.

Recognizing the potential, more companies are entering the biological seed treatment market space. In 2021, the FMC corporation entered into distribution agreements with Syngenta Crop Protection to commercialize Draco, a biological seed treatment for corn and soybean in Canada. The product has a unique mode of action that combines bacillus licheniformis and bacillus subtilis to offer Canadian farmers protection against yield-robbing root pests, such as rhizoctonia and nematodes.

South America Dominates the Market

In 2020, Brazil was the top producer of soybean in the world acoording to the Food and Agriculture Organization(FAO). This, coupled with increasing fungal diseases, leads to the hiher application of seed treatment fungicide and is anticipated to be increase in the coming years. Soybean rust, caused by Phakopsora pachyrhizi, is the major fungal infestation in the country. However, soybean is majorly affected by insects, compared to other pests.

Increasing farm size and decreasing crop rotation, coupled with rising awareness on Bio agribusiness are some of the factors contributing to the continuing strength of Brazil's seed sector which leads to the rapid adoption of high-value seeds. With Brazilian crop production narrowly focused on soybeans along with maize, virtually every seed gets treated, often more than once before it is planted.

In recent years, increased adoption of advanced technologies and management practices in agriculture can be witnessed, including biological seed treatments that significantly improve implantation and reduce costs. In this regard, in 2018, Syngenta launched Vibrance Maxx, a soybean seed treatment in the Argentine market. Therefore, being a major producer and exporter for soybeans, increased adoption of innovating technologies, coupled with the active participation of players, the soybean fungicide seed treatment market is anticipated to grow during the forecast period.

Soybean Fungicide Seed Treatment Industry Overview

The global market for soybean fungicide seed treatment is highly consolidated, with major players such as Syngenta International AG, BASF SE, Bayer Crop Science AG, Corteva Agriscience, UPL, and Kureha Corporation, among others. Syngenta International AG occupies the largest market share, followed by BASF SE and Bayer Crop Science AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Chemical

- 5.1.2 Non-Chemical/Biological

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Spain

- 5.2.2.5 Italy

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Thailand

- 5.2.3.5 Vietnam

- 5.2.3.6 Australia

- 5.2.3.7 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Kureha Corporation

- 6.3.2 Syngenta International AG

- 6.3.3 Bayer CropScience AG

- 6.3.4 BASF SE

- 6.3.5 Bioworks Inc.

- 6.3.6 UPL

- 6.3.7 Corteva Agriscience

- 6.3.8 Nufarm Ltd

- 6.3.9 Sumitomo Chemical Co. Ltd

- 6.3.10 Andermatt Group AG