|

市场调查报告书

商品编码

1432886

小麦种子处理:全球市场占有率分析、产业趋势、统计资料、成长预测(2024-2029)Global Wheat Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

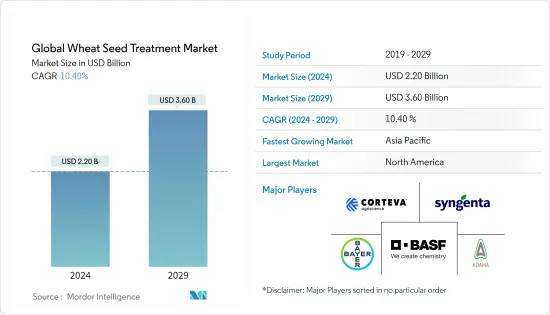

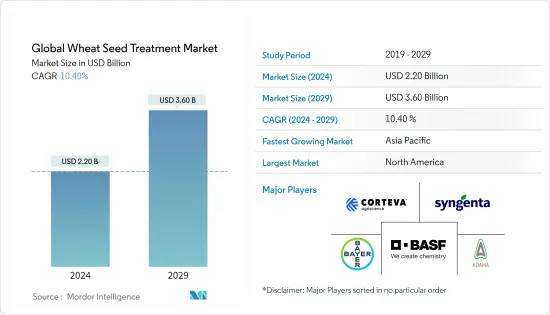

2024年全球小麦种子加工市场规模预计为22亿美元,预计到2029年将达到36亿美元,在预测期内(2024-2029年)复合年增长率为10.40%增长。

由于小麦贸易的增加、其潜在需求以及病虫害的出现,需要提高小麦产量,这将加强对小麦种子的种子处理的使用并提高种子产量。治疗市场。

小麦种子处理市场以北美为主,而亚太和南美市场则呈现快速成长。根据美国农业部(USDA)2019年的报告,全球小麦供应量较2017年增加490万吨,2018年全球产量增加至330万吨。 2018年,印度产量为1.012亿吨,欧盟产量为1.538亿吨。产量的增加表明对小麦种子处理产品的需求不断增长,因为它们在保护种子免受气候影响方面具有成本效益且有效。逆境。

COVID-19感染疾病影响了农民获得关键中间投入的情况。冠状病毒在种植季节之前抵达加拿大,引发了人们对种子和农药产品运输可能受到干扰的担忧。因此,杀虫剂等投入品的供应量低和/或价格高也可能影响种子处理市场的产量。

小麦种子处理市场趋势

不利的生产因素导致增加种子处理

作物生产力主要取决于气候条件,因为小麦必须有理想的生长温度和降水范围。除了气候条件外,病虫害的流行也导緻小麦种植区作物严重损失。因此,考虑到优质种子的高成本,农民越来越多地进行种子处理以保护作物免受不利条件的影响。这推动了全球小麦种子加工市场的成长。 2020年,由于主要作物病虫害爆发,我国作物遭受损失,损失程度较2019年增加。具体来说,小麦赤霉病可能会大量发生。

此外,干旱和气候变迁对俄罗斯、乌克兰和哈萨克地区的粮食生产以及全球粮食安全构成严重威胁。严重干旱严重影响了这些地区的小麦产量。为了满足全球需求,小麦生产商致力于提高小麦产量,提高生产绩效和收益。种子处理是防治土传害虫和病原体最重要的手段之一,全球小麦种子处理市场未来存在市场成长机会,预计将增加对种子处理产品的需求。确保最佳作物产量。

北美洲—最大的小麦种子处理市场

由于小麦种子处理化学品的采用率很高,预计北美将成为最大的小麦种子处理市场,并在预测期内实现强劲成长。小麦种子加工市场需求由全球需求驱动。小麦的种植面积、产量和田间作物总收入在美国农田作物中排名第三,仅次于玉米和大豆。根据美国农业部的报告,2019 年小麦总产量为 18.84 亿蒲式耳,包括 4,780 万英亩农地中的冬小麦、春小麦和硬粒小麦。小麦銹病、镰刀菌属和线虫每年造成的损害是该地区的一个主要问题。鑑于作物的经济重要性,许多公司和政府组织正在花钱资助新种子处理技术创新的研发。 2017年,先正达在明尼苏达州史丹顿开设了北美种子管理实验室,进行种子处理技术的研发。透过该实验室,先正达为客户提供基于最新技术的客製化解决方案,适合客户的特定需求以及农场和土壤条件。

小麦种子加工产业概况

小麦种子处理市场正在由领先的小麦种子处理化学品公司进行整合,因为这些公司主要集中在正在出现新发展的欧洲和北美。此外,各大公司也专注于占领亚太、南美和非洲的新兴市场。例如,2017年,BASF推出了一款名为Stamina F4谷物杀菌剂种子处理的新型小麦种子处理剂,以提供更一致且持续的病害管理。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 工业吸引力 - 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 目的

- 化学

- 生物

- 功能

- 种子保护

- 种子富集

- 其他特性

- 应用科技

- 种子披衣

- 种子製丸

- 种子拌药

- 其他应用技术

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Adama Agricultural Solutions Ltd

- Advanced Biological Marketing Inc

- BASF SE

- Bayer Cropscience AG

- Bioworks Inc.

- Corteva Agriscience

- Germains Seed Technology

- Incotec Group BV

- Nufarm Ltd

- Syngenta International AG

- Valent Biosciences Corp.

- Verdesian Life Sciences

第七章 市场机会及未来趋势

第八章 COVID-19 对市场的影响

The Global Wheat Seed Treatment Market size is estimated at USD 2.20 billion in 2024, and is expected to reach USD 3.60 billion by 2029, growing at a CAGR of 10.40% during the forecast period (2024-2029).

Owing to the increasing trade of wheat, because of the underlying rise in demand, and the emergence of pests and diseases, there is a need to improve wheat yields, which is driving an enhanced usage of seed treatment on wheat seeds, thus driving the seed treatment market.

North America dominates the wheat seed treatment market, however, Asia-Pacific and South America are showing a rapid pace of market growth. As per the United States Department of Agriculture (USDA) report 2019, global wheat supplies have increased by 4.9 million metric ton and global production increased to 3.3 million metric ton in the year 2018, compared to 2017. In addition, the report estimates the wheat production for India was recorded at 101.2 million metric ton and for European Union (EU) at 153.8 million metric ton in 2018. The increasing production indicates a higher demand for wheat seed treatment products as it is cost-effective and efficient in protecting seeds against climatic adversities.

The COVID-19 pandemic affected the availability of key intermediate inputs for farmers. With COVID reaching Canada just before planting season, concerns were centered on possible disruptions of seeds and crop protection product delivery. Therefore, low availability and/or high prices of inputs such as pesticides could weigh on yields consequently, seed treatment market as well.

Wheat Seed Treatment Market Trends

Unfavorable Production Factors Leading to Increased Practice of Seed Treatment

Crop productivity is primarily determined by climatic conditions because ideal temperatures and precipitation must be in range for wheat growth. In addition to climatic conditions, increasing pest and disease infestation resulted in severe crop loss in wheat-growing regions. Therefore, taking into consideration of high cost involved in quality seeds, farmers are increasingly practicing seed treatment to protect crops against unfavorable conditions. This is driving the growth of the wheat seed treatment market, globally. China has suffered crop loss due to the occurrence of major crop pests and diseases in 2020, heavier than that of 2019. Specifically, wheat scab, which is likely to occur heavily.

Furthermore, droughts and climate change are the significant threats to grain production in the Russia, Ukraine, and Kazakhstan (RUK) region and for global food security. Severe droughts have been significantly affecting wheat production in these regions. To maintain pace with global demand, wheat producers focus on enhancing the wheat yield both in production outcome and revenue. Seed treatment, being one of the most important means of combating soil-borne pests and pathogens, it is anticipated that the global market for wheat seed treatment is anticipated to have the opportunity for future market growth, enhancing demand for seed treatment products, in order to ensure optimal crop output.

North America-Largest Market for Wheat Seed Treatment

North America is anticipated to be the largest wheat seed treatment market, owing to the higher adoption rate of seed treatment chemicals for wheat, recording a robust growth rate during the forecasted period. The demand for the wheat seed treatment market is driven by its global demand . Wheat ranks third among U.S. field crops in planted acreage, production, and gross farm receipts, behind corn and soybeans. As per the USDA report, in 2019 the total production of wheat was 1.884 billion bushels of winter, spring, and durum wheat on 47.8 million acres of cropland. Annual losses due to wheat rust, Fusarium spp, and nematode are a major concern in the region. Taking into account the economic importance of the crop, many companies and government associations are spending funds towards the funding of research and development for innovation of new seed treatment technology. In 2017, Syngenta opened a North American Seedcare Institute in Stanton, Minnesota for doing research and development on seed treatment technology. Through this institute, Syngenta provides customized solutions to customers based on their specific needs and the latest technology suited to the farm and soil condition.

Wheat Seed Treatment Industry Overview

The wheat seed treatment market is consolidated among the major wheat seed treatment chemical companies, owing to a high concentration of companies mainly in Europe and North America, where new developments are taking place. Additionally, all major companies are also focused on capturing the new emerging markets of Asia-Pacific, South America, and Africa. For instance, in 2017, BASF launched a new wheat seed treatment, named, Stamina F4 Cereals fungicide seed treatment, providing more consistent and continuous disease control.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Chemical

- 5.1.2 Biological

- 5.2 Function

- 5.2.1 Seed Protection

- 5.2.2 Seed Enhancement

- 5.2.3 Other Functions

- 5.3 Application Technique

- 5.3.1 Seed Coating

- 5.3.2 Seed Pelleting

- 5.3.3 Seed Dressing

- 5.3.4 Other Application Techniques

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Adama Agricultural Solutions Ltd

- 6.3.2 Advanced Biological Marketing Inc

- 6.3.3 BASF SE

- 6.3.4 Bayer Cropscience AG

- 6.3.5 Bioworks Inc.

- 6.3.6 Corteva Agriscience

- 6.3.7 Germains Seed Technology

- 6.3.8 Incotec Group BV

- 6.3.9 Nufarm Ltd

- 6.3.10 Syngenta International AG

- 6.3.11 Valent Biosciences Corp.

- 6.3.12 Verdesian Life Sciences