|

市场调查报告书

商品编码

1683166

北美种子处理市场:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

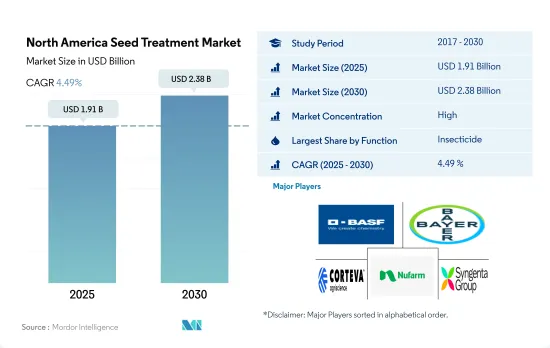

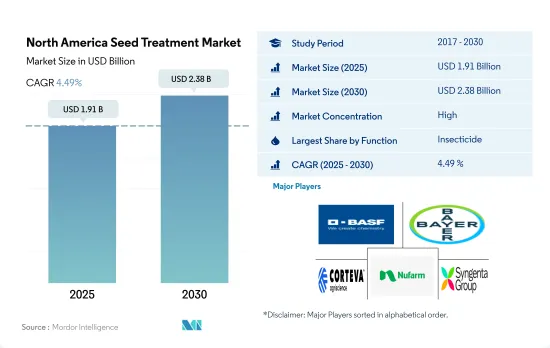

北美种子处理市场规模预计在 2025 年将达到 19.1 亿美元,预计到 2030 年将达到 23.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.49%。

人们越来越意识到种子应用技术在保护和建立健康幼苗方面的好处,这推动了市场的发展。

- 北美种子处理行业正在经历显着的成长。 2022 年的市场规模与 2020 年相比成长了 9.8%。推动这一成长的因素是人们越来越意识到种子应用技术在保护和建立健康幼苗方面的好处,以及提高整体生产力的必要性。

- 美国和加拿大是农业大国,广泛使用种子处理来保护作物免受各种真菌疾病和害虫的侵害。这两个国家占据该地区种子处理市场占有率。美国约占该地区市值的82.6%,而加拿大约占市场占有率的3.7%。

- 在关键的早期生长期,种子处理产品具有针对病虫害和不确定的土壤条件的先进防护功能,可以提高功效,从而促进消费并促进市场成长。

- 预计 2023-2029 年预测期内种子处理市场将成长 36.2%。这一增长的主要驱动力是为了满足不断增长的人口的需求而不断增加的粮食生产需求。为了提高作物产量并减少病虫害造成的损失,农民越来越多地采用种子处理,这对于提高幼苗活力和整体作物产量至关重要。

- 因此,预计在预测期内,人们对种子处理益处的认识不断提高、创新产品的可用性以及种子处理采用率的提高将推动市场成长。

农民越来越认识到种子处理对改善作物健康的价值,从而导致市场不断扩大。

- 随着农民认识到种子处理在改善作物健康和生产力方面的价值,种子处理剂的消费量不断增加,北美种子处理剂市场正在迅速扩张。

- 种子处理市场涵盖各种各样的作物。其中,谷物和谷类到2022年将占据43.8%的市场占有率。病虫害发生率的上升对这些作物产生了不利影响,促使人们采用谷物和谷类种子处理技术。

- 美国是北美最大的种子处理市场,2022 年占 82.6%。受粮食安全需求增加和种子处理产品采用率不断提高等因素推动,该国正经历显着成长。

- 2017 年至 2022 年,该地区的市值成长了 30.8%。政府推动永续农业和增加粮食产量的措施促进了该地区种子处理市场的发展,尤其是在美国和加拿大。例如,国家食品和农业研究所(NIFA)透过其资助计划在促进永续农业方面发挥了关键作用。其中之一是永续农业研究和教育(SARE)计划,该计划为农民、生产者和农村社区提供了大力支持。

- 推动种子处理市场成长的另一个因素是永续农业实践的兴起。种子处理可以针对性地防治病虫害,减少对广谱农药的依赖,并最大限度地减少对环境的影响。

- 因此,预计预测期内(2023-2029 年)市场复合年增长率将达到 4.8%。

北美种子处理市场趋势

由于土传疾病和线虫造成主要作物的损失不断增加,因此必须使用更高剂量的种子处理剂。

- 在北美,每公顷种子处理剂的消费量明显增加,2022年将比2017年增加53克。消费量的大幅增长是由于影响该地区农业实践的多种因素所造成的。一个关键因素是气候变迁的影响,它导致了天气模式的改变并给农民带来了新的挑战。由于这些变化,人们越来越需要有效的种子处理产品来减轻不可预测的天气对作物健康和产量的不利影响。

- 此外,真菌和线虫的侵染对农作物构成重大威胁,需要使用更高施用率的种子处理来保护植物健康并确保最佳产量。

- 种子处理剂消费量的增加是对北美农业格局变化的反应。农民正积极采用种子处理解决方案作为预防措施。该地区的主要农业国家美国和加拿大目前正在努力应对植物寄生线虫、土壤传播疾病和各种其他害虫带来的重大挑战。

- 大豆、玉米、棉花和玉米是该地区的主要作物,但面临各种线虫和土传疾病的巨大挑战。这些挑战包括根瘤线虫、根腐病、镰刀菌、谷类胞囊线虫、大豆胞囊线虫、立枯丝核菌、腐霉菌、同质体、幼苗猝倒病等等。这些疾病和线虫的治疗正在增加,需要更高剂量的种子处理。

种子处理需求的增加预计将推高活性成分的价格。

- 北美种子处理中常用的活性成分包括Cypermethrin、Metalaxyl、Malathion、Avermectin和Azoxystrobin。种子处理透过在播种时形成保护层为种子和幼苗提供对病虫害的初步保护。当种子在土壤中开始生长时,这道保护屏障可以保护种子免受潜在伤害。

- 作为一种杀虫剂,氯氰菊酯主要存在于经过处理的种子和植物的表面,形成一道保护屏障,能够快速击倒多种害虫。 2022 年的价格为每吨 21,000 美元。Cypermethrin的作用方式是破坏昆虫的神经系统,导致瘫痪并最终死亡。

- Malathion的系统作用使其能够成功控制多种害虫,包括蚜虫、叶蝉、蓟马、介壳虫和某些毛虫。 2022 年的价格为每吨 124,000 美元。Malathion透过抑制乙酰胆碱酯酶使昆虫丧失能力,而乙酰胆碱酯酶对于昆虫的神经功能至关重要。

- Avermectin属于伊维菌素家族,对线虫具有强烈的内在活性。它用于玉米、大豆和棉花生产中,以保护幼苗免受线虫侵害根部。 2022 年的价格为每吨 8,800 美元。

- 透过使用Metalaxyl进行种子处理,农民可以从植物生命週期开始就主动解决疾病问题。这种早期疗育可确保幼苗更健康、更有活力,进而提高作物产量。甲霜灵2022年的价格为每吨4400美元。

北美种子处理行业概况

北美种子处理市场相当集中,前五大公司占76.44%的市占率。市场的主要企业是BASF公司、拜耳公司、科迪华农业科技、Nufarm Ltd 和先正达集团。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 有效成分价格分析

- 法律规范

- 加拿大

- 墨西哥

- 美国

- 价值链与通路分析

第五章 市场区隔

- 功能

- 杀菌剂

- 杀虫剂

- 杀线虫剂

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- Albaugh LLC

- BASF SE

- Bayer AG

- Corteva Agriscience

- Nufarm Ltd

- Sharda Cropchem Limited

- Syngenta Group

- Upl Limited

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 56637

The North America Seed Treatment Market size is estimated at 1.91 billion USD in 2025, and is expected to reach 2.38 billion USD by 2030, growing at a CAGR of 4.49% during the forecast period (2025-2030).

The market is fueled by increasing awareness of the benefits of seed-applied technologies in protecting and establishing healthy seedlings

- The seed treatment industry in North America is experiencing significant growth. The market value increased by 9.8% in 2022 compared to 2020. This growth is driven by growing awareness of the benefits of seed-applied technologies in protecting and establishing healthy seedlings and the need to improve overall productivity.

- The United States and Canada are leading agricultural nations that extensively use seed treatment chemicals to safeguard their crops against various fungal diseases and pests. These two countries hold a significant market share for seed treatments in the region. The United States constitutes approximately 82.6% of the regional market value, while Canada contributes around 3.7% of the market share.

- The availability of seed treatment products with advanced protection against pests, disease, and uncertain soil conditions during the critical early growth period results in improved effectiveness, which drives consumption, thereby contributing to the growth of the market.

- The seed treatment market is expected to witness a growth of 36.2% during the forecast period of 2023-2029. This growth is primarily driven by the rising demand for food production to meet the needs of a growing population. In order to optimize crop yields and minimize losses due to diseases and pests, farmers are increasingly adopting seed treatment, which plays a crucial role in improving seedling vigor and overall crop productivity.

- Therefore, growing awareness about the benefits of seed treatment, the availability of innovative products, and the rising adoption rate of seed treatment are expected to fuel the growth of the market during the forecast period.

Farmers are increasingly recognizing the value of seed treatments in improving crop health, which is leading to the expansion of the market

- The North American seed treatment market is expanding rapidly due to the rising consumption of seed treatment as farmers increasingly recognize the value of seed treatments in improving crop health and productivity.

- The seed treatment market includes a wide range of crops. Among all, grains and cereals accounted for 43.8% of market share in 2022. The rising incidence of pests and diseases is negatively affecting these crops, which is driving the adoption of seed treatments in grains and cereals.

- The United States is the largest seed treatment market in North America, accounting for a share of 82.6% in 2022. The country has been witnessing substantial growth driven by factors such as increasing demand for food security and rising adoption of seed treatment products.

- The market value increased in the region by 30.8% between 2017 and 2022. Government initiatives aimed at promoting sustainable agriculture and increasing food production boosted the seed treatment market in the region, mainly in the United States and Canada. For instance, the National Institute of Food and Agriculture (NIFA), through its funding initiatives, played a crucial role in advancing sustainable agriculture. One such program is the Sustainable Agriculture Research and Education (SARE) program, which has significantly supported farmers, growers, and rural communities.

- Another factor contributing to the growth of the seed treatment market is the growing sustainable agricultural practices. Seed treatments offer targeted protection against pests and diseases, reducing the reliance on broad-spectrum pesticides and minimizing the environmental impact.

- Therefore, the market is expected to register a CAGR of 4.8% during the forecast period (2023-2029).

North America Seed Treatment Market Trends

Increased crop losses in major crops due to soilborne diseases and nematodes necessitate the use of seed treatments with higher dosages

- North America experienced a noteworthy upsurge in seed treatment consumption per hectare, with a recorded increase of 53 grams in 2022 compared to the figures from 2017. This substantial growth in consumption can be attributed to several factors that have influenced agricultural practices in the region. One significant factor is the impact of climate changes, which have resulted in shifts in weather patterns and the emergence of new challenges for farmers. As a consequence of these changes, there has been a greater need for effective seed treatment products to mitigate the adverse effects of unpredictable weather on crop health and yield.

- Additionally, the rise in fungal and nematode infestations has posed significant threats to crops, necessitating the use of seed treatments at higher application rates to safeguard plant health and ensure optimal yields.

- The increase in seed treatment consumption is a response to the changing agricultural landscape in North America. Farmers are proactively adopting seed treatment solutions as a precautionary measure. The United States and Canada, as major agricultural countries in the region, are currently grappling with significant challenges posed by plant parasitic nematodes, soil-borne diseases, and various other insect pests.

- Soybeans, maize, cotton, and corn are the prominent crops grown in the region, but they encounter significant challenges from various nematodes and soilborne diseases. These challenges include root-lesion nematodes, root rots, fusarium species, cereal cyst nematodes, soybean cyst nematodes, rhizoctonia, pythium species, phomosis, seedling blights, and others. The increasing damage by these diseases and nematodes necessitates the seed treatment application method with higher dosages.

The growing demand for Seed treatment is anticipated to fuel the prices of the active ingredients.

- In North America, commonly utilized active ingredients for seed treatment chemicals include cypermethrin, metalaxyl, malathion, abamectin, and azoxystrobin. Seed treatment offers initial protection to seeds and young plants from pests and diseases by establishing a defensive layer upon seed sowing. This protective barrier shields the seed from potential harm as it begins its growth in the soil.

- Cypermethrin, as an insecticide, remained primarily on the surface of treated seeds or plants, forming a protective barrier for quick knockdown action against a wide range of insect pests. Its price stood at USD 21.0 thousand per metric ton in 2022. The mode of action of Cypermethrin involves disrupting the nervous systems of insects, leading to paralysis and, ultimately, their death.

- Malathion's systemic effect allowed for the successful management of a wide range of insect pests, such as aphids, leafhoppers, thrips, scales, and specific caterpillar types. It was priced at USD 124 thousand per metric ton in 2022. Malathion inhibits acetylcholinesterase, a vital enzyme for nerve function in insects, leading to their incapacitation.

- Abamectin belongs to the Ivermectin chemical class and has high intrinsic activity against nematodes. It is used to protect young plants from the root-attacking nematodes in corn, soybeans, and cotton production. It was priced at USD 8.8 thousand per metric ton in 2022.

- By applying metalaxyl as a seed treatment, farmers can proactively address disease issues right from the start of the plant's life cycle. This early intervention helps ensure healthier and more vigorous seedling establishment, which can lead to improved crop yields. Metalaxyl was priced at USD 4.4 thousand per metric ton in 2022.

North America Seed Treatment Industry Overview

The North America Seed Treatment Market is fairly consolidated, with the top five companies occupying 76.44%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, Nufarm Ltd and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Insecticide

- 5.1.3 Nematicide

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Albaugh LLC

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 Nufarm Ltd

- 6.4.6 Sharda Cropchem Limited

- 6.4.7 Syngenta Group

- 6.4.8 Upl Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219