|

市场调查报告书

商品编码

1690928

大豆杀菌剂种子处理:市场占有率分析、产业趋势与成长预测(2025-2030)Soybean Fungicide Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

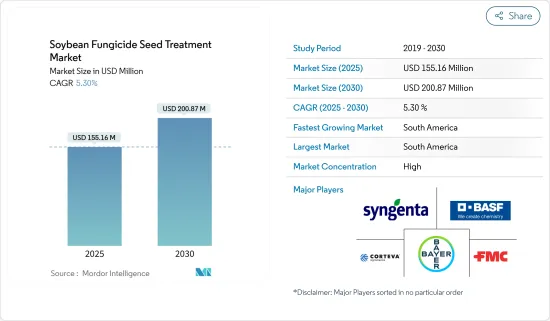

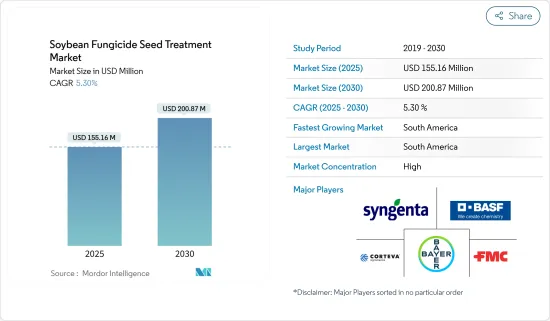

大豆杀菌剂种子处理市场规模预计在 2025 年为 1.5516 亿美元,预计到 2030 年将达到 2.0087 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.30%。

随着农民注重保护作物免受真菌疾病的侵害以保持健康的产量,大豆杀菌剂种子处理市场正在扩大。大豆麵临来自土壤和种子传播的病原体(如疫霉菌、立枯丝核菌和镰刀菌)的严重风险,这些病原体会影响发芽和植物早期发育。

全球食品、饲料和工业领域的大豆消费量持续增加。大豆为豆腐、豆浆和肉类替代等植物性食品提供必需的蛋白质和脂肪,并且由于健康和永续性的考虑而变得越来越受欢迎。在畜牧业中,豆粕用于家禽、猪和牛的饲料。 2023年全球家牛隻数量将达15.757亿头,高于先前的15.577亿头。生质燃料产业也透过用于生物柴油生产的大豆油增加了需求。人口成长和饮食偏好的变化维持了这种消费成长,进一步推动了大豆杀菌剂处理市场的发展。

先进的杀菌剂配方可以增强对多种病原体的防护。这些处理可以提高幼苗的活力,确保均匀生长,并增强对环境压力的抵抗力。该行业正在从传统的化学喷洒转向有针对性的种子处理,专注于最大限度地提高作物产量,同时降低投入成本和应用复杂性。

大豆杀菌剂和种子处理市场主要由南美洲主导,其中巴西和阿根廷由于大豆产量大而贡献巨大。北美,尤其是美国,由于潮湿的环境增加了真菌感染的风险,占据了主要的市场占有率。由于大豆种植面积增加和种子处理技术的采用,亚太市场正在扩大,尤其是在中国和印度。根据ITC贸易地图,印度大豆进口量从489,500吨增加至724,900吨。由于大豆需求的增加,预计预测期内大豆杀菌剂种子处理市场将会扩大。

大豆杀菌剂种子处理市场趋势

生物种子处理剂需求激增

已开发地区的环境问题增加了对生物种子处理的需求,推动了预测期内的市场成长。化学公司正在透过扩大生物种子处理剂的供应来应对这一问题。在美国,各大公司提供经过生物和化学方法处理的大豆种子。根据粮农组织统计资料库(FAOSTAT),加拿大大豆收穫面积将从2022年的211万公顷增加到2023年的226万公顷。

生物种子处理包含活性成分,如活微生物、发酵产物、植物抽取物、植物激素和化合物,以帮助植物生长。这些处理方法越来越受欢迎,因为它们能够透过最大限度地发挥植物的遗传潜力来促进植物生长、减少压力并提高产量。

由于作物消费量的增加和大豆早期种植实践,美国种子处理市场正在扩大。根据粮农组织统计资料库 (FAOSTAT) 的数据,2023 年大豆产量将达到 1.133 亿吨。早期在潮湿的土壤上种植往往会使种子和幼苗暴露在昆虫、疾病和害虫的侵害下,因此需要对种子进行处理以保护种子并提高产量。美国环保署 (EPA)监督化学农药在农作物和食品中的应用,近年来许多公司已在 EPA 註册。

越来越多的公司正在进入生物种子处理市场。 2022年,BASF欧洲公司在加拿大註册了大豆种植的Veltyma杀菌剂。本产品结合了Fluconazole(Revysol)和Pyraclostrobin的植物健康益处以及Metconazole的镰刀菌控制能力,可提供全面的大豆病害管理。

南美洲占据市场主导地位

南美洲占世界大豆产量和出口的大部分,其中巴西和阿根廷是主要贡献者。根据粮农组织统计,巴西是全球最大的大豆生产国,占全球产量的40%以上,而阿根廷仍是最大的大豆出口国。该地区广阔的可耕地、适宜的气候和现代化的农业方法使其能够大规模生产大豆,满足全球对食品、饲料和生质燃料的需求。根据粮农组织统计资料库 (FAOSTAT) 的数据,大豆产量将从 2022 年的 1.212 亿吨增至 2023 年的 1.521 亿吨。巴西主要的大豆生产州——马托格罗索州、巴拉那州和南里奥格兰德州——占全国大豆产量的大部分。阿根廷的潘帕斯地区是主要的大豆种植区,拥有完善的农业基础设施。

南美洲占据世界大豆出口市场的主导地位,中国是主要进口国。根据ITC贸易地图,巴西大豆出口量将从2022年的7,890万吨增加到2023年的1.019亿吨,主要供应亚洲、欧洲和北美等市场。儘管产量不如巴西,但阿根廷专门出口豆粕和豆油等加工大豆产品。该地区的港口基础设施,例如巴西的桑托斯港和阿根廷的罗萨里奥港,促进了高效的全球分销。这些出口支持了全球粮食安全和畜牧业生产,特别是在大豆产量有限的地区。

在南美洲,受永续农业和环境意识的推动,对生物基种子处理杀菌剂的需求正在增加。大豆种植者正在与影响作物产量的疫霉菌根腐病、镰刀菌枯萎病和立枯丝核病等真菌疾病作斗争。由于生物基种子处理剂具有环境效益以及对种子发芽和作物早期发育有积极作用,因此传统化学杀菌剂向生物基种子处理剂的转变仍在继续。这些生物杀菌剂利用天然微生物和植物抽取物来控制真菌病原体,同时改善土壤条件,并支持全球永续性努力。南美洲凭藉着强大的生产和出口能力以及生物种子处理杀菌剂等永续农业实践的日益普及,维持了其市场地位。

大豆杀菌剂种子处理产业概况

全球大豆杀菌剂种子处理市场正在整合,主要企业包括先正达集团、BASF公司、拜耳作物科学公司、科迪华农业科学公司和富美实公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 大豆真菌病害发生率不断上升

- 优质作物产量的需求不断增加

- 政府支持和倡议

- 市场限制

- 化学种子处理杀菌剂的不良影响

- 农药的严格监管

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 类型

- 化学

- 非化学/生物

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 泰国

- 越南

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲国家

- 北美洲

第六章竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Syngenta Group

- Bayer CropScience AG

- BASF SE

- UPL

- Corteva Agriscience

- Sumitomo Chemical Co. Ltd

- FMC Corporation

第七章 市场机会与未来趋势

The Soybean Fungicide Seed Treatment Market size is estimated at USD 155.16 million in 2025, and is expected to reach USD 200.87 million by 2030, at a CAGR of 5.30% during the forecast period (2025-2030).

The soybean fungicide seed treatment market is growing as farmers focus on protecting crops against fungal diseases to maintain healthy yields. Soybeans face significant risks from soil- and seed-borne pathogens including Phytophthora, Rhizoctonia, and Fusarium, which affect germination and early plant development.

Global soybean consumption continues to rise across food, animal feed, and industrial sectors. Soybeans provide essential protein and oil for plant-based foods, including tofu, soy milk, and meat alternatives, which are increasing in popularity due to health and sustainability concerns. The livestock industry depends on soybean meal for feeding poultry, swine, and cattle. The global cattle population reached 1,575.7 million in 2023, up from 1,557.7 million previously. The biofuel industry also increases demand through soybean oil used in biodiesel production. Population growth and changing dietary preferences sustain this consumption growth further driving the soybean fungicide treatment market.

Advanced fungicide formulations provide enhanced protection against multiple pathogens. These treatments improve seedling vigor, ensure uniform growth, and strengthen environmental stress resistance. The industry is moving from traditional chemical applications to targeted seed treatments, focusing on maximizing crop productivity while reducing input costs and application complexity.

South America dominates the soybean fungicide seed treatment market, with Brazil and Argentina as major contributors due to extensive soybean production. North America, particularly the United States, represents a significant market share due to humid conditions that increase fungal infection risks. The Asia-Pacific market is expanding through increased soybean cultivation and seed treatment adoption, particularly in China and India. India's soybean imports increased to 724.9 thousand metric tons from 489.5 thousand metric tons, according to the ITC trade map. The market for soybean fungicide seed treatments is anticipated to expand during the forecast period, driven by increasing soybean demand.

Soybean Fungicide Seed Treatment Market Trends

Rapidating Demand for Biological Seed Treatment

Environmental concerns in developed regions are increasing the demand for biological seed treatments, driving market growth during the forecast period. Chemical companies are responding by expanding their biological seed treatment offerings. In the United States, major companies are providing soybean seeds treated with biological and chemical combinations. According to FAOSTAT, Canada's soybean harvested area increased from 2.11 million hectares in 2022 to 2.26 million hectares in 2023.

Biological seed treatments incorporate active ingredients such as living microbes, fermentation products, plant extracts, phytohormones, and chemical compounds to benefit plant development. These treatments are gaining popularity due to their ability to enhance plant growth, reduce stress, and increase yield by maximizing plant genetic potential.

The United States seed treatment market is expanding due to increased crop consumption and early soybean planting practices. FAOSTAT reports soybean production reached 113.3 million metric tons in 2023. Early planting in moist soils often exposes seeds and seedlings to insects, diseases, and pests, necessitating seed treatment for protection and yield improvement. The US Environmental Protection Agency (EPA) oversees chemical pesticide application on crops and food products, with numerous companies securing EPA registration in recent years.

Companies are increasingly entering the biological seed treatment market. In 2022, BASF SE registered Veltyma Fungicide for Canadian soybean farming. This product combines mefentrifluconazole (Revysol) with pyraclostrobin's plant health benefits and metconazole's Fusarium control capabilities to provide comprehensive soybean disease management.

South America Dominates the Market

South America dominates global soybean production and export, with Brazil and Argentina as major contributors. Brazil, the world's largest soybean producer, accounts for over 40% of global soybean output, while Argentina maintains its position among top exporters according to FAO. The region's extensive arable land, suitable climate, and modern farming practices enable large-scale production to meet global demand for soybeans in food, animal feed, and biofuels. According to FAOSTAT, soybean production increased from 121.2 million metric tons in 2022 to 152.1 million metric tons in 2023. Brazil's main soybean-producing states - Mato Grosso, Parana, and Rio Grande do Sul - constitute a significant portion of national output. Argentina's Pampas region serves as a primary soybean cultivation area, supported by established agricultural infrastructure.

South America controls the global soybean export market, with China as the primary importer. Brazil's soybean exports increased from 78.9 million metric tons in 2022 to 101.9 million metric tons in 2023, according to the ITC Trade map, supplying key markets in Asia, Europe, and North America. Argentina, despite lower production volumes than Brazil, specializes in exporting processed soybean products, including meal and oil. The region's port infrastructure, including Brazil's Santos Port and Argentina's Rosario Port, facilitates efficient global distribution. These exports support worldwide food security and livestock industries, particularly in regions with limited soybean production.

South America experiences increasing demand for bio seed treatment fungicides, driven by sustainable agriculture needs and environmental awareness. Soybean farmers combat fungal diseases including Phytophthora root rot, Fusarium wilt, and Rhizoctonia damping-off, which affect crop yields. The transition from conventional chemical fungicides to bio-based seed treatments continues due to their environmental benefits and positive effects on seed germination and early crop development. These biofungicides utilize natural microbes and plant extracts to control fungal pathogens while improving soil conditions, supporting global sustainability initiatives. South America maintains its market position through strong production and export capabilities, combined with increasing adoption of sustainable farming practices like bio seed treatment fungicides.

Soybean Fungicide Seed Treatment Industry Overview

The global market for soybean fungicide seed treatment is consolidated, with major players such as Syngenta Group, BASF SE, Bayer Crop Science AG, Corteva Agriscience, and FMC Corporation among others. Syngenta International AG occupies the largest market share, followed by BASF SE and Bayer Crop Science AG. Major players in the market have extended their product portfolio and taken the approach of expansion and partnerships to broaden their business and strengthen their position in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidence of Soybean Fungal Diseases

- 4.2.2 Growing Demand for High-Quality Crop Yield

- 4.2.3 Government Support and Initiatives

- 4.3 Market Restraints

- 4.3.1 Adverse Effect of Chemical Seed Treatment Fungicides

- 4.3.2 Stringent Regulations on Agrochemicals

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Chemical

- 5.1.2 Non-Chemical/Biological

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Spain

- 5.2.2.5 Italy

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Thailand

- 5.2.3.5 Vietnam

- 5.2.3.6 Australia

- 5.2.3.7 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Syngenta Group

- 6.3.2 Bayer CropScience AG

- 6.3.3 BASF SE

- 6.3.4 UPL

- 6.3.5 Corteva Agriscience

- 6.3.6 Sumitomo Chemical Co. Ltd

- 6.3.7 FMC Corporation