|

市场调查报告书

商品编码

1685806

稻米种子处理:市场占有率分析、产业趋势与成长预测(2025-2030)Rice Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

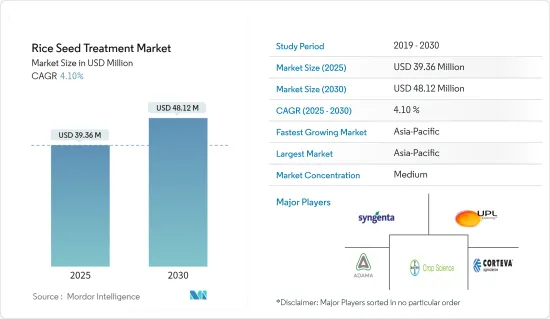

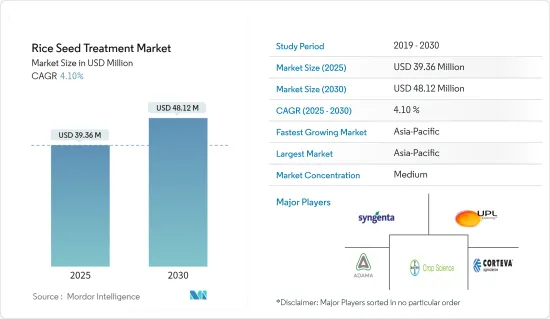

预计 2025 年水稻种子处理市场规模为 3,936 万美元,到 2030 年将达到 4,812 万美元,预测期内(2025-2030 年)的复合年增长率为 4.10%。

种子处理可以保护种子和幼苗免受影响作物出苗和生长的种子和土壤传播的疾病和害虫的侵害。为了使稻农能够在全球范围内采用这种处理方法,需要有效的推广策略,包括获得适当的化学/生物农药和设备,以及了解种子处理方法和后处理程序。在稻米种植中,化学种子处理主要用于种子改良和保护。

全球范围内都在进行种子处理,以生产无虫害种子,使用能够在整个作物週期内防止害虫发芽的产品。根据美国农业部的资料,2023-2024财年米总产量预计将达到5.227亿吨。中国占产量的28%,其次是印度(26%)、孟加拉(7%)、印尼(6%)和越南(5%)。

根据美国农业部报告,预计2024-2025财年全球稻米产量将达到创纪录的5.337亿吨(碾米基数),增加1,100万吨。阿根廷、巴西和台湾的产量数据被上调,而澳洲、哥斯大黎加、古巴、欧盟、宏都拉斯、尼泊尔、巴拿马、菲律宾和韩国的产量预测则被下调。预计2024-2025年全球稻米消费量及剩余使用量将达5.303亿吨,比上年度增加620万吨。稻米种子处理市场的成长得益于稻米作为主食的消费量不断增加、优质种子采用率不断提高、政府对种子产业的支持以及种子处理技术的进步,以减少水稻病虫害的侵染。

稻米种子处理市场趋势

优质种子的需求和采用不断增加

农民越来越接受种子处理作为保护其在优质种子上的昂贵投资的一种方式。由于对具有理想农艺性状的优质种子的需求不断增加,种子成本也在上升。公司和农民都愿意在种子处理解决方案上花费额外的钱来保存昂贵的高品质种子。

基因改造种子的引入使得种子的附加价值很高,种子的成本也很高,有时甚至是非基因改造种子的两倍。此前,农民预计产量只能增加 85%,因为有些种子会腐烂或受到昆虫的侵袭。随着趋势的变化,种子处理变得至关重要,种植者希望即使在恶劣的条件下也能 100% 的种子出苗。新兴市场的关键参与者不断专注于透过现代育种技术开发优质种子,从而提高种子的成本。

市场的主要企业正专注于透过现代育种技术开发优质种子,从而提高种子成本。未能发芽或被昆虫损坏的种子必须重新种植,这可能会很昂贵。此外,所需的高昂劳动成本也增加了总成本。根据粮食及农业组织的数据,2022 年谷物产量为每公顷 4,182.4 公斤,高于前一年的每公顷 4,152.2 公斤。因此,农民需要经过精心加工的高品质种子来提高有限作物面积的产量,并满足日益增长的需求。

非洲国家米产量不足,依赖进口。塞拉利昂就是这样一个国家。因此,为了实现自给自足,政府采取了多种策略。一个有希望的解决方案是广泛使用新非洲稻(NERICA)等产量品种。 NERICA 被非洲稻农誉为奇蹟作物,因为它结合了亚洲水稻(产量)和非洲水稻(抗旱、抗病)的基因特性。然而,目前的估计表明,只有 2% 的非洲农民使用 NERICA。这是因为改良品种的价格比传统品种高出40%至100%,这对贫困农民采用NERICA造成了重大障碍。因此,由于这些杂交品种的成本较高,稻农有机会以可负担的成本使用经过处理的种子。预计这将在未来几年推动水稻种子处理市场实现积极成长。

亚太地区占市场主导地位

2023 年,亚太地区占据水稻种子处理领域最大的市场占有率,这得益于水稻作为主要主食和种植作物最大的作物。中国已成为该地区最大、成长最快的市场,其次是印度和日本。中国是仅次于美国的世界第二大种子市场,2021年种子年产量达1,200万吨,市场价值达190亿美元。根据美国农业部的资料,2022年全球杂交稻种子产量将达16.8万吨,平均产量为每公顷2160公斤。

根据中国农业部报道,水稻种子产业正在优先发展差别化商业品种,以解决当前水稻品种产量、低抗性(特别是抗稻瘟病)的限制。中国注重提高种子价值,从而促进了杂交品种的开发。稻米仍然是中国的主要作物,根据粮农组织的资料,预计到 2022 年,稻米产量将达到 2.1 亿吨,种植面积为 2,970 万公顷。国家稻米产量的扩大和粮食需求的增加继续推动稻米种子处理市场的成长。

印度是世界第二大稻米生产国和主要稻米出口国。该国多样的海拔和气候条件适合广泛种植水稻。根据ITC Trade Map的资料,2023年印度米出口量将达到1,050万吨,占全球出口量的32.5%,成为全球最大的米出口国。该国良好的气候和农业实践提高了水稻产量,增强了对水稻种子处理剂的需求。受食品需求不断增长和持续研发创新产品的推动,区域稻米种子处理市场预计将保持稳定成长。

稻米种子处理产业概况

稻米种子处理市场正在整合,预计到 2023 年,少数几家大公司将占据市场占有率的主导地位。拜耳股份公司、先正达国际股份公司、UPL 有限公司、安道麦农业解决方案有限公司和科迪华农业科技是该市场的主要企业。这些公司主要专注于新产品的发布、合作和收购。投资研发和开发创新产品系列仍是市场成长的重要策略。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 优质种子的需求和采用不断增加

- 作物保护产业的技术发展

- 政府加大对种子处理的支持

- 市场限制

- 日益严重的环境问题

- 农场级种子处理的局限性

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 应用

- 化学

- 非化学/生物

- 功能

- 种子保护

- 种子增强

- 其他功能

- 应用科技

- 种子披衣

- 种子丸粒化

- 拌种

- 其他应用技术

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 西班牙

- 英国

- 法国

- 德国

- 俄罗斯

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 世界其他地区和非洲

- 北美洲

第六章 竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Adama Agricultural Solutions Ltd

- Yara International ASA

- Bayer AG

- Indofill Industries Limited

- Dhanuka Agritech Limited

- Corteva Agriscience

- Croda International(INCOTEC)

- Crystal Crop Protection Limited

- UPL Limited

- Nufarm Limited

- Syngenta AG

第七章 市场机会与未来趋势

The Rice Seed Treatment Market size is estimated at USD 39.36 million in 2025, and is expected to reach USD 48.12 million by 2030, at a CAGR of 4.10% during the forecast period (2025-2030).

Seed treatment protects seeds and seedlings from seed and soil-borne diseases and insect pests that affect crop emergence and growth. The global adoption of this practice among rice farmers requires effective extension strategies, including access to appropriate chemical pesticides/bio-pesticides and equipment, along with knowledge of seed treatment methods and post-treatment handling procedures. In rice cultivation, chemical seed treatment is primarily used for seed enhancement and protection.

Seed treatment is implemented globally to produce pest and disease-free seeds using products that protect against pests and diseases throughout germination and the crop cycle. According to USDA data, total rice production reached 522.7 million metric tons during MY 2023-2024. China contributed 28% of this production, followed by India at 26%, Bangladesh at 7%, Indonesia at 6%, and Vietnam at 5%.

USDA reports indicate that global rice production for MY 2024-2025 is projected to reach a record 533.7 million metric tons (milled basis), an increase of 11 million metric tons. While Argentina, Brazil, and Taiwan received upward production revisions, forecasts were reduced for Australia, Costa Rica, Cuba, the European Union, Honduras, Nepal, Panama, the Philippines, and South Korea. Global rice consumption and residual use in MY 2024-2025 is anticipated to reach 530.3 million metric tons, increasing by 6.2 million metric tons from the previous year. The rice seed treatment market growth is driven by increasing rice consumption as a staple food, higher adoption of high-quality seeds, government support in the seed industry, and technological advancements in seed treatment for reducing rice diseases and pest infestation.

Rice Seed Treatment Market Trends

Increasing Demand and Adoption of High-Quality Seeds

Farmers are increasingly acknowledging seed treatment as a mode to protect high investments made in good quality seeds. Owing to the increasing demand for high-quality seeds with desirable agronomic traits, the cost of seeds is increasing. Both companies and farmers are ready to spend extra on seed treatment solutions to save costly high-quality seeds.

The introduction of GM seeds added high value to seeds, with the cost of seeds being high and sometimes being twice as much as that of non-GM seeds. Earlier, a growth of 85% was anticipated by farmers as some seeds would rot or be destroyed by insects. With changing trends and 100% seed emergence expectations by growers even in unfavorable conditions, seed treatment has become a necessity. The key players in the market are constantly focusing on developing superior-quality seeds through modern breeding techniques, thereby increasing the cost of the seeds.

Top players in the market are focusing on the development of superior quality seeds through modern breeding techniques, thereby increasing the seed cost. Replanting seeds due to poor germination and insect attack is expensive. Moreover, the high cost of labor requirements is associated with overall cost. According to the Food and Agriculture Organization, the total crop yield of cereals accounted for 4,182.4 kg/ha in 2022, which is higher than the previous year at 4,152.2 kg/ha. Hence to meet the growing demand, farmers need quality seeds that are well-treated to enhance the yield in limited harvested areas.

African countries do not produce enough rice and are reliant on imports. One such country is Sierra Leone. Hence, to become self-sufficient, the country's government is adopting a few strategies. A promising solution is the dissemination of high-yielding rice varieties, such as the New Rice of Africa (NERICA), which have become known as the miracle crop for African rice farmers because they combine the genetic qualities of Asian rice (high yielding) and African rice (high resistance to drought and disease). However, current estimates suggest only 2% of farmers in the country use NERICAs. This is due to the cost of improved varieties that cost 40-100% more than traditional ones, representing a significant barrier to adoption among poor farmers. Hence, due to the high cost of these hybrid varieties, there is an opportunity for paddy farmers to use treated seeds at an affordable cost. This, in turn, is anticipated to lead to the positive growth of the rice seed treatment market in the coming years.

Asia-Pacific Dominates the Market

The Asia-Pacific region held the largest market share in the rice seed treatment sector in 2023, driven by rice being the primary staple food and most cultivated crop. China emerged as the region's largest and fastest-growing market, followed by India and Japan. China represents the world's second-largest seed market after the United States, with an annual seed planting volume of 12 million metric tons and a market value of USD 19 billion in 2021. According to USDA data, global hybrid rice seed production reached 168,000 metric tons in 2022, with an average yield of 2,160 kg/ha.

The Chinese Ministry of Agriculture reports that the rice seed industry is prioritizing differentiated commercial varieties to address the limitations of current high-yield, low-resistance varieties, particularly regarding rice blast resistance. China's emphasis on seed value enhancement has resulted in increased hybrid rice variety development. Rice remains China's primary crop, with FAO data showing production of 210 million metric tons in 2022 across 29.7 million hectares. The country's expanding rice production and growing food demand continue to drive the rice seed treatment market growth.

India maintains its position as the world's second-largest producer and primary rice exporter. The country's diverse altitude and climatic conditions support widespread rice cultivation. ITC Trade Map data indicates that India exported 10.5 million metric tons of rice in 2023, accounting for 32.5% of global export volume and ranking as the world's leading rice exporter. The country's favorable climate and agricultural practices have increased rice production, strengthening the demand for rice seed treatment chemicals. The regional rice seed treatment market is projected to maintain steady growth, supported by increasing food demand and ongoing research and development efforts to develop innovative products.

Rice Seed Treatment Industry Overview

The rice seed treatment market is consolidated, with a few major players dominating the market share in 2023. Bayer AG, Syngenta International AG, UPL Limited, Adama Agricultural Solutions Ltd, and Corteva Agriscience are the key companies operating in the market. These companies primarily focus on new product launches, partnerships, and acquisitions. Investment in research and development and the development of innovative product portfolios remain essential strategies for market growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand And Adoption Of High-Quality Seeds

- 4.2.2 Technological Developments In The Crop Protection Industry

- 4.2.3 Rising Government Support For Seed Treatment

- 4.3 Market Restraints

- 4.3.1 Rising Environmental Concerns

- 4.3.2 Limitations Across Farm-Level Seed Treatment

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Chemical

- 5.1.2 Non-chemical/Biological

- 5.2 Function

- 5.2.1 Seed Protection

- 5.2.2 Seed Enhancement

- 5.2.3 Other Functions

- 5.3 Application Techniques

- 5.3.1 Seed Coating

- 5.3.2 Seed Pelleting

- 5.3.3 Seed Dressing

- 5.3.4 Other Application Techniques

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Germany

- 5.4.2.5 Russia

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Adama Agricultural Solutions Ltd

- 6.3.2 Yara International ASA

- 6.3.3 Bayer AG

- 6.3.4 Indofill Industries Limited

- 6.3.5 Dhanuka Agritech Limited

- 6.3.6 Corteva Agriscience

- 6.3.7 Croda International (INCOTEC)

- 6.3.8 Crystal Crop Protection Limited

- 6.3.9 UPL Limited

- 6.3.10 Nufarm Limited

- 6.3.11 Syngenta AG