|

市场调查报告书

商品编码

1685777

欧洲种子处理:市场占有率分析、行业趋势和成长预测(2025-2030)Europe Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

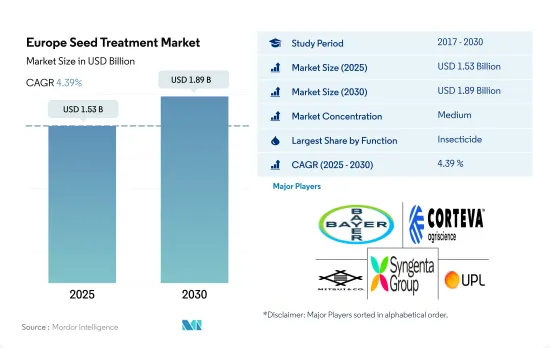

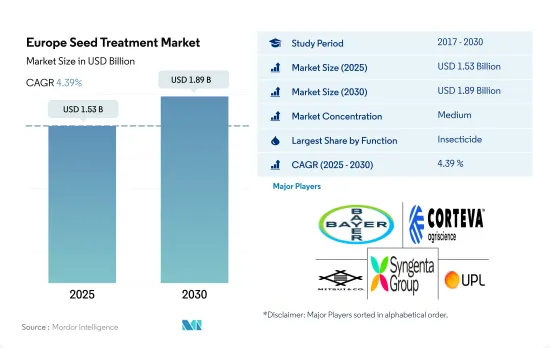

预计 2025 年欧洲种子处理市场规模将达到 15.3 亿美元,到 2030 年预计将达到 18.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.39%。

由于种子易受土壤真菌的侵害,杀菌剂占据欧洲种子处理市场的主导地位

- 种子处理是指将杀菌剂、杀虫剂或两者的混合物施用于种子,以对其进行消毒并保护其免受种子和土壤传播的病原体的侵害。种子处理可以提高发芽率、幼苗存活率、植物活力、幼苗存活率和产量,使作物充分发挥其遗传潜力。

- 播种后的前 4-6 週是新植物生命的关键时期,因为幼苗会发芽并发育。播种经过处理的种子有助于保护发芽和幼苗形成阶段。这是它们最容易受到入侵害虫和病原体侵袭的时候。

- 杀菌剂将占2024年欧洲种子处理市场的46.9%。同样,立枯丝核菌、疫霉菌属、腐霉菌属、黄萎病菌属。和核盘菌属是最常见的土壤真菌。

- 欧洲种子处理市场将以谷物作物为主,到2024年将占据59.8%的市场占有率。谷物作物易受由真菌、细菌和病毒引起的各种种子传播疾病的侵害。种子处理有助于保护种子免受这些病原体的侵害,并防止在发芽和早期生长阶段受到感染。谷物中常见的种子传染病包括镰刀菌病、黑穗病、黑穗病和幼苗猝倒病。

- 欧洲种子管理保证计划(ESTA)等计划有助于推动市场成长,该计划是一种品质保证体系,确保种子处理和由此产生的处理种子符合立法机构和行业规定的要求。

欧洲种子管理保障计划等计划将推动种子处理市场

- 在欧洲,一年作物又细分为冬季作物和春夏作物。冬季作物在秋季播种,并于隔年夏季收成。春作物和夏作物同年播种,同年收穫。在欧盟,小麦、油菜籽、黑麦和黑小麦是常见的冬季作物,而玉米、向日葵、稻米、大豆、马铃薯和甜菜是夏季作物。大麦可于冬季和春季种植。

- 谷物和谷类将主导欧洲种子处理消费,约占市场价值的 59.8%,到 2024 年价值约为 8.78 亿美元。预计到预测期结束时将达到 11.3 亿美元。谷类种植面积增加趋势,从2022年的1.192亿公顷增加到2030年的1.335亿公顷。

- 在欧洲国家中,西班牙将在2024年占据欧洲种子管理市场12.9%的市场占有率。预计种植面积将从2022年的1,270万公顷增加到2030年的1,400万公顷。这将进一步推动该国种子处理市场的发展,预计预测期内的复合年增长率为3.7%。

- 此外,欧洲种子管理保证计划(ESTA)等多项计划正在推动市场成长,该计划是一项品质保证计划,确保种子处理和由此产生的处理种子符合立法者和行业定义的要求。 ESTA 旨在与法国 (PQP) 和德国 (SeedGuard) 的国家品质保证体系相容。这将进一步推动市场发展,预计预测期内市场复合年增长率为 4.4%。

欧洲种子处理市场趋势

人们越来越多地采用从农场到餐桌的策略和其他控制种子和土壤传播疾病的方法,导致每公顷种子处理剂的消费量下降。

- 儘管农业对欧洲经济贡献巨大,但它面临多重挑战,包括杂草感染、害虫和真菌疾病,这些挑战每年都会造成作物产量严重损失。为了解决这些问题,2022年欧洲农业产业平均每公顷土地使用619.3克种子处理剂。这些种子处理剂专门用于在作物早期保护作物免受病虫害的侵害,帮助农民提高产量并满足该地区日益增长的粮食需求。

- 多年来,该地区每公顷土地使用的种子处理剂量已大幅下降。 2022年每公顷种子处理剂消费量与2017年相比大幅下降,为33.0公克。这种下降主要是由于欧洲国家越来越多地采用从农场到餐桌的策略。该策略的主要目标是将化肥和杀虫剂的使用量减少一半,并将有机农业的产量提高25%。此策略的广泛采用对控制土壤和种子传播疾病的种子处理产生了重大影响。农民目前正在积极探索控制这些疾病的替代方案。

- 玉米是法国、罗马尼亚、德国、匈牙利和义大利等欧洲国家的重要田间作物。这些国家有超过一百万公顷的土地种植玉米。基因改造玉米品种的引入大大减少了种子处理化学品的使用,从而减少了喷洒农药的需要。因此,种子处理在欧洲玉米种植中变得越来越不常见。

以Cypermethrin、Metalaxyl、Azoxystrobin、Avermectin和Emamectin benzoate等农药为主要成分的种子处理剂,在保护作物免受病虫害侵害方面发挥重要作用。

- Cypermethrin、Metalaxyl、Azoxystrobin、Avermectin、Emamectin benzoate酯类农药在保护作物免受病虫害侵害方面发挥着重要作用。处理农民开始意识到使用种子处理农药的好处。由于这些杀虫剂具有针对性保护作用,因此所需的用量比叶面喷布或土壤施用的杀虫剂少,从而节省了成本。

- 2022年Cypermethrin的价格为每吨21,100美元。农民在种植前使用这种合成拟除虫菊酯杀虫剂进行种子处理,以防止昆虫、害虫和鸟类的侵袭。Cypermethrin是一种高效的杀虫剂种子处理剂,可以控制球茎蝇和金针虫。

- Metalaxyl是重要的酰丙胺酸类杀菌剂,具有十分重要的意义。它对腐霉菌、疫霉菌和各种霜霉菌等真菌有效,常用于玉米、豌豆、高粱和向日葵等作物。 2022 年的价格为每吨 4,500 美元。

- 2022 年,Azoxystrobin将以每吨 4,600 美元的价格用作种子处理杀菌剂。Azoxystrobin可有效对抗多种导致种子腐烂、幼苗猝倒病和猝倒病的种子和土壤传播的病原体。Azoxystrobin主要针对腐霉菌、镰刀菌病、白霉病、褐斑病和拟茎点霉病等疾病。

- 2022年Avermectin价格为每吨8,800美元。透过使用Avermectin种子处理,植物从一开始就受到保护,从而降低了关键早期生长阶段遭受虫害的风险。这种广泛使用的杀虫剂可以有效控制包括昆虫和螨虫在内的多种害虫,在农业和园艺中发挥重要作用。

欧洲种子处理行业概况

欧洲种子处理市场适度整合,前五大公司占58.33%。市场的主要企业有:拜耳股份公司、科迪华农业科技、三井物产(Certis Belchim)、先正达集团和联合磷化有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 活性成分价格分析

- 法律规范

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 乌克兰

- 英国

- 价值炼和通路分析

第五章市场区隔

- 功能

- 杀菌剂

- 杀虫剂

- 杀线虫剂

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 乌克兰

- 英国

- 其他欧洲国家

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Albaugh LLC

- Bayer AG

- Corteva Agriscience

- Mitsui & Co. Ltd(Certis Belchim)

- PI Industries

- Syngenta Group

- UPL Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 47353

The Europe Seed Treatment Market size is estimated at 1.53 billion USD in 2025, and is expected to reach 1.89 billion USD by 2030, growing at a CAGR of 4.39% during the forecast period (2025-2030).

Fungicides dominated the European seed treatment market as seeds are more susceptible to soil-borne fungi

- Seed treatment refers to the application of fungicide, insecticide, or a combination of both to seeds to disinfect them and protect them from seed-borne or soil-borne pathogenic organisms. Seed treatment can improve germination, seedling emergence, plant vigor, stand establishment, and total yield, helping ensure the crop is on its way to reaching its full genetic potential.

- The first four to six weeks after sowing is a critical period in the life of a new plant as seedlings emerge and develop their physical makeup. Sowing treated seeds helps protect the germination and establishment stages when emerging seedlings are most vulnerable to attack from invasive insect pests and disease pathogens.

- Fungicides accounted for 46.9% of the European seed treatment market in 2024. The most common disease-causing fungi found in Europe are Fusarium spp., Septoria spp., Pyrenophora spp., Ustilago spp., Tilletia spp., and Botrytis spp. Similarly, Rhizoctonia solani, Phytophthora spp., Pythium spp., Verticillium spp., and Sclerotinia spp. are the most common soil-borne fungi.

- The European seed treatment market is dominated by cereal and grain crops, accounting for 59.8% of the market share in 2024. Cereal crops are susceptible to various seed-borne diseases caused by fungi, bacteria, and viruses. Seed treatment helps protect the seeds from these pathogens, preventing infection during germination and early growth stages. Common seed-borne diseases in cereals include Fusarium, smuts, bunts, and seedling blights.

- Schemes like the European Seed Treatment Assurance Scheme (ESTA), a quality assurance system to ensure that seed treatment and the resulting treated seeds meet requirements defined by legislators and the industry, are boosting the market's growth.

Schemes like the European Seed Treatment Assurance Scheme drive the seed treatment market

- In Europe, annual crops can be subdivided into winter crops and spring and summer crops. Winter crops are sown in autumn and harvested in the summer of the following year. Spring and summer crops are sown and harvested in the same year. In the European Union, wheat, rapeseed, rye, and triticale are typically winter crops, whereas maize, sunflowers, rice, soybeans, potatoes, and sugar beet are summer crops. Barley is common in both its winter and spring varieties.

- Grains and cereals dominated the consumption of seed treatment chemicals in Europe, accounting for about 59.8% of the market value, which was valued at about USD 878.0 million in 2024. It is anticipated to reach USD 1.13 billion by the end of the forecast period. The area under grains and cereals is showing an increasing trend, which was 119.2 million hectares in 2022 to 133.5 million hectares by 2030.

- Among the European countries, Spain accounted for a market share of 12.9% of the European seed treatment market in 2024. The area under cultivation is anticipated to grow from 12.7 million hectares in 2022 to 14.0 million hectares by 2030. This will further drive the country's seed treatment market and it is anticipated to register a CAGR of 3.7% during the forecast period.

- Moreover, a few schemes like the European Seed Treatment Assurance Scheme (ESTA), a quality assurance system to ensure that seed treatment and the resulting treated seed meet requirements defined by legislators and industry are boosting the market's growth. The ESTA has been designed to be compatible with the national quality assurance systems in France (PQP) and Germany (SeedGuard). This will further drive the market and is anticipated to grow at a value CAGR of 4.4% during the forecast period.

Europe Seed Treatment Market Trends

Growing adoption of farm-to-fork strategy and other alternatives for controlling seed and soil-borne diseases is reducing the per hectare consumption of seed treatments

- Agriculture is a major contributor to the European economy, but it faces several challenges, such as weed infestation, insect pests, and fungal diseases, which cause significant losses in crop production every year. To address these issues, the European agricultural industry employed an average of 619.3 grams of seed treatment chemicals per hectare of farmland in 2022. These seed treatment chemicals are specifically designed to protect crops from early crop growth pests and diseases, allowing farmers to increase their yields and meet the growing demand for food in the region.

- Over the years, there has been a significant decrease in the usage of seed treatments per hectare in the region. In 2022, the consumption of seed treatments per hectare was reduced by a substantial 33.0 grams compared to 2017. This decline can be mainly attributed to the increasing adoption of the farm-to-fork strategy in European countries. The primary goal of this strategy is to reduce the use of fertilizers and pesticides by half and increase organic farming by 25%. The widespread adoption of this strategy has led to a significant impact on the application of seed treatments to control soil-borne and seed-borne diseases. Farmers are now actively seeking alternative methods to control these diseases.

- Maize is a crucial field crop cultivated in several European countries such as France, Romania, Germany, Hungary, and Italy. These countries have more than a million hectares of farmland dedicated to maize cultivation. The introduction of genetically modified varieties of maize has led to a significant decrease in the use of seed treatment chemicals, resulting in a lower need for their application. As a result, seed treatment is becoming less common in European maize cultivation.

Cypermethrin, metalaxyl, azoxystrobin, abamectin, and emamectin benzoate-based pesticide seed treatments play an important role in protecting crops from pests and diseases

- Cypermethrin, metalaxyl, azoxystrobin, abamectin, and emamectin benzoate-based pesticides play an essential role in protecting crops from pests and diseases. Farmers are becoming more aware of the advantages of using seed treatment pesticides. These chemicals provide targeted protection, requiring lower quantities compared to foliar or soil-applied pesticides, which can lead to cost savings.

- In 2022, cypermethrin was priced at USD 21.1 thousand per metric ton. This synthetic pyrethroid is used as an insecticide by farmers for seed treatment before planting, providing protection against insect, pest, and bird attacks. Cypermethrin serves as a highly effective insecticide seed treatment to mitigate bulb flies and wireworms.

- Metalaxyl, a significant acyl-alanine fungicide, holds crucial importance. Effective against oomycetes such as Pythium, Phytophthora, and various downy mildews, it is commonly applied in crops like corn, peas, sorghum, and sunflower. In 2022, its price amounted to USD 4.5 thousand per metric ton.

- Azoxystrobin, which was priced at USD 4.6 thousand per metric ton in 2022, is used as a seed treatment fungicide. It is effective against numerous seed-borne and soil-borne pathogens, which cause seed decay, seedling blight, and damping-off. Azoxystrobin mainly targets diseases such as Pythium, Fusarium, white mold, brown spot, and Phomopsis.

- In 2022, abamectin was priced at USD 8.8 thousand per metric ton. By employing abamectin seed treatment, plants receive protection right from the start, mitigating the risk of early pest damage during critical early growth stages. This widely used pesticide plays a significant role in agriculture and horticulture by effectively controlling various pests, including insects and mites.

Europe Seed Treatment Industry Overview

The Europe Seed Treatment Market is moderately consolidated, with the top five companies occupying 58.33%. The major players in this market are Bayer AG, Corteva Agriscience, Mitsui & Co. Ltd (Certis Belchim), Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Ukraine

- 4.3.8 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Insecticide

- 5.1.3 Nematicide

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Ukraine

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Albaugh LLC

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 Mitsui & Co. Ltd (Certis Belchim)

- 6.4.5 PI Industries

- 6.4.6 Syngenta Group

- 6.4.7 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219