|

市场调查报告书

商品编码

1683095

美国种子处理:市场占有率分析、行业趋势和成长预测(2025-2030 年)United States Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

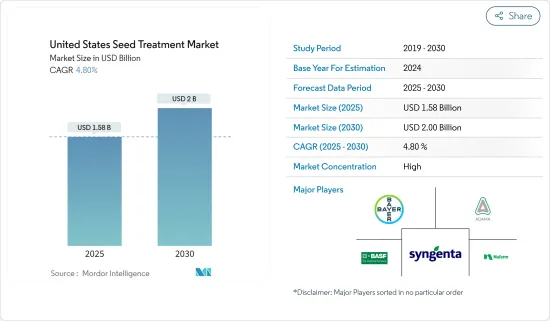

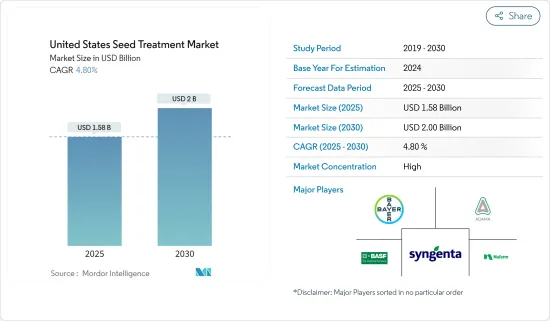

美国种子处理市场规模预计在 2025 年为 15.8 亿美元,预计在 2030 年将达到 20 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.8%。

由于食品安全需求不断增加、种子处理产品采用率不断上升以及农民对种子处理益处的认识不断提高等因素,美国种子处理市场正在经历显着增长。美国每年种植的几乎每一英亩玉米都使用了种子处理产品,帮助支持美国农民种植的价值约 800 亿美元的作物。

随着人口不断增长,提高农业生产力和确保粮食安全的需求也日益增加。种子处理在实现这些目标方面发挥着重要作用。透过处理种子,农民可以保护它们免受各种可能阻碍作物生长并降低产量的疾病、害虫和环境压力的侵害。种子处理提供早期防线,在发育的关键阶段保护种子和幼苗。

美国种子处理市场的趋势

优质种子成本上涨

杂交种子和基因改造种子的高成本是推动种子处理市场成长的主要因素之一。由于对熏蒸和叶面喷布农药的监管问题日益严重,农民越来越多地考虑透过种子处理来保护其对优质种子的投资。由于对具有良好农艺性状的优质种子的需求不断增加,预计种子成本将会上升。公司和农民都愿意花钱购买种子处理解决方案来保存高品质的种子。由于大多数基因改造种子价格昂贵且经过化学处理,基因改造作物的种植面积正在增加,这对市场成长产生了积极影响。

增加处理过的种子的使用

由于农业消费量呈指数级增长而对更高产量的需求正在推动美国种子处理市场的需求。农场规模的扩大和作物轮作的减少是导致种子处理产品需求增加的主要因素。玉米是美国主要作物之一,2018年收穫面积约3,310万公顷。美国约90%的玉米种子都经过种子处理,种子处理的成长率十分显着。

美国种子处理产业概况

主要市场参与企业最广泛采用的策略是新产品发布(占所有其他策略市场占有率的 41%),其次是收购(超过 20%)。扩大研发、伙伴关係和合资企业也是市场主要企业采取的其他一些关键策略。主要企业正在利用战略伙伴关係授权合约来解决大面积机会,扩大其销售团队以涵盖更大的地域,同时进行研究以了解种子处理在农业中的重要性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 产品类型

- 杀虫剂

- 杀菌剂

- 杀线虫剂

- 作物类型

- 粮食

- 油籽和豆类

- 水果和蔬菜

- 经济作物

- 草坪和观赏作物

第六章 竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Syngenta International AG

- Bayer CropScience AG

- BASF SE

- Corteva Agriscience

- Adama Agricultural Solutions Ltd

- Germains Seed Technology

- UPL Limited

- Incotec Group BV

第七章 市场机会与未来趋势

The United States Seed Treatment Market size is estimated at USD 1.58 billion in 2025, and is expected to reach USD 2.00 billion by 2030, at a CAGR of 4.8% during the forecast period (2025-2030).

The seed treatment market in the United States has been witnessing substantial growth driven by factors such as increasing demand for food security, rising adoption of seed treatment products, and growing awareness among farmers about the benefits of seed treatment. Seed treatment products, applied to nearly every acre of corn planted in the United States every year, helped support nearly USD 80 billion worth of crops grown by the American farmers.

As the population continues to grow, there is a greater need to enhance agricultural productivity and ensure food security. Seed treatments play a crucial role in achieving these objectives. By treating seeds, farmers can protect them from various diseases, pests, and environmental stresses, which can hinder crop growth and reduce yields. Seed treatments provide an early line of defense and protect seeds and young seedlings during critical stages of growth.

US Seed Treatment Market Trends

Increase in Cost of High-quality Seeds

High costs associated with hybrids and genetically modified seeds are among the major factors driving the growth of the seed treatment market. Seed treatment is being increasingly considered by farmers as a mode to protect investments made on good-quality seeds, due to an increase in regulatory issues relating to fumigation, as well as the foliar application of pesticides. The cost of seeds is expected to increase, owing to an increase in the demand for high-quality seeds with desirable agronomic traits. Both companies and farmers are ready to spend on seed-treatment solutions, in order to save high-quality seeds. Since most of the GM seeds are costly and treated with chemical treatments, there is an increase in the area under GM crops, which is positively affecting the market growth.

Increasing Usage of Treated Seeds

The demand for higher yield due to the rapid increase in the consumption of crops has increased the demand for the seed treatment market in the United States. Increasing farm size and decreasing crop rotation are the major factors that lead to an increase in the demand for seed-treatment products. Corn is one of the major crops grown in the United States, with around 33.1 million hectares harvested in 2018. In the United States, around 90% of the corn seeds are treated with seed treatment, and there is a significant percentage of growth in seed treatment.

US Seed Treatment Industry Overview

The most widely adopted strategies by major market players include new product launches (which is being adopted 41% times of all other strategies market share), followed by acquisitions (over 20% of the time). R&D expansion and partnerships or joint ventures are some of the other important strategies, followed by major companies in the market. Strategic partnership licensing and distribution agreements to address broad-acre opportunities are being used by top players, who are expanding their sales teams for larger geographic coverage, with researches on understanding the significance of seed treatment in agriculture.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Insecticides

- 5.1.2 Fungicides

- 5.1.3 Nematicides

- 5.2 Crop Type

- 5.2.1 Grains and Cereals

- 5.2.2 Oilseeds and Pulses

- 5.2.3 Fruits and Vegetables

- 5.2.4 Commercial crops

- 5.2.5 Turf and Ornamentals

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Syngenta International AG

- 6.3.2 Bayer CropScience AG

- 6.3.3 BASF SE

- 6.3.4 Corteva Agriscience

- 6.3.5 Adama Agricultural Solutions Ltd

- 6.3.6 Germains Seed Technology

- 6.3.7 UPL Limited

- 6.3.8 Incotec Group BV