|

市场调查报告书

商品编码

1430953

全球汽车机油市场:市场占有率分析、产业趋势/统计、成长预测(2021-2026)Global Automotive Engine Oils - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2021 - 2026) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

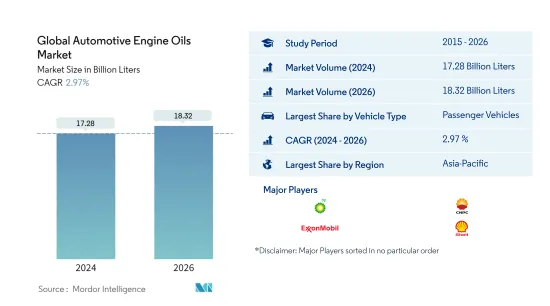

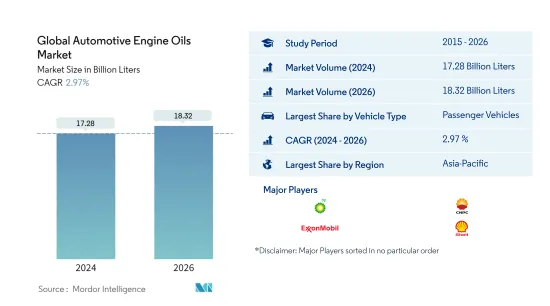

预计2024年全球汽车机油市场规模为172.8亿升,预计2026年将达183.2亿升,复合年增长率预计为2.97%。

主要亮点

- 按车型划分最大的细分市场 -小客车:由于世界持有小客车数量众多,该细分市场的引擎机油消费量是各种车型中最高的。

- 按车辆类型划分最快的细分市场 - 两轮车:儘管出现了新冠肺炎 (COVID-19) 大流行,但一些国家的两轮车销量仍在增长,因此该细分市场的机油消费量可能会继续保持高位成长。

- 最大的区域市场-亚太地区:亚太地区拥有庞大的持有,如中国、印度和印尼。因此,亚太地区的机油消费量最高。

- 快速成长的亚太市场:合成油普及率低以及印度等国家汽车保有量的预期高成长率可能会增加亚太地区的润滑油消费量。

汽车机油市场趋势

按车型划分最大的细分市场:小客车

- 机油是所有产品类型中最常用的汽车润滑油。 2015年至2019年,全球汽车机油消费量量复合年增率为2.5%。 2020年,机油将占全球整体汽车润滑油消费量的约78%。

- 2020年,受新冠肺炎(COVID-19)疫情影响,全球现有车辆的使用量因商业活动减少而大幅减少。因此,与 2019 年相比,2020 年小客车和两轮车领域的引擎机油消费量下降幅度最大。

- 预计汽车销售和生产将復苏,电动车的普及将增加,预计将对引擎油消费量产生轻微影响。因此,由于这些因素,预计2021-2026年机油消费量的复合年增长率为3.72%。

最大区域:亚太地区

- 2015年至2019年,全球汽车机油消费量量复合年增长率超过2%。在此期间,亚太地区是汽车机油的主要消费地区,约占全球消费量的43%,其次是北美和欧洲。

- 由于 COVID-19 爆发后实施的旅行限制,2020 年机油消耗量受到限制。北美是受影响最严重的地区,2019-2020年消费量下降17.5%,其次是欧洲(下降15.8%)。

- 亚太地区预计将见证机油市场成长最快,2021-2026 年消费量预计复合年增长率为 4.73%,其次是非洲和南美洲(预计复合年增长率分别为 4.07% 和 2.97%) ).马苏。这一增长可能是由 2022 年起汽车销售和生产的预期復苏所推动的。

汽车机油产业概况

全球车用机油市场适度整合,前五大企业占40.16%。该市场的主要企业包括(按字母顺序排列)英国石油公司(嘉实多)、中国石油天然气集团公司、埃克森美孚公司、荷兰皇家壳牌公司和道达尔能源公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章执行摘要和主要发现

第二章简介

- 研究假设和市场定义

- 调查范围

- 调查方法

第三章 产业主要趋势

- 汽车产业趋势

- 法律规范

- 价值炼和通路分析

第四章市场区隔

- 按车型

- 商用车

- 摩托车

- 小客车

- 按产品等级

- 按地区

- 非洲

- 埃及

- 摩洛哥

- 奈及利亚

- 南非

- 其他非洲

- 亚太地区

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 菲律宾

- 新加坡

- 韩国

- 泰国

- 越南

- 其他亚太地区

- 欧洲

- 保加利亚

- 法国

- 德国

- 义大利

- 挪威

- 波兰

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲国家

- 中东

- 伊朗

- 卡达

- 沙乌地阿拉伯

- 土耳其

- 阿拉伯聯合大公国

- 其他中东地区

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 其他北美地区

- 南美洲

- 阿根廷

- 巴西

- 哥伦比亚

- 南美洲其他地区

- 非洲

第五章竞争形势

- 重大策略倡议

- 市场占有率分析

- 公司简介

- BP PLC(Castrol)

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ENEOS Corporation

- ExxonMobil Corporation

- Idemitsu Kosan Co. Ltd

- Royal Dutch Shell PLC

- TotalEnergies

- Valvoline Inc.

第六章 附录

- 附录1 参考文献

- 附录-2 图表清单

第七章 执行长的关键策略问题 执行长的关键策略问题

简介目录

Product Code: 90301

The Global Automotive Engine Oils Market size is estimated at 17.28 Billion Liters in 2024, and is expected to reach 18.32 Billion Liters by 2026, growing at a CAGR of 2.97% during the forecast period (2024-2026).

Key Highlights

- Largest Segment by Vehicle Type - Passenger Vehicles : The large fleet size of passenger vehicles across the globe has resulted in this sector accounting for the highest engine oil consumption among the various vehicle types.

- Fastest Segment by Vehicle Type - Motorcycles : The sales boost for motorcycles in several countries despite the COVID-19 pandemic is likely to continue and boost engine oil consumption by this sector in the future.

- Largest Regional Market - Asia-Pacific : Asia-Pacific is home to countries with large vehicle fleets like China, India & Indonesia. As a result, the engine oil consumption by this sector was highest in Asia-Pacific.

- Fastest Growing Regional Market - Asia-Pacific : The low penetration of synthetic oils and expected high growth rates of vehicle population in countries like India are likely to drive the lubricant consumption in APAC.

Automotive Engine Oils Market Trends

Largest Segment By Vehicle Type : Passenger Vehicles

- Engine oils are the most used automotive lubricants among all the product types. During 2015-2019, global automotive engine oil consumption increased at a CAGR of 2.5%. In 2020, engine oils accounted for around 78% of the total automotive lubricant consumption volume globally.

- In 2020, the COVID-19 outbreak resulted in a huge decline in the usage of the existing global vehicle fleet due to a reduction in business activities. As a result, the passenger vehicles and motorcycles segments witnessed the largest drop in engine oil consumption in 2020 compared to 2019.

- Along with the expected recovery in sales and production of motor vehicles, an increase in the penetration of electric vehicles is expected to impact engine oil consumption slightly. Therefore, due to such factors, engine oil consumption is expected to register a CAGR of 3.72% during 2021-2026.

Largest Region : Asia-Pacific

- During 2015-2019, the global automotive engine oil consumption increased at a CAGR of over 2%. During this period, Asia-Pacific was the leading consumer of automotive engine oils and accounted for around 43% of the global volume, followed by North America and Europe.

- The travel restrictions imposed after the COVID-19 outbreak restricted engine oil consumption in 2020. North America was the most affected region as it witnessed a 17.5% drop in consumption during 2019-2020, followed by Europe (a 15.8% drop).

- Asia-Pacific is expected to be the fastest-growing engine oil market as the consumption is anticipated to increase at a CAGR of 4.73%, followed by Africa and South America (with an expected CAGR of 4.07% and 2.97%, respectively), during 2021-2026. The expected recovery in automotive sales and production from 2022 will likely drive this growth.

Automotive Engine Oils Industry Overview

The Global Automotive Engine Oils Market is moderately consolidated, with the top five companies occupying 40.16%. The major players in this market are BP PLC (Castrol), China National Petroleum Corporation, ExxonMobil Corporation, Royal Dutch Shell PLC and TotalEnergies (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 Key Industry Trends

- 3.1 Automotive Industry Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 Market Segmentation

- 4.1 By Vehicle Type

- 4.1.1 Commercial Vehicles

- 4.1.2 Motorcycles

- 4.1.3 Passenger Vehicles

- 4.2 By Product Grade

- 4.3 By Region

- 4.3.1 Africa

- 4.3.1.1 Egypt

- 4.3.1.2 Morocco

- 4.3.1.3 Nigeria

- 4.3.1.4 South Africa

- 4.3.1.5 Rest of Africa

- 4.3.2 Asia-Pacific

- 4.3.2.1 China

- 4.3.2.2 India

- 4.3.2.3 Indonesia

- 4.3.2.4 Japan

- 4.3.2.5 Malaysia

- 4.3.2.6 Philippines

- 4.3.2.7 Singapore

- 4.3.2.8 South Korea

- 4.3.2.9 Thailand

- 4.3.2.10 Vietnam

- 4.3.2.11 Rest of Asia-Pacific

- 4.3.3 Europe

- 4.3.3.1 Bulgaria

- 4.3.3.2 France

- 4.3.3.3 Germany

- 4.3.3.4 Italy

- 4.3.3.5 Norway

- 4.3.3.6 Poland

- 4.3.3.7 Russia

- 4.3.3.8 Spain

- 4.3.3.9 United Kingdom

- 4.3.3.10 Rest of Europe

- 4.3.4 Middle East

- 4.3.4.1 Iran

- 4.3.4.2 Qatar

- 4.3.4.3 Saudi Arabia

- 4.3.4.4 Turkey

- 4.3.4.5 UAE

- 4.3.4.6 Rest of Middle East

- 4.3.5 North America

- 4.3.5.1 Canada

- 4.3.5.2 Mexico

- 4.3.5.3 United States

- 4.3.5.4 Rest of North America

- 4.3.6 South America

- 4.3.6.1 Argentina

- 4.3.6.2 Brazil

- 4.3.6.3 Colombia

- 4.3.6.4 Rest of South America

- 4.3.1 Africa

5 Competitive Landscape

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Profiles

- 5.3.1 BP PLC (Castrol)

- 5.3.2 Chevron Corporation

- 5.3.3 China National Petroleum Corporation

- 5.3.4 China Petroleum & Chemical Corporation

- 5.3.5 ENEOS Corporation

- 5.3.6 ExxonMobil Corporation

- 5.3.7 Idemitsu Kosan Co. Ltd

- 5.3.8 Royal Dutch Shell PLC

- 5.3.9 TotalEnergies

- 5.3.10 Valvoline Inc.

6 Appendix

- 6.1 Appendix-1 References

- 6.2 Appendix-2 List of Tables & Figures

7 Key Strategic Questions for Lubricants CEOs

02-2729-4219

+886-2-2729-4219