|

市场调查报告书

商品编码

1431294

HVAC 现场设备:市场占有率分析、产业趋势/统计、成长预测 (2024-2029)HVAC Field Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

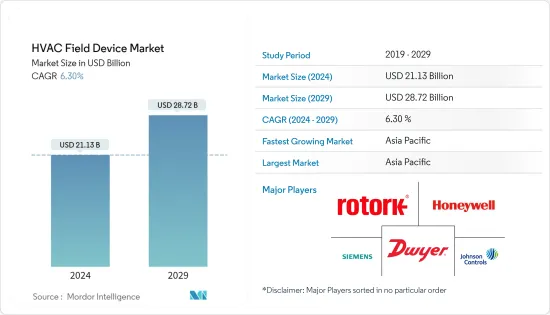

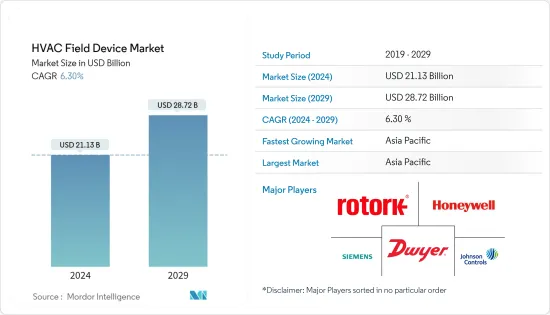

全球HVAC现场设备市场规模预计到2024年将达到211.3亿美元,并在2024-2029年预测期内以6.30%的复合年增长率增长,到2029年达到287.2亿美元。

疫情对暖通空调产业产生了重大影响,由于挨家挨户的限制以及企业避免投资新设备,前几个月的系统需求大幅减少。受疫情影响,世界各地许多建设计划被取消。商业、住宅和工业建设活动的下降暂时减少了对 HVAC 现场设备的需求。

主要亮点

- 因此,美国政府投入了大量联邦资金,可用于改善公共设施、学校和其他环境的室内空气品质。例如,美国救援计画向州和地方政府提供了 3500 亿美元,向学校提供了 1220 亿美元用于通风和过滤升级。

- 最终用户正在采用智慧型 HVAC 设备来在实际问题发生之前预测何时需要维护。利用物联网 (IoT) 系统的现代 HVAC 技术整合了感测器、软体和连接功能,使 HVAC 系统能够与其他联网设备交换资料。物联网系统透过感测有关空气品质和设备健康状况的资料来增强预防性保养。此外,最新、最实惠的物联网 HVAC 技术使查看多种设备类型的见解变得更加容易,包括屋顶空气调节机、风冷和水冷热泵以及带再热系统的可变风量 (VAV) 。 变得。暖通空调设备的这些开拓预计将进一步推动所研究的市场。

- 消费者购买力的上升加上可支配收入的增加,特别是在新兴经济体,也对市场产生正面影响。例如,根据中国国家统计局的数据,中国居民人均可支配收入为36883元,2022年扣除通膨因素的名义收入与前一年同期比较增5.0%,绝对收入增加2.9%。

- 除此之外,製造业的崛起进一步加强了暖通空调设备和现场设备的范围。根据工业《世界製造业生产第三季报告(2022年)》,亚洲和大洋洲製造业生产成长4.4%,超过北美(3.5%)和欧洲(1.7%)。拉丁美洲和加勒比海地区的製造业成长了 4.9%,而南美洲则成长了 3.0%。

- 此外,东欧气候寒冷,例如捷克共和国、波兰和保加利亚,对暖气解决方案的需求很高。与该地区其他国家一样,正在采取更多措施来提高暖气和冷气产业的能源效率。 Stratego 的共同创办人欧盟智慧能源欧洲计画声称,2010 年至 2050 年间投资 500 亿欧元可以节省足够的燃料,从而降低能源系统的成本。作为这项投资的一部分,区域供暖的份额将达到 50 亿欧元,个人热泵的份额将达到 150 亿欧元。

- 世界各地的一些政府正在提供财政优惠,以鼓励在住宅和商业空间中使用节能设备。例如,美国政府推出了2005年能源政策法案,为新建商业建筑提供每平方英尺高达1.80美元的扣除额。美国暖气、冷气和空调工程师协会认为,政府的努力以及对环境退化和能源管理认识的提高将维持对节能 HVAC 控制系统(包括现场设备)的需求。

HVAC现场设备市场趋势

住宅领域预计将占据较大市场占有率

- 推动暖通空调现场设备市场的主要因素之一是住宅建筑能源消耗比例的不断增加,这导致利用能源维修系统来提高建筑物的效率。例如,HomeServe 于 2022 年 8 月推出了家庭 HVAC 订阅福利计划。这有助于公用事业公司实现能源效率目标,并透过降低更换昂贵的家庭 HVAC(冷暖气空调)系统的成本来提高客户满意度。

- 对空调的需求不断增长是推动该行业市场的最重要因素之一。中央空调预计将成为世界各地人们最受欢迎的居家降温方式。根据IEA统计,空调和风扇约占全球建筑物总电力消耗量的五分之一,即全球总电力消耗量的10%。未来 30 年,空调的使用预计将迅速增加,并成为全球电力需求的主要推动力之一。

- 此外,推动住宅领域暖通空调现场设备市场扩张的主要因素之一是人们对室内空气品质日益增长的关注。一些政府也透过颁布法律来满足能源需求并实施以折扣价销售这些空调的计画来鼓励购买这些高效能设备。例如,能源效率局 (BEE) 和电力部透过定期向上修改能源标籤计画以支援节能係统来执行有关住宅空调能耗的法规。

- OBERLO 预计,2023 年将有 6,040 万美国家庭积极使用智慧家庭设备,比 2022 年的 5,740 万家庭使用智慧家庭设备增加 3%。到2023年,使用智慧家庭科技的家庭比例预计将达到所有家庭的46.5%。这种普及预计将增加对能耗更少的智慧型装置(包括暖通空调系统)的需求。

- 为了减少二氧化碳排放,供应商和许多政府也致力于住宅脱碳。因此,热泵在住宅领域的采用预计将加速,帮助住宅减少能源费用,并帮助减少导致全球气候变迁的石化燃料的使用。开利、大金、江森自控、丹佛斯等主要供应商不断投资推出住宅产品,这是推动市场的主要因素之一。

亚太地区预计将占据主要市场占有率

- 过去几年,由于永续建设政策和向服务主导经济的转变,中国建筑业实现了大幅成长。大型基础建设计划投资已成为中国政府提振成长策略的重要组成部分。

- 根据中国建设业协会统计,2021年我国完工建筑中住宅建筑占比较大。住宅建筑面积占竣工占地面积67%以上。随着国家经济的成长,人们从农村地区迁移到大城市,增加了这些地区的住宅需求。此外,用作投资物业的公寓正在推动需求。如此大规模的住宅预计将推动调查市场。

- 根据国土交通省的数据,2022 年日本住宅数约为 85.95 万套。与与前一年同期比较相比成长了0.4%。 2022年日本开工办公大楼数量将超过10,200栋。如此庞大的建筑数量可能会推动所研究的市场。

- 此外,根据IBEF的数据,印度去年在房地产资产的投资为24亿美元,年增率为52%。 2000年4月至2022年9月,该产业的直接投资(包括建设开发和营运)总计551.8亿美元。房地产的显着成长可能会促进所研究市场的成长。

- 此外,韩国的新资料中心建设计划也支持了市场成长。例如,SK Telecom 的网路基础设施部门 SK Broadband 最近宣布计划投资 17.5 亿美元,在新兴企业园区周围建造一个全新的超大规模资料中心。资料中心和Start-Ups丛集开发的第一阶段预计将于 2024 年完成,包括 4 座资料中心大楼,并计划在 2029 年再增加 12 座。

HVAC 现场设备产业概述

全球 HVAC 现场设备市场高度分散,主要参与者众多。从市场占有率来看,目前少数大公司占据市场主导地位。这些拥有显着市场份额的领先公司致力于扩大海外基本客群。这些公司利用策略合作计划来增加市场占有率和盈利。

2023 年 3 月,Honeywell推出了 Versatilis 变送器,用于对帮浦、马达、压缩机、风扇、鼓风机和变速箱等旋转设备进行状态监控。HoneywellVersatilis 变送器可为旋转设备提供正确的测量,提供可提高各行业安全性、可用性和可靠性的智慧。

2022年8月,Airzone宣布将凭藉独特的HVAC变频系统智慧控制解决方案进入快速成长的北美市场。 Airzone 的 Aidoo Pro 连接了专有的 HVAC 逆变器和小型分离式製造商通讯协定以及物联网设备 API,包括流行的 Ecobee、Honeywell 和 Nest 智慧恆温器。 Aidoo Pro 允许 HVAC 专业人员将 HVAC 逆变器系统与领先的智慧恆温器集成,保留所有逆变器功能并提供无与伦比的效率、节能、连接性和舒适性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对工业的影响评估

第五章市场动态

- 市场驱动因素

- 开拓建筑市场

- 支持性政府法规,包括透过税额扣抵计划激励节能

- 物联网和产品创新的出现支持替代

- 市场限制因素

- 取决于宏观经济经济状况

- 节能係统的初始成本较高

第六章市场区隔

- 按类型

- 控制阀

- 平衡阀

- PICV

- 风门暖通空调

- 风门致动器HVAC

- 其他类型

- 透过感测器

- 环境感测器

- 多感测器

- 空气品质感测器

- 运转率/照明

- 其他感测器

- 按最终用户产业

- 商业的

- 住宅

- 工业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Siemens AG

- Honeywell International Inc.

- Johnson Controls International PLC

- Rotork Plc

- Dwyer Instruments Inc.

- Belimo Holding AG

- Robert Bosch GmbH

- Electrolux AB

- Azbil Corporation

- Danfoss A/S

- Daikin Industries Ltd.

第八章投资分析

第九章 市场未来展望

The HVAC Field Device Market size is estimated at USD 21.13 billion in 2024, and is expected to reach USD 28.72 billion by 2029, growing at a CAGR of 6.30% during the forecast period (2024-2029).

The pandemic significantly influenced the HVAC industry, as demand for the systems observed a significant drop during the initial months, owing to lockdown restrictions and businesses refraining from investing in new equipment. Due to the pandemic, many construction projects were halted across the world. Reduced commercial, residential, and industrial construction activities temporarily dampened the demand for HVAC field devices.

Key Highlights

- Consequently, the US government has significantly invested in federal funds that can be used in public buildings, schools, and other settings to improve indoor air quality. For instance, the American Rescue Plan provided USD 350 billion for state and local governments, along with USD 122 billion for schools, that can be used for ventilation and filtration upgrades.

- The end users are adopting smart HVAC equipment to predict when maintenance is needed before a real issue occurs. The latest HVAC technologies, which utilize an Internet of Things (IoT) system, are embedded with sensors, software, and connectivity, enabling the HVAC system to exchange data with other connected devices. IoT systems enhance preventative maintenance by sensing data on air quality and equipment status. Moreover, the latest and most affordable Internet of Things HVAC technology makes it significantly easier to view insights across several equipment types, such as rooftop air-handling units, air- and water-cooled heat pumps, variable air volume (VAV) with reheat systems, etc. These developments in HVAC equipment are expected to further drive the studied market.

- Rising consumer purchasing power coupled with increasing disposable income, especially in developing economies, also positively impacts the market. For instance, according to the National Bureau of Statistics of China, the average disposable income per capita for residents in China was 36,883 yuan, a nominal increase of 5.0% compared to the previous year and an absolute increase of 2.9% after adjusting for inflation in 2022.

- In addition to this, the rising manufacturing sector has further bolstered the scope of HVAC equipment and field devices. According to the World Manufacturing Production Quarter 3 2022 Report by the United Nations Industrial Development Organization, manufacturing production in Asia and Oceania experienced an output growth of 4.4%, ahead of North America (3.5%) and Europe (1.7%). The manufacturing sector in Latin America and the Caribbean expanded by 4.9%, and South Africa grew by 3.0%.

- Furthermore, Eastern Europe has colder climatic conditions, and the demand for heating solutions is significant in these countries, such as the Czech Republic, Poland, Bulgaria, and others. Like other countries in the region, measures to increase energy efficiency in the heating and cooling sectors are rising. The Intelligent Energy Europe Programme of the EU, which co-founded Stratego, claims that an investment of EUR 50 billion between 2010 and 2050 will save enough fuel to lower the costs of the energy system. As part of this investment, district heating's share stood at EUR 5 billion and individual heat pumps at EUR 15 billion.

- Several governments worldwide are offering financial benefits to promote the use of energy-saving equipment in residential and commercial spaces. For instance, the U.S. government introduced the Energy Policy Act of 2005, which provides a tax deduction of up to USD 1.80 per square foot for new commercial buildings. Buildings that reduce their regulated energy consumption by 50% in comparison to the specifications outlined in the American Society of Heating, Refrigerating, and Air-Conditioning Engineers, Inc.'s 2001 new construction standard (ASHRAE 90.1) were eligible for the tax benefit. Government initiatives and rising awareness about environmental degradation and energy management are expected to keep the demand for energy-efficient HVAC control systems, including field devices.

HVAC Field Device Market Trends

Residential Sector is Expected to Hold Significant Market Share

- One of the key drivers propelling the market for HVAC field devices is the growing percentage of energy consumption in residential buildings, which has led to the usage of energy retrofit systems to increase the efficiency of buildings. For instance, HomeServe introduced its benefits program for home HVAC subscriptions in August 2022. This helps utilities accomplish energy efficiency goals and improve customer satisfaction by lowering the cost of replacing an HVAC (heating and air conditioning) system, which is expensive for households.

- Growing demand for air conditioners has been one of the most critical factors driving the market in this sector. Central air conditioning is expected to become the most common way people across the globe cool their homes. According to the IEA, air conditioners and electric fans account for about a fifth of the total electricity in buildings worldwide, or 10% of all global electricity consumption. Over the next three decades, the use of ACs is set to soar, becoming one of the top drivers of global electricity demand.

- Furthermore, one of the key factors propelling the expansion of the HVAC field device market in the residential sector is the rising concern for indoor air quality. Also, several governments are encouraging the purchase of this high-efficiency equipment by enforcing laws to satisfy energy demand and implementing sales programs for these air conditioners at discounted prices. By routinely making upward changes to the Energy Labeling Program in favor of energy-efficient systems, the Bureau of Energy Efficiency (BEE) and the Ministry of Electricity, for instance, have been enforcing rules on the amount of electricity consumed by residential air conditioners.

- According to OBERLO, 60.4 million US homes were expected to be actively utilizing smart home devices in 2023, which was 3% more than in 2022, when 57.4 million households used smart home devices. In 2023, the proportion of households utilizing smart home technology is expected to be 46.5% of all households. This penetration is likely to lead to an increase in demand for smart devices with low energy consumption, including HVAC systems.

- To reduce CO2 emissions, vendors and numerous governments are also focused on residential decarbonization. As a result, it is anticipated that the adoption of heat pumps in the residential sector will gain traction, which will aid homeowners in reducing their utility costs and promote a decrease in the use of fossil fuels, which feed global climate change. Major vendors like Carrier, Daikin, Johnson Controls, Danfoss, and others are constantly investing in residential product launches, which is one of the major factors driving the market.

Asia-Pacific is Expected to Hold Significant Market Share

- The construction industry in China has witnessed massive growth due to sustainable construction policies and a shift toward a service-led economy over the past few years. Investing in large-scale infrastructure projects has been a vital part of the Chinese government's strategy to boost growth.

- According to the China Construction Industry Association, in 2021, residential structures accounted for a significant share of finished construction in China. Buildings intended for housing accounted for over 67% of the completed floor space. As the country's economy grows, people migrate from rural areas to major cities, increasing demand for residential accommodation in these locations. Furthermore, apartments utilized as investment properties drive up demand. Such massive residential construction is expected to drive the study market.

- According to MLIT (Japan), there were about 859.5 thousand home starts in Japan in 2022. Compared to the prior year, this represented an increase of 0.4%. Over 10,200 office building construction projects began in Japan in 2022. Such a vast number of constructions would drive the studied market.

- Further, according to IBEF, India invested USD 2.4 billion in real estate assets over the last year, a 52% increase annually. From April 2000 to September 2022, FDI in the industry, comprising construction development and operations, totaled USD 55.18 billion. Such a massive rise in real estate would allow the studied market to grow.

- Further, the new data center construction projects in the country are also pushing the market's growth in South Korea. For instance, SK Broadband, the internet infrastructure division of SK Telecom, recently announced plans to invest USD 1.75 billion in the creation of a brand-new hyperscale data center encircling a startup campus. The first phase of the data center and startup cluster development is expected to be completed by 2024 and comprise four data center buildings, with plans to add 12 more by 2029.

HVAC Field Device Industry Overview

The global HVAC field device market is highly fragmented and has several major players. In terms of market share, a few of the major players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market shares and profitability.

In March 2023, Honeywell introduced its Versatilis transmitters for condition-based monitoring of rotating equipment such as pumps, motors, compressors, fans, blowers, and gearboxes. Honeywell Versatilis transmitters provide relevant measurements of rotating equipment, delivering intelligence that can improve safety, availability, and reliability across industries.

In August 2022, Airzone announced it was entering the rapidly growing North American market with an exclusive smart control solution for HVAC inverter systems. Airzone's Aidoo Pro acted as the bridge between proprietary HVAC inverter and mini-split manufacturers' protocols and IoT device APIs, including for the popular Ecobee, Honeywell, and Nest smart thermostats. The Aidoo Pro enables HVAC professionals to integrate HVAC inverter systems with leading smart thermostats, preserving all inverter features and providing unparalleled efficiency, energy savings, connectivity, and comfort.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Development of the Construction Market

- 5.1.2 Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs

- 5.1.3 The Emergence of IoT and Product Innovations to Aid Replacements

- 5.2 Market Restraints

- 5.2.1 Dependence on Macro-economic Conditions

- 5.2.2 High Initial Cost of Energy Efficient Systems

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Control Valve

- 6.1.2 Balancing Valve

- 6.1.3 PICV

- 6.1.4 Damper HVAC

- 6.1.5 Damper Actuator HVAC

- 6.1.6 Other Types

- 6.2 By Sensors

- 6.2.1 Environmental Sensors

- 6.2.2 Multi Sensors

- 6.2.3 Air Quality Sensors

- 6.2.4 Occupancy & Lighting

- 6.2.5 Other Sensors

- 6.3 By End-user Industry

- 6.3.1 Commercial

- 6.3.2 Residential

- 6.3.3 Industrial

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Honeywell International Inc.

- 7.1.3 Johnson Controls International PLC

- 7.1.4 Rotork Plc

- 7.1.5 Dwyer Instruments Inc.

- 7.1.6 Belimo Holding AG

- 7.1.7 Robert Bosch GmbH

- 7.1.8 Electrolux AB

- 7.1.9 Azbil Corporation

- 7.1.10 Danfoss A/S

- 7.1.11 Daikin Industries Ltd.