|

市场调查报告书

商品编码

1431448

全球陶瓷电容器市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Ceramic Capacitors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

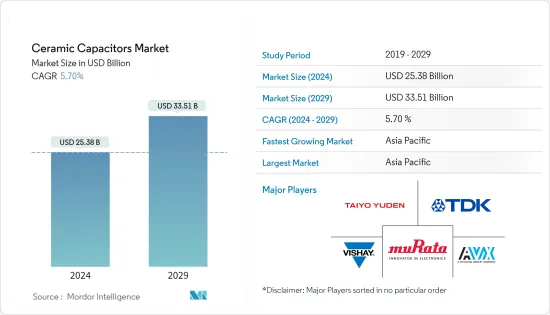

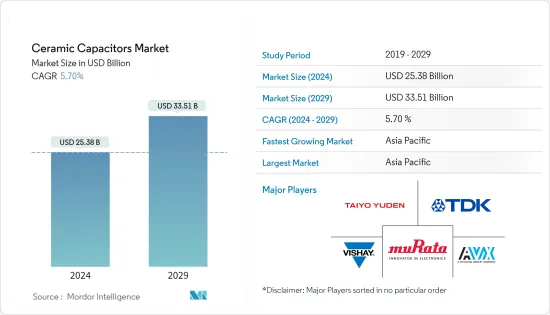

预计2024年全球陶瓷电容器市场规模为253.8亿美元,2029年达335.1亿美元,在预测期间(2024-2029年)复合年增长率为5.70%。

陶瓷电容器因其高可靠性和低製造成本而在大多数电气设备中最常使用。这些电容器用于多个行业,主要由以非极化形式存在的陶瓷或瓷盘组成。陶瓷材料也是良好的电介质,因为它们具有低电导率并有效支援静电场。

主要亮点

- 陶瓷电容器主要分为三种类型。用于通孔安装的有引线盘式陶瓷电容器、树脂涂层表面黏着技术积层陶瓷电容(MLCC) 以及主要用于安装在PCB 插槽中的特殊类型微波裸露无引线盘。它是一种陶瓷电容器。

- 其中,MLCC是许多电子设备中必不可少的元件,广泛应用于穿戴式装置和智慧型手机(智慧型手机配备了大约900至1,100个积层陶瓷电容)。

- 此外,人们对电子产品的偏好正从消费性电子产品转向运算产品。随着人工智慧、物联网、云端和数数位化的出现,製造商开始关注这一领域。这些新技术比消费品具有更高的报酬率,并且需要更少的设备,使製造商更容易管理其生产线。

- 5G 智慧型手机的广泛普及和功能的增加刺激了对进一步小型化和更高密度电子电路的需求。例如,包括高通、联发科在内的许多公司都发布了支援5G的晶片组,许多智慧型手机製造商都在使用它们。此前,5G 支援仅限于旗舰手机,但现在中阶智慧型手机也支援 5G,并为市场带来更便宜的晶片组。这些努力增加了对陶瓷电容器的需求。

- 另一方面,生产陶瓷电容器也面临一些挑战。主要挑战之一是製造高电容积层陶瓷电容(MLCC),这需要将许多单层电容器堆迭到单一封装中。这种电容器的製造存在易受机械影响、表面黏着技术到电路基板时容易破裂、各层电容难以获得高均匀性等问题,一直困扰着我。另一个挑战是电容的温度和频率依赖性,这可能会在高性能应用中造成问题。

- COVID-19 大流行影响了陶瓷电容器市场。疫情扰乱了供应链和製造流程,导致陶瓷电容器的供需波动。

- 然而,随着疫苗接种运动和限制的放鬆,情况正常化,市场预计将復苏。另一方面,由于世界各地在家工作的人数增加,对笔记型电脑和个人电脑等家用电器和行动装置的需求不断增加,预计其他行业对陶瓷电容器元件的需求也会增加。此外,疫情期间线上游戏的成长趋势以及游戏和家庭剧院电子产品需求的增加也导致了强劲的需求。

陶瓷电容器市场趋势

汽车领域预计将推动市场成长

- 陶瓷电容器因其尺寸紧凑、可靠性高且能够承受高温和振动而常被选择用于汽车应用。过滤来自各种汽车系统电源的高频噪声,例如引擎控制单元、资讯娱乐系统和照明系统。它们也用于抑制开关电路中的电压尖峰和振铃的缓衝电路,以及在电路之间传递高频讯号的耦合电路。此外,它们还用于计时电路和振盪电路,例如感测器和致动器的谐振电路以及各种汽车系统的时脉产生器。

- 自动驾驶汽车技术、车对车通讯、ADAS(高级驾驶员辅助系统)以及倒车相机和车道偏离侦测器等安全和侦测系统的新车辆功能和特性正在推动对汽车电子元件的需求。陶瓷电容器等被动元件对于确保稳定性和无干扰设计是必要的。

- 根据世界经济论坛预测,到2035年,全自动驾驶汽车的年销售量预计将超过1,200万辆,占全球汽车市场的25%。此外,新法强调此类车辆「必须继续提供与目前小客车相同等级的乘员保护」。正如交通部长所说,Pete Battigieg 的新规则对于为配备 ADS 的车辆建立严格的安全标准至关重要。此类新兴市场的开拓将透过促进该地区联网汽车市场的普及来支持研究市场的成长。这可能为国内外缘运算公司扩大市场占有率创造机会。

- 向自动驾驶汽车和 ADAS(高级驾驶辅助系统)等先进车辆的转变正在推动每辆车使用 MLCC。因此,为了应对这些趋势,製造商正在致力于与增加陶瓷电容器的电容相关的产品创新。例如,2021年12月,村田製作所宣布开发出GCM31CC71C226ME36 MLCC,此MLCC的电容最高为22 µF,额定电压为16 V。该 MLCC 非常适合汽车和安全应用。此外,电容器采用薄层片状成型技术设计,具有更高的可靠性和效率。

- 同样在 2022 年 2 月,该公司推出了 NFM15HC435D0E3 MLCC,旨在三个端子上提供 4.3 µF 的电容。这款电容器专为汽车应用而设计,可提供安装在 ADAS(高级驾驶辅助系统)和自动驾驶功能中的高性能处理器所需的降噪和出色的去耦功能。这表明汽车行业对陶瓷电容器的需求正在增加。然而,由于 COVID-19 的持续影响,供应链预计将受到干扰,儘管规模较小。

- 此外,电动车对MLCC的需求也在增加。这是因为,由于驾驶辅助功能和全自动驾驶系统等功能的增加,大多数电动车使用了接近 10-15,000 个 MLCC。 IEA 的数据显示,2022 年电动车销量将增加,达到 102 万辆。此类案例显示汽车产业对 MLCC 的需求不断增长。此外,电动车的高普及和各国政府设定的内燃机引擎的完全淘汰日期可能会推动汽车产业 MLCC 的成长。

预计亚太地区市场将出现高速成长

- 亚太地区是陶瓷电容器最重要的市场之一。中国汽车产业规模不断扩大,在全球汽车市场中扮演重要角色。政府认为汽车工业,包括汽车零件产业,是国家的主要产业之一。中国政府预计2025年中国汽车产量将达3,500万辆。预计这将推动电容器需求。

- 电动车越来越受欢迎,中国被认为是采用电动车的主要国家之一。中国的「十三五」规划促进了混合动力汽车汽车和电动车等绿色交通解决方案的发展,以推动国家交通运输业的发展。中国的电动车将在2022年实现全国普及,显着高于政府2025年的预测,数十家竞争对手的新车型吸引了新的购买者并鼓励车主转换电动车。我们有望实现20%的目标。

- 此外,日本政府的目标是到 2050 年普及所有新车在日本销售,无论是电动车还是混合动力汽车。也计划提供补贴,帮助私人企业加快电动车电池和马达的开发。日本是最早推出电动车的国家之一,十多年前推出了日产 Leaf 和三菱 i-MIEV。

- 陶瓷电容器因其电容量大、耐压高、成本低而常用于通讯业。它们可用于多种应用,包括滤波、去耦和电压调节。特别是,积层陶瓷电容(MLCC)由于其紧凑的尺寸和高电容值而在通讯业中很受欢迎。 MLCC 用于多种应用,包括智慧型手机、基地台和其他通讯设备。

- 京瓷 (Kyocera) 和基美 (KEMET) 等亚太製造商生产专为通讯应用设计的陶瓷电容器。该地区电讯需求的增加预计将推动该地区陶瓷电容器的需求。例如,根据中国电信的数据,2022年其收入约为4,750亿元人民币,较前一年的4,400亿元大幅成长。

- 中国是亚太地区 AGV 成长的主要贡献者。製造业、汽车和电子商务等所有行业对 AGV 产品的需求不断增长,正在积极推动市场成长。 AGV 需要爆发性的高功率来进行倾倒和提升,并且需要持续的能量来在站点之间移动。这些突发功率会显着缩短电池寿命,要求製造商经常更换电池。您还需要在轮班期间更换电池。与电池不同,电容器几乎不需要维护,并且可以使用地面感应式充电在几秒钟内充电,使製造商无需更换电池。亚太地区工厂自动化程度的提高预计将在预测期内推动陶瓷电容器的需求。

- 此外,该地区的公司还提供各种产品,以满足广泛的客户需求。例如,村田製作所提供各种陶瓷电容器,包括积层陶瓷电容(MLCC)、高效电容片式MLCC、用于汽车动力传动系统的高涟波电流片式MLCC以及用于家用电器和工业设备的安全片式MLCC。村田製作所的陶瓷电容器以其小尺寸和大电容值而闻名。我们也开发出全球首款MLCC,电容为1μF/25V的GCM033D70E105ME36,并已开始量产。

陶瓷电容器行业概况

由于全球市场供应商有限,陶瓷电容器市场处于半固化状态。主要企业参与收购和合作等各种策略,以提高市场占有率并提高市场盈利。村田製作所、TDK Corporation、太阳诱电、AVX Corporation 和 Vishay Intertechnology, Inc. 等主要公司都参与其中。

- 2023年11月,京瓷AVX发表了符合X1/Y2级标准的KGK系列电容器和符合X2级标准的KGH系列电容器。这些电容器的额定电压为 250VAC,设计符合 EN 60384-14、IEC 60384-14 和 UL 60384-14 标准的要求。配备突波保护、瞬态保护和EMI滤波功能,适用于数据机和传真机等各种消费性电子和工业设备。

- 2023 年 9 月,TDK 公司(总裁:Takehiro Kamigama)宣布推出 CN 系列积层陶瓷电容(MLCC) 的增强版,该产品具有创新和独特的设计。在传统的软端型MLCC中,整个端子电极都被树脂层覆盖,但本产品仅在安装在基板的一侧形成树脂层。此外,TDK 公司还推出了 CNA 系列(汽车级)和 CNC 系列(商业级)来扩大其产品阵容,以满足对更高容量 MLCC 不断增长的需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 价值链分析

- 宏观经济评估,包括后 COVID-19 分析

第五章市场动态

- 市场驱动因素

- 数位化和5G技术的普及

- 采用工厂自动化和机器人技术

- 市场限制因素

- 陶瓷电容器开发所需的先进微观技术力

第六章市场区隔

- 按类型

- MLCC

- 陶瓷圆盘电容器

- 穿心陶瓷电容器

- 陶瓷电力电容器

- 按最终用户

- 家用电器

- 车

- 通讯

- 工业的

- 能源/电力

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- Taiyo Yuden Co., Ltd.

- Vishay Intertechnology, Inc.

- AVX Corporation

- Johanson Dielectrics, Inc.

- AFM Microelectronics

- Kemet Corporation

- Walsin Technology Corporation

- TE Connectivity

第八章投资分析

第九章 市场未来展望

The Ceramic Capacitors Market size is estimated at USD 25.38 billion in 2024, and is expected to reach USD 33.51 billion by 2029, growing at a CAGR of 5.70% during the forecast period (2024-2029).

Ceramic capacitors are one of the most commonly used in most electrical instruments, as they offer reliability and are cheaper to manufacture. These capacitors are used in multiple industries and primarily consist of ceramic or porcelain discs that exist in a non-polarized form. The ceramic material is also an excellent dielectric due to its poor conductivity and its efficient support of electrostatic fields.

Key Highlights

- Ceramic capacitors are mostly available in three types. However, other styles are also available: leaded disc ceramic capacitors for through-hole mounting, resin-coated surface mount multilayer ceramic capacitors (MLCC), and special type microwave bare lead-less disc ceramic capacitors, which are primarily intended to sit in a slot on the PCBs.

- Among the applications, MLCCs are essential components of many electronic devices and are widely used in such devices as wearable devices and smartphones (approximately 900 to 1100 multilayer ceramic capacitors are installed in a smartphone).

- Also, there has been a shift in preference in electronics from consumer electronics to computing. The emergence of AI, IoT, cloud, and digitalization has led manufacturers to concentrate on this segment. These new technologies have a high profit margin compared to consumer goods, and the units needed are also fewer, making it viable for manufacturers to manage their production lines.

- The widespread adoption of 5G smartphones and their increasing functionality are stoking demand for further miniaturization and higher electronic circuitry density. For instance, a number of companies, including Qualcomm and MediaTek, are releasing chipsets that support 5G, and numerous smartphone manufacturers are using them. Previously, 5G support was confined to only flagship mobiles; now, mid-level smartphones also support 5G to introduce cheaper chipsets in the market. Such initiatives are increasing the need for ceramic capacitors.

- On the flip side, the production of ceramic capacitors presents several challenges. One major challenge is manufacturing high-capacitance multilayer ceramic capacitors (MLCCs), which involves stacking many single-layer capacitors into a single package. The manufacture of these capacitors is fraught with problems, including mechanical susceptibility, cracking during surface-mount soldering to a circuit board, and difficulty achieving high uniformity of capacitance across the layers. Another challenge is capacitance's temperature and frequency dependence, which can cause issues in high-performance applications.

- The COVID-19 pandemic impacted the ceramic capacitor market. The pandemic caused disruptions in the supply chain and manufacturing processes, leading to fluctuations in the demand and supply of ceramic capacitors.

- However, the market was anticipated to recover as the situation normalized with the ongoing vaccination drives and relaxed regulations. Meanwhile, ceramic capacitor components were expected to witness a growing demand from other industries due to an increasing demand for consumer electronics and mobile devices, such as laptops and computers, due to the work-from-home scenario across the world. Also, significant demand was witnessed from the increasing trend of online gaming during the pandemic, which subsequently increased the demand for gaming and home theater electronics.

Ceramic Capacitors Market Trends

Automotive Segment is Expected to Drive the Market's Growth

- Ceramic capacitors are usually employed in automotive applications due to their compact size, high reliability, and ability to withstand high temperatures and vibrations. They filter out high-frequency noise from power supplies in various automotive systems, such as engine control units, infotainment systems, and lighting systems. They are also employed in snubber circuits to suppress voltage spikes and ringing in switching circuits and in coupling circuits to pass high-frequency signals between circuits. Further, they are used in timing and oscillation circuits, such as in resonant circuits for sensors and actuators, as well as in clock generators for various automotive systems.

- The new automotive features and functionality due to autonomous vehicle technologies, vehicle-to-vehicle communications, advanced driver-assistance systems, and other safety and sensing systems, like backup cameras and lane-departure detectors, are driving the demand for electronic components in automotive applications. Passive components, like ceramic capacitors, are required to ensure stability and interference-free designs.

- According to the World Economic Forum, over 12 million fully autonomous cars are expected to be sold annually by 2035, covering 25% of the global automotive market. Further, the new law emphasizes that such cars "must continue to offer the same high levels of occupant protection as current passenger vehicles." As the Transportation Secretary said, Pete Buttigieg's new rule is essential to establishing robust safety standards for ADS-equipped vehicles. Such developments aid the growth of the studied market by propelling the proliferation of the connected car market in the region. This may create opportunities for local and international edge computing players to expand their market share.

- The shift towards sophisticated vehicles, such as self-driving vehicles, ADAS (Advanced Driver Assistance Systems), is driving the use of MLCCs per vehicle. Therefore, to cater to such a trend, manufacturers are involved in product innovation related to higher capacitance for ceramic capacitors. For instance, in December 2021, Murata announced the development of a GCM31CC71C226ME36 MLCC that features the highest capacitance of 22 µF for MLCCs and has a voltage rating of 16V. The application of this MLCC is streamlined for automotive and safety applications. In addition, the capacitors are designed with thin-layer sheet forming technology to achieve greater reliability and efficiency.

- Similarly, in February 2022, the company launched the NFM15HC435D0E3 MLCC, designed with three terminals to provide a capacitance of 4.3 µF. The capacitors are designed for automotive applications to attain results on noise removal and superior decoupling that are required for high-performance processors employed in advanced driver assistance systems and autonomous driving functions. This indicates the growing demand for ceramic capacitors in the automotive industry. However, with the impact of the constant COVID-19 pandemic, the supply chain is expected to be disrupted on a small scale.

- Moreover, the demand for MLCC in electric vehicles is also increasing, as most of the EVs use close to 10-15,000 MLCC due to increased features like driver assistance functions and fully autonomous systems. The sales of EVs increased in 2022, according to the IEA, and accounted for 1.02 million electric vehicles. Such instances indicate the growing demand for MLCC in the automotive sector. Further, the high adoption of EVs and the complete phase-out dates of ICE engines set by various governments will drive the growth of MLCC in the automotive sector.

Asia-Pacific Region is Expected to Witness a High Market Growth

- The Asia-Pacific region is one of the most important markets for ceramic capacitors. The automotive industry is expanding in China, and the country plays an important role in the worldwide automotive market. The government sees its automotive industry, including the auto parts sector, as one of the country's primary industries. The government of China anticipates that China's automobile output is expected to reach 35 million units by 2025. This is expected to drive the capacitors' demand.

- The popularity of EVs is growing, and China is regarded as one of the dominant adopters of electric vehicles. The country's 13th Five-Year Plan promotes the development of green transportation solutions, such as hybrid and electric vehicles, for advancements in the country's transportation sector. China's electric cars were on track to reach the 20% nationwide penetration goal in 2022, well ahead of the Chinese government's 2025 forecast, due to new models by dozens of competitors attracting new buyers and encouraging owners to switch to electric vehicles.

- Further, the Japanese government aims to have all the new cars sold in Japan, whether electric or hybrid, by the year 2050. The country plans to also offer subsidies to accelerate the private sector's development of batteries and motors for electricity-powered vehicles. Japan is one of the countries that were early adopters of electric vehicles, with the launch of the Nissan LEAF and Mitsubishi i-MIEV more than a decade ago.

- Ceramic capacitors are commonly used in the telecommunications industry due to their high capacitance, high voltage tolerance, and low cost. They are employed in various applications, such as filtering, decoupling, and voltage regulation. In particular, multilayer ceramic capacitors (MLCCs) are popular in the telecommunications industry due to their compact size and high capacitance values. MLCCs are used in various applications, including smartphones, base stations, and other telecommunications equipment.

- Manufacturers in the Asia-Pacific region, such as Kyocera and KEMET, produce ceramic capacitors designed for telecommunications applications. The increasing telecom demand in the region is anticipated to boost the demand for ceramic capacitors in the region. For instance, according to China Telecom, in 2022, it generated revenue of approximately CNY 475 billion, a significant increase from CNY 440 billion in the previous year.

- China has been a significant contributor to the growth of the AGVs in the Asia-Pacific region. The growing demand for AGV products across industries, such as manufacturing, automotive, and e-commerce, among others, is boosting the market's growth positively. An AGV requires high power bursts for dumping or lifting, as well as continuous energy for traveling between stations. These bursts of power significantly reduce battery life, requiring manufacturers to replace batteries frequently. There is also the need to exchange batteries during working shifts. Unlike batteries, capacitors require little maintenance and can be charged in seconds using in-floor inductive charging, freeing manufacturers from constant battery swaps and replacements. The increasing factory automation in the Asia-Pacific region is anticipated to drive the demand for ceramic capacitors during the forecast period.

- Additionally, the players in the region are offering various products to cater to a wide range of customers' needs. For example, Murata Manufacturing Co., Ltd. offers various ceramic capacitors, including multilayer ceramic capacitors (MLCCs), high effective capacitance, and high ripple current chip MLCCs for automotive powertrains, and safety chip MLCCs for consumer electronics and industrial equipment. Murata's ceramic capacitors are renowned for their small size and large capacitance values. They have also developed and started mass production of the GCM033D70E105ME36, the world's first MLCC capacitance of 1 µF/25 V.

Ceramic Capacitors Industry Overview

The ceramic capacitor market is Semi-consolidated due to limited vendors in the global market. The key players are involved in various strategies, such as acquisitions and partnerships, to improve their market share and enhance their profitability in the market. Some of the leading players are there in the market are Murata Manufacturing Co., Ltd., TDK Corporation, Taiyo Yuden Co., Ltd., AVX Corporation, Vishay Intertechnology, Inc., and many others.

- November 2023: Kyocera AVX has introduced the KGK series of capacitors that comply with Class X1/Y2 standards and the KGH series of capacitors that comply with Class X2 standards. These capacitors, with a voltage rating of 250 VAC, are designed to meet the requirements set by EN 60384-14, IEC 60384-14, and UL 60384-14 standards. They offer surge and transient protection and EMI filtering, making them suitable for use in various consumer and industrial devices such as modems and fax machines.

- September 2023: TDK Corporation has introduced an enhanced version of its CN series of multilayer ceramic capacitors (MLCCs) that boasts an innovative and distinctive design. In contrast to conventional soft termination MLCCs, where the entire terminal electrodes are coated with resin layers, this new design incorporates resin layers only on one side that is mounted on a board. Moreover, TDK Corporation has also expanded its product range by introducing the CNA series (automotive grade) and CNC series (commercial grade) to cater to the growing demand for MLCCs with larger capacitances.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Macro-economic Assessment Including Post-COVID-19 Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Penetration of Digitalization and 5G technology

- 5.1.2 Adoption of Factory Automation and Robotics

- 5.2 Market Restraints

- 5.2.1 Requirement of Advanced Micro level Technical Competence for Developing Ceramic Capacitors

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 MLCC

- 6.1.2 Ceramic Disc Capacitor

- 6.1.3 Feedthrough Ceramic Capacitor

- 6.1.4 Ceramic Power Capacitor

- 6.2 By End-User

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 Telecommunication

- 6.2.4 Industrial

- 6.2.5 Energy & Power

- 6.2.6 Other End-Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Murata Manufacturing Co., Ltd.

- 7.1.2 TDK Corporation

- 7.1.3 Taiyo Yuden Co., Ltd.

- 7.1.4 Vishay Intertechnology, Inc.

- 7.1.5 AVX Corporation

- 7.1.6 Johanson Dielectrics, Inc.

- 7.1.7 AFM Microelectronics

- 7.1.8 Kemet Corporation

- 7.1.9 Walsin Technology Corporation

- 7.1.10 TE Connectivity