|

市场调查报告书

商品编码

1684044

低压MLCC:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Low Voltage MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

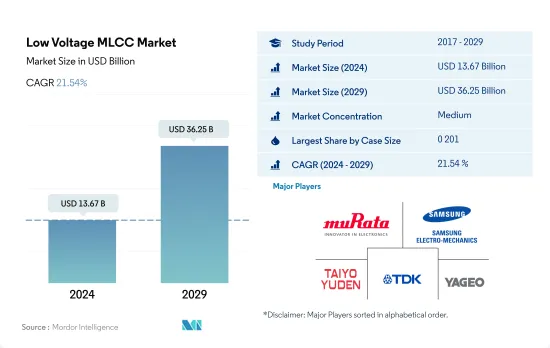

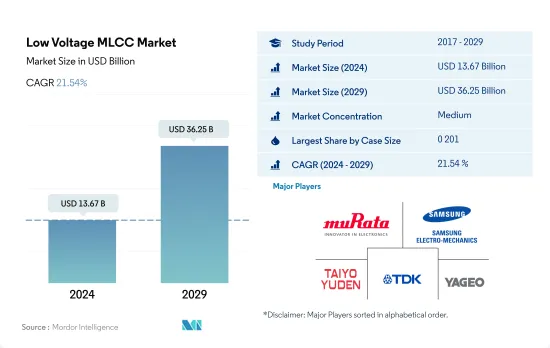

低压 MLCC 市场规模预计在 2024 年为 136.7 亿美元,预计到 2029 年将达到 362.5 亿美元,预测期内(2024-2029 年)的复合年增长率为 21.54%。

慢性病的流行以及小型高阶 5G 智慧型手机的日益普及推动了对 MLCC 的需求。

- 0201 外形尺寸将成为领跑者,到 2022 年将占据最大的市场占有率,达到 29.78%,其次是 0402,占 28.21%,0603,占 15.67%。

- 0201 外壳尺寸最为紧凑,可在电路基板实现更高的元件密度。这些 MLCC 广泛 用于家用电子电器,电讯和医疗设备. COG Dielectric 的 0201 MLCC 电压较低,低于 500 伏特,用于医疗设备。例如,在中国等亚太国家,心血管疾病(CVD)是沉重的医疗负担,盛行率和发生率不断上升。 2022年,心血管疾病发生率为每千人年8.35例,死亡率为5.33例。值得注意的是,中西部地区的死亡率高于东部地区。 0201 MLCC 作为能源储存电容器在心血管心律调节器中发挥重要作用,因此对其的需求正在增加。

- 在德国等欧洲国家,2021年智慧型手机需求大幅成长,销售量达2,220万台,较上年的2,000万台有显着成长。对紧凑、功能丰富的智慧型手机的需求不断增长,推动了对 0402 MLCC 等小型化组件的需求。 0402表面黏着技术MLCC在将多种功能整合到有限空间方面发挥关键作用,促进了智慧型手机体积更小、更智慧的发展。

高度发达的电讯业和庞大的基本客群预计将大幅增加亚太地区对 MLCC 的需求。

- 亚太地区成为领跑者,2022 年占据最大市场占有率,为 43.00%,其次是北美,为 23.57%,欧洲为 22.80%。

- 亚太地区在笔记型电脑、桌上型电脑和行动电话等IT设备製造中占有很大的份额。中国凭藉强大的技术实力,占据全球IT设备製造和出口的很大份额。从产量来看,亚太地区继续成为桌上型电脑的主要供应商。因此,预计预测期内对表面黏着技术MLCC 的需求将会增加。

- 由于便携性和植入性的需要,医疗设备通常有严格的尺寸限制。小尺寸、高电容、可靠性和性能特性的结合使得 MLCC 适用于各种医疗设备,从可携式诊断仪器到心律调节器等植入式设备。由于慢性病增加、医疗保健支出高以及主要企业的存在等因素,预计北美将在预测期内主导医疗设备市场。心血管疾病盛行率的不断上升是推动医疗设备需求的一个主要因素。例如,根据美国疾病管制与预防中心发布的2021年资料,美国每年有805,000人罹患心臟病。例如,根据美国疾病管制与预防中心2021年发布的资料,美国每年有80.5万人罹患心臟病。

全球低压MLCC市场趋势

小型化趋势推动对 0 1005 MLCC 的需求

- 0 1005 MLCC 的前置作业时间资料突显了分析期间对这些组件的稳定和持续的需求。前置作业时间变化保持在 15 至 18 週的相对较窄范围内,显示 0 1005 MLCC 的供应和交货稳定。前置作业时间的稳定性表明供应商正在有效地管理需求,确保依赖这些零件的製造商的供应链顺畅。

- 0 1005 MLCC 具有广泛的应用,尤其是在智慧型手机、穿戴式装置和物联网装置等小型电子设备。小外形规格和高电容使其成为空间受限设计的理想选择。对此类 MLCC 的需求受到持续的小型化趋势和更高元件密度需求的推动。 0 1005 MLCC在各行业都有广泛的应用。在消费性电子领域,这些 MLCC 是智慧型手机、穿戴式装置和物联网设备生产中必不可少的元件,使製造商能够在不影响效能的情况下创造出时尚、紧凑的设计。在汽车产业,0 1005 MLCC 广泛应用于 ADAS(高级驾驶辅助系统)、资讯娱乐系统和引擎控制单元(ECU),有助于提高车辆的整体功能和连接性。总体而言,0 1005 MLCC 在各个行业的广泛使用证实了它们在为各种电子设备和系统供电和提供支援方面的重要性。

- 0 1005 MLCC 的稳定前置作业时间有助于供应商满足依赖这些组件的电子设备的需求并确保连续的生产流程。这有助于防止生产和交付延迟。

全球经济不确定性和供应链中断正在压低铜价。

- 铜是製造高容量MLCC的必需原料,也是最重要的原料。它以矿石形式开采并转化为奈米级薄片和粉末,最终用于 MLCC 的製造过程,特别是与镍电极结合时用作端接材料。

- 铜需求严重依赖中国,中国占全球消费量的近50%。因此,铜价的波动在很大程度上取决于多种因素,包括疫情的影响以及对全球经济可能崩坏的担忧。欧洲买家不愿购买俄罗斯产品,以及智利和秘鲁的矿场供应面临挑战,导致 2020 年出现铜供不应求。

- 铜市场依然动盪,受到多种因素的影响,包括疫情的影响、全球经济不确定性和供应链中断。儘管面临这些严峻挑战,但近期采矿业的放鬆管制已导致铜产量过剩。结果,这种过剩大大提振了铜价,铜价出现了明显上涨。

低压MLCC产业概况

低压MLCC市场适度整合,前五大企业占62.07%。市场的主要企业有:村田製作所、三星电机、太阳诱电、TDK株式会社和国巨株式会社。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 价格趋势

- 铜价走势

- 镍价趋势

- 油价趋势

- 钯金价格趋势

- 白银价格趋势

- 锌价趋势

- MLCC前置作业时间

- 01005 MLCC

- 0201 MLCC

- 0201/0402 MLCC-HI CV

- 0402 MLCC

- 0603 MLCC

- 0603 MLCC-高CV

- 0603 MLCC-高压

- 0805 MLCC

- 0805 MLCC-高CV

- 0805 MLCC-高压

- 1206 MLCC

- 1206 MLCC-高压

- 1206 MLCC-高压

- 1210~1825-高真空

- 1210~1825 MLCC

- 1210+MLCC-高压

- 2220+MLCC

- 2220+MLCC-高压

- 汽车销售

- 全球BEV(纯电动车)产量

- 全球电动车销量

- 全球FCEV(燃料电池电动车)产量

- 全球HEV(混合动力电动车)产量

- 全球重型商用车销售

- 全球ICEV(内燃机汽车)产量

- 全球轻型商用车销售

- 全球非电动车销量

- 全球插电式混合动力汽车(PHEV)产量

- 全球乘用车销量

- 全球摩托车销售

- 家电销量

- 空调销售

- 桌上型电脑销量

- 游戏机销售

- HDD 和 SSD 销售

- 笔记型电脑销售

- 印表机销售

- 冰箱销售

- 智慧型手机销量

- 智慧型手錶

- 平板电脑销量

- 电视销售

- 电动汽车销售

- 全球BEV(纯电动车)产量

- 全球FCEV(燃料电池电动车)产量

- 全球HEV(混合动力电动车)产量

- 全球ICEV(内燃机汽车)产量

- 全球插电式混合动力汽车(PHEV)产量

- 其他的

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 介电类型

- 1级

- 2级

- 錶壳尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他的

- 电容

- 高频电容

- 低频电容

- 中檔电容

- Mlcc安装类型

- 金属盖

- 径向引线

- 表面黏着技术

- 最终用户

- 航太和国防

- 车

- 家用电子电器

- 工业设备

- 医疗设备

- 电力和公共产业

- 通讯设备

- 其他的

- 地区

- 亚太地区

- 欧洲

- 北美洲

- 世界其他地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001988

The Low Voltage MLCC Market size is estimated at 13.67 billion USD in 2024, and is expected to reach 36.25 billion USD by 2029, growing at a CAGR of 21.54% during the forecast period (2024-2029).

The demand for MLCCs is driven by the growing prevalence of chronic diseases and the growing popularity of compact and high-end 5G smartphones

- 0 201 case size emerged as the frontrunner, capturing the largest market share of 29.78%, followed by 0 402 with 28.21% and 0603 with 15.67% in terms of volume in 2022.

- The case size of 0201 is among the most compact available, thus increasing the component density of the circuit board. These MLCCs are widely used in consumer electronics, telecom, and medical devices. The 0201 MLCCs of COG dielectric with low voltages of less than 500 volts are being used in medical devices. For instance, in Asia-Pacific countries like China, cardiovascular disease (CVD) poses a significant healthcare burden, with increasing prevalence and incidence rates. In 2022, the rates of CVD and associated mortality were 8.35 and 5.33 per 1,000 person-years, respectively. Notably, mortality rates were higher in the central and western regions compared to the eastern region. The demand for 0201 MLCCs is increasing as they play a crucial role in cardiovascular pacemakers, serving as energy storage capacitors.

- In European countries like Germany, the demand for smartphones experienced significant growth in 2021, with sales volume reaching 22.2 million units, a notable increase from the previous year's 20 million units. The increasing demand for compact and feature-rich smartphones has led to a critical need for miniaturized components like the 0402 MLCCs. The 0402-surface mount MLCCs play a crucial role in enabling the integration of multiple functionalities within a limited space, facilitating the development of smaller and sleeker smartphones.

The highly developing telecom sector and large customer base are expected to surge the demand for MLCCs in Asia-Pacific

- Asia-Pacific emerged as the frontrunner, capturing the largest market share of 43.00%, followed by North America with 23.57% and Europe with 22.80% in terms of volume in 2022.

- Asia-Pacific holds a significant share in manufacturing IT devices like laptops, desktop computers, and mobile phones. On the back of its excellent technological presence, China has a significant share of manufacturing and exporting IT devices to the rest of the world. It continues to be the major provider of desktop computers in Asia-Pacific in terms of volume. As a result, the demand for surface-mount MLCCs is expected to increase during the forecast period.

- Due to their portability or implantation requirements, medical devices often have strict size limitations. MLCCs offer a combination of small size, high capacitance, reliability, and performance characteristics that make them well-suited for use in various medical devices, ranging from portable diagnostic equipment to implantable devices like pacemakers. North America is expected to dominate the medical devices market over the forecast period owing to factors such as the growing burden of chronic diseases, high healthcare expenditures, and the presence of key players. The growing number of people suffering from cardiovascular diseases is the key factor driving the demand for medical devices. For instance, as per the 2021 data published by the CDC, it was observed that every year, 805,000 people in the United States suffer from heart attacks. For instance, as per data published by the CDC in 2021, every year, 805,000 people in the United States suffer from heart attacks.

Global Low Voltage MLCC Market Trends

The ongoing trend of miniaturization is propelling the demand for 0 1005 MLCCs

- The lead time data for 0 1005 MLCCs highlights a stable and consistent demand for these components over the analyzed period. The lead time variations within a relatively narrow range of 15-18 weeks suggest a consistent availability and delivery of 0 1005 MLCCs. This stability in lead times indicates that suppliers have effectively managed the demand, ensuring a smooth supply chain for manufacturers relying on these components.

- The usage of 0 1005 MLCCs spans diverse applications, particularly in compact electronic devices such as smartphones, wearables, and IoT devices. Their small form factor and high capacitance make them ideal for space-constrained designs. The demand for these MLCCs is driven by the ongoing trend of miniaturization and the need for higher component density. The usage of 0 1005 MLCCs extends to a wide range of applications in various industries. In the consumer electronics sector, these MLCCs are vital components in the production of smartphones, wearables, and IoT devices, enabling manufacturers to achieve sleek and compact designs without compromising performance. The automotive industry heavily relies on 0 1005 MLCCs for advanced driver assistance systems (ADAS), infotainment systems, and engine control units (ECUs), contributing to the overall functionality and connectivity of vehicles. Overall, the widespread usage of 0 1005 MLCCs across multiple industries underscores their significance in powering and enabling various electronic devices and systems.

- The stability in lead times for 0 1005 MLCCs helps suppliers meet the demands and ensure a continuous flow of production for electronic devices that rely on these components. This, in turn, prevents potential delays in manufacturing and delivery timelines.

Uncertainties in the global economy and disruptions within the supply chain are impeding the copper prices

- Copper, a raw material essential for the production of high-capacitance MLCCs, holds paramount importance. Mined in the form of ore, it transforms into nano-scale flakes or powder, ultimately finding application as a termination material in the manufacturing process of MLCCs, particularly when combined with nickel electrodes.

- The demand for copper is heavily driven by China, which accounts for nearly 50% of global consumption. Consequently, fluctuations in copper prices are profoundly influenced by various factors, including the repercussions of the pandemic and apprehensions surrounding a potential global economic collapse. European buyers' reluctance to engage with Russian products and the challenges faced in the mining supply from Chile and Peru contributed to a shortage in copper supplies in 2020.

- The copper market remained susceptible to volatility, primarily influenced by a multitude of factors, such as the far-reaching impact of the COVID-19 pandemic, uncertainties prevailing in the global economy, and disruptions within the supply chain. Despite these formidable challenges, recent governmental relaxations about regulations within the mining sector have led to a surplus in copper production. Consequently, this surplus has significantly driven up copper prices, demonstrating a noteworthy increase in value.

Low Voltage MLCC Industry Overview

The Low Voltage MLCC Market is moderately consolidated, with the top five companies occupying 62.07%. The major players in this market are Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd, TDK Corporation and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Price Trend

- 4.1.1 Copper Price Trend

- 4.1.2 Nickel Price Trend

- 4.1.3 Oil Price Trend

- 4.1.4 Palladium Price Trend

- 4.1.5 Silver Price Trend

- 4.1.6 Zinc Price Trend

- 4.2 Mlcc Lead Times

- 4.2.1 01005 MLCC

- 4.2.2 0201 MLCC

- 4.2.3 0201/0402 MLCC-HI CV

- 4.2.4 0402 MLCC

- 4.2.5 0603 MLCC

- 4.2.6 0603 MLCC - HI CV

- 4.2.7 0603 MLCC - HI VOLT

- 4.2.8 0805 MLCC

- 4.2.9 0805 MLCC - HI CV

- 4.2.10 0805 MLCC - HI VOLT

- 4.2.11 1206 MLCC

- 4.2.12 1206 MLCC - HI CV

- 4.2.13 1206 MLCC - HI VOLT

- 4.2.14 1210 TO 1825 - HI CV

- 4.2.15 1210 TO 1825 MLCC

- 4.2.16 1210+ MLCC - HI VOLT

- 4.2.17 2220+ MLCC

- 4.2.18 2220+ MLCC - HI CV

- 4.3 Automotive Sales

- 4.3.1 Global BEV (Battery Electric Vehicle) Production

- 4.3.2 Global Electric Vehicles Sales

- 4.3.3 Global FCEV (Fuel Cell Electric Vehicle) Production

- 4.3.4 Global HEV (Hybrid Electric Vehicle) Production

- 4.3.5 Global Heavy Commercial Vehicles Sales

- 4.3.6 Global ICEV (Internal Combustion Engine Vehicle) Production

- 4.3.7 Global Light Commercial Vehicles Sales

- 4.3.8 Global Non-Electric Vehicle Sales

- 4.3.9 Global PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.3.10 Global Passenger Vehicles Sales

- 4.3.11 Global Two-Wheeler Sales

- 4.4 Consumer Electronics Sales

- 4.4.1 Air Conditioner Sales

- 4.4.2 Desktop PC's Sales

- 4.4.3 Gaming Console Sales

- 4.4.4 HDDs and SSDs Sales

- 4.4.5 Laptops Sales

- 4.4.6 Printers Sales

- 4.4.7 Refrigerator Sales

- 4.4.8 Smartphones Sales

- 4.4.9 Smartwatches Sales

- 4.4.10 Tablets Sales

- 4.4.11 Television Sales

- 4.5 Ev Sales

- 4.5.1 Global BEV (Battery Electric Vehicle) Production

- 4.5.2 Global FCEV (Fuel Cell Electric Vehicle) Production

- 4.5.3 Global HEV (Hybrid Electric Vehicle) Production

- 4.5.4 Global ICEV (Internal Combustion Engine Vehicle) Production

- 4.5.5 Global PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.5.6 Others

- 4.6 Regulatory Framework

- 4.7 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Dielectric Type

- 5.1.1 Class 1

- 5.1.2 Class 2

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Capacitance

- 5.3.1 High-Range Capacitance

- 5.3.2 Low-Range Capacitance

- 5.3.3 Mid-Range Capacitance

- 5.4 Mlcc Mounting Type

- 5.4.1 Metal Cap

- 5.4.2 Radial Lead

- 5.4.3 Surface Mount

- 5.5 End User

- 5.5.1 Aerospace and Defence

- 5.5.2 Automotive

- 5.5.3 Consumer Electronics

- 5.5.4 Industrial

- 5.5.5 Medical Devices

- 5.5.6 Power and Utilities

- 5.5.7 Telecommunication

- 5.5.8 Others

- 5.6 Region

- 5.6.1 Asia-Pacific

- 5.6.2 Europe

- 5.6.3 North America

- 5.6.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219