|

市场调查报告书

商品编码

1431460

商业建筑机器人:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Robots for Commercial Buildings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

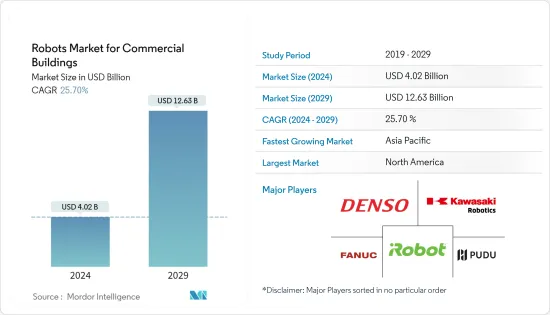

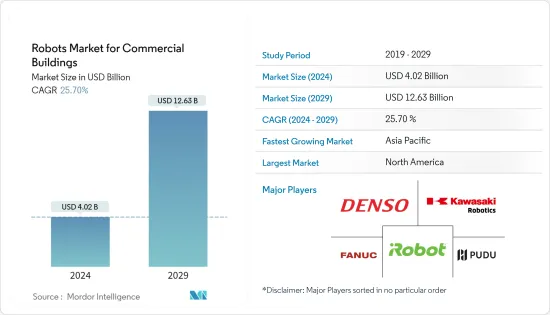

商业建筑机器人市场预计将从2024年的40.2亿美元成长到2029年的126.3亿美元,预测期间(2024-2029年)复合年增长率为25.70%。

主要亮点

- 技术发展的加速和劳动力短缺的加剧正促使设施管理公司转向自动化工具,以实现更高水准的清洁度、服务和技术力。

- 自动化和人工智慧技术正在改变许多行业,从医疗保健到银行再到零售,虽然商业建筑不是早期采用者,但它们是另一个开始受益于先进技术以提高效率的行业。这绝对是一个行业。

- 商用机器人广泛用于扫地、拖地、吸尘等清洁任务。这些机器人可以透过编程在特定时间清洁特定区域,从而降低人事费用并提高效率。

- 服务器机器人因其提高的效率、非接触式服务、增加的容量和成本效益而在餐厅中越来越受欢迎。这些机器人可以同时提供多种菜餚和饮料,有助于加快服务速度并减少顾客等待时间。

- 因此,各供应商定期进行技术进步并专注于策略投资,以扩大产品阵容并满足不同的客户需求。例如,2023 年 2 月,Kum &Go 宣布与 ICE Cobotics 合作,推出自动地板清洁机器人。透过整合无人商店,该品牌可以将员工从重复性任务中解放出来,专注于为货架和冷藏柜备货、提供生鲜食品以及提高店内顾客参与度。

商业建筑机器人市场趋势

扫地机器人可望占据较大份额

- 地板清洁机器人是一种自主设备,旨在无需人工干预即可清洁地板。这些机器人使用各种技术,包括感测器、地图演算法和摄影机,来导航房间和清洁地板。这些机器人通常具有刷子和吸力来清洁地板上的污垢和碎片。

- 商务用地板清洁机器人可以将清洁人员解放出来,让他们从事其他无法自动化的任务,让清洁人员有更多的时间专注于只有人类才能完成的任务,从而帮助最大限度地提高员工的生产力和效率。我可以。

- 此外,推动机器人地板清洁需求的主要因素是其便利性。随着忙碌的生活方式,人们正在寻找简单有效的方式来维护自己的房屋,而机器人地板清洁机需要更少的人手并提供无忧的清洁体验。

- 地面清洁机器人广泛应用于机场,清洁航站入口、安检口、行李提取区等人流量大的区域。这些区域积聚了大量污垢,机器人可以有效清除这些污垢。

- 由于这些原因,各机场越来越多地引入地板清洁机器人。例如,2022 年 12 月,夏威夷运输部机场部门对 Daniel K. Inouye 国际机场进行了现代化改造,安装了两台自动地板清洁机来补充清洁服务。丹尼尔井上国际机场平均每天接待 73,000 名旅客。如此大量的日常用户创造了对自主清洁机器人的需求。

北美占据主要市场占有率

- 北美是全球最大、最先进的机器人解决方案市场之一。强劲的经济、显着的机场客流量、零售和医院清洁机器人的使用增加以及餐旅服务业服务机器人的使用都将推动该国对商用机器人的需求。

- 许多家庭和企业正在投资这些技术,以使服务、清洁和消毒任务更有效率、更省时。

- 清洁机器人透过减少接触有害清洁化学物质和过敏原来帮助改善健康和安全。保持地板和表面清洁干燥还可以降低滑倒、绊倒和跌倒的风险。

- 根据美国美国职业安全与健康研究所的数据,职场化学品暴露是美国最严重的问题之一。美国有超过 1300 万工人可能透过皮肤接触化学物质。皮肤病是最常见的职业病之一,在美国每年造成的损失估计超过 10 亿美元。

- 基于这些原因,在该地区营运的各种供应商都致力于开发创新解决方案。例如,2022 年 9 月,iRobot Corporation 发布了一款二合一机器人吸尘器、Roomba Combo j7+ 和拖把,配备了 iRobot OS 5.0 更新。 Roomba Combo J7+ 首先清洁地毯,然后同时吸尘和拖地硬地板,一次清洁该区域,从而节省用户时间。

商业楼宇机器人产业概况

商业建筑机器人市场高度分散,由许多相互竞争的公司组成。从市场占有率来看,目前由几家大公司占据市场主导地位,包括 iRobot Corporation、Omron Adept Technologies Inc. 和 Pudu Robotics。这些拥有重要市场份额的领先公司正在扩大其在全部区域的基本客群。许多公司正在与各种新兴企业进行策略合作计划,以提高市场占有率和盈利。

2023年2月,中国领先的餐饮服务机器人製造商普渡机器人完成C轮资金筹措,融资超过1,500万美元。公司将利用这笔资金建造生产基地,扩大产能,开发适用于商务用清洁场景的产品。

2022年10月,领先的清洁机器人公司科沃斯发表了两款新型智慧机器人。除了该公司在全球的机器人清洁产品阵容,包括 DEEBOT(家用地板清洁器)、WINBOT(窗户和表面清洁器)和 AIRBOT(空气净化机器人)之外,科沃斯还在扩大其机器人清洁类别。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 政府加大对机器人调查的力度

- 租赁、RaaS(机器人即服务)等多样化经营模式

- 市场限制因素

- 产品成本高

- 缺乏客户意识

第六章市场区隔

- 机器人类型

- 地板清洁机器人

- 消毒机器人

- 零售货架管理机器人

- 服务机器人

- 楼宇服务机器人

- 按最终用户产业

- 零售

- 餐厅

- 医疗机构

- 飞机场

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- iRobot Corporation

- Pudu Robotics

- Denso Corporation

- Fanuc Corporation

- Kawasaki Robotics GmbH

- Kuka AG

- Mitsubishi Electric Corporation

- SoftBank Robotics Corp

- Ecovacs Robotics

- ABB Ltd.

- Nachi Fujikoshi Corporation

- Diversey

- Yaskawa Electric Corporation

- Samsung Electronics Co Ltd.

- Vorwerk & Co. KG

第八章投资分析

第九章 市场未来展望

The Robots Market for Commercial Buildings Industry is expected to grow from USD 4.02 billion in 2024 to USD 12.63 billion by 2029, at a CAGR of 25.70% during the forecast period (2024-2029).

Key Highlights

- The increasing technological developments and the ongoing labor shortage encourage facility management companies to switch to automated tools for higher cleanliness, service, and technological capabilities.

- Automation and AI technology have transformed many industries, from healthcare to banking to retail, and while commercial buildings were not early adopters, they are definitely another industry beginning to benefit from advanced technology for improving efficiency.

- Commercial robots are widely used for cleaning tasks such as sweeping, mopping, and vacuuming. These robots can be programmed to clean specific areas at specific times, reducing labor costs and improving efficiency.

- Serving robots are also becoming increasingly popular in restaurants, as they provide improved efficiency, contactless service, increased capacity, and are cost-effective. These robots can carry multiple dishes or drinks at once, which helps speed up service and reduce wait times for customers.

- Due to such reasons, various vendors regularly make technological advancements and focus on strategic investments to expand their product offerings and cater to varying customer needs. For instance, in February 2023, Kum & Go announced a partnership with ICE Cobotics to deploy automated floor-cleaning robots. By integrating the autonomous equipment, the brand will help free up associates from repetitive work and allow them to focus on keeping shelves and coolers fully stocked, delivering fresh food offerings, and increasing engagement with in-store customers.

Commercial Buildings Robots Market Trends

Floor Cleaning Robots Expected to Have a Major Share

- Floor-cleaning robots are autonomous devices designed to clean floors without human intervention. These robots use various technologies, such as sensors, mapping algorithms, and cameras, to navigate around the room and clean floors. These robots typically have brushes and vacuum suction to clean dirt and debris from floors.

- Commercial floor cleaning robots free up cleaning staff for other tasks that can't be automated and help to maximize employees' productivity and efficiency so that the cleaning staff has more time to focus on the tasks that only humans can do.

- Moreover, the primary factor driving the demand for robot floor cleaning is its convenience. With busy lifestyles, people are looking for easy and efficient ways to maintain their homes, and robot floor cleaners offer a hassle-free cleaning experience without requiring much human intervention.

- Floor-cleaning robots are widely used in airports to clean high-traffic areas, such as terminal entrances, security checkpoints, and baggage claim areas. These areas accumulate a lot of dirt, which these robots can efficiently remove.

- Due to such reasons, various airports are deploying floor-cleaning robots. For instance, in December 2022, the Hawaii Department of Transportation's Airports Division modernized the Daniel K. Inouye International Airport with two automatic floor cleaners to supplement janitorial services. An average of 73,000 arrivals walk through the Daniel K. Inouye International Airport daily. Such a high daily footfall creates a need for autonomous cleaning robots.

North America to Account for Major Market Share

- North America is one of the largest and most advanced markets for robotic solutions in the world. The strong economy, with notable airport traffic, increased use of cleaning robots in retail and hospitals, and the use of servicing robots in the hospitality sector, is poised to drive the demand for commercial robots in the country.

- Robots in commercial buildings are becoming increasingly popular in the region, as many households and businesses are investing in these technologies to make serving, cleaning, and disinfecting tasks more efficient and less time-consuming.

- Cleaning robots help improve health and safety by reducing exposure to harmful cleaning chemicals and allergens. They also reduce the risk of slips, trips, and falls by keeping floors and surfaces clean and dry.

- According to the National Institute for Occupational Safety and Health, chemical exposure in the workplace is one of the most significant problems in the United States. Over 13 million workers in the country are potentially exposed to chemicals through their skin. Skin disorders are among the most significantly reported occupational diseases, resulting in an estimated annual cost of over USD 1 billion in the United States.

- Due to such reasons, various vendors operating in the region are focusing on developing innovative solutions. For instance, in September 2022, iRobot Corporation introduced a Roomba Combo j7+, a 2-in-1 robot vacuum, and a mop with iRobot OS 5.0 updates. The Roomba Combo j7+ vacuums rugs and carpets first and then vacuums and mops hard floors concurrently, saving users time by cleaning the area in a single job.

Commercial Buildings Robots Industry Overview

The robots market for commercial buildings is highly fragmented and consists of many competitive players. In terms of market share, a few major players, such as iRobot Corporation, Omron Adept Technologies Inc., and Pudu Robotics, currently dominate the market. These major players with a significant share of the market are expanding their customer base across the region. Many companies are forming strategic and collaborative initiatives with various start-ups to increase their market share and profitability.

In February 2023, Pudu Robotics, a leading restaurant service robotics manufacturer based in China, completed its Series C funding round to raise more than USD 15 million. The company will use the funds to build a production base, expand production capacity, and develop products for commercial cleaning scenarios.

In October 2022, ECOVACS, one of the leading cleaning robotics companies, announced the launch of two new smart robots. Adding to its global lineup of robotic cleaning products, including DEEBOT robotic home floor cleaners, WINBOT window and surface cleaners, and AIRBOT air purifying robots, the additions expand the robotic cleaning category with ECOVACS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Government Initiatives for Robot Research

- 5.1.2 Various Business Models, Such As Leasing and Robot-as-a-Service

- 5.2 Market Restraints

- 5.2.1 High Product Cost

- 5.2.2 Lack of Customer Awareness

6 MARKET SEGMENTATION

- 6.1 Type of Robots

- 6.1.1 Floor Cleaning Robots

- 6.1.2 Disinfection Robots

- 6.1.3 Retail Shelf Management Robots

- 6.1.4 Serving Robots

- 6.1.5 Building Service Robots

- 6.2 End-user Verticals

- 6.2.1 Retail

- 6.2.2 Restaurants

- 6.2.3 Healthcare Facilities

- 6.2.4 Airports

- 6.2.5 Other End-user Verticals

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 iRobot Corporation

- 7.1.2 Pudu Robotics

- 7.1.3 Denso Corporation

- 7.1.4 Fanuc Corporation

- 7.1.5 Kawasaki Robotics GmbH

- 7.1.6 Kuka AG

- 7.1.7 Mitsubishi Electric Corporation

- 7.1.8 SoftBank Robotics Corp

- 7.1.9 Ecovacs Robotics

- 7.1.10 ABB Ltd.

- 7.1.11 Nachi Fujikoshi Corporation

- 7.1.12 Diversey

- 7.1.13 Yaskawa Electric Corporation

- 7.1.14 Samsung Electronics Co Ltd.

- 7.1.15 Vorwerk & Co. KG