|

市场调查报告书

商品编码

1431529

聚酰胺 (PA) 6:市场占有率分析、产业趋势与统计、成长预测(2024-2029 年)Polyamide (PA) 6 - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

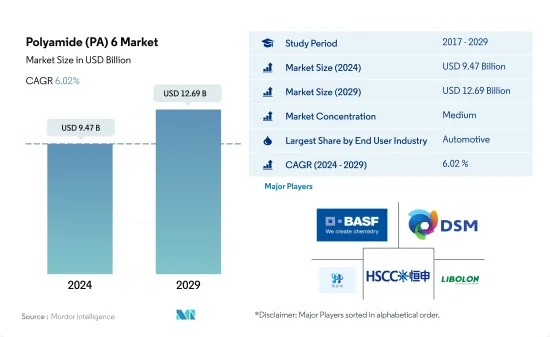

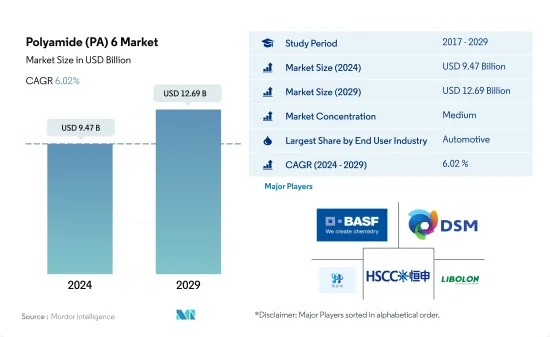

聚酰胺6市场规模预计到2024年为94.7亿美元,预计到2029年将达到126.9亿美元,在预测期内(2024-2029年)复合年增长率为6.03%。

航太领域推动市场成长

- 聚酰胺 6(尼龙)树脂因其韧性和耐磨性而在几乎每个产业都有多种用途。尼龙 6 用于韧性、润滑性和耐磨性很重要的应用。至2022年,全球聚酰胺(PA)6市场将占聚酰胺总消费量的50%。

- 聚酰胺 6 广泛应用于汽车产业的各种应用。进气歧管阀门和引擎盖是 PA 6 的常见应用。汽车中高强度、轻质复合材料的不断增长趋势正在推动对 PA 6 的需求。 2022年全球汽车产量为1.43亿辆。预计 2023 年至 2029 年基于销售量的复合年增长率为 3.16%。

- 电气和电子产业是聚酰胺6的第二大消费者。电气和电子产业的收益在2022年达到高峰5,800亿美元,2023年至2029年的复合年增长率为6.61%。例如,全球消费性电子产品销售额预计将从 2023 年的 6,660 亿美元增至 2027 年的 10,710 亿美元。

- 航太是全球聚酰胺 6 成长最快的最终用户产业,预计在预测期(2023-2029 年)以金额为准年增长率最高,达 7.48%。全球航太零件产量的增加预计将推动未来几年对聚酰胺 6 的需求。例如,全球航太零件生产收益预计将从2023年的5,055亿美元增加到2029年的7,235亿美元。

亚太地区在预测期内将继续占据主导地位

- 聚酰胺 6 具有多种特性,例如耐高温和耐腐蚀性环境,使其适用于航太、汽车和电气/电子产业。

- 2022 年,亚太地区在 PA 6消费量方面占据最大市场占有率。预计 2022 年中国和日本的聚酰胺 6消费量将分别占 61% 和 11%,预测期内以金额为准年增长率为 6.81%。中国汽车工业是聚酰胺6的主要消费领域,2022年将占全国聚酰胺6总消费量的32%。由于国内需求激增和外国投资下降,特别是电动车市场,中国汽车工业可能会继续增长,从而导致对聚酰胺6的需求增加。例如,中国汽车产量预计到2029年将达到6,400万辆,而2022年为4,600万辆。

- 中东是聚酰胺 6 快速成长的消费地区,预计在预测期内以金额为准复合年增长率为 7.18%。这是由于电气和电子行业、包装和航太行业的成长,预计这些行业的复合年增长率分别为 8.88%、7.16% 和 8.08%。中东各国政府正在应用数位转型来实现国家转型目标,加大对电气电子产业的投资,电气电子生产收入大幅增加。各国政府不断增加对航太和国防的投资,以促进该地区的零件製造。

全球聚酰胺(PA)6大市场趋势

电子产业的技术进步可以推动成长

- 电子产品技术创新的快速发展推动了对新型、更快的电气和电子产品的持续需求。 2022年,全球电气电子产品销售额将为58,070亿美元,其中亚太地区占74%的市场占有率,其次是欧洲,占13%的份额。预计全球电气和电子设备市场在预测期内的复合年增长率为 6.71%。

- 2018年,亚太地区经济成长强劲,中国、韩国、日本、印度、东南亚国协工业化快速发展。 2020年,受疫情影响,全球电子电气设备生产因晶片短缺和供应链效率低而放缓,销售成长与前一年同期比较停滞0.1%。这一增长是由对远端工作和家庭娱乐家用电器的需求推动的,因为人们在大流行期间被迫留在室内。

- 在预测期内,对数位化、机器人、虚拟实境、扩增实境、物联网 (IoT) 和 5G 连接等先进技术的需求预计将成长。预计2027年全球电气和电子设备产量将成长5.9%。由于技术进步,消费性电子产品的需求预计在预测期内将会增加。例如,预计2027年全球消费性电子产业收益将达到约9,046亿美元,而2023年为7,191亿美元。因此,预计技术发展将在预测期内引领电气和电子产品的需求。

聚酰胺 (PA) 6 产业概览

聚酰胺(PA)6市场适度整合,前5家企业占比49.52%。该市场的主要企业包括(按字母顺序排列)BASF股份公司、帝斯曼、杭州聚和顺新材料、海印控股集团和力宝龙。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章执行摘要和主要发现

第二章 报告条款

第三章简介

- 研究假设和市场定义

- 调查范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑/施工

- 电力/电子

- 包装

- 法律规范

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 中国

- EU

- 印度

- 日本

- 马来西亚

- 墨西哥

- 奈及利亚

- 俄罗斯

- 沙乌地阿拉伯

- 南非

- 韩国

- 阿拉伯聯合大公国

- 英国

- 美国

- 价值炼和通路分析

第五章市场区隔(包括市场规模、2029年预测、成长前景分析)

- 最终用户产业

- 航太

- 车

- 建筑/施工

- 电力/电子

- 工业/机械

- 包装

- 其他最终用户产业

- 地区

- 非洲

- 按国家/地区

- 奈及利亚

- 南非

- 其他非洲

- 亚太地区

- 按国家/地区

- 澳洲

- 中国

- 印度

- 日本

- 马来西亚

- 韩国

- 其他亚太地区

- 欧洲

- 按国家/地区

- 法国

- 德国

- 义大利

- 俄罗斯

- 英国

- 其他欧洲国家

- 中东

- 按国家/地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 北美洲

- 按国家/地区

- 加拿大

- 墨西哥

- 美国

- 南美洲

- 按国家/地区

- 阿根廷

- 巴西

- 南美洲其他地区

- 非洲

第六章 竞争形势

- 主要策略趋势

- 市场占有率分析

- 公司形势

- 公司概况(包括全球概况、市场层级、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、近期发展分析)。

- BASF SE

- Domo Chemicals

- DSM

- Guangdong Xinhui Meida Nylon Co.,Ltd

- Hangzhou Juheshun New Materials Co., Ltd.

- Highsun Holding Group

- KuibyshevAzot

- LANXESS

- LIBOLON

- UBE Corporation

第七章 CEO 面临的关键策略问题

第8章附录

- 世界概况

- 概述

- 五力分析框架(产业吸引力分析)

- 世界价值链分析

- 市场动态(DRO)

- 资讯来源和参考文献

- 图表列表

- 重要见解

- 资料包

- 词彙表

简介目录

Product Code: 5000192

The Polyamide 6 Market size is estimated at USD 9.47 billion in 2024, and is expected to reach USD 12.69 billion by 2029, growing at a CAGR of 6.03% during the forecast period (2024-2029).

Aerospace sector to lead the market's growth

- Polyamide 6 (nylon) resins have many applications in almost every industry due to their toughness and abrasion resistance. Nylon 6 is used in applications where toughness, lubricity, and wear are important. The global polyamide (PA) 6 market accounted for 50% of the overall polyamide consumption by revenue in 2022.

- Polyamide 6 is widely used in the automotive industry for a variety of applications. Air intake manifold valves and engine covers are frequent applications of PA 6. The rising trend of high-strength and lightweight composites in automotive is driving the demand for PA 6. Global vehicle production was at 143 million units in 2022. It is expected to record a CAGR of 3.16% by volume between 2023 and 2029.

- The electrical and electronics industry is the second-largest consumer of polyamide 6. The revenue from electrical and electronics production peaked in 2022 at USD 580 billion, recording a CAGR of 6.61% between 2023 and 2029 due to an increase in the demand for consumer electronics with increasing technological innovations across different regions. For instance, consumer electronics worldwide are projected to reach a revenue of USD 1071.0 billion by 2027 from USD 666.0 billion in 2023.

- Aerospace is expected to be the fastest-growing end-user industry for polyamide 6 at the global level, with the highest CAGR of 7.48% in terms of value during the forecast period (2023-2029). The rising aerospace components production across the world is expected to drive the demand for polyamide 6 in the coming years. For instance, the aerospace components production revenue at the global level is projected to reach USD 723.5 billion by 2029 from USD 505.5 billion in 2023.

Asia-Pacific to remain dominant during the forecast period

- Polyamide 6 exhibits versatile properties like resistance to high temperatures and corrosive environments, making it suitable for the aerospace, automotive, and electrical and electronics industries.

- Asia-Pacific held the largest market share in terms of PA 6 consumption in 2022. It is projected to register a CAGR of 6.81% in terms of value during the forecast period, attributed to countries like China and Japan, which accounted for 61% and 11%, respectively, of the region's overall polyamide 6 consumption in 2022. China's automotive industry is the major consumer of polyamide 6, accounting for 32% of the country's overall polyamide 6 consumption in 2022. Owing to a surge in local demand and reduced foreign investments, particularly in the EV market, the Chinese automotive industry may continue to grow, thus increasing the demand for polyamide 6. For instance, China's vehicle production is expected to reach 64 million units by 2029 compared to 46 million units in 2022.

- Middle East is the fastest-growing consumer of PA 6. It is likely to record a CAGR of 7.18% in terms of value during the forecast period, attributed to growing electrical and electronics industry, packaging and aerospace industry, which is expected to grow at a CAGR of 8.88%, 7.16% and 8.08% respectively. The governments in the Middle East are applying digital transformation to achieve the national transformation goals, it has increased investments in electrical and electronics segment and there has been a significant increase in the electrical and electronics production revenue. The governments have been consistently increasing their aerospace and defense investment to boost the component manufacturing in the region.

Global Polyamide (PA) 6 Market Trends

Technological advancements in electronics industry may foster the growth

- The rapid pace of technological innovation in electronic products is driving the consistent demand for new and fast electrical and electronic products. In 2022, the global revenue of electrical and electronics stood at USD 5,807 billion, with Asia-Pacific holding a 74% market share, followed by Europe with a 13% share. The global electrical and electronics market is expected to record a CAGR of 6.71% during the forecast period.

- In 2018, the Asia-Pacific region witnessed strong economic growth owing to rapid industrialization in China, South Korea, Japan, India, and ASEAN countries. In 2020, due to the pandemic, there was a slowdown in global electrical and electronics production due to the shortage of chips and inefficiencies in the supply chain, which led to a stagnant growth rate of 0.1% in revenue compared to the previous year. This growth was driven by the demand for consumer electronics for remote working and home entertainment as people were forced to remain indoors during the pandemic.

- The demand for advanced technologies, such as digitalization, robotics, virtual reality, augmented reality, IoT (Internet of Things), and 5G connectivity, is expected to grow during the forecast period. Global electrical and electronics production is expected to register a growth rate of 5.9% in 2027. As a result of technological advancements, the demand for consumer electronics is expected to rise during the forecast period. For instance, the global consumer electronics industry is projected to witness a revenue reach of around USD 904.6 billion in 2027, compared to USD 719.1 billion in 2023. As a result, technological development is projected to lead the demand for electrical and electronic products during the forecast period.

Polyamide (PA) 6 Industry Overview

The Polyamide (PA) 6 Market is moderately consolidated, with the top five companies occupying 49.52%. The major players in this market are BASF SE, DSM, Hangzhou Juheshun New Materials Co., Ltd., Highsun Holding Group and LIBOLON (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Regulatory Framework

- 4.2.1 Argentina

- 4.2.2 Australia

- 4.2.3 Brazil

- 4.2.4 Canada

- 4.2.5 China

- 4.2.6 EU

- 4.2.7 India

- 4.2.8 Japan

- 4.2.9 Malaysia

- 4.2.10 Mexico

- 4.2.11 Nigeria

- 4.2.12 Russia

- 4.2.13 Saudi Arabia

- 4.2.14 South Africa

- 4.2.15 South Korea

- 4.2.16 United Arab Emirates

- 4.2.17 United Kingdom

- 4.2.18 United States

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Region

- 5.2.1 Africa

- 5.2.1.1 By Country

- 5.2.1.1.1 Nigeria

- 5.2.1.1.2 South Africa

- 5.2.1.1.3 Rest of Africa

- 5.2.2 Asia-Pacific

- 5.2.2.1 By Country

- 5.2.2.1.1 Australia

- 5.2.2.1.2 China

- 5.2.2.1.3 India

- 5.2.2.1.4 Japan

- 5.2.2.1.5 Malaysia

- 5.2.2.1.6 South Korea

- 5.2.2.1.7 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 By Country

- 5.2.3.1.1 France

- 5.2.3.1.2 Germany

- 5.2.3.1.3 Italy

- 5.2.3.1.4 Russia

- 5.2.3.1.5 United Kingdom

- 5.2.3.1.6 Rest of Europe

- 5.2.4 Middle East

- 5.2.4.1 By Country

- 5.2.4.1.1 Saudi Arabia

- 5.2.4.1.2 United Arab Emirates

- 5.2.4.1.3 Rest of Middle East

- 5.2.5 North America

- 5.2.5.1 By Country

- 5.2.5.1.1 Canada

- 5.2.5.1.2 Mexico

- 5.2.5.1.3 United States

- 5.2.6 South America

- 5.2.6.1 By Country

- 5.2.6.1.1 Argentina

- 5.2.6.1.2 Brazil

- 5.2.6.1.3 Rest of South America

- 5.2.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 BASF SE

- 6.4.2 Domo Chemicals

- 6.4.3 DSM

- 6.4.4 Guangdong Xinhui Meida Nylon Co.,Ltd

- 6.4.5 Hangzhou Juheshun New Materials Co., Ltd.

- 6.4.6 Highsun Holding Group

- 6.4.7 KuibyshevAzot

- 6.4.8 LANXESS

- 6.4.9 LIBOLON

- 6.4.10 UBE Corporation

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219