|

市场调查报告书

商品编码

1431612

电力零售:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Electricity Retailing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

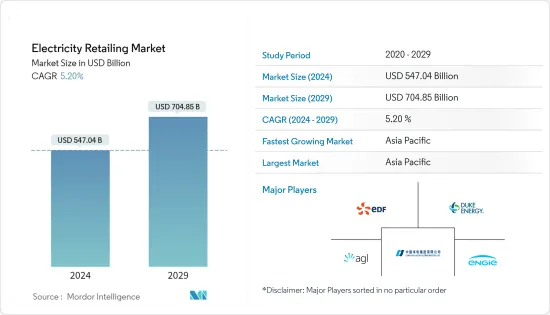

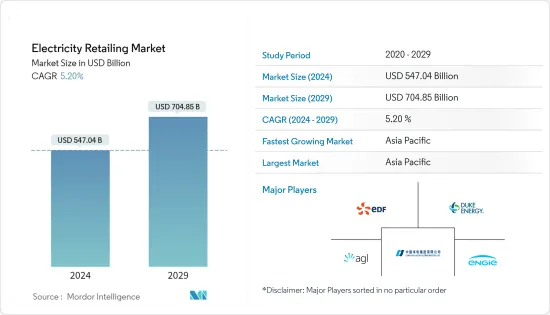

预计2024年全球电力零售市场规模将达5,470.4亿美元,2024-2029年预测期间复合年增长率为5.20%,2029年将达到7,048.5亿美元。

主要亮点

- 从中期来看,电力需求的增加和电动车的普及预计将在预测期内推动市场发展。

- 另一方面,新兴的分散式发电资源预计将抑制市场成长。

- 然而,电力零售市场的技术进步(如先进电錶)和撒哈拉以南非洲地区的电力需求预计将在预测期内为市场创造机会。

- 预计亚太地区将在预测期内主导市场,因为该地区到 2022 年的电力消耗需求最高。

主要市场趋势

住宅领域预计将占据很大的市场份额

- 住宅用电包括照明、暖气、冷气、冷气以及电器产品、电脑、电子设备、机械和大众交通工具系统运作的用电。

- 美国占世界发电量的很大一部分。 2022年,美国发电量占全球的15.6%。

- 根据美国能源资讯署预测,2022年美国总电力消耗量量约4.5兆千瓦时,创有纪录以来最高,是1950年用电量的14倍。最终电力消费量总量包括向消费者的零售售电量和直接用电量。

- 此外,2022年住宅领域的电力零售份额为38.9%,较2021年提高3.5个百分点。 2022年,美国住宅零售用电量消费量为1.42兆度。

- 智慧电錶是面向未来的技术的关键指标,其引入透过通用的打包无线服务技术实现配电公司和消费者之间的双向即时通讯,为智慧电网铺平了道路。由于政府对智慧电錶安装的支援政策,零售电力需求预计将增加。在住宅领域,智慧电錶可用于提高客户电力服务的可靠性和品质、追踪用电情况,并就减少能源消费量和节省电费做出明智的决策。您可以做到。

- 例如,2022年4月,欧盟(EU)向清洁能源领域的五个计划拨款约1.34亿美元。塞尔维亚的计划将支持在塞尔维亚配电系统中引入智慧电錶。这些资金将用于克拉列沃、恰克和尼什智慧电錶实施的第一阶段。

- 基于以上几点,预计住宅领域将占据较大的市场占有率。

亚太地区预计将主导市场

- 亚太地区拥有全球 50% 以上的人口和 60% 的最大城市。随着人口的快速成长和工业化,随着数百万新客户获得电力,非洲大陆未来将面临电力需求的增加。

- 根据世界能源数据统计,2022年亚太地区初级能源消费量为277.6艾焦耳,与前一年同期比较%。中国等国家电力需求最高,占全球能源消费量总量的26.4%。

- 各地方政府也正在采取措施将现代技术应用于电力零售。亚太地区许多国家需要加强其输配电(T&D)网路。为了向这些地区提供电力,该地区各国正大力投资建造电网和智慧电錶系统。

- 例如,2023 年 3 月,印度政府根据配电部门现代化计划 (RDSS) 实施了全国范围内的智慧电錶计划。根据该计划,印度政府的目标是在全国安装超过2.5兆个智慧电錶。

- 基于上述情况,预计亚太地区将在预测期内主导市场。

竞争形势

全球零售电力市场适度分散。主要企业(排名不分先后)包括 Engie SA、AGL Energy Ltd.、中国华电集团有限公司 (CHD)、Duke Energy Corporation. 和 Electricite de France SA。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 市场规模与需求预测,10 亿美元(~2028 年)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 电力需求增加

- 电动车的普及

- 抑制因素

- 分散式发电的新来源

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 最终用户

- 住宅

- 商业的

- 工业的

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 法国

- 义大利

- 德国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东/非洲

- 北美洲

第六章 竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Engie SA

- AGL Energy Ltd.

- China Huadian Corporation LTD.(CHD)

- Duke Energy Corporation

- Electricite de France SA.

- Enel SpA

- Keppel Electric Pte. Ltd.

- Tata Power Co. Ltd.

- E.ON SE

- Iberdrola SA

第七章 市场机会及未来趋势

- 透过在电力零售中使用数位技术提高客户参与

简介目录

Product Code: 50000761

The Electricity Retailing Market size is estimated at USD 547.04 billion in 2024, and is expected to reach USD 704.85 billion by 2029, growing at a CAGR of 5.20% during the forecast period (2024-2029).

Key Highlights

- Over the medium period, the increase in the demand for electricity and the rising adoption of electric vehicles is expected to drive the market in the forecast period.

- On the other hand, new sources of distributed electricity generation are expected to restrain the market's growth.

- Nevertheless, advancements in the technology of the electricity retail market, like advanced meter and the requirement of power in the sub-Saharan Africa region, is expected to create opportunity for the market in the forecast period.

- Asia-Pacific is expected to dominate the market in the forecast period owing to the highest demand for electricity consumption in 2022.

Key Market Trends

Residential Segment is Expect to have a Significant Share in the Market

- Residential electricity use includes using electricity for lighting, heating, cooling, refrigeration, and operating appliances, computers, electronics, machinery, and public transportation systems.

- The United States has a significant share in World's electricity generation. In 2022, the country's share was 15.6% of the World's electricity generation.

- According to U.S. Energy Information Administration, total electricity consumption in the United States was about 4.05 trillion kWh in 2022, the highest amount recorded and 14 times greater than electricity use in 1950. Total electricity end-use consumption includes retail electricity sales to consumers and direct electricity use.

- Additionally, in 2022, the residential sector's retail electricity share was 38.9% of total electricity retail sales, 3.5% higher than in 2021. The total retail electricity consumption of the residential sector in the United States accounted for 1.42 trillion kWh in 2022.

- The adoption of smart meters, a significant measure of future-ready technologies, paves the way for the smart grid by enabling two-way real-time communication between distribution companies and consumers through general package radio services technologies. With supportive government policies for installing smart meters, the demand for retail electricity is expected to increase. In the residential sector, using smart meters can help improve the reliability and quality of electricity service for customers, track their electricity usage, and make informed decisions about reducing their energy consumption and saving money on their bills.

- For instance, in April 2022, European Union allocated around USD 134 million for five projects in the clean energy sector, including Advanced System for Remote Meter Reading Project. The project in Serbia will help the introduction of smart metering in the electricity distribution system in Serbia. The funds will be used for the first phase of smart meter deployment in Kraljevo, Cacak, and Nis.

- Thus, owing to the above points, the residential segment is expected to hold a significant market share.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is home to more than 50% of the global population and 60% of the large cities. The continent will face increasing demand for power in the future as millions of new customers are gaining access to electricity, with rapid population growth and industrialization.

- According to the Statistical Review of World Energy Data, in 2022, Asia-Pacific's total primary energy consumption accounted for 277.6 Exajoules, an annual growth rate of 2.1% compared to the previous year. A country like China has the highest electricity demand, accounting for 26.4 % of total world energy consumption.

- Various regional governments are also taking steps to apply modern technology in electricity retailing. Many countries in Asia-Pacific need more transmission and distribution (T&D) networks, and hence, electricity is not available in some of the remote and rural areas. To bring electricity to these areas, the countries in the region are investing heavily in building a transmission line network and smart metering system.

- For instance, in March 2023, the government of India implemented a nationwide Smart Meter program in the Revamped Distribution Sector Scheme (RDSS). Under this scheme, the government of India aims to install over 25 crore Smart Meters is envisaged across the country.

- Thus, owing to the above points, Asia-Pacific is expected to dominate the market in the forecast period.

Competitive Landscape

The global electricity retailing market is moderately fragmented. Some of the major companies (in no particular order) include Engie SA, AGL Energy Ltd., China Huadian Corporation LTD. (CHD), Duke Energy Corporation., and Electricite de France SA., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increase in the Demand for Electricity

- 4.5.1.2 Rising Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 New Sources of Distributed Electricity Generation

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-User

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.1.3 Industrial

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States of America

- 5.2.1.2 Canada

- 5.2.1.3 Rest of the North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 France

- 5.2.2.3 Italy

- 5.2.2.4 Germany

- 5.2.2.5 Rest of the Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of the Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of the South America

- 5.2.5 Middle-East & Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Rest of the Middle-East & Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Engie SA

- 6.3.2 AGL Energy Ltd.

- 6.3.3 China Huadian Corporation LTD. (CHD)

- 6.3.4 Duke Energy Corporation

- 6.3.5 Electricite de France SA.

- 6.3.6 Enel S.p.A.

- 6.3.7 Keppel Electric Pte. Ltd.

- 6.3.8 Tata Power Co. Ltd.

- 6.3.9 E.ON SE

- 6.3.10 Iberdrola SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Using Digital Technologies in Electricity Retailing to Improve Customer Engagement

02-2729-4219

+886-2-2729-4219