|

市场调查报告书

商品编码

1432368

游戏化:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Gamification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

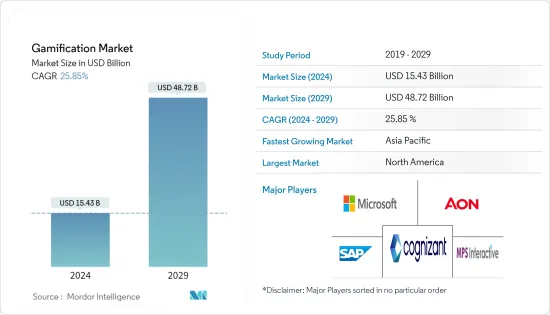

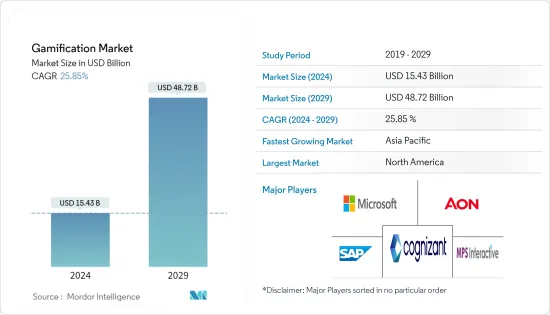

游戏化市场规模预计到 2024 年为 154.3 亿美元,预计到 2029 年将达到 487.2 亿美元,在预测期内(2024-2029 年)复合年增长率为 25.85%。

智慧型手机和行动装置的快速成长直接为游戏化市场创造了广阔的基础。人们越来越认识到游戏化系统是一种设计人类行为以引发创新、生产力和参与的方式,这也支持了这种成长。

主要亮点

- 智慧型手机的普及大大扩展了游戏化的可能性。随着客户和员工从桌上型电脑转向行动电话和网路设备,银行拥有了一个利润丰厚的平台来吸引具有高转换和使用潜力的消费者。

- 此外,与社交网站的连接允许用户与朋友、熟人和同事共用他们的体验,从而扩大了平台的覆盖范围和有效性。另一个好处是,行动应用程式允许负责人发送调查,甚至一个问题很长,直接从目标受众成员收集资料,并相应地调整他们的努力。例如,麻省理工学院最近的一项研究发现,敏捷组织的收益成长更快,并且比非敏捷组织的盈利高出 30%。

- 对游戏化在商业中的应用的研究表明,游戏化通常以最常见的方式进行。他们没有设计平衡竞争与协作的体验,而是在整个过程中采用积分系统、排行榜和徽章。这种在阐述方法的意义时的疏忽预计将导致采用者 80% 的努力失败。

- 此外,人工智慧和机器学习等先进技术的采用预计将在未来几年获得关注,供应商和公司将专注于开发能够学习并随着时间的推移而变得更加直观和有效的解决方案。预计未来几年供应商对该技术的投资将会增加。

- 在游戏产业,自 COVID-19 爆发以来,全球对行动游戏的需求激增,全州范围内的关闭影响了多项业务。在最近的全国封锁期间,智慧型手机用户下载了各种游戏和其他应用程式。俄罗斯和乌克兰之间的衝突也对更广泛的包装生态系统产生了影响。

游戏化市场趋势

零售领域占据最大市场份额

- 零售业是一个正在经历显着成长的新兴产业。近年来,随着客户寻求反映他们在社群媒体上推广的个人品牌的体验和产品,零售额一直以健康的速度稳定成长。例如,根据美国人口普查局的资料,美国零售总额将从2015年的4.72兆美元增加到2021年的6.69兆美元。

- 游戏化可以在不偏离核心业务理念的情况下,为零售商的营销和参与策略添加娱乐性和戏剧性,同时鼓励客户和员工的积极行为和充实,从而带来独特的品牌体验并增加销售。

- 正如《HBR》报导指出的那样,游戏化还有助于提高客户维繫,将客户维繫提高 5%,将利润提高 25% 至 95%,并提供更好的业务成果。品牌可以在其产品上提供可扫描的代码,透过扫描代码,客户可以兑换一定数量的忠诚度积分。从推动发现和参与到建立品牌宣传和忠诚度,体验式零售商正在使用游戏化作为客户购物旅程的一部分。

- 零售游戏化是一种快速成长的电子商务趋势。线上零售商希望透过继续创造互动式客户体验来增加销售。游戏化应用程式已被证明可以增加多家零售公司的销售线索和销售。游戏化还可以吸引新客户和重复访问。

- 透过利用创新的游戏化,零售商可以提高消费者参与度、建立品牌忠诚度并改善整体零售体验。不出所料,Z 世代主要参与该系统。据 Tapjoy 称,77% 的 Z 世代每天都玩手机游戏。杂货零售商热衷于建立这一人群和其他人群的忠诚度,因此部署正确的策略对于取得巨大成果至关重要。

- 如果零售商和品牌的游戏化解决方案包含他们透过平台取得的成就的进度表,则可以进一步受益。其中包括对您很重要的指标,例如过去的购买情况、朋友的推荐以及感兴趣的新产品类别的更新。 「胜利」和「奖励」的平衡可以进一步吸引观众并带动商业性利益。如果部署得当,这种方法可以奖励客户并增加回头客。

预计北美将占据最大市场占有率

- 在行销方面,游戏化市场在北美正在发展。然而,不同地区的产品开发和创新用途不同。此外,网路和智慧型手机用户的高普及正在增加游戏化在行销中的使用,特别是透过社群媒体整合工具。

- 自从游戏化产业诞生以来,各家公司都推出了大型计划。例如 Adobe、NBC、Walgreens、eBay、Panera 和 Threadless 等消费品牌。游戏化已发展成为Oracle、Cisco 和销售团队等 B2B 公司区域企业策略消费化的关键要素。

- 此外,这些公司被游戏化的能力所吸引,随着时间的推移,透过现场、重复访问和病毒式传播,参与度和忠诚度平均提高 30%。除了参与度之外,游戏化也对收入产生重大影响。美国跨国软体公司 Autodesk 将试用使用率提高了 40%,转换率提高了 15%,而 Extraco Bank 则将客户获取量提高了 700%。

- 此外,跨国公司正在扩大在北美市场的业务,以满足不断增长的需求。例如,Low6 Sports Gaming Technology 于 2022 年 8 月与游戏顾问公司 SCCG Management 合作。该投资和管理组织将协助识别和推广有兴趣利用 Low6 技术获取新客户的北美体育博彩营运商。

游戏化产业概述

游戏化市场竞争温和,有几家主要公司进入该市场。从市场占有率来看,目前少数大公司占据市场主导地位。这些拥有重要市场占有率的领先公司致力于扩大海外基本客群。这些公司正在利用策略合作措施来提高市场占有率和盈利。

2022 年 9 月,Bragg Gaming Group 突破性的玩家参与和游戏化工具「Fuze」将提供给运动博彩公司,为营运商提供改善客户体验的新机会。 Fuze 工具集已透过其专有的分发平台向布拉格线上赌场内容的客户提供,该工具集将扩展到体育博彩产品,允许营运商创建投注者可以即时追踪的有针对性的游戏化促销活动。对事件驱动投注的需求。

2022 年 6 月,微软透过 Xbox 和 PC 游戏升级,让 Edge 浏览器对游戏玩家更加友善。 Edge 现在提高了清晰度,以改善 Xbox 云端游戏串流和效率选项,以防止 Edge 使用您的 PC 资源。同时,游戏也在玩,此外还有一个专门用于游戏的新主页,并融合了休閒游戏。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 基于行动装置的游戏化势头强劲

- 众包被视为创新和发展的巨大机会

- 市场限制因素

- 製造复杂性和较低的投资报酬率

第六章市场区隔

- 按发展

- 本地

- 在云端

- 按尺寸

- 中小企业

- 大公司

- 按平台

- 开放平台

- 封闭式/企业平台

- 按行业分类

- 零售

- 银行

- 政府机关

- 卫生保健

- 教育/研究

- 资讯科技和电讯

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Cognizant Technology Solution Corp.

- MPS Interactive Systems Limited

- Microsoft Corporation

- SAP SE

- Aon plc

- Axonify Inc.

- IActionable Inc

- Bunchball Inc.

- Ambition

- G-Cube

第八章投资分析

第九章 市场机会及未来趋势

The Gamification Market size is estimated at USD 15.43 billion in 2024, and is expected to reach USD 48.72 billion by 2029, growing at a CAGR of 25.85% during the forecast period (2024-2029).

The exponential growth in smartphones and mobile devices directly created a vast base for the gamification market. The increasing recognition of gamification systems also supports this growth as a method to architect human behavior to induce innovation, productivity, or engagement.

Key Highlights

- The increasing popularity of smartphones has greatly broadened the possibilities for gamification. The migration of customers and staff from desktop computers to mobile phones and internet devices provides a lucrative platform for banks to grab consumer interest with a higher likelihood of conversion and usage.

- Furthermore, connections with social networking sites have enabled users to share their experiences with friends, acquaintances, and coworkers, extending the platform's reach and efficacy. Another benefit is that mobile applications allow marketers to send out surveys, even if they are only one question long, allowing them to collect firsthand data from their target audience members and tailor their efforts accordingly. Recent MIT research, for example, found that agile organizations experience faster revenue growth and 30% higher profitability than non-agile organizations.

- According to a study on the use of gamification in businesses, it is frequently done in the most generic ways. They employ point systems, leaderboards, and badges in any process rather than designing experiences that balance competition and collaboration. This omission in developing the meaning of this method is expected to result in 80% of the efforts in companies that have used it.

- Furthermore, the adoption of advanced technologies such as AI and ML is expected to gain traction in the coming years, with vendors and enterprises focusing on developing solutions that learn and become more intuitive and effective over time. Vendor investment in the technology is expected to increase in the coming years.

- The gaming industry saw a global spike in mobile game demand since the COVID-19 outbreak, and the statewide shutdown impacted several companies. Smartphone users downloaded various games and other apps during the recent statewide lockdowns imposed nationwide. The Russia-Ukraine conflict also influenced the wider packaging ecosystem.

Gamification Market Trends

The Retail Segment Holds the Largest Share in the Market

- The retail industry is an emerging industry that is growing significantly. Retail sales growth has been increasing steadily over the past few years at a healthy pace as customers seek experiences and products that reflect the personal brand they promote on social media. For instance, according to the data from the US Census Bureau, total retail sales in the United States increased from USD 4.72 trillion in 2015 to USD 6.69 trillion in 2021.

- While gamification can add entertainment and drama to a retailer's marketing or engagement strategy without diverting from the core idea of the business, it can also encourage positive behaviors from customers and employees, leading to a rich brand experience and higher sales.

- As an HBR article points out, gamification also helps in customer retention, increases customer retention rates by 5%, increases profits by 25% to 95%, and can fetch better business results. Brands can provide scannable codes on the products, and on scanning the code, the customer can avail of a certain number of loyalty points. From driving discovery and engagement to building brand advocacy and loyalty, experiential retailers adopt gamification techniques as part of the customer shopping journey.

- Retail gamification is an e-commerce trend that is growing rapidly. Online retailers will want to continue creating interactive customer experiences to drive higher sales. Gamification apps have proven to improve leads and sales for several retailers. Gamification can also drive new and recurring customers to a store.

- By using innovative forms of gamification, retailers find they are better placed to engage with consumers, build brand loyalty, and enhance the overall retail experience. Unsurprisingly, Gen Z is mainly involved with this mechanic. According to Tapjoy, 77% of Gen Zers play mobile games daily. As grocery retailers are keen to build loyalty with this and other segments of the population, it is essential to deploy the right strategy to deliver outstanding results.

- Retailers and brands further benefit from gamification solutions when these include progress charts on what they've achieved through the platform. This could consist of key metrics for users with details on past purchases, friend referrals, and updates on new product categories of interest. A balance of 'wins' or 'rewards' can further engage an audience and drive commercial benefits. This approach can incentivize customers and keep them returning for more when deployed well.

North America is Anticipated to Hold the Largest Market Share

- In marketing, North America has a developed market for gamification. However, systems are finding various regional uses for product development and innovation. The region's high penetration of internet and smartphone users has also resulted in increased use of gamification for marketing, particularly through social media integration tools.

- Various companies have launched large gamification projects since the industry's inception. Consumer brands such as Adobe, NBC, Walgreens, eBay, Panera, and Threadless are among them. Gamification has evolved as a crucial component in B2B firms' consumerization of regional enterprise strategies, such as Oracle, Cisco, and Salesforce.

- Furthermore, these organizations are drawn to gamification's capacity to increase engagement and loyalty by an average of 30% over time, on-site, through repeat visits, and viral diffusion. Aside from engagement, the income effects of gamification are also significant. Autodesk, an American multinational software business, increased trial usage by 40% and conversion rates by 15%, while Extraco Bank increased client acquisitions by 700%.

- Furthermore, global corporations are expanding their presence in the North American market to meet the increasing demand. For example, Low6 Sports Gaming Technology collaborated with gaming consultancy SCCG Management in August 2022. The investment and management organization will assist with the identification and facilitation of North American-based sports betting operators interested in leveraging Low6's technology to gain new customers.

Gamification Industry Overview

The gamification market is moderately competitive and consists of several major players. In terms of market share, a few significant players currently dominate the market. These major players, with a prominent market share, focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

In September 2022, Bragg Gaming Group's breakthrough player engagement and gamification tool, Fuze, was to be available on sportsbooks, providing operators with a new opportunity to improve the customer experience. The Fuze toolset, already available to customers of Bragg's online casino content via its proprietary distribution platform, was extended to sports betting products, allowing operators to leverage event-driven betting demand with targeted gamified promotions that punters can track in real time.

In June 2022, Microsoft made its Edge browser more gamer-friendly, thanks to Xbox and PC gaming upgrades. Edge is getting a clarity boost to improve Xbox Cloud Gaming streams and an efficiency option to prevent Edge from using PC resources. At the same time, a game is being played, in addition to a new gaming-focused homepage and casual game integration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Mobile-based Gamification Gaining Momentum

- 5.1.2 Crowdsourcing Seen as a Major Opportunity in Innovation and Development

- 5.2 Market Restraints

- 5.2.1 Manufacturing Complications and Lower ROI

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 On-cloud

- 6.2 By Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Platform

- 6.3.1 Open Platform

- 6.3.2 Closed/ Enterprise Platform

- 6.4 By End-user Vertical

- 6.4.1 Retail

- 6.4.2 Banking

- 6.4.3 Government

- 6.4.4 Healthcare

- 6.4.5 Education and Research

- 6.4.6 IT and Telecom

- 6.4.7 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cognizant Technology Solution Corp.

- 7.1.2 MPS Interactive Systems Limited

- 7.1.3 Microsoft Corporation

- 7.1.4 SAP SE

- 7.1.5 Aon plc

- 7.1.6 Axonify Inc.

- 7.1.7 IActionable Inc

- 7.1.8 Bunchball Inc.

- 7.1.9 Ambition

- 7.1.10 G-Cube