|

市场调查报告书

商品编码

1432540

M2M 连结:市场占有率分析、产业趋势与统计、成长预测(2024-2029)M2M Connections - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

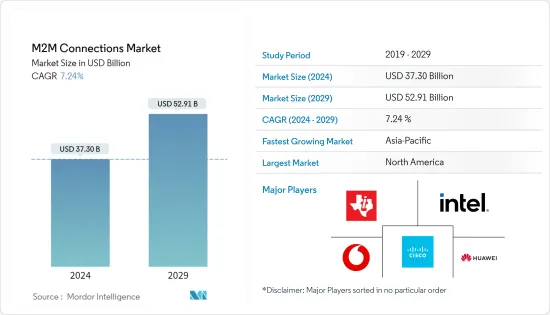

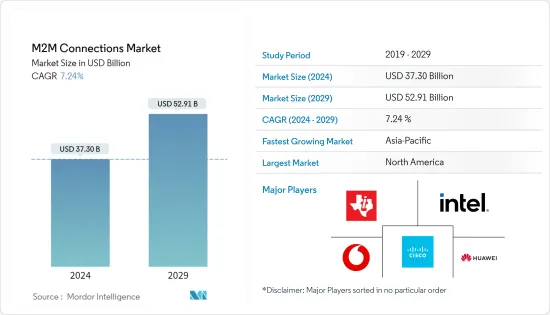

M2M连接市场规模预计到2024年为373亿美元,预计到2029年将达到529.1亿美元,在预测期内(2024-2029年)复合年增长率为7.24%。

由于互联网使用量的增加和法规环境的改善,预计该行业将在预测期内增长。此外,由于跨行业 M2M 连接的增加以及 4G/LTE 和蓝牙智慧/BLE 等新通讯技术的使用增加,预计该市场将在预测期内扩大。

主要亮点

- 过去几十年来,随着世界互联网和IP网路系统的发展,M2M连线发生了变化。这使得远距通讯大量设备之间的通讯变得更加容易和有效。根据Cisco系统公司预测,到年终,全球M2M连线数将达到147亿个。 2018年至2023年连接量年均成长率预估为19%。

- 减少人类参与和与工作相关的活动是机器对机器通讯的基本好处之一。自动资料收集使机器控制系统能够执行许多先前由人工干预执行的业务。操作员和技术人员可以腾出时间来执行需要人机互动的更高价值的任务。

- 印度等新兴国家已经认识到 M2M 的重要性,因此广泛关注扩大 M2M的普及。此外,2022年2月,印度政府宣布M2M/物联网(IoT)是世界上发展最快的技术之一,为社会、企业和消费者提供丰富而有利的可能性。 。政府措施鼓励增加机器对机器 (M2M) 产业的使用和创新。

- 机器对机器 (M2M) 连接市场的推动因素包括扩大网路覆盖范围、无线通讯进步、快速数位化、工业化、研发活动、投资激增以及各行业垂直领域 M2M 连接的增加。受到了增加的正面影响在预测期内,进入机器对机器(M2M)连接市场的公司也可能受益于对联网汽车和智慧城市不断增长的需求,以及与系统整合商的策略合作伙伴关係。

- 然而,隐私和安全问题以及复杂的应用开发是阻碍该行业持续扩张的主要因素。此外,缺乏扩充性和高昂的交付成本也导致市场难以发展。

- COVID-19的疫情对M2M业务产生了积极影响,对远端监控和操作工具产生了迫切需求,增加了对M2M技术和解决方案的需求。此外,这些解决方案还帮助医生和护士监测单独接受治疗的患者。

M2M连结市场趋势

扩大网路使用正在推动市场成长

- 网路主要透过计量型的高速连线的普及,在工作时间和地点方面提供了更大的弹性。您可以使用多种方法(包括行动互联网设备)在任何地方存取互联网。用户可使用行动电话、资料卡、掌上游戏机、行动电话路由器等无线上网。

- 根据 Speedtest 的数据,截至 2023 年 4 月,卡达拥有世界上最快的平均行动网路连线速度,约为 190 Mbps。其次是阿拉伯联合大公国 (UAE) 和澳门,这两个国家的平均中位数速度均超过 170 Mbps。

- 由于网路和无线技术标准的改进,遥测技术在暖气设备、电錶和连网家用电器等日常产品中的使用不断扩大。此前,遥测技术仅用于製造、工程和纯科学领域。

- 全球对M2M连接的关注和不断增长的互联网使用是推动M2M连接市场成长的两个主要原因。 4G/LTE 蜂窝技术的普及和 5G 技术的出现将进一步影响 M2M 连接。

- 根据国际电信联盟称,到 2022 年,欧洲的网路普及将成为世界上最显着的地区,从 2009 年的略低于 60% 上升到有数资料的最近一年的 89%。非洲的网路使用率最低,为 40%。截至同年,根据全球网路存取总数,约有 49 亿人在使用网路。

- 此外,各国政府正在积极寻求新的策略来扩展网路连接技术和 M2M 连接。例如,2022 年 11 月,欧洲议会和欧盟 (EU) 成员国相关人员宣布,他们即将签署一项价值 60 亿欧元(61.8 亿美元)的协议,以启动卫星网路基础设施。欧盟委员会表示,天基连结是欧盟在现代数位环境中保持弹性的战略资产。它支撑着欧盟的经济、数位领导力、技术独立性、竞争力和社会发展。

北美预计将占据很大份额

- 该地区是 AT&T、Verizon 和 Cisco 等知名通讯业者的所在地,并且不断投资扩大和改善其基础设施,以跟上技术创新的步伐。 M2M 连线的采用预计将在预测期内加速。

- 5G 的出现预计将在预测期内推动 M2M 连接的成长。 M2M通讯的目的可以透过5G技术成功解决,5G技术具有多样化的应用、低延迟、高速度和巨大的频宽。例如,自动驾驶汽车使用 5G 技术以最小的延迟和卓越的可靠性进行连接。此外,5G系统为网路技术提供了保证的QoS。

- 此外,北美5G连线数(不包括物联网)将从2021年的14%增加到2025年的2.8亿个,占所有行动连线数的64%。预计届时加拿大将排名第四,仅次于日本,美国将拥有仅次于韩国的全球第二高 5G 采用率。

- 多家大公司透过研发、策略联盟、併购等方式提升了该领域的技术水准。因此,预计该地区 M2M 连接的使用量在预测期内将会增加。

- 例如,2022年12月,总部位于加州的物联网和机器对机器(IoT和M2M)通讯供应商Aeris Communications将收购连网型的物联网加速器和车联网云端业务,该计画已公布。该协定预计将使Aeris和爱立信的物联网平台能够连接全球190个国家的超过1亿个物联网设备。此外,随着两家公司的合併,整个物联网市场预计将快速成长。对 4G 和 5G 的需求将包括并成长很大一部分物联网。

M2M连结产业概况

M2M 连接市场竞争激烈,其特点是大型和小型製造商都存在。这些公司正在投资研发,以提高产能并满足不断扩大的市场需求。在北美和欧洲等成熟市场,竞争更加激烈。由于生产和服务扩张、收购增加以及技术进步等多种变数的影响,未来几年该市场的竞争程度可能会继续加剧。

- 2022 年 5 月 C-DOT 和 Vodafone Idea Limited 合作评估不同解决方案提供者的应用程式和装置是否符合 oneM2M 要求,并授予联合认证以解决实施中的这些困难。我们同意独家合作和工作。通讯部 (DOT) 和远端资讯处理发展中心 (C-DoT) 签署了一份谅解备忘录,就印度机器对机器 (M2M) 和物联网 (IoT) 解决方案进行合作。

- 2022 年 2 月 T-Mobile 和德国电信推出 T-IoT,这是一种用于物联网连接、平台管理和支援的企业解决方案。 T-IoT 在全球 188 个地点和 383 个网路中可用,因此使用 T-IoT 的企业可以支援其所有国际连接。企业依赖此解决方案,因为他们知道物联网将改变他们的行业并帮助他们为 5G 时代做好准备。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 应用扩展远端资讯处理

- 扩大网路使用

- 移动连接增加

- 市场限制因素

- 隐私和安全问题

- 缺乏标准化

第六章市场区隔

- 按连线类型

- 有线

- 无线的

- 科技

- 蜂巢连接

- 低功率广域 (LPWA)

- 短距离

- 男人

- 广域固定

- 卫星

- 最终用户产业

- 零售业

- 银行/金融机构

- 通讯/IT产业

- 卫生保健

- 汽车产业

- 油和气

- 运输

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Vodafone Group

- Texas Instruments Incorporated

- VMWare Inc.

- AT&T Inc.

- Duetsche Telecom AG

- Siera Wireless

- China Mobile Ltd.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Gemalto NV(Thales Group)

- Telefonica SA

- Telit Communications

第八章投资分析

第9章市场的未来

The M2M Connections Market size is estimated at USD 37.30 billion in 2024, and is expected to reach USD 52.91 billion by 2029, growing at a CAGR of 7.24% during the forecast period (2024-2029).

The industry is anticipated to grow over the forecast period due to rising internet usage and a supportive regulatory environment. Also, the market is expected to grow during the forecast period because more M2M connections are being made between different types of businesses and because more new communication technologies like 4G/LTE and Bluetooth Smart/BLE are being used.

Key Highlights

- M2M connections have changed over the past few decades as the global Internet and IP network systems have grown. This has made it easier and more effective to communicate over long distances and between many devices. According to Cisco Systems, by the end of 2023, there will be 14.7 billion M2M connections globally. The forecasted compound annual growth rate of connections from 2018 to 2023 is 19 percent.

- Reducing human involvement and task-related activities is one of the essential benefits of machine-to-machine communication. Due to automated data collection, mechanical machine control systems can now do numerous duties that were formerly done by human intervention. Operators and technicians are freed up to perform higher-value tasks that require human interaction.

- Developing countries like India have identified the importance of M2M and are, therefore, focusing extensively on the increased penetration of M2M. Moreover, in February 2022, the government of India stated that M2M/Internet of Things (IoT) is one of the most rapidly developing technologies worldwide, offering a wealth of advantageous potential for society, businesses, and consumers. The government initiative encourages greater use and innovation in the machine-to-machine (M2M) industry.

- The market for machine-to-machine (M2M) connections is positively impacted by increased demand for expanded network coverage, wireless communication advancements, rapid digitization, industrialization, R&D activities, a surge in investment, and a rise in M2M connections among different industry verticals. During the period of the forecast, those in the machine-to-machine (M2M) connections market would also benefit from the growing demand for connected vehicles and smart cities, as well as from strategic partnerships with system integrators.

- However, issues with privacy and security and complex application development are a few of the primary factors hindering the industry under study from continuing to expand. Also, the lack of scalability and high delivery costs are making it hard to grow the market.

- The COVID-19 pandemic positively impacted the M2M business due to a sudden requirement for remote monitoring and operating tools, leading to increasing requests for M2M technology and solutions. Moreover, these solutions helped doctors and nurses keep an eye on patients who were being treated alone.

M2M Connections Market Trends

Growing Usage of Internet is Expected to Drive the Market Growth

- The Internet provides more flexibility in terms of working hours and location, due mainly to the proliferation of unmetered high-speed connections. Many methods, including mobile Internet devices, may be used to access the Internet anywhere. Users can access the Internet wirelessly using mobile phones, data cards, portable gaming consoles, and cellular routers.

- According to Speedtest, as of April 2023, Qatar had the fastest average mobile internet connections globally, nearly 190 Mbps. The United Arab Emirates (UAE) and Macau followed, with each of these countries registering average median speeds above 170 Mbps.

- Telemetry usage in daily items like heating units, electric meters, and internet-connected appliances has grown because of the Internet and better wireless technology standards. Previously, telemetry was only used in manufacturing, engineering, and pure science.

- The global focus on machine-to-machine (M2M) connections and the expansion of internet usage are the two main reasons promoting the market's growth for M2M connections. Machine-to-machine (M2M) connections are affected even more by the spread of 4G/LTE cell technologies and the coming of 5G technology.

- According to the ITU, Europe had the most significant internet penetration rate among all world regions in 2022, increasing from just under 60% in 2009 to 89% in the most recent year for which data was available. The lowest internet usage rate, at 40%, was found in Africa. Around 4.9 billion people were reportedly online as of the same year, based on total global internet access.

- Furthermore, governments are actively pursuing new strategies for broadening internet connectivity technologies, thereby increasing M2M connectivity. For instance, in November 2022, officials from the European Parliament and member states of the European Union (EU) announced that they were close to concluding a EUR 6 billion (USD 6.18 billion) agreement to launch a satellite internet infrastructure. The European Commission stated that space-based connectivity is a strategic asset for the resilience of the EU in the modern digital environment. It supports the development of its economy, digital leadership, technical independence, competitiveness, and society.

North America is Expected to Hold Significant Share

- Some of the prominent telecom sector firms are based in the area, including AT&T, Verizon, Cisco, and many more, who are constantly investing in expanding and improving their infrastructure in order to stay up with technological breakthroughs. Over the projected period, it is anticipated to accelerate the adoption of M2M connections.

- The advent of 5G is expected to fuel the growth of M2M connections over the forecast period. M2M communication objectives may be successfully addressed by 5G technology, which has a wide variety of applications, low latency, greater speed, and enormous bandwidth. As an illustration, autonomous cars will use 5G technology to connect with minimal latency and great dependability. Moreover, networking technologies with assured QoS can be offered by the 5G system.

- Furthermore, the number of 5G connections (excluding IoT) in North America will increase from 14% in 2021 to 280 million by 2025, making up 64% of all mobile connections. Canada is expected to rank fourth behind Japan by then, with the United States having the world's second-highest 5G adoption rate, trailing only South Korea.

- Several big companies in the area have been able to improve the technology through research and development, strategic alliances, and mergers and acquisitions. This is expected to increase the use of M2M connections in the area during the projection period.

- For instance, in December 2022, Aeris Communications, a California-based Internet of Things and machine-to-machine (IoT and M2M) communications provider, announced plans to acquire Ericsson's IoT Accelerator and Connected Vehicle Cloud businesses. The agreement is expected to enable Aeris and Ericsson's IoT platforms to link over 100 million IoT devices worldwide in 190 different countries. Additionally, the loT market will grow faster overall owing to the two businesses' merger. The demand for 4G and 5G will include a significant and expanding portion of IoT.

M2M Connections Industry Overview

The market for M2M connections is highly competitive and distinguished by the abundance of both large- and small-scale manufacturers. These businesses have been investing in R&D to increase their production capacity and satisfy the expanding market demand. In established markets like North America and Europe, competition is more intense. The degree of rivalry in this market will continue to increase over the coming years as a result of a variety of variables, including rising production and service extensions, an increase in acquisitions, and technical advancements.

- May 2022 - C-DOT and Vodafone Idea Limited have agreed to cooperate and work on a non-exclusive basis to evaluate apps and devices from different solution providers to meet oneM2M requirements and to give joint certifications to solve these difficulties in the implementation. The Department of Telecommunications (DOT) and the Center for Development of Telematics (C-DoT) signed a memorandum of understanding (MoU) to work together on machine-to-machine (M2M) and Internet of Things (IoT) solutions for India.

- February 2022 - T-Mobile and Deutsche Telekom AG will introduce T-IoT, a corporate solution for IoT connection, platform administration, and support. Businesses using T-IoT can handle all of their international connections because it will be accessible in 188 locations and on 383 networks globally. The firms use the solution because they know that IoT can change their industries and help them get ready for the 5G era.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Augmenting Applications Telematics

- 5.1.2 Growing Usage of Internet

- 5.1.3 Increasing Number of Mobile Connections

- 5.2 Market Restraints

- 5.2.1 Privacy and Security Issues

- 5.2.2 Lack of Standardization

6 MARKET SEGMENTATION

- 6.1 By Connection Type

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 Technology

- 6.2.1 Cellular Connections

- 6.2.2 Low Power Wide Area (LPWA)

- 6.2.3 Short Range

- 6.2.4 MAN

- 6.2.5 Wide Area Fixed

- 6.2.6 Satellite

- 6.3 End User Industry

- 6.3.1 Retail Sector

- 6.3.2 Banking and Financial Institution

- 6.3.3 Telecom and IT Industry

- 6.3.4 Healthcare

- 6.3.5 Automotive

- 6.3.6 Oil & Gas

- 6.3.7 Transportation

- 6.3.8 Other End User Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Vodafone Group

- 7.1.2 Texas Instruments Incorporated

- 7.1.3 VMWare Inc.

- 7.1.4 AT&T Inc.

- 7.1.5 Duetsche Telecom AG

- 7.1.6 Siera Wireless

- 7.1.7 China Mobile Ltd.

- 7.1.8 Cisco Systems, Inc.

- 7.1.9 Huawei Technologies Co., Ltd.

- 7.1.10 Intel Corporation

- 7.1.11 Gemalto NV(Thales Group)

- 7.1.12 Telefonica SA

- 7.1.13 Telit Communications