|

市场调查报告书

商品编码

1432546

表面声波感测器:市场占有率分析、产业趋势、成长预测(2024-2029)Surface Acoustic Wave Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

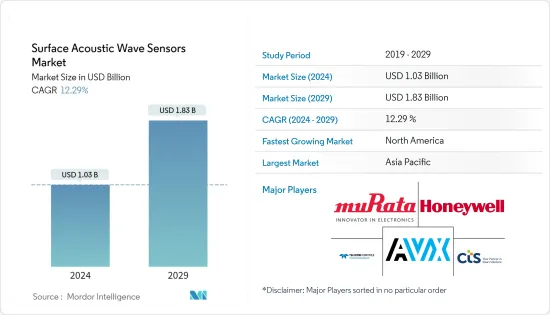

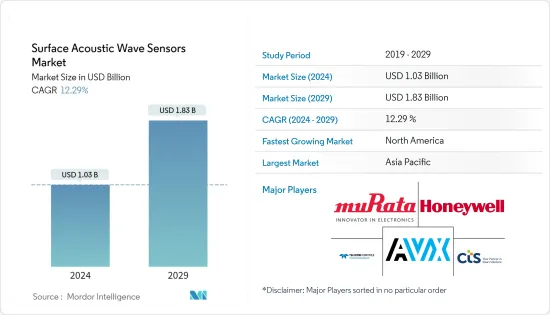

声表面波感测器市场规模预计到 2024 年为 10.3 亿美元,预计到 2029 年将达到 18.3 亿美元,在预测期内(2024-2029 年)复合年增长率为 12.29%。

由于表面声波感测器尺寸小、坚固耐用、经济生产率、运行稳定性以及在各个最终用户行业中的应用,在预测期内,表面声波感测器已成为越来越多采用的感测器技术。

主要亮点

- 声表面波 (SAW) 技术已广泛应用于航太、通讯和汽车等多种工业应用。最常见的应用是被称为 SAW 滤波器的电子元件,它是一种基本的射频 (RF) 电路元件。 SAW 设备也用于测量湿度、压力和温度以及检测某些化学物质。

- 随着通讯领域的进步,SAW 和体声波(BAW)共振器、滤波器、振盪器和延迟线越来越受欢迎。除了被动和无线之外,SAW 感测器还具有价格竞争力、固有的稳健性、高响应性和固有的可靠性。

- 汽车、国防和航太产业也吸引了近年来探索的市场供应商。由于这些感测器对磁场不敏感,因此许多汽车应用需要感测马达和螺线管附近的扭矩。这对于其他类型的感测器技术来说是有问题的。

- 在 COVID-19 的早期阶段,由于全国范围内的封锁和许多製造产能的关闭,受访市场出现了供应链中断。然而,从2020年第二季开始,市场开始出现需求和生产的復苏,半导体产业的趋势也反映在研究市场。然而,电动车和强制性车辆安全设备等趋势正在增加每辆车的半导体含量,而 SAW 感测器的需求可能会在未来几个月帮助克服这种影响。

- 专门从事声表面波感测器研究的研究人员正在积极寻求与无损检测解决方案提供者合作的机会,以确认其可行性并最终为这些感测器开拓新的应用领域。我正在努力。例如,航太和国防工业无损检测解决方案提供商 X-Wave Innovations Inc. 与纽约理工学院 (NYIT) 工程学院和计算科学学院合作,与 NASA 合作, Development 宣布开发出一种嵌入式感测器系统,可以测量温度、压力和其他影响推进引擎系统的刺激。该计划还获得了 NASA 超过 125,000 美元的资助。

声表面波感测器市场趋势

医疗保健领域预计将显着成长

- 软式电路板的需求正在增加,医疗保健产业对 SAW 感测器的需求也在增加。生物感测应用是医疗保健行业最常见的声表面波技术应用之一,并且越来越多地应用于特定疾病的护理点测试和分析设备。

- 由于对快速、紧凑、高精度和可携式诊断感测系统的需求不断增加,医疗保健和生物医学领域越来越多地投资于生物感测器和 MEMS。 SAW 感测器可用于癌细胞检测、心电图 (ECG)、生物电位监测生物感测器、心臟病监测、血糖监测以及穿戴式生物感测器的开发等装置。

- 另一个有前景的应用是新生儿护理室中的胸音监测,其中微型 SAW 感测器可最大限度地减少新生儿的不适。手持式监控设备的日益普及和发展也扩大了 SAW 感测器的采用范围。

- 近年来,SAW 感测器越来越多地用于检测几种备受瞩目的细菌病毒,包括伊波拉出血热、爱滋病毒、Sin Nombre 和炭疽菌。最近的 COVID-19 大流行也促使许多 SAW 製造商瞄准了这个应用。

- 例如,2022 年 8 月,麻省理工学院 (MIT) 的工程师开发了一种新型无线可穿戴类皮肤感测器,用于健康监测。这种新感测器将被称为“电子皮肤”,它使用由压电材料製成的超薄半导体薄膜,附着在皮肤上来检测身体振动。诸如此类的各种组织的努力预计将有助于扩大医疗保健市场对 SAW 感测器的需求。

- 同样,由于 COVID-19 的普及,医疗保健市场对无线和远端监控系统的需求增加预计也将有助于市场成长。

北美地区可望大幅成长

- 美国是北美地区弹性表面波感测器的主要市场之一,其次是加拿大。在北美市场,由于该地区汽车行业安全相关指令的应用,预计对 SAW 感测器的需求将会增加。

- 随着北美地区技术的不断进步,许多行业预计将使用这些感测器。由于汽车、航空航太、医疗保健、家用电子电器和工业领域等各行业的多种应用,对这些感测器的需求也在迅速增长。

- 此外,由于政府和研究机构的各种创新研发活动,该区域市场也不断成长。最近的 COVID-19 大流行等市场情景进一步刺激了对这些研究活动的支持和需求。

- 此外,由于存在许多着名的系统供应商、感测器製造商和领先的半导体公司,北美地区也是这些感测器技术最先进的应用市场之一。该地区幅员辽阔、消费者富裕以及医疗设备製造商之间的激烈竞争使其成为弹性表面波感测器製造商利润丰厚的市场。

- 此外,半导体产业相关人员也在尝试各种方式,以从MEMS的预期需求中获利。该市场预计将由 IDM 和现有的无厂半导体公司未来将外包部分技术。为了在这个市场的竞争中生存下来,各个公司都在进行与这个领域相关的开拓和拓展活动。

- 例如,2021 年 12 月,Microchip Technology Inc. 宣布将透过覆盖频率高达 20吉赫(GHz) 的新型 MMIC 和分离电晶体大幅扩展其氮化镓 (GaN) 射频 (RF) 功率元件产品组合。该公司的 SAW 感测器、电子机械系统 (MEMS) 振盪器和高度整合的模组结合了微控制器 (MCU) 和RF收发器(Wi-Fi MCU),支援从蓝牙、Wi-Fi 到LoRa 设计的关键短期应用。通讯协定。

声表面波感测器产业概况

声表面波感测器市场的竞争是温和的,因为国内外市场上有许多大大小小的公司。市场集中度适度,主要企业采取产品创新及併购等策略。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 感测器的无线和被动特性

- 製造成本低

- 市场限制因素

- 相容性和安装问题

- 液体感测的局限性

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 感测型

- 压力感测器

- 扭力感测器

- 温度感应器

- 湿度感测器

- 化学感测器

- 其他感测器

- 最终用户产业

- 车

- 航太/国防

- 消费性电子产品

- 其他最终用户产业

- 地区

- 北美洲

- 亚太地区

- 世界其他地区

第六章 竞争形势

- 公司简介

- API Technologies Corp.

- Vectron International(Microchip Technology Inc.)

- AVX Corporation

- Boston Piezo-Optics Inc.

- Ceramtec

- CTS Corporation

- TDK Electronics AG

- Honeywell International Inc

- Teledyne Microwave Solutions

- Murata Manufacturing Co., Ltd.

第七章 投资分析

第八章市场的未来

The Surface Acoustic Wave Sensors Market size is estimated at USD 1.03 billion in 2024, and is expected to reach USD 1.83 billion by 2029, growing at a CAGR of 12.29% during the forecast period (2024-2029).

Due to their small size, rugged nature, economical production, stability in operation, and applications across various end-user industries, the surface acoustic wave sensors make them an increasingly adopted sensor technology during the forecast period.

Key Highlights

- Surface acoustic wave (SAW) technology has been significantly adopted across some industry applications, including aerospace, telecommunication, and automotive. The most common use is in electronic components known as SAW filters, a basic radio frequency (RF) circuit component. SAW devices have also been utilized to measure humidity, pressure, and temperature and detect certain chemicals.

- With advancements in the communication sector, SAW and bulk-acoustic-wave (BAW) resonators, filters, oscillators, and delay lines have gained traction. Apart from being passive and wirelessly interrogated, SAW sensors are competitively priced, intrinsically rugged, highly responsive, and intrinsically reliable.

- The automotive, defense, and aerospace industries are also attracting vendors in the market studied in recent years. As these sensors are insensitive to Magnetic Fields, many automotive applications require torque-sensing close to electric motors and solenoids. This is problematic for some other types of sensor technology.

- In the initial phase of COVID-19, the studied market witnessed a disruption in the supply chain owing to a nationwide lockdown and closure of many manufacturing capacities. However, after Q2 2020, the market started witnessing a recovery in demand and in production, the trend of the semiconductor industry was also reflected in the studied market. However, trends like electric vehicles and mandating safety features in automotive are increasing the per vehicle semiconductor content, which will help the SAW sensors demand to overcome the impact in the coming months.

- Researchers specializing in SAW sensors are actively seeking opportunities to partner with non-destructive testing solution providers in a bid to check the feasibility and ultimately open new application areas for these sensors. For instance, in partnership with NYIT's School of Engineering and Computing Sciences, the NDT solution provider for the aerospace and defense industry, X-Wave Innovations Inc., announced to work for NASA to develop an embedded sensor system capable of measuring temperature, pressure, and other stimuli affecting rocket propulsion engine systems. The project was also awarded funding of over USD 125,000 by NASA.

Surface Acoustic Wave Sensors Market Trends

Healthcare Segment is Expected to Grow at a Significant Rate

- The ongoing demands for low-cost sensor adaptability with flexible substrates, which are also capable of wireless monitoring, are driving the need for SAW sensors in the Healthcare industry. Biosensing application is one of the most common SAW technology applications in the healthcare industry, increasing its adoption in Point of Care (POC) testing and analysis devices for a particular disease.

- The healthcare and the biomedical sectors are increasingly investing in biosensors and MEMS due to the increasing requirement for rapid, compact, accurate, and portable diagnostic sensing systems. SAW sensors are useful for devices used for cancer cell detection, electrocardiogram (ECG), biopotential monitoring biosensors, heart attack monitoring, blood glucose monitoring, and the development of wearable biosensors.

- Another promising application is monitoring chest sounds in neonatal care units where the miniature SAW sensors minimize discomfort for newborns. The increasing adoption and development of hand-held monitoring devices are also expanding the scope of SAW sensor adoption.

- In recent years, SAW sensors have been increasingly used for detecting multiple high-profile bacteria viruses, including Ebola, HIV, Sin Nombre, and Anthrax. The recent COVID-19 pandemic has also motivated many SAW manufacturers to target this application.

- For instance, in August 2022, engineers at the Massachusetts Institute of Technology (MIT) developed a new category of wireless wearable skin-like sensors for health monitoring. The new sensor is an ultrathin semiconductor film made of a piezoelectric substance that adheres to the skin, sensing the vibrations of the body, and will be called 'e-skin.' Such initiatives by various organizations are expected to contribute to the increase in demand growth for SAW sensors in the healthcare market.

- Similarly, the increase in the demand for wireless and remote monitoring systems in the healthcare market owing to the spread of COVID-19 is also expected to contribute to the market growth.

North America Region is Expected to Witness Significant Growth

- The United States is one of the major markets for surface acoustic wave sensors in the North American region, followed by Canada. The North American market is expected to witness an increase in the demand for SAW sensors owing to the applications in the safety-related mandates for the automobile industry in the region.

- With the increasing technological advancements in the North American region, many industries are expected to take advantage of these sensors. The rapid surge in demand for these sensors is also due to multiple applications in various industries, including automotive, aerospace, healthcare, consumer electronics, and the industrial sector.

- Moreover, the regional market is also growing owing to the various innovative research and development activities undertaken by the government and research institutions. Market scenarios like the recent COVID-19 pandemic have further fueled the support and demand for these research activities.

- Moreover, the North American region is also one of the most technologically advanced application markets for these sensors owing to the presence of many prominent system suppliers, sensor manufacturers, and large semiconductor companies. The enormous size of the region, the affluence of its consumers, and the highly competitive nature of the medical equipment manufacturers make this region a lucrative market for surface acoustic wave sensor manufacturers.

- Further, semiconductor industry participants are also trying different ways to benefit from the anticipated MEMS demand. The market is expected to constitute IDMs and established fabless companies that would outsource some of their technologies in the future. The market has been witnessing several developments and expansion activities related to the field by various players to stay ahead of the competition.

- For instance, in December 2021, Microchip Technology Inc. announced a significant expansion of its Gallium Nitride (GaN) Radio Frequency (RF) power device portfolio with new MMICs and discrete transistors that cover frequencies up to 20 gigahertz (GHz). The company's SAW sensors and microelectromechanical systems (MEMS) oscillators and highly integrated modules combine microcontrollers (MCUs) with RF transceivers (Wi-Fi MCUs) that support major short-range wireless communications protocols from Bluetooth and Wi-Fi to LoRa design.

Surface Acoustic Wave Sensors Industry Overview

The Surface Acoustic Wave Sensors Market is moderately competitive owing to the presence of many small and large players operating in the domestic as well as the international markets. The market appears to be moderately concentrated, with the key players adopting strategies like product innovation and mergers and acquisitions.

- August 2022 - The next generation of McLaren Applied's cutting-edge torque system that uses Transense's SAW (Surface Acoustic Wave) technology has been successfully delivered to one of their leading motorsport clients, who will mandate the part across all entrants. The new torque sensor is a non-contact measurement device based on Transense's SAW technology which uses small sensors, is lightweight, robust, and provides accurate wireless measurement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Wireless and Passive Nature of Sensors

- 4.2.2 Low Manufacturing Cost

- 4.3 Market Restraints

- 4.3.1 Compatibility and Installation Issues

- 4.3.2 Limitations in Liquid Sensing

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sensing Type

- 5.1.1 Pressure Sensors

- 5.1.2 Torque Sensors

- 5.1.3 Temperature Sensors

- 5.1.4 Humidity Sensors

- 5.1.5 Chemical Sensors

- 5.1.6 Other Sensors

- 5.2 End-User Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Consumer Electronics

- 5.2.4 Healthcare

- 5.2.5 Industrial

- 5.2.6 Other End-User Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 API Technologies Corp.

- 6.1.2 Vectron International (Microchip Technology Inc.)

- 6.1.3 AVX Corporation

- 6.1.4 Boston Piezo-Optics Inc.

- 6.1.5 Ceramtec

- 6.1.6 CTS Corporation

- 6.1.7 TDK Electronics AG

- 6.1.8 Honeywell International Inc

- 6.1.9 Teledyne Microwave Solutions

- 6.1.10 Murata Manufacturing Co., Ltd.