|

市场调查报告书

商品编码

1432575

邻二甲苯:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Ortho-Xylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

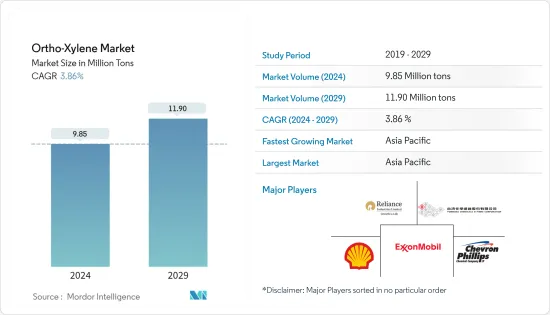

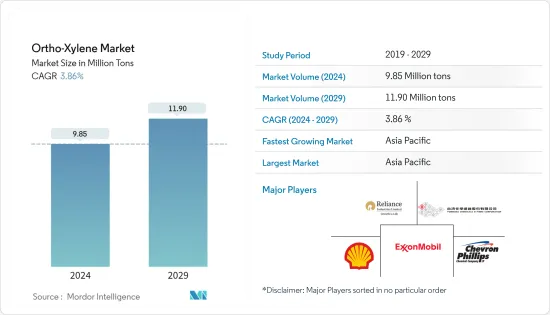

预计2024年邻二甲苯市场规模为985万吨,预计2029年将达到1,190万吨,在预测期间(2024-2029年)复合年增长率为3.86%。

推动市场的主要因素是邻二甲苯作为PVC生产中间体的需求不断增加,以及邻二甲苯在油漆和黏剂生产中的广泛使用。

主要亮点

- 邻二甲苯的负面神经影响以及在邻苯二甲酐(PA)生产中使用萘预计将阻碍市场成长。

- 亚太地区主导了全球市场,其中中国和印度等国家的消费量最高。

邻二甲苯市场趋势

邻苯二甲酐(PA)主导市场

- 邻苯二甲酐是工业蒽醌的重要原料。它也用于生产许多浴染剂以及茜素和茜素衍生物。也可直接用于萤光素、伊红和罗丹明染料。

- 有几种酯是由邻苯二甲酐製成的,主要用作塑胶工业中的塑化剂。也用于生产醇酸树脂、乙醛树脂、树脂树脂、邻苯二甲酸二辛酯、聚乙烯树脂等。

- 随着对邻苯二甲酐的需求不断增加,对替代原料的寻找正在加紧进行。精製大量供应的邻二甲苯似乎是最适合的。

- 邻二甲苯作为生产邻苯二甲酐的原料具有多种优点。邻二甲苯氧化允许比萘氧化更简单的输送系统,因为邻二甲苯是液体。

- 邻二甲苯氧化所需空气的理论量仅为萘氧化所需量的三分之二。反应过程中放出的热量比萘少121大卡。产品纯度高,理论产率也比萘高。此外,邻二甲苯在常温下是液体,允许更简单的输送系统。

- 因此,随着邻苯二甲酐需求的增加,预测期内邻二甲苯的消费量可能会增加。

亚太地区主导市场

- 在亚太地区,中国是GDP最大的经济体。邻二甲苯主要比例用于生产邻邻苯二甲酐,邻苯二甲酸酐用于生产邻苯二甲酸类PVC塑化剂。中国是塑化剂最大的单一市场,占全球消费量的40%以上。

- PVC广泛应用于汽车工业。 PVC 的热塑性特性使其比金属重量更轻。与其他製造方法相比,它的成本也较低。非常适合外饰件和汽车内装件。 PVC 是外部零件的首选,因为它重量轻、耐用、易于成型且具有吸引人的外观。

- 透过使用 PVC 代替替代材料,零件的整体成本可降低 20-60%。 PVC 製成的汽车零件包括仪錶面板、地板覆盖物、挡泥板、密封件、遮阳帽和岩石防护。

- 中国自2009年以来一直是全球最大的汽车製造国,目前产量份额约为29.06%。

- 由于国内需求下降以及汽车製造商向其他国家渗透,2018年产量下降4.2%。由于需求仍在增加,预计下降是暂时的。

- 因此,由于上述因素,邻苯二甲酐的消费量较高。这可能会增加预测期内对邻二甲苯的需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 作为 PVC 生产中间体的需求不断增加

- 邻二甲苯在油漆和黏剂工业的广泛使用

- 抑制因素

- 邻二甲苯的神经系统不良反应

- 萘在邻苯二甲酐(PA) 生产中的用途

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 目的

- 邻苯二甲酐

- 杀菌剂

- 大豆除草剂

- 润滑油添加剂

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- China Petroleum & Chemical Corporation

- Exxon Mobil Corporation

- Flint Hills Resources

- Formosa Chemicals and Fibre Corporation

- KP Chemical Corp.

- Nouri Petrochemical Company

- Reliance industries Ltd

- Royal Dutch Shell PLC

- SK Global Chemical Co. Ltd

第七章 市场机会及未来趋势

The Ortho-Xylene Market size is estimated at 9.85 Million tons in 2024, and is expected to reach 11.90 Million tons by 2029, growing at a CAGR of 3.86% during the forecast period (2024-2029).

The major factors driving the market studied are the increasing demand for ortho-xylene as an intermediate for PVC production, and extensive usage of ortho-xylene in the production of paints and adhesive.

Key Highlights

- Detrimental neurological effects of ortho-xylene and usage of naphthalene for the production of phthalic anhydride (PA) areexpected to hinder the growth of the market studied.

- Asia-Pacific dominated the global market, with the largest consumption recorded from the countries, such as China and India.

Ortho-Xylene Market Trends

Phthalic Anhydride (PA) to Dominate the Market

- Phthalic anhydride is industrially an important raw material for the production of anthraquinone. Itis also used in the manufacture of many vat dyes, as well as in alizarin and alizarin derivatives. It is used directly for the fluorescein, eosin, and rhodamine dyes.

- Several esters are made from phthalic anhydride, and are largely used in the plastics industry, as plasticizers. It is also used to manufacture alkyd resins, the glyptal and rezyl resins, dioctyl phthalate, and the poly-vinyl resins.

- The ever-increasing demand for phthalic anhydride has stimulated a search for alternative raw materials. Ortho-xylene, which is available in abundant quantities from the petroleum refineries, appears to be the most suitable.

- O-xylene has several advantages as a raw material for the production of phthalic anhydride. The oxidation of o-xylene permits a simpler feed system than that of the oxidation of naphthalene, due tothe liquid state of o-xylene.

- The theoretical amount of air required for oxidizing o-xylene is only two-thirdof the amount required for the oxidation of naphthalene. The heat emitted off during the reaction is 121 kcal less than that of naphthalene. The product is of higher purity, and the theoretical yield percentage is higher than that of naphthalene. Furthermore, as o-xylene is a liquid at ordinary temperature, its use permits a simpler feed system.

- Thus, with increasing demand for phthalic anhydrade, the consumption of o-xylene is likely to increase during the forecast period.

Asia-Pacific to Dominate the Market

- In the Asia-Pacific region, China is the largest economy in terms of GDP. The major proportion of ortho-xylene is used in the manufacture of phthalic anhydride that is used in the production of phthalate-based PVC plasticizers. China is the single largest market for plasticizers, with more than 40% of the global consumption. Some of the manufacturers of PVC in the country are Shin-Etsu Chemical Co. Limited, Xinjiang Zhongtai Chemical Co. Ltd, Lubrizol, Hanwha Chemical, Formosa Plastics, etc.

- PVC is widely used in the automotive industry. PVC's thermoplastic properties have lesser weight compared to metals. It has a lower cost of manufacturing methods compared to the cost of other methods. It is an ideal choice for exterior and automotive interior parts. PVC is favored for exterior parts, owing to its light weight, durability, easily shapeable quality, and attractive appearance.

- The overall cost of a component can be brought down to 20-60%, by using PVC instead of alternative materials. Some of the automotive components made with PVC include instrument panels, floor coverings, mud flaps, seals, sun visors, and anti-stone damage protection.

- China is by far the largest automotive manufacturer in the world, since 2009, with a current share of production of about 29.06%.

- The production decreased by 4.2% in 2018, owing to the decrease in domestic demand and penetration of automotive manufacturers to other countries. The decline is expected to be temporary, as the demand is still increasing.

- Therefore, owing to the aforementioned factors, the consumption of phthalic anhydride is high. This may lead to an increase in demand for ortho-xylene, during the forecast period.

Ortho-Xylene Industry Overview

The ortho-xylene market is fragmented in nature. The major companies includeRoyal Dutch Shell PLC,Reliance Industries Limited,China Petroleum & Chemical Corporation, andExxon Mobil Corporation, and Formosa Chemicals & Fibre Corp.among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand as an Intermediate for PVC Production

- 4.1.2 Extensive Usage of Ortho-xylene in Paints and Adhesive Industries

- 4.2 Restraints

- 4.2.1 Detrimental Neurological Effects of Ortho-xylene

- 4.2.2 Usage of Naphthalene for the Production of Phthalic Anhydride (PA)

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Phthalic Anhydride

- 5.1.2 Bactericides

- 5.1.3 Soybean Herbicides

- 5.1.4 Lube Oil Additives

- 5.1.5 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East & Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East & Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 China Petroleum & Chemical Corporation

- 6.4.2 Exxon Mobil Corporation

- 6.4.3 Flint Hills Resources

- 6.4.4 Formosa Chemicals and Fibre Corporation

- 6.4.5 KP Chemical Corp.

- 6.4.6 Nouri Petrochemical Company

- 6.4.7 Reliance industries Ltd

- 6.4.8 Royal Dutch Shell PLC

- 6.4.9 SK Global Chemical Co. Ltd