|

市场调查报告书

商品编码

1432578

汽车零件镁压铸件:市场占有率分析、产业趋势、成长预测(2024-2029)Automotive Parts Magnesium Die Casting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

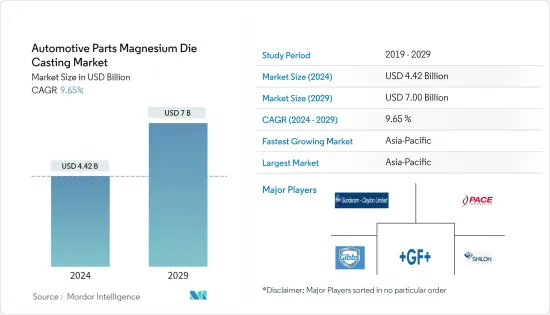

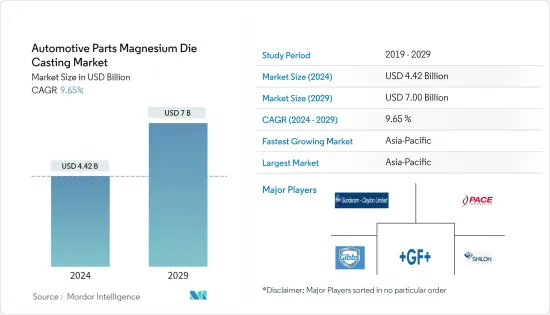

汽车零件镁压铸件市场规模预计到2024年为44.2亿美元,预计到2029年将达到70亿美元,在预测期内(2024-2029年)复合年增长率为9.65%。 。

COVID-19大流行阻碍了2020年的重点市场,主要是由于汽车销售和产量的下降。 2020年全球汽车销量较2019年下降16%。各主要汽车生产国降幅均显着,从11%降至近40%。欧洲产量几乎占全球产量的 22%。然而,疫情后的汽车产业在2020年却呈现出显着的成长。预计在预测期内,汽车销售的整体成长和电动车销售的成长将主要推动市场。

由于使用轻质汽车材料来製造关键零件,从而提高了车辆的燃油效率,轻量化汽车在汽车製造商中越来越受欢迎。此外,减轻汽车重量必须在不影响品质或性能之前安全性的前提下进行。

随着世界各地严格废气法规的颁布,该市场预计将显着成长。消费者对轻型汽车的趋势日益增长,预计将推动镁和碳纤维增强塑料等轻质部件渗透到汽车零件中,从而提振市场。

主要製造业正在投资新型镁合金和高效能製造技术的研发活动。例如,印度马德拉斯理工学院、美国研究实验室和北德克萨斯大学联合开发了一种新型镁合金,可在汽车工业中取代铝和钢合金,并提高汽车燃油效率。

增加对製造过程自动化的投资可能标誌着市场的显着成长。镁压铸製造流程的高成本很可能会阻碍汽车零件镁压铸市场的发展。

汽车零件镁压铸件市场趋势

压力压铸占市场主导地位

对电动车的偏好不断增加,消费者偏好不断变化,迫使汽车製造商用镁等合金製成的较轻零件取代较重的零件。

主要汽车製造商在后视镜外壳、转向柱、驾驶座安全气囊外壳、座椅框架和仪表板盖等应用中使用镁合金。提高电池效率和燃料效率的不断增长的趋势以及对提高性能的需求正在推动人们对高压压铸镁合金的兴趣。这些合金具有优异的机械性能和所有结构金属中最高的强度重量比。

此外,製造电动车的公司也积极采购高压压铸机并采用该技术来满足不断增长的消费者需求。

该地区提供汽车压铸件的一些主要企业包括 OEFORM Limited、CNM Tech、Dalian Yaming Automotive Parts 和 LC Rapid。一些公司专注于升级其产品组合,而另一些公司则专注于扩大其製造设施并透过合作来确立自己的市场主要企业。

预计亚太地区将在预测期内主导市场

亚太地区拥有大量的製造业,很可能为汽车零件镁压铸市场提供良好的机会。该地区中小型製造业的快速扩张可能预示着市场的显着成长。全部区域汽车产量的增加可能会增加对镁压铸零件的需求,进而显示市场的显着成长。

由于更严格的排放法规,全部区域对电动车的需求不断增加,汽车製造商正在寻求将轻质部件整合到车辆中。中国是压铸件主要生产国之一,占亚太地区压铸件市场占有率60%以上。中国金属铸造业拥有26,000多台设备,其中8,000多台生产有色铸件。我国铸造产量超过4,930万吨。先进且高效的自动压铸机支撑着国家的金属压铸需求。快速成长的国际汽车工业对中国镁压铸市场有着巨大的需求。预计这将在预测期内推动中国市场的成长。

印度政府正专注于发展「印度製造」来发展汽车工业,严格的排放法规正在推动该国汽车零件镁压铸市场的发展。汽车工业消耗的铸件占全国产量的35%。在印度,由于经济放缓、燃油成本上涨和保险费上涨等多种原因,小客车销售量正在下降。不过,儘管面临油门法规审查、NBFC危机等诸多压力,商用车整体销售仍达到27.28%的稳健成长。

最新的法规结构「中国6」于2016年推出,第一阶段「中国6a」将于2020年7月生效,第二阶段计画于2023年7月生效。监管标准的变化对于确定该地区汽车市场的动态至关重要。环境保护部 (MEP) 保存在中国註册的每辆新车的排放气体性能标准记录。因此,在预测期内,亚太地区汽车零件镁压铸市场可能会显着成长。

汽车零件镁压铸件产业概况

全球汽车零件镁压铸市场由来自全球新兴和已开发地区的中小型企业主导。 Georg Fischer Automotive、Ryobi Die Casting、Shiloh Industries、Pace Industries等大公司占据全球市场30%以上的份额。

全球汽车製造商和汽车零件製造公司之间的併购数量不断增加,显示市场的显着成长。主要产业正在投资轻量化零件的研发设施,以提高车辆的燃油效率。例如,2022 年 5 月,GF、沙夫豪森和 Bocar 集团旗下子公司 GF Casting Solutions 签署了一项协议,在全球提供专业产品和服务。此次合作协助开发和投资新技术和服务,为北美、欧洲和亚洲的客户提供支援。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 生产流程

- 压力铸造

- 真空压铸

- 重力铸造

- 挤压铸造

- 目的

- 身体部位

- 引擎零件

- 传动部件

- 其他用途

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Chicago White Metal Casting Inc.

- Sandhar Group

- Georg Fischer AG

- Gibbs Die Casting Group

- Magic Precision Ltd.

- Meridian Lightweight Technologies Inc.

- Morimura Bros Ltd.

- Tadir-Gan Group(Ortal Ltd)

- Pace Industries

- Shiloh Industries Inc.

- Sundaram-Clayton Ltd.

- Twin City Die Castings Co.

- Dynacast(Form Technologies Inc.)

- Ryobi Limited

第七章 市场机会及未来趋势

The Automotive Parts Magnesium Die Casting Market size is estimated at USD 4.42 billion in 2024, and is expected to reach USD 7 billion by 2029, growing at a CAGR of 9.65% during the forecast period (2024-2029).

The COVID-19 pandemic hampered the market in focus for the year 2020, primarily attributed to decline in vehicle sales and production. The global vehicle sale declined by 16% in 2020 as compared to the 2019 vehicle sales. All main vehicle-producing countries had major declines, ranging from 11% to almost 40%. Europe represented an almost 22% share of global production. However, post-pandemic the automotive industry witnessed significant growth for the year 2020. The overall increase in vehicle sales and expected increase in electric vehicle sales is anticipated to primarily drive the market during the forecast period.

Lightweight vehicles are gaining popularity among vehicle manufacturers owing to an enhanced fuel economy of automobiles with adoption of lightweight automotive materials manufacturing crucial parts. Additionally, the light-weighting of vehicles must be done without compromising on safety before quality and performance.

An enactment of stringent emission norms across the globe is liekly to witness significant growth for the market. Rising consumer trend towards light weight vehicle is likely to increase the penetration of light weight parts such as magnesium and carbon fiber reinforced plastic, to manufacture vehicle components, which in turn is anticipated to boost the market.

Major manufacturing industries are investing in research and development activities regarding new magnesium alloys and efficient manufacturing techniques. For instance, the Indian Institute of Technology, Madras, the US Army Research Laboratory, and the University of North Texas developed a new magnesium alloy that can replace aluminum and steel alloys in the automotive industry and increase the fuel efficiency of vehicles.

Growing investment in automation of manufacturing process is likely to witness major growth for the market. High cost of magnessium die casting manufacturing process is liekly to hamper the automotive parts magnesium die casting market.

Automotive Parts Magnesium Die Casting Market Trends

Pressure Die Casting dominating the market

Rise in demand for electric vehicles and a shift in consumer preferences have pushed vehicle manufacturer to replace heavier components with lightweight which are manufactured from alloys like Magnesium.

Major vehicle manufcturer use magnesium alloy for applications like mirror housings, steering columns, driver's airbag casings, seat frames, and dash encasings. Growing trend towards greater battery and fuel efficiency, along with demand for improved performance, has driven an increased interest in high-pressure die cast magnesium alloys. These alloys have an excellent combination of mechanical properties and the highest strength to weight ratio of any structural metal.

In addition, the companies manufacturing EV are also actively procuring pressure diecasting machines and are adopting this technology to make themselves ready for growing consumer demand.

Some of the key players offering automotive pressure die casting components in the region include OEFORM Limited, CNM Tech, Dalian Yaming Automotive Parts Co. Ltd, LC Rapid, and others. While some players focusing on upgrading their portfolio others focus on the manufacturing plants expansion, collaborations, etc. to pitch themselves as top players in the market. For instance,

- In February 2021, Nantong Jiangzhong Photoelectricity Co., Ltd. Installed its Italpresse gauss TF5700 high pressure die casting (HPDC) machine at the company's base in Jiangsu province, China. With its huge 3500 x 3500mm plates, the TF5700's closing force of 5700 tons making it the ideal solution for large part production. Jiangzhong has also purchased a Westomat 3100 from StrikoWestofen to integrate seamlessly with the machine.

Asia-Pacific Projected to Dominate the Market During the Forecast Period

Asia Pacific has major presence of manufacturing industries which is likely to create an opprtunity for automotive parts magnesium die casting market. Rapid expansion of small and medium manufacturing industries across the region is likely to witness major growth for the market. Rise in vehicle production across the region is likely to increase the demand for magnesium die casting parts which in turn is likely to witness major growth for the market.

Rise in demand for electric vehicle across the region owing to an enactment of stringent emission norms is prmpting vehicle manufacturer to integrate lightweight parts in vehicle. China is one of the major producers of die casting parts and accounts for more than 60% of the regional (Asia-Pacific) die casting market share. The metal casting industry in China has more than 26,000 facilities, out of which 8,000 facilities produce non-ferrous castings. The country produces over 49.3 million metric tons of castings. The advanced and efficient automatic die casting machines supported the demand for metal die castings in the country. The Chinese magnesium die casting market experiences high demand from the automotive industry, which is rapidly growing at the international level. This is expected to drive the Chinese market's growth over the forecast period.

The Government of India focus on Make in India, developing the automotive industry, and the stringent emission norms are driving the market for automotive parts magnesium die casting in the country. The castings consumed by the automotive sector accounted for 35% of the country's production. India witnessed a declining trend in passenger vehicle sales, owing to numerous reasons, such as economic slowdown, rise in fuel, and insurance costs. However, despite numerous pressures, such as revised axel norms and NBFC crisis, the overall commercial vehicle sales increased and showcased a robust 27.28% growth.

The latest regulatory framework, the China 6, which was introduced in 2016 and the first stage China 6a came into effect from July 2020 and the second stage is planned for July 2023. The change in the regulatory standards that have been crucial in determining the dynamics of the automotive market in the region. The Ministry of Environmental Protection (MEP), has been maintaining the record of emission performance standard for each new vehicle registered in. This is likely to witness major growth for the automotive part magnesium die casting market across the Asia-Pacific during the forecast period.

Automotive Parts Magnesium Die Casting Industry Overview

The global automotive parts magnesium die casting market isdomnaitng by regional small- and medium-scale players across both developing and developed countries around the world. Major recognized players, such as Georg Fischer Automotive, Ryobi Die Casting, Shiloh Industries, and Pace Industries, accounted for over 30% of the overall global market share.

Growing merger and acquisition between vehicle manufacturer and automotive parts manufacturing companies across the globe is witnessing major growth for the market. Major industries investing on research and development facilities on the light weight parts to enhance vehicle fuel efficiency. For instance,

- In May 2022, GF Casting Solutions, a division of GF, Schaffhausen and the Bocar Group have signed an agreement to offer a specialized range of products and services worldwide. The collabration helped to develop and invest in new technologies and services to support customers in North America, Europe and Asia.

- In January 2022, Koch Enterprises, Inc. has announced the acquisition of Amprod Holdings, LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porters Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Production Process

- 5.1.1 Pressure Die Casting

- 5.1.2 Vacuum Die Casting

- 5.1.3 Gravity Die Casting

- 5.1.4 Squeeze Die Casting

- 5.2 Application

- 5.2.1 Body Parts

- 5.2.2 Engine Parts

- 5.2.3 Transmission Parts

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Chicago White Metal Casting Inc.

- 6.2.2 Sandhar Group

- 6.2.3 Georg Fischer AG

- 6.2.4 Gibbs Die Casting Group

- 6.2.5 Magic Precision Ltd.

- 6.2.6 Meridian Lightweight Technologies Inc.

- 6.2.7 Morimura Bros Ltd.

- 6.2.8 Tadir-Gan Group (Ortal Ltd)

- 6.2.9 Pace Industries

- 6.2.10 Shiloh Industries Inc.

- 6.2.11 Sundaram-Clayton Ltd.

- 6.2.12 Twin City Die Castings Co.

- 6.2.13 Dynacast (Form Technologies Inc.)

- 6.2.14 Ryobi Limited