|

市场调查报告书

商品编码

1432582

汽车照明:市场占有率分析、产业趋势、成长预测(2024-2029)Automotive Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

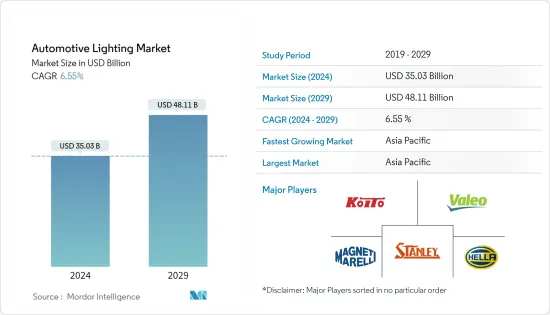

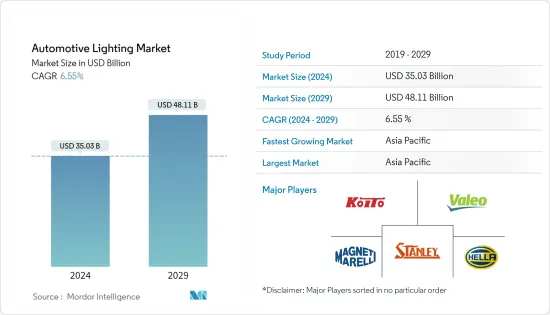

汽车照明市场规模预计到2024年为350.3亿美元,预计到2029年将达到481.1亿美元,在预测期内(2024-2029年)复合年增长率为6.55%。

全球汽车和 SUV 销量自 2017 年约 9,435 万辆的峰值以来一直在下降,并将于 2020 年降至略低于 7,700 万辆。在全球经济放缓和各主要经济体出现冠状病毒大流行的背景下,预计该行业将进入下行趋势。

汽车製造商对将 LED 灯整合到他们的车辆中表现出极大的兴趣,因为它们比卤素灯或 HID 灯消耗更少的电力并且具有更长的使用寿命。此外,LED 灯耐用、坚固,并具有高品质发光二极体,优于所有其他照明技术。

汽车製造商正在开发新的照明技术,并专注于车头灯等关键照明零件。我们建立合作伙伴关係以在市场竞争中获得优势。车头灯是为夜间驾驶提供安全环境的主要因素。例如,大众汽车与海拉合作开发了IQ.LIGHT LED头灯。新款途锐豪华级 SUV 配备 IQ.LIGHT-LED 矩阵头灯,配备 256 个 LED。

汽车照明市场趋势

对车内舒适性和豪华功能的需求不断增长

汽车产业正处于一场以新技术与传统汽车製造融合为特征的技术革命之中。随着电动车的日益流行,汽车照明製造商正在开发新的照明技术来取代传统的旧照明。电动车製造商正在推出具有最佳内装的新车型。例如,2020年9月,Lucid Motors推出了Lucid Air,这是一款豪华电动轿车,基于Lucid独特的空间概念理念,提供全尺寸豪华级内装。

未来室内照明的发展将主要由安全、通讯、舒适和造型需求所驱动。光投影、智慧 LED、微型 LED、智慧功能表面、雷射照明、按需 3D 光图案的引导材料以及具有隐藏照明效果的区域背光是一些新的照明技术。

机舱灯越来越受欢迎。主要包括阅读灯和仪表板灯。车内灯具有多种应用,包括阅读灯、车内环境照明系统以及采用最佳化导光技术的车顶模组。此外,儘管需求低于 LED 灯,但自我调整照明系统正呈现正成长率。

亚太地区推动汽车照明市场

从地区来看,汽车照明市场以亚太地区为主导,其次是欧洲和北美。推动这些地区市场成长的关键因素是:

- 豪华车的需求和销售增加

- 汽车产量增加

- 由于物流业(主要是由于该地区电子商务行业的成长)和建筑业的成长,商用车的销售和需求增加

- 由于中阶消费者可支配收入增加,低价汽车销售增加

- 事故数量增加,尤其是在夜间

欧洲被认为是实施车辆安全标准的领先地区,重点关注乘客和行人的安全。本土汽车製造商和汽车零件供应商持续投资安全技术研发。随着汽车产业技术的快速进步,欧洲地区有望在全球汽车照明市场中发挥重要作用。该地区拥有许多主要製造商,包括 Hella KGaA Hueck &Co.、飞利浦、OSRAM Licht AG、法雷奥、Zizala、罗伯特博世和 ZKW。

汽车照明产业概况

汽车照明市场相当整合,主要企业包括 Koito Manufacturing、法雷奥集团、Magneti Marelli、Stanley Electric、Hella、Lumax Industries、Zizila Lichtsysteme、Osram 和 Tungsram。公司正在建立合资企业并扩大其全球影响力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场挑战

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按车型

- 小客车

- 商用车

- 按应用程式类型

- 室内照明

- 环境照明

- 脚坑灯

- 顶灯

- 引导照明

- 外部照明

- 头灯

- 雾灯

- 尾灯

- 日间行车灯 (DRL)

- 桨灯

- 高位煞车灯

- 室内照明

- 依技术

- 卤素

- 氙

- LED

- 其他技术

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 巴西

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他国家

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Koito Manufacturing Co. Ltd

- Stanley Electric Co. Ltd

- Valeo Group

- Magneti Marelli SpA

- HELLA KGaA Hueck & Co.

- Tungsram

- Hyundai Mobis

- Lumax Industries

- Osram

- Philips

- Zizala Lichtsysteme

第七章 市场机会及未来趋势

The Automotive Lighting Market size is estimated at USD 35.03 billion in 2024, and is expected to reach USD 48.11 billion by 2029, growing at a CAGR of 6.55% during the forecast period (2024-2029).

Global sales of cars and SUVs fell to just under 77 million units in 2020, down from a peak of almost 94.35 million units in 2017. The sector is projected to experience a downward trend on the back of a slowing global economy and the advent of the coronavirus pandemic in all key economies.

Vehicle manufacturers are showing great interest in integrating LED lights in vehicles, as these lights consume less power and have a longer life when compared to halogen and HID lights. Furthermore, LED lights offer durability and strength, have high-quality light-emitting diodes, and are superior to all other forms of lighting technology.

The automotive manufacturers are developing new lighting technologies and are focusing on the major lighting components, such as headlights. They are entering into partnerships to be ahead in the competition within the market. Headlights are a major factor in providing a safe environment for driving at night. For instance, Volkswagen partnered with Hella to develop IQ.LIGHT LED headlamps. The new luxury-class Touareg SUV uses the IQ.LIGHT-LED Matrix Headlamps and 256 LEDs.

Automotive Lighting Market Trends

Growing Demand for Cabin Comfort and Luxury Features

The automotive industry is in the midst of a technological revolution characterized by the convergence of new technology with traditional car manufacturing. With the increasing trend of electric vehicles, automotive lighting manufacturers are developing new lighting technologies to replace the old traditional lights. Electric vehicle manufacturers are launching new vehicle models with the best cabin interiors. For instance, in September 2020, Lucid Motors launched Lucid Air, a luxurious electric sedan that offers a full-size luxury-class interior, which is based on Lucid's exclusive Space Concept philosophy.

Upcoming interior lighting developments will be mainly driven by safety, communication, comfort, and styling demands. Light projections, smart LEDs, micro-LEDs, smart functional surfaces, laser-based lighting, guiding materials for 3D light patterns on-demand, and area backlighting with hidden-until-lit effects are some of the new lighting technologies.

Cabin lights are gaining popularity. They mainly include reading lights and dashboard lights. Interior lights include various applications in the form of reading lamps, ambient interior lighting systems, and roof modules with optimized light guide technology. Additionally, the adaptive lighting system is seeing a positive growth rate, although their demands remain much smaller than LED lights.

Asia-Pacific is Leading the Automotive Lighting Market

Geographically, the automotive lighting market is led by the Asia-Pacific region, followed by the European and North American regions. Some of the major factors driving the growth of the markets in these regions are -

- An increase in the demand for and the sales of luxury cars.

- An increase in the production of vehicles.

- An increase in the sales of and demand for commercial vehicles, owing to the growing logistics industry (primarily due to the propelling e-commerce sector in the region) and the construction industry.

- A rise in the sales of low-cost vehicles, due to an increase in the disposable incomes of middle-class consumers.

- An increase in the number of accidents, especially during the night.

Europe has been recognized as a major region, focusing on both passengers and pedestrian safety and implementing safety standards for vehicles. The regional automotive manufacturers and the automotive component suppliers have been continually investing in the R&D of safety technologies. With rapid technological advancements in the automotive industry, the European region is expected to play a major role in the global automotive lighting market. The region is home to numerous major manufacturers, such as Hella KGaA Hueck & Co., Philips, OSRAM Licht AG, Valeo, Zizala, Robert Bosch, and ZKW.

Automotive Lighting Industry Overview

The automotive lighting market is fairly consolidated with key players such as Koito Manufacturing, Valeo Group, Magneti Marelli, Stanley Electric, Hella, Lumax Industries, Zizila Lichtsysteme, Osram, and Tungsram. Companies are entering into joint ventures and are expanding their global presence. For instance,

- Valeo announced the acquisition of 10.5% of the stake in Aledia, a technology startup company dedicated to the development of cutting-edge LED technology for general and automotive lighting.

- Koito Automotive inaugurated the Hubei Koito Automotive Lamp Co. Ltd plant in China.

- ZKW started the production of the world's first laser-beam headlamps for the BMW i8.

- In 2017, Osram India launched a new automotive lighting solution called Rallye, which is compatible with two-wheelers, four-wheelers, and other commercial vehicles. The product is being manufactured in Osram's manufacturing plants in Germany and China.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Challenges

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Application Type

- 5.2.1 Interior Lighting

- 5.2.1.1 Ambient Lighting

- 5.2.1.2 Footwell Lights

- 5.2.1.3 Roof Lights

- 5.2.1.4 Boot Lights

- 5.2.2 Exterior Lighting

- 5.2.2.1 Headlamps

- 5.2.2.2 Fog Lamps

- 5.2.2.3 Taillights

- 5.2.2.4 Daytime Running Lights (DRLs)

- 5.2.2.5 Puddle Lamps

- 5.2.2.6 High Mounted Stop Lamp

- 5.2.1 Interior Lighting

- 5.3 By Technology

- 5.3.1 Halogen

- 5.3.2 Xenon

- 5.3.3 LED

- 5.3.4 Other Technologies

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 United Arab Emirates

- 5.4.4.4 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Koito Manufacturing Co. Ltd

- 6.2.2 Stanley Electric Co. Ltd

- 6.2.3 Valeo Group

- 6.2.4 Magneti Marelli SpA

- 6.2.5 HELLA KGaA Hueck & Co.

- 6.2.6 Tungsram

- 6.2.7 Hyundai Mobis

- 6.2.8 Lumax Industries

- 6.2.9 Osram

- 6.2.10 Philips

- 6.2.11 Zizala Lichtsysteme