|

市场调查报告书

商品编码

1432645

蒸馏包装:市场占有率分析、产业趋势、成长预测(2024-2029)Retort Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

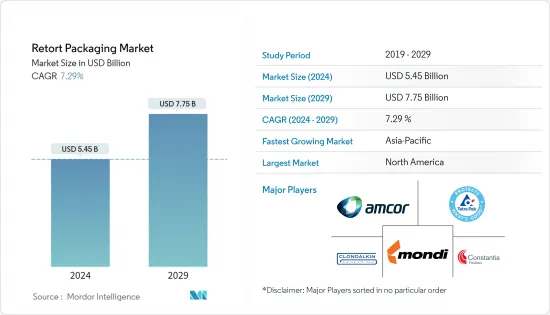

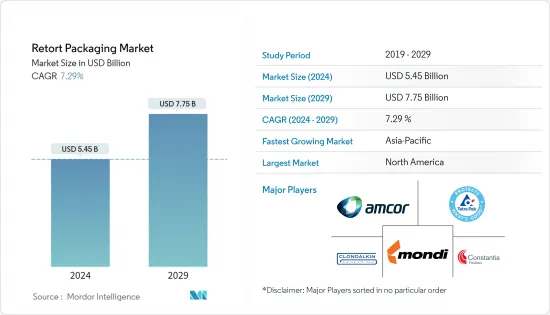

蒸馏包装市场规模预计2024年为54.5亿美元,预计到2029年将达到77.5亿美元,在预测期内(2024-2029年)复合年增长率为7.29%增长。

主要亮点

- 由于多种原因,包括生活方式的改变、工作时间长和都市化加快,对即食食品的需求不断增加。许多顾客正在寻找快速、简单的用餐选择,可以在几分钟内完成而不牺牲味道或品质。对于想要节省时间和精力的忙碌消费者来说,已烹调用餐提供了一个简单明了的答案。随着许多消费者选择蒸馏包装选项,蒸煮包装已扩展到袋装和托盘产品。据软包装协会称,蒸馏拉绳和袋子约占全球所有食品包装的 60%。

- 美国人口普查局报告称,2022 年 9 月至 2022 年 12 月期间,美国食品和饮料月度零售额有所增长。 2022年9月的售价为782.16亿美元。 2022年12月,其价值达到惊人的884.32亿美元。预计这一趋势将在未来几年持续下去。因此,由于市场零售需求逐渐增加,蒸馏包装的需求预计在预测期内将会扩大。

- 消费者最初不愿支付高价购买宠物的心理正在逐渐让位于宠物人性化和敏感性增加等趋势,收养率的迅速上升就证明了这一点。我是。由于软包装技术在零售、製药、食品和饮料以及宠物食品等各个领域的广泛使用,杀菌袋在世界各地变得越来越受欢迎。

- 然而,蒸馏包装产业的主要问题之一是蒸馏包装材料的製造成本高。蒸馏包装由塑胶、铝和其他材料製成,使其耐用且能够承受高温。然而,这些材料的价格以及製造它们所需的专用机械和生产方法增加了製造价格。由于蒸馏包装的成本较高,对于资源有限的中小型企业来说,采用该技术可能很困难。为了解决成本问题,製造商正在寻找使蒸馏包装过程更加高效且更具成本效益的方法。

- 由于冠状病毒 -19 供应链感染疾病和先前的封锁,纸板在全球范围内变得越来越难找到。基于此,2020年纸包装开始涨价,价格还在上涨。此后,这些问题进一步恶化,俄罗斯对乌克兰形势的干预导致造纸原物料价格升至创纪录水平。多国对俄罗斯实施经济制裁,导致大宗商品价格上涨、供应链中断,并因俄乌战争而对多个世界市场造成影响。俄罗斯和乌克兰之间的衝突不仅显着改变了贸易格局,也严重影响了人们的生活和生存手段。能源成本和石油价格上涨正在推高全球供应链中塑胶树脂的价格。然而,聚合物产业因2022年俄罗斯入侵乌克兰而占据主导地位。市场供应商面临的主要挑战是石油和天然气价格波动导致国内市场原料成本波动。

蒸馏包装市场趋势

饮料增速显着

- 软包装解决方案(例如蒸馏包装)在减少废弃物方面发挥重要作用,并使线上品牌能够创新其包装并改善电子商务体验。在饮料领域,由于易于处理以及生产和出货成本降低,对蒸馏包装的需求正在增加。

- 杀菌袋软质包装是一种由耐热层压塑胶製成的软包装,在确保减少饮料和产品废弃物的同时,在帮助线上品牌创新包装以改善电子商务体验方面发挥关键作用。

- 轻质包装材料对于饮料尤其是袋装至关重要。改良的袋设计扩大了其用途,并促使更多消费者购买果汁食品、营养补充、代餐奶昔、纤维补充品和冷压果汁。

- 然而,饮料品质受到 pH 值、储存温度、压力和污染物存在的影响。杀菌袋包装无需使用防腐剂即可对饮料进行灭菌,从而保持 pH 值在 4.0 至 7.0 之间的饮料产品的品质和安全性。公司越来越多地采用具有阻隔性(耐热、防潮和抗菌)和消除氧化可能性等特性的包装产品。

- 消费者对健康和保健的意识越来越强。从早晨果汁到能量饮料,消费者现在在符合健康趋势的提神产品上花费更多。这使得饮料行业对具有成本效益的包装解决方案产生了很高的需求。

- 英国国家统计局的数据显示,2022 年第一季消费者在食品和非酒精饮料上的支出超过 290 亿英镑(352.6 亿美元)。 2019 年第一季家庭金额约 270 亿英镑(328 亿美元)。消费者支出的增加可能会推动蒸馏饮料销售和产量的增加,这可能会增加对包装材料的需求。对蒸馏饮料包装不断增长的需求使该行业的公司有可能提高製造能力并生产尖端的包装解决方案。

预计北美将占据重要市场占有率

- 城市人口的增加、工作生活的繁忙、单人家庭的增加以及人口购买力的提高正在推动现成产品的增长,这些产品通常采用自立式杀菌袋,从而成为重要的推动力。杀菌袋的成长,也给了我力量。行业。

- 蒸馏包装作为一种方便、便携的包装解决方案正在迅速普及。与传统的硬质包装相比,这个国家的许多消费者更喜欢灵活的立式袋。在过去的十年中,消费者对休閒食品、饮料、婴儿食品、工业油和润滑油等产品的立式袋的需求急剧增加。

- 在美国,卫生与公共服务部负责监管人类和动物消费的食品、药品和营养补充。这是透过美国食品药物管理局(FDA) 或美国农业部 (USDA) 完成的。用于蒸馏包装的法规在最高温度下非常严格,并要求材料和工艺符合 FDA 法规 21 CFR 177.1390。

- 许多行业,包括零售、製药、食品饮料和宠物食品,都越来越多地采用软包装技术,加拿大正在推广杀菌袋的使用。

- 在这个国家,大约 75% 的食品供应来自包装食品和加工食品。饮食习惯也发生了变化,中国增加了即食、超加工食品的消费量,这些食品通常富含脂肪、糖和钠,而且能量密集。这些食品主要包装在杀菌袋,因为这是包装需要长期储存的食品的有效技术。

蒸馏包装产业概述

蒸馏包装市场竞争激烈,由多家大公司组成。从市场占有率来看,目前很少大公司占据市场主导地位。然而,凭藉创新和永续的包装,许多公司正在透过赢得新合约和开拓新市场来扩大其市场份额。

2022 年 6 月,斯道拉恩索和利乐合作开发饮料纸盒回收解决方案。斯道拉恩索比利时朗格布鲁日工厂回收工厂的设计是联合可行性研究的一部分。每年约有 75,000 吨饮料纸盒抵达比荷卢市场。其中 70% 以上已被收集用于回收。

2022 年 4 月,ProAmpac 推出了其标誌性的 ProActive PCR杀菌袋。 ProActive PCR杀菌袋用于包装宠物和人类食品,并已获得 FDA 和 EU核准,可用于蒸馏应用中的食品接触。为了减少包装中原始树脂的使用,ProActive PCR杀菌袋含有超过 30 重量%的 PCR 含量。此外,这些发明的袋子符合英国(UK) 塑胶包装税 (PPT) 标准。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- COVID-19 对产业的影响

- 市场驱动因素

- 对轻质紧凑包装材料的需求不断增长

- 包装食品产业的永续发展

- 市场挑战

- 增加资本投入和原物料回收问题

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按包装类型

- 小袋

- 纸盒

- 托盘

- 其他类型

- 按材质

- 聚丙烯

- 聚酯纤维

- 铝箔

- 纸板

- 尼龙

- 食品级铸塑聚丙烯

- 其他材料

- 按最终用户材料

- 食品

- 饮料

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 公司简介

- Amcor PLC

- Constantia Flexibles

- Clifton Packaging Group Limited

- Clondalkin Industries BV

- Coveris Holdings SA

- Flair Flexible Packaging Corporation

- Mondi PLC

- Tetra Pak International SA

- Proampac LLC

- Sonoco Product Company

- Winpak Ltd

- Sealed Air Corporation

第七章 投资分析

第八章 市场未来展望

The Retort Packaging Market size is estimated at USD 5.45 billion in 2024, and is expected to reach USD 7.75 billion by 2029, growing at a CAGR of 7.29% during the forecast period (2024-2029).

Key Highlights

- There is a rising demand for ready-to-eat meals as a result of a number of causes, including changing lifestyles, long workdays, and increased urbanization. Many customers are searching for quick and simple meal options that can be made in a matter of minutes without compromising on taste or quality. For consumers who are busy and want to save time and effort, ready meals provide an easy, simple answer. Retort packaging has expanded due to products in pouches and trays since many consumers choose packaging options for on-the-go consumption. Retorting purses and bags makeup about 60% of all food packaging worldwide, according to the Flexible Packaging Association.

- The US Census Bureau reports that from September 2022 to December 2022, there was a rise in the monthly retail sales of food and drink in the US. In September 2022, the sale was valued at USD 78,216 million. In December 2022, it was worth an astounding USD 88,432 million. In the coming years, it is anticipated that this tendency will continue. Retort packaging demand is therefore anticipated to expand during the projection period as a result of the market's progressive increase in retail sales demand.

- Consumers' initial hesitation of overpaying for pets is progressively giving way to trends like pet humanization and sensitization, which are clearly shown in the sharp increase in adoption rates. Retort pouches are becoming more and more popular all over the world as a result of the expanding use of flexible packaging techniques in a variety of sectors, including retail, pharmaceutical, food and beverage, and pet food.

- However, one key difficulty in the retort packaging industry is the high cost of manufacturing retort packaging materials. Retort packaging is strong and able to survive high temperatures since it is comprised of plastic, aluminium, and other materials. However, the price of these materials and the need for specialized machinery and production methods to create them drive up manufacturing prices. Adopting this technique may be challenging for small enterprises with tight resources due to the high cost of retort packing. Manufacturers are searching for ways to improve the efficiency and cost-effectiveness of the retort packaging process to meet cost issues.

- Due to COVID-19 supply chain issues and earlier lockdowns, finding paper boards has grown increasingly challenging on a global scale. In light of this, a hike in the price of paper packaging began in 2020 and is still in force today. Since then, these problems have gotten worse, and because of Russia's interference in the Ukrainian situation, the price of raw paper materials has increased to record levels. Economic sanctions imposed on Russia by a number of countries have caused a rise in commodity prices, interruptions in the supply chain, and effects on several global markets as a result of the war between Russia and Ukraine. The conflict between Russia and Ukraine has had a profound effect on people's life and means of subsistence, as well as greatly altered trade patterns. The price of plastic resins is increasing across the whole global supply chain as a result of rising energy costs and oil prices. However, the polymer industry was dominated by Russia's invasion of Ukraine in 2022. A major challenge for market vendors is the varying cost of raw materials on the domestic market as a result of fluctuations in the price of oil and gas.

Retort Packaging Market Trends

Beverages to Witness Significant Growth Rate

- Flexible packaging solutions, such as retort packaging, play a crucial role in reducing waste and allows online brands to innovate their packaging to enhance the e-commerce experience. There is a high demand for retort packaging in the beverage sector due to factors such as ease of handling and reduced production and shipment costs.

- Made from heat-resistant laminated plastic, retort pouch packaging, a form of flexible packaging, plays a crucial role in ensuring the reduction of beverage and product waste while allowing online brands to innovate their packaging to enhance the e-commerce experience simultaneously.

- Lightweight packaging material is essential for beverages, particularly in pouches. The improving designs of pouches increased their applications, attracting more consumers to purchase fruit drinks, nutraceuticals, meal replacement shakes, fibre supplements, and cold-pressed juices.

- However, the quality of beverages is affected by pH, storage temperature, pressure, and contaminants' presence. Retort pouch packaging sterilizes beverages by preserving the quality and safety of beverage products with pH levels between 4.0 and 7.0 without using preservatives. Companies are increasingly employing packaging products with properties such as barrier resistance (to heat, moisture, and bacteria) and to eliminate possible oxidation.

- Consumers are becoming increasingly conscious of health and wellness. From juice in the morning to energy drinks, consumers now are spending more on products that provide refreshments that are well within the wellness trend. This has created a high demand for cost-effective packaging solutions in the beverage segment.

- In the first quarter of 2022, consumer spending on food and non-alcoholic drinks amounted to over GBP 29 billion (USD 35.26 billion), according to the Office for National Statistics (UK). The amount of money spent by households in the first quarter of 2019 was around GBP 27 billion (USD 32.8 billion). Increased sales and manufacturing of retort drinks might result from rising consumer expenditure, which would increase the need for packaging materials. Companies in this industry may be able to boost their manufacturing capabilities and produce cutting-edge packaging solutions as a result of the rising demand for retort beverage packaging.

North America is Expected to Hold Significant Market Share

- Increased urban population, busy work life, growing single households, and increasing spending power of the population have boosted the growth of readymade, which are normally packaged in stand-up retort pouches, thereby also acting as key drivers for the growth of the retort pouch industry.

- Retort packaging has been rapidly gaining popularity, as it is a highly convenient and portable packaging solution. Many shoppers in the country prefer flexible, stand-up pouches over traditional, rigid packaging. Consumers have driven demand for stand-up pouches exponentially over the past decade, whether for snack food, beverage, baby food, or industrial oils and lubricants.

- In the United States, the Department of Health and Human Services regulates food, pharmaceutical, and nutraceutical products consumed by humans and animals. This is done through either the Food and Drug Administration (FDA) or the US Department of Agriculture (USDA). The regulation used for retort packages is quite demanding under the highest temperatures and requires the materials and processes to be listed under FDA regulation 21 CFR 177.1390.

- The growing adoption of flexible packaging techniques across numerous industries, including retail, pharmaceutical, food and beverage, and pet food, is propelling the use of retort pouches in Canada.

- In the country, about 75% of the food supply comes from packaged, processed food items. Also, there is a change in eating habits, and the country is witnessing an increase in consumption of ultra-processed, ready-to-consume foods, which are typically energy-dense with high fat, sugar, and sodium content. These food are mostly packed in retort pouches as it provides an effective technique for packaging food products that require extended shelf life.

Retort Packaging Industry Overview

The retort packaging market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many companies are increasing their market presence by securing new contracts and by tapping new markets.

In June 2022, Stora Enso and Tetra Pak joined forces on a beverage carton recycling solution. A design for a recycling plant at Stora Enso's Langerbrugge location in Belgium is part of the joint feasibility study. The Benelux market receives around 75,000 tonnes of beverage cartons annually. More than 70% of these have already been collected for recycling.

In April 2022, ProAmpac introduced its distinctive ProActive PCR Retort pouches. ProActive PCR Retort pouches are made for packaging pet and human food, and they are both FDA and EU-approved for food contact in retort applications. In order to reduce the usage of virgin resins in the packaging, ProActive PCR Retort pouches have a 30-weight percentage or higher PCR content. Additionally, these inventive pouches are Plastics Packaging Tax (PPT) compliant for the United Kingdom (UK).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growing Demand for Lightweight and Compact Packaging Materials

- 4.3.2 Sustained Growth in the Packaged Food Industry

- 4.4 Market Challenges

- 4.4.1 Higher Capital Investments and Raw Material Recycling Issues

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Packaging Type

- 5.1.1 Pouches

- 5.1.2 Cartons

- 5.1.3 Trays

- 5.1.4 Other Types

- 5.2 By Material

- 5.2.1 Polypropylene

- 5.2.2 Polyester

- 5.2.3 Aluminum Foil

- 5.2.4 Paper Board

- 5.2.5 Nylon

- 5.2.6 Food Grade Cast Polypropylene

- 5.2.7 Other Materials

- 5.3 By End-User Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Other End-User Industry

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Italy

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 Argentina

- 5.4.4.4 Rest of Latin America

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Constantia Flexibles

- 6.1.3 Clifton Packaging Group Limited

- 6.1.4 Clondalkin Industries BV

- 6.1.5 Coveris Holdings SA

- 6.1.6 Flair Flexible Packaging Corporation

- 6.1.7 Mondi PLC

- 6.1.8 Tetra Pak International SA

- 6.1.9 Proampac LLC

- 6.1.10 Sonoco Product Company

- 6.1.11 Winpak Ltd

- 6.1.12 Sealed Air Corporation