|

市场调查报告书

商品编码

1640504

3D 扫描:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)3D Scanning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

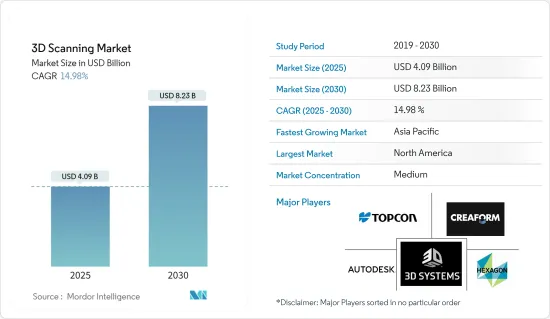

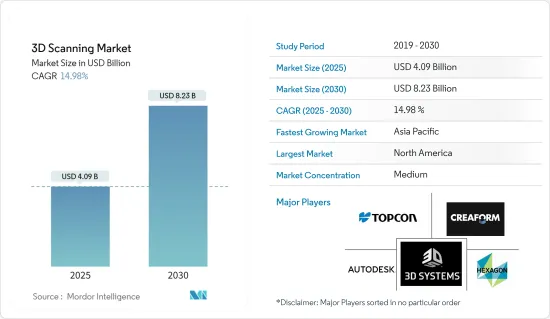

3D扫描市场在2025年的价值估计为40.9亿美元,预计到2030年将达到82.3亿美元,在市场估计和预测期(2025-2030年)内复合年增长率为14.98%。

虽然 3D 扫描技术尚未进入住宅或个人环境,但这些设备已广泛应用于娱乐和媒体等行业,用于製作电玩游戏和影片。这些设备广泛用于其他工业应用,包括建筑、航太、医疗保健和汽车,可用于现场零件生产。 3D扫描器是应用主导创新的一部分。

主要亮点

- 3D 扫描技术在商业应用中已广泛应用。此外,该技术具有客製化灵活性,能够满足不同行业的专业需求,从而得到了主要终端用户行业的广泛采用。

- 此外,3D 扫描器也用于建设产业,以 3D 比例创建大量建筑结构。在建筑业,3D 扫描仪可协助博物馆保存和存檔历史建筑。该技术的可定制性和扩充性使製造商在构建和开发先进的军事和防御系统时可以依靠它来获得测量的准确性和速度,3D扫描仪有助于准确测量武器和巡防舰。

- 此外,预测期内,全球建筑和基础设施活动的增加可能会推动对 3D 扫描的需求。据印度基础设施基金会称,政府已拨款 1,305.7 亿美元用于加强印度基础设施部门,为该产业带来了巨大的推动作用。此外,印度计划未来五年透过国家基础设施管道投资1.4兆美元用于基础建设。

- 在医学领域,3D扫描仪用于对身体部位进行3D并製作矫正器具。它还可以促进创伤治疗和护理并产生身体植入。 3D 扫描仪广泛被医疗保健和医疗专业人员用于创建客自订矫正器具解决方案、背部支架、人体工学义肢、人工植牙、测量等。

- 此外,老年人口的不断增长预计将推动医疗产业对先进技术的需求。根据美国消化系统疾病负担报告显示,美国每年进行胃肠道内视镜检查超过2000万例,而美国每年进行内视镜检查的人数为7500万例。此外,根据美国癌症协会的数据,预计2023年美国将新增238,340总合肺癌和支气管癌病例。

- 此外,各行业也越来越多采用3D列印技术也是推动3D列印机应用的主要因素之一。随着3D列印机的普及,对3D扫描系统的需求也将同时增加,进而推动市场成长。随着各行各业的公司开始将 3D 列印技术用于快速原型製作以外的其他用途,3D 列印很可能即将达到这个曲折点。

- 3D扫描作为一种非接触式技术,已在COVID-19胸部扫描中发挥了作用。这次呼吸道疾病的爆发促使人们使用 3D 扫描技术作为检测和量化 COVID-19 病毒的有用工具。

3D 扫描市场趋势

按硬体类型分類的结构光扫描器推动市场成长

- 结构光 3D 扫描器是一种 3D 扫描设备,它使用单一光源将多条线投射到物体上,透过一个或多个摄影机进行跟踪,以测量物体的3D形状。这与雷射扫描器形成对比,雷射扫描器会连续将各种雷射点照射到物体上。

- 物体的逆向工程以创建 CAD资料、工程部件的体积测量、扩增实境游戏的运动和环境捕捉、时尚零售的身体测量、高速生产线的自动光学检测、无人机的障碍物检测结构光扫描仪正在积极部署于成像系统等应用领域。

- 手持式 3D 扫描器具有速度快、无需设定时间等特点,方便整合。因此,几种用于 3D 列印的手持式 3D 扫描器采用了结构光技术。该技术透过将光图案投射到被扫描的物体上来进行空间三角测量。

- 工业领域对机器人技术的日益广泛应用可能会支持 3D 扫描市场的成长。结构光 3D 扫描器由视讯投影机和多个摄影机组成。 3D 扫描器可安装在机械臂上并自动围绕物体移动,从各个角度进行 3D 扫描。这些扫描仪能够快速产生具有最精细解析度和最高精度的表面扫描,精确到几微米的范围。

- 然而,这种扫描器的一个显着缺点是它对特定环境的照明条件很敏感,这在户外工作时是一个显着的问题。

北美占主要份额

- 美国是全球最重要、最具影响力的 3D 扫描市场之一,主要涉及医疗保健、航太和国防、建筑和工程、3D 数位公司、研究和教育、娱乐和媒体等行业。最发达市场。

- 3D 扫描为艺术家开启了无限的可能性,让他们能够将最疯狂的想法变成现实。例如,美国媒体和娱乐 (M&E) 市场占全球动画 &E 行业的 33%,是美国动画最大的 M&E 市场。 M&E 市场。在 3D 扫描出现之前,许多特技和视觉效果很难甚至不可能实现。

- 政府也正在投资帮助加拿大的创新产业在全球扩张。例如,2022年8月,联邦政府宣布将向29家出版、电视和电玩公司投资1,120万美元,进一步支持市场成长。

- 加拿大非常重视民众的医疗保健,因此政府在医疗保健方面的支出占加拿大国内生产毛额的10%以上,是已开发国家中最高的比例。同时,对整形外科、义肢和截肢的需求不断增加,这推动了新型 3D 扫描仪和扫描技术的发展。

3D 扫描行业概况

3D扫描市场比较分散。整体来看,现有竞争对手之间的竞争非常激烈。大公司和小公司的新产品创新策略正在推动 3D 扫描市场的发展。该领域的一些主要发展包括:

- 2023 年 4 月-Shining 3D 推出新型多功能 3D 扫描器 FreeScan Combo。 FreeScanCombo 将 FreeScan 系列的计量精度、精细扫描和高精度与更轻、更紧凑的设计相结合。它配备26+7+1条蓝色雷射线和红外线扫描模式。这些扫描器用于逆向工程、计量级检查和其他应用等扫描场景。

- 2023 年 3 月-Capture 3D 推出 ZEISS T-Scan Hawk 2。这款轻型手持式 3D 扫描仪由蔡司在德国开发和製造,具有红色雷射标记器,可实现完美的距离控制,具有新型卫星模式、GOM Inspect 3D 检测软体和超尺度校准。 ZEISS T-SCAN Hawk 2 也经过了符合最高业界标准的验收测试。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 航太和汽车产业对 3D 计量的需求庞大

- 3D 列印机在医疗保健领域重组手术的应用不断扩大

- 市场挑战

- 高解析度 3D 扫描器越来越贵

第六章 市场细分

- 按类型

- 硬体

- 光学扫描仪

- 结构光扫描仪

- 雷射扫描仪

- 其他硬体

- 软体

- 硬体

- 按范围

- 短距离

- 中型

- 远端

- 按应用

- 逆向工程

- 快速原型製作

- 品管/检验

- 脸部和身体扫描

- 工业测量

- 数位建模

- 按行业

- 航太和国防

- 车

- 卫生保健

- 製造业

- 媒体与娱乐

- 建筑和施工

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- 3D Systems Inc.

- CREAFORM Inc.

- GOM GmbH

- Faro Technologies Inc.

- Topcon Corporation

- Maptek Pty Ltd

- Autodesk Inc.

- Artec Inc.

- Hexagon AB

- Trimble Inc.

第八章投资分析

第九章:市场的未来

The 3D Scanning Market size is estimated at USD 4.09 billion in 2025, and is expected to reach USD 8.23 billion by 2030, at a CAGR of 14.98% during the forecast period (2025-2030).

Though 3D scanning technology has not penetrated residential and private settings, these devices are prominently used to produce video games and movies in industries such as entertainment and media. Other industrial applications where these devices are found to be of great use are architecture, construction, aerospace, healthcare, and automotive, among others, where these can be used for onsite parts production. 3D scanners have been a part of the innovations led by applications.

Key Highlights

- 3D scanning technology witnessed considerable adoption from commercial applications. Further, the flexibility of the technology to be customized to meet professional needs in various industries has made it profoundly popular across major end-user industries.

- Furthermore, 3D scanners are used in the construction industry to create a scaled 3D many-building structure. In the architectural industry, these devices help preserve and archive historical monuments from museums. Due to this technology's customizability and scalability, manufacturers rely on measurement accuracy and speed when building and developing advanced military and defense systems, using 3D scanners in making weapons and vehicles, such as frigates.

- Moreover, the growing construction or infrastructure activities across the globe will increase the demand for 3D scanning during the projected timeline. According to IBEF, the government has dramatically pushed the infrastructure sector by allocating USD 130.57 billion to enhance the infrastructure sector in India. Additionally, India plans to spend USD 1.4 trillion on infrastructure through the 'National Infrastructure Pipeline' in the following five years.

- In the medical sector, 3D scanners are used to model body parts in three dimensions, which are used to create prosthetics. It can also facilitate wound healing and care and generate body implants. 3D scanners are widely used by healthcare and medical professionals for creating custom-fit orthotic solutions, back braces, ergonomic prosthetic devices, dental implants, measurements, etc.

- Moreover, the increasing elderly population is expected to boost the demand for advanced technologies in the medical industry. According to the Burden of Digestive Diseases in the United States, it is estimated that more than 20 million GI endoscopies are performed yearly in the United States, whereas a total of 75 million endoscopies are performed in the U.S. every year. Also, as per the American Cancer Society, It is estimated that in 2023 there will be a total of 238,340 new cases of lung and bronchus cancer in the United States.

- Additionally, the rising adoption of 3D printing technology in various industries is one of the major factors thriving the adoption of 3D printers. As the adoption of 3D printers grows, the need for 3D scanning systems will increase simultaneously, driving market growth. 3D printers are experiencing this inflection point, likely because companies across multiple industries are increasingly using 3D printing technologies for more than just rapid prototyping.

- 3D scanning as a non-contact technique helped the thoracic chest scanning for COVID-19. The outbreak of this respiratory disease led to using 3D scanning technology as a useful tool to detect and quantify the COVID-19 virus.

3D Scanning Market Trends

Structured-light Scanner by Hardware Type to Drive the Market Growth

- A structured-light 3D scanner is a 3D scanning device for measuring the three-dimensional shape of an object using a single light source projecting multiple lines on the object being tracked by a camera or multiple cameras. This contrasts a laser scanner, which emits various laser dots on a single object, one after the other.

- Applications, such as reverse engineering of objects to produce CAD data, volume measurement of engineering parts, motion, and environment capture for augmented reality games, body measurements for fashion retailing, automated optical inspection in high-speed manufacturing lines, and obstacle detection systems on unmanned aircraft, have been actively deploying structured light scanners.

- By offering capabilities such as fast and no setup time, handheld 3D scanners conveniently integrate the same. Thus, multiple handheld 3D scanners for 3D printing have been deploying structured light technology. The technology uses trigonometric triangulation by projecting a light pattern onto the object to scan.

- The growing adoption of robots in the industrial sector will support the growth of the 3D scanning market. A structured light 3D scanner consists of a video projector and multiple cameras. The 3D scanner can be attached to a robotic arm, automatically moving around the object and 3D-scans it from all angles. These scanners can perform quick surface scans with the finest resolution in the range of a few microns and the highest accuracy.

- However, a significant downside of this type of scanner is sensitivity to the lighting conditions in a given environment, which poses a significant issue in working outside.

North America to Account for Major Share

- The United States is one of the most significant and consequential 3D scanning markets globally, with healthcare, aerospace and defense, architecture and engineering, 3D Digital Corporation, research and education, entertainment, and media as the significant, largest, and among some of the most advanced.

- 3D scanning opens up boundless possibilities for artists, allowing them to translate their most fantastic ideas into reality. For instance, the US media and entertainment (M&E) market, which is 33% of the global M&E industry, is the largest M&E market in the world, especially 3D animation production in the country, which houses the animation studios such as Disney and Pixar. The technology drives forward the movie industry and video games - many stunts and visual effects would have been difficult or even impossible to bring off before the advent of 3D scanning.

- Furthermore, the government invests in helping Canadian creative industries expand their global reach. For instance, in August 2022, the Federal government announced investing USD 11.2 million into 29 publishing, television, and video game companies, further supporting the market growth.

- Due to Canada's commitment to public access to healthcare, the government spending on healthcare exceeds 10% of Canada's GDP, one of the highest percentages in the developed world, equating to well over USD 5000 in healthcare spending per capita. These, coupled with the increased demand for plastic surgery, prosthetics, amputation, etc., provide new 3D scanners and scanning technologies.

3D Scanning Industry Overview

The 3D scanning market is fragmented. Overall, the competitive rivalry among the existing competitors is high. Large and small companies new product innovation strategy is giving rise to the 3D scanning market. Some of the key developments in the area are:

- April 2023 - Shining 3D introduced its new multifunctional FreeScan Combo 3D scanner. FreeScanCombo adopts metrology-grade accuracy, fine scanning, and high precision from the FreeScan series while providing an even lighter and more compact design. It features 26 + 7 + 1 blue laser lines and an infrared scanning mode. These scanners are used for scanning scenarios such as reverse engineering, metrology-grade inspection, and further applications.

- March 2023 - Capture 3D introduced a ZEISS T-Scan Hawk 2. Developed and produced in Germany by ZEISS, this lightweight handheld 3D scanner includes a red laser marker for perfect distance control, new satellite mode, GOM Inspect 3D inspection software, and hyperscale calibration. The ZEISS T-SCAN Hawk 2 also comes with acceptance testing certified to the highest industry standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Significant Demand for 3D Metrology Across the Aerospace and Automobile Secto

- 5.1.2 Growth in Deployment of 3D Printers for Reconstructive Surgeries in the Healthcare Sector

- 5.2 Market Challenges

- 5.2.1 Significant Price of High-resolution 3D Scanners

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 Optical Scanners

- 6.1.1.2 Structured Light Scanners

- 6.1.1.3 Laser Scanners

- 6.1.1.4 Other Hardware

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By Range

- 6.2.1 Short Range

- 6.2.2 Medium Range

- 6.2.3 Long Range

- 6.3 By Application

- 6.3.1 Reverse Engineering

- 6.3.2 Rapid Prototyping

- 6.3.3 Quality Control/Inspection

- 6.3.4 Face and Body Scanning

- 6.3.5 Industrial Metrology

- 6.3.6 Digital Modeling

- 6.4 By End-user Vertical

- 6.4.1 Aerospace and Defense

- 6.4.2 Automotive

- 6.4.3 Healthcare

- 6.4.4 Manufacturing

- 6.4.5 Media and Entertainment

- 6.4.6 Architecture and Construction

- 6.4.7 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 3D Systems Inc.

- 7.1.2 CREAFORM Inc.

- 7.1.3 GOM GmbH

- 7.1.4 Faro Technologies Inc.

- 7.1.5 Topcon Corporation

- 7.1.6 Maptek Pty Ltd

- 7.1.7 Autodesk Inc.

- 7.1.8 Artec Inc.

- 7.1.9 Hexagon AB

- 7.1.10 Trimble Inc.