|

市场调查报告书

商品编码

1432899

合约包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Contract Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

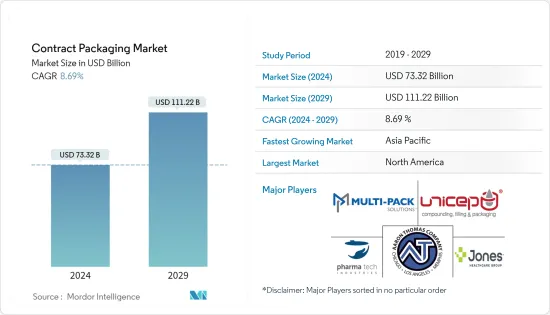

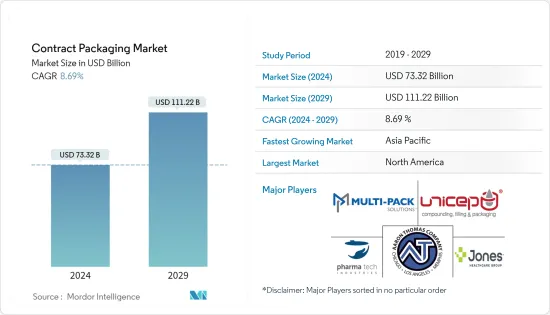

合约包装市场规模预计到 2024 年为 733.2 亿美元,预计到 2029 年将达到 1112.2 亿美元,在预测期内(2024-2029 年)复合年增长率为 8.69%。

随着COVID-19大流行的爆发,合约包装市场呈现巨大的成长。由于隔离和社交距离规范使大多数消费者更喜欢线上购物管道,电子商务市场正在蓬勃发展,公司正在增加包装成本以满足不断增长的需求。我们外包两端或独立服务。

主要亮点

- 然而,疫情影响了各公司的自动化计划,对所研究的市场影响甚微。根据包装和加工技术协会 (PMMI) 的一项研究,大约 67% 的 CPG 公司已搁置其自动化计划。

- 全球合约包装市场的成长主要受到製造公司偏好的影响,这些公司通常将包装任务委託给第三方供应商。这是因为製造商越来越关注成本优化和核心业务。合约包装有几个优点。首先,它降低了製造商的营运成本。在许多情况下,估计透过将包装业务委託给合约包装公司并减少机械和人事费用,营运成本可降低多达7%至9%。

- 其次,包装法规正在迅速发展,尤其是食品和饮料方面。满足这些严格的法规和规范需要多次检查和品质检查。透过外包包装业务,满足这些法规(也称为军用规格包装)的重任由合约包装公司接管,越来越多的製造商选择合约包装而不是内部包装业务。这促使我喜欢它。

- 此外,包装产业发展迅速,许多新产品、新技术不断推出。因此,包装公司需要随时了解情况,以满足不断变化的客户需求。都市化、可支配收入增加以及对方便且易于打开的包装的偏好因素正在塑造市场新趋势。

- 消费者对环境议题的认识不断提高,加上生产商对经济型包装选择的需求,正在推动合约包装商采用地球友善替代品和环保包装设计。此外,永续性和客製化将继续对合约包装市场产生积极影响,其在个人护理、食品和饮料等消费包装商品中的使用在预测期内可能会成长。 2020 年 6 月,CPA、合约包装商和製造商协会以及欧洲包装商协会 (ECPA) 联手提高各自地区对合约包装和契约製造的认识和利用。这为协会成员提供了投资新技术并在业务中实施永续性的机会。

- 供应商也专注于收购和地理扩张,以维持其在市场中的地位,从而导致市场逐步整合。例如,2020 年3 月,总部位于温斯顿塞勒姆的South Atlantic Packaging Co. (SAPC) 是一家提供包装、配套、组装和仓储解决方案的合约包装公司,加入了总部位于佛罗里达州的Versatile Packaging Co., Ltd.。罐子。这是 SAPC 的完美选址。

合约包装市场趋势

医药可望维持强劲成长

- 製药业的进步和研究的发展导致了性能优于前辈的新药的推出。随着对包装药物的需求迅速增加,最近的医学进步以及许多疾病和缺陷的现有药物的补充正在间接推动合约包装市场。

- 各种製药公司现在将最终产品的包装委託给拥有专门从事药品包装的熟练业务的公司。药品包装是至关重要的方面,因为产品必须对患者安全食用。

- 据估计,到年终,近 50 种处方笺的处方药将在北美专利到期,这为合约包装商创造了机会。患者依从性和用药依从性差会导致住院率增加和疾病恶化。製造商对药品安全和保护的持续关注以及政府法规的更新是包装外包要求的因素。根据美国食品药物管理局(FDA) 的规定,药品需要高阻隔的包装材料和密封剂,这些材料和密封剂具有防渗性、耐溶剂、油脂、化学品和耐热性,以提供更好的保护。

- 自2020年2月下旬以来,美国药品製造商因对中国的依赖而面临供不应求的高风险,这种情况可能会持续未来三个月。同时,FDA 已要求美国药品和医疗设备製造商评估和规划 API 采购替代方案。

- 在医疗设备方面,FDA 已对中国各地的 63 家製造商和 72 家工厂进行了认证,并已联繫这些工厂增加基本设备的库存,以避免供应中断时短缺。然而,与这些措施相反,原料药供应製造商 C2 Pharma 认为,美国政府对冠状病毒的反应可能会导致该国药品供应链的重组。

北美地区占比最大

- 由于食品和饮料、药品和美容护理等行业对包装的需求不断增加,北美的合约包装行业正在快速成长。美国和加拿大的各种合约包装公司已经学会适应充满挑战的商业环境。该公司也意识到激烈的全球竞争、成本压力以及OEM的高度可变的需求。这种环境正在显着扩大美国合约包装市场。许多欧洲公司已经在美国投资,包括兰根集团和佩尔森创新公司。

- 由于这种稳定性、不断增长的需求以及製造公司对合约包装供应商的偏好不断变化,美国合约包装市场预计将稳定成长。此外,美国政府制定了有关药品标籤和包装的各种法律和法规。此外,美国政府制定了有关药品标籤和包装的各种法律和法规,这可能会对合约包装的需求产生积极影响,因为该地区的製药公司没有内部包装设施。

- 2020 年 2 月,大型饮料合约製造公司 (BBCM) 宣布在北卡罗来纳州开设一家新的饮料联合包装工厂。 BBCM 的新工厂将从一条每分钟生产 1,200 罐的高速罐头生产线开始,并计划在未来 18 个月内增加第二条和第三条生产线。 BBCM 计划向全国和地区的大型客户提供各种罐装饮料产品。 BBCM计划于2020年第二季末全面运作,第一条生产线已售出80%。

- 2020 年 1 月,MSI Express 在美国HCI Equity Partners 的支持下收购了 Power Packaging。 MSI Express 为耐贮存的人类和宠物食品领域的知名品牌提供合约包装和契约製造服务。透过收购 Power Packaging,MSI Express 进一步扩大了其地理分布、能力和客户关係。收购 Power 也将 MSI Express 扩展到新的食品类别,如粉状饮料、汤底、烘焙混合物、饮料混合物、咖啡和茶、餐饮服务饮料、晚餐套件、义式麵食、米饭、预製食品和沙拉酱。参与。

合约包装产业概述

合约包装市场适度分散,拥有大量国内外供应商。该市场中的公司透过联盟和合併不断扩大其接近性。随着各种老牌公司和中小企业外包活动的成长,调查市场在提供可靠、及时的服务方面正面临着巨大的竞争,而竞争已成为一个市场。总体而言,替代品的威胁是温和的,预计在预测期内将会成长。

- 2020 年 6 月 - Jones Healthcare Group 对其包装服务产品进行了重大投资,包括完全整合的双车道 Uhlmann泡壳包装线。随着临床和商业性更复杂的药物剂型和制度的发展,这种全自动设备提高了我们满足需求激增和独特泡壳组合的能力。

- 2020 年 5 月 - Sharp Corporation(UDG Healthcare PLC) 从 Quality Packaging Specialists International LLC (QPSI) 收购了一家药品包装工厂。该设施占地 160,000 平方英尺,并已获得监管机构的全面核准。我们在多条二级包装线上拥有 12 个主要生产基地,提供初级和二级药品包装,包括装瓶、泡壳加工、管瓶贴标、医疗设备配套以及序列化服务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 寻求透过外包非核心业务来获得竞争优势的公司

- 电商产业需求增加

- 对尖端技术和创新包装的需求不断增长

- 市场限制因素

- 严格的政府法规

- 与内部包装的竞争

- 行业法规和标准

- 合约包装的演变

第六章市场区隔

- 按包装

- 初级包装

- 二次包装

- 三级包装

- 按最终用户产业

- 食品

- 饮料

- 药品

- 家居用品/个人护理

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 荷兰

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Aaron Thomas Company

- Multipack Solutions LLC

- Pharma Tech Industries Inc.

- Reed Lane Inc.

- Sharp Packaging Services

- UNICEP Packaging LLC

- Green Packaging Asia

- Jones Healthcare Group

- Stamar Packaging Inc.

- Budelpack Poortvliet BV

- Complete Co-Packing Services Ltd

第八章投资分析

第9章 未来展望

The Contract Packaging Market size is estimated at USD 73.32 billion in 2024, and is expected to reach USD 111.22 billion by 2029, growing at a CAGR of 8.69% during the forecast period (2024-2029).

With the outbreak of the COVID-19 pandemic, the contract packaging market has witnessed tremendous growth, as the e-commerce market has taken a boom, owing to lockdown and social distancing norms where the majority of the consumers has been preferring online channel for shopping, and companies have been outsourcing their packaging end to end or standalone services to meet the growing demand.

Key Highlights

- However, the pandemic impacted the automation plans for various company, which has some minimalistic effect in the market studied. According to the Association for Packaging and Processing Technologies (PMMI) survey, around 67% of CPG companies have put automation plans on hold than win comparison to 23% of SMEs.

- Growth in the global contract packaging market is mainly influenced by the changing preferences of manufacturing firms, who usually outsource packing activities to third-party players. This is because manufacturers are increasingly focusing on cost optimization and their core business. Contract packaging provides several advantages. Firstly, it reduces the operational costs of the manufacturers. In many cases, it is estimated that the operational costs can be reduced by as much as 7% to 9% through outsourcing packaging activities to contract packagers and the decreasing costs of machines and labor costs.

- Secondly, packaging regulations, especially in the case of food and beverage products, are evolving rapidly. Meeting such stringent rules and norms require several inspection and quality check operations. By outsourcing packaging activities, the hectic task of meeting such regulations (also known as mil-spec packaging) is passed on to the contract packaging agency, motivating more manufacturers to prefer contract package over in-house packaging activities.

- Moreover, the packaging industry is rapidly growing, with many new products and technologies being introduced. Therefore, packaging companies need to stay updated to meet the changing needs of customers. Factors, such as urbanization, increasing disposable incomes, and preference for convenient and easy-to-open packages, shape new trends in the market.

- Raising consumer awareness about environmental concerns, along with the producers' demand for economical packaging options, is impelling contract packagers to adopt earth-friendly alternatives and eco-sensitive package designs. Furthermore, sustainability and customization are likely to continue to positively impact the contract packaging market, leading to growth in use in consumer-packaged goods, such as personal care and food and beverages, over the forecast period. In June 2020, CPA, The Association for Contract Packagers, and Manufacturers and The European CoPackers Association (ECPA) collaborated to increase the awareness and use of the contract packaging and contract manufacturing industry in their respective regions. This presents an opportunity for the members of each organization to invest in new technologies and introduce sustainability into their operations.

- To remain relevant in the market, vendors are also focusing on acquisitions and geographical expansions, due to which the market is gradually consolidating. For instance, in March 2020, South Atlantic Packaging Corp. (SAPC) in Winston-Salem, a contract packaging company that offers to package, kitting, assembly, and warehousing solutions, bought Florida-based Versatile Packagers. It provides an excellent location for SAPC.

Contract Packaging Market Trends

Pharmaceutical is Expected to Hold Significant Growth

- The growth in advancement and research in the pharmaceutical industry has resulted in the introduction of new drugs, with more exceptional performance compared to their predecessors. Recent improvements in medical sciences and additions to medicines already available for numerous diseases and deficiencies drive the contract packaging market, indirectly, as the necessity of packaging the drugs has multiplied rapidly.

- Various pharmaceutical companies are now outsourcing the job of packaging end-products to companies skilled labor specialized in handling the packaging of medicines. The pharmaceutical packaging of drugs is a vital aspect, as the product should be safe for patient's consumption.

- In North America, it is estimated that by the end of 2020, nearly 50 well-known, highly-prescribed drugs will go off-patent, which creates opportunities for contract packagers. Poor patient compliance or medication adherence can lead to increased hospitalization and worsening of the disease. Manufacturers' ongoing focus on drug safety and protection, and the latest government regulations, are the factors for the outsourcing packaging requirements. As per the Food and Drug Administration (FDA) regulations in the United States, pharmaceutical drugs need high barrier packaging materials and sealants that are impermeable and resistant to solvents, grease, chemicals, and heat for better security protection.

- Since late February 2020, U.S. pharmaceutical manufacturers, being dependent on China, have a high risk of supply shortages, which may continue over the next three months. In the meantime, the FDA asked U.S. pharmaceutical and medical device manufacturers to evaluate and plan for API sourcing alternatives.

- Concerning medical devices, FDA recognized 63 manufacturers and 72 facilities across China, which were contacted for essential devices inventory pileup, to avoid shortage in case of a supply disruption. However, contrary to such measures being taken, C2 Pharma, an API supplier outsourcing manufacturer, observed that the U.S. government's coronavirus response could realign the country's pharmaceutical supply chain.

North America to Account for the Largest Share

- The contract packaging sector in North America is rapidly growing due to the increasing demand for packaging in segments, like food and beverages, pharmaceuticals, beauty care, and other sections. Various contract packaging companies in the United States and Canada have learned to adapt to challenging business conditions. The companies are also getting aware regarding the intense global competition, cost pressures, and highly variable demand from OEMs. This environment is significantly increasing the contract packaging market in the United States. Many European companies, such as Langen Group and Persson Innovation, have already invested in the United States.

- Owing to the stability, rising demand, and changing the preference of manufacturing firms toward contract packagers, the U.S. contract packaging market is expected to witness steady growth. Also, the U.S. government has placed various laws and regulations on the labeling and packaging of the drugs. This could create a positive impact on the demand for contract packaging, owing to the inability of an in-house packaging facility for few pharmaceutical companies in this region.

- In February 2020, Big Beverages Contract Manufacturing (BBCM) announced the opening of its new beverage co-packing facility in North Carolina. In their new facility, BBCM will begin with one highspeed can-line capable of producing 1,200 cans per minute with plans to add lines two and three over the next 18 months. BBCM plans to provide a variety of canned beverage products for large national and regional customers. BBCM will be fully operational in late Q2 2020, and its first production line is 80% sold out.

- In January 2020, MSI Express, backed by HCI Equity Partners, which is headquartered in the United States, has acquired Power Packaging. MSI Express is a provider of contract packaging and contract manufacturing services for well-known brands in the shelf-stable human and pet food space. The acquisition of Power Packaging further expands MSI Express's geographical presence, capabilities, and customer relationships. Power also brings MSI Express into new food categories such as powdered beverages, soups and bases, baking mixes, beverage mixes, coffees and teas, foodservice beverages, dinner kits, pasta, rice, side dishes, and salad dressings.

Contract Packaging Industry Overview

The contract packaging market is moderately fragmented, with the presence of many domestic and international vendors. The companies in the market are continually expanding their geographical proximity with the help of partnerships and mergers. With the growth of outsourcing activities among various established players, as well as SMB, the market studied has been witnessing significant competition, in terms of providing reliable and speed of services, making it a competitive market. Overall, the threat of substitutes is moderate and is expected to grow during the forecast period.

- June 2020 - Jones Healthcare Group made a major investment in its packaging services offering which includes a fully integrated two-lane Uhlmann blister packaging line. The fully automated equipment will improve the firm's capacity to manage surges regarding the demand and unique blister combinations, as more complex pharmaceutical dosage forms and regimes are evolving clinically and commercially.

- May 2020 - Sharp (UDG Healthcare PLC) acquired a pharmaceutical packaging facility from Quality Packaging Specialists International LLC (QPSI). The facility covers an area of 160,000 sq. ft and has full regulatory approval. It encompasses 12 primary production sites for multiple secondary packaging lines to offer both primary and secondary pharmaceutical packaging, including bottling, blistering, vial labeling, and medical device kitting, as well as serialization services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Companies Looking to Gain Competitive Advantage by Outsourcing Non-core Operations

- 5.1.2 Increasing Demand from the E-commerce Industry

- 5.1.3 Increasing Need for Latest Technology and Innovative Packaging

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations

- 5.2.2 Competition from In-house Packaging

- 5.3 Industry Regulations and Standards

- 5.4 Evolution of Contract Packaging

6 MARKET SEGMENTATION

- 6.1 By Packaging

- 6.1.1 Primary

- 6.1.2 Secondary

- 6.1.3 Tertiary

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Pharmaceutical

- 6.2.4 Household and Personal Care

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Netherlands

- 6.3.2.5 Italy

- 6.3.2.6 Spain

- 6.3.2.7 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Aaron Thomas Company

- 7.1.2 Multipack Solutions LLC

- 7.1.3 Pharma Tech Industries Inc.

- 7.1.4 Reed Lane Inc.

- 7.1.5 Sharp Packaging Services

- 7.1.6 UNICEP Packaging LLC

- 7.1.7 Green Packaging Asia

- 7.1.8 Jones Healthcare Group

- 7.1.9 Stamar Packaging Inc.

- 7.1.10 Budelpack Poortvliet BV

- 7.1.11 Complete Co-Packing Services Ltd