|

市场调查报告书

商品编码

1432960

资料收集:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Data Acquisition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

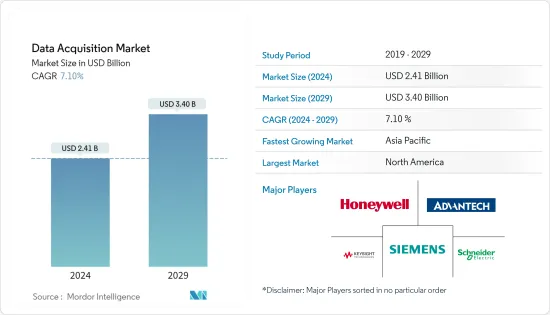

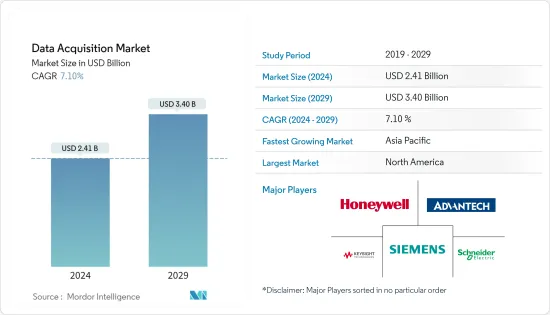

资料收集市场规模预计到 2024 年为 24.1 亿美元,预计到 2029 年将达到 34 亿美元,在预测期内(2024-2029 年)复合年增长率为 7.10%。

资料采集系统在工业领域的即时决策中发挥重要作用。随着公司在生产和营运中朝着资料为中心的方法发展,并保持竞争优势,同时让用户无论身在何处都可以随时访问资料,资料收集系统正在从单纯的处理系统转变为获得自动化的好处。您可以充分利用它。

主要亮点

- 资料收集市场的主要驱动力之一是乙太网路的前景广阔的成长。近年来,工业乙太网的发展速度超过了传统现场汇流排,并且已经超越了现场汇流排。

- 由于更快的互联网速度、工厂设备的无缝整合、物联网的采用以及工业控制需求的不断增长,这种需求正在不断增长。这些趋势有助于推动对资料收集系统的需求。

- 此外,工厂自动化和智慧製造在全球范围内的采用是资料收集市场的关键成长动力。这包括追踪多个系统参数并监控许多资料来源,同时即时交换资料,例如 PLC、资料库、维护应用程式和现有资料采集系统,以提供机器和车间操作的可见性。

- 资料采集系统市场以北美为主,但良好的政府改革、工业自动化的大力实施以及智慧製造的启动将推动欧洲地区的市场,这在预测期内将变得更加重要。获得市场占有率。这一发展预计将得到正在实施下一代工业解决方案的德国和英国经济的支持。

- 此外,电子技术的进步使得廉价的感测和监控能力成为可能。一个名为 Arduino 的开放原始码硬体计划已被用来开发几种用于研究目的的廉价自动感测和资料登录系统以及低成本感测器。这表明未来可能会增加对用于开发先进系统的开放原始码资料采集软体的投资。

- 这场大流行迫使多个行业和企业进行转型,促使市场转向全面监督的业务,并透过精心设计的系统获得更高的远见。最重要的系统已开始实施资料收集系统以提高效率。

资料收集市场的趋势

航太和国防占据主要市场份额

- 高效太空探勘设备的发展增加了对资料收集系统的需求,这些系统可以实现更安全、更好控制的旅程。该领域的新兴企业,例如 SpaceX 和 BlueOrigin,一直致力于建立高效的互连繫统。 2021 年 8 月,SpaceX 收购了卫星资料Start-UpsSwarm Technologies,将 120 颗 SpaceBee 卫星整合到轨道上,推进资料收集工作,并扩展 Starlink 基础设施。

- DDS 用于显示来自 P&V 系统、32 个 IP 摄影机、8 个麦克风和 DAS 观察正在进行的测试的资料。 GUI 互补地用于显示即时进展和检索历史测试资料。三个系统的串联操作使工程师能够重新创建真实场景,并促进完成早期结构测试所需的功能的更详细的模拟。

- 并非所有航太合作都集中在太空探勘。由于感测器和资料分析系统灵敏度的提高,预计空间观测工作将会成长。 2021年7月,Spire World宣布继续参与NASA的商业小型卫星资料收集(CSDA)计划,并签订了600万美元的延期合约。该合约包括任务订单 6,这是一种订阅资料解决方案,可提供无线电掩星 (RO)资料、土壤湿度、精密定轨 (POD)资料、倾斜 GNSS-RO、总电子含量 (TEC)资料和海洋学资料。 (TO6 )包括。采集地面风速GNSS反射率测量资料和磁力计资料。资料将供所有联邦机构、美国太空总署资助的研究人员和所有美国政府资助的研究人员用于科学目的。

- NASA 指出了 Spire资料带来的好处,特别是 GEOS 大气资料同化系统,该系统利用天基资料来分析地球大气并将其整合到地球观测系统中。此外,NASA 使用 Spire资料来研究极地水和海冰水平、行星边界层 (PBL) 高度以及飞行层热层密度的每日变化。

北美目前拥有最大的市场占有率

- 北美资料采集市场成长显着,美国国家仪器公司、是德科技、泰克和西门子等公司占据了超过35%的市场。然而,透过选择正确的硬体和软体,透过工业物联网 (IIoT)架构对智慧製造日益增长的需求正在成为可能。该地区明显采用了更快的生产方式,可提供无错误的结果。

- 平均而言,製造商花了近 80% 的时间来处理架构和资料收集。剩余的20%可用于资料分析,透过实施IIoT减少收集资料所需的时间。这需要该地区主流采用工业物联网。为了建立工业物联网生态系统,供应商正在采取几个步骤。例如,National Instruments 与 Cisco、Intel 等合作建立了 IIoT 实验室。此外,物联网在整个供应链中都很重要。

- 此外,美国是世界上最大的汽车市场之一,拥有超过 13 家主要汽车製造商。汽车製造是该国製造业最大的收益来源之一。

- 工业自动化预计将是推动数据采集系统需求的主要驱动力。人们越来越多地采用不涉及人工干预并严重依赖资料来提供指令的控制流程。因此,一个小小的误导就会为产业带来巨大的损失。

- 高效的资料收集已成为任何车辆的核心组件,以提供车辆运行的准确资料,以确保遵守任何法规并保持对任何操作的监视意识。自从大众汽车排放丑闻以来,使用者需求从可靠性角度出现,而其他系统和系统功能(例如 DCS 和运行监控功能)的合规性已成为优先考虑的事项。

资料采集行业概况

资料收集市场是分散的。市场上经营的大公司透过收购和策略合併来消除竞争对手并提高自己的能力。市场主要企业包括ABB Ltd、Advantech、Agilent Technologies、Campbell Scientific Inc.、Data Translation Inc.、施耐德电气SE、霍尼韦尔国际、西门子股份公司、罗克韦尔自动化公司、MathWorks Corporation、通用电气有限公司、欧姆龙公司、横河电机电气公司、艾默生电气公司

市场的主要发展包括:

- 2021 年 4 月 - 全球客户经验平台 Piano 与 ID5、InfoSum、LiveRamp 和 Usercentrics 合作扩展其第一方资料收集解决方案。它将资料管理、身分和客户旅程编配功能结合在一起,创建一个单一视图,跨一个系统和数位生态系统收集、统一和激活用户资料,以防止资料外洩和广告效果下降,同时改善客户体验。

- 2021 年 4 月 - 自动化外部资料平台 Explorium 宣布推出 Signal Studio,这是一款用于进阶分析和机器学习的资料收集产品。这使得资料和业务分析师团队能够快速找到并整合最相关的外部资料讯号。分析管道。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进因素与市场约束因素介绍

- 市场驱动因素

- 工业乙太网解决方案的采用率不断提高

- 製造现场日益复杂,促使采用资料撷取进行设计检验与测试

- 边缘运算和 TSN 等技术进步

- 市场限制因素

- 主要市场的成本问题和饱和可能会阻碍预测期内的成长

- 价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 分销通路分析(经销商、系统整合商、直销)

- 技术简介

- DAQ连接技术的演变

- 预测采用 TSN 和边缘运算的影响

- 分析向统一平台的转变

第五章市场区隔

- 频道

- 小于 32

- 32-128

- 128 或更多

- 类型

- 硬体

- 软体

- 按最终用户产业

- 水处理/废弃物处理

- 电力/能源

- 车

- 教育/研究

- 航太/国防

- 纸浆

- 化学

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争形势

- 供应商市场占有率分析 - 全球和按地区

- 公司简介

- Advantech Co. Ltd

- Spectris PLC(HBM and Bruel & Kjaer and Omega)

- National Instruments Corporation

- Schneider Electric SE

- ABB Ltd

- Honeywell International

- Siemens AG

- Rockwell Automation Inc.

- Keysight Technologies

- General Electric Ltd

- Omron Corporation

- Yokogawa Electric Co.

- Tektronix

- AMETEK(VTI Instruments)

- Bustec

- Emerson Electric Co.

- Curtiss-Wright Corporation

- DAQ Systems Co, Limited

- Imc Dataworks, LLC

- ADLINK Technology, Inc.

- Beijing GEMOTECH Intelligent Technology

- DATAQ Instruments

第七章 投资分析

- DAQ硬体和软体领域主要供应商的竞争因素和策略

- 主要併购

第八章 市场机会及未来趋势

The Data Acquisition Market size is estimated at USD 2.41 billion in 2024, and is expected to reach USD 3.40 billion by 2029, growing at a CAGR of 7.10% during the forecast period (2024-2029).

Data acquisition systems play an essential role in real-time decision-making in the industrial sector. As companies develop toward a data-centric approach in production and operations to maintain a competitive edge while promoting the users to access the data at any time, irrespective of the location, data acquisition systems have evolved from mere processing systems to the key to achieving the full benefits of automation.

Key Highlights

- One of the primary drivers of the data acquisition market is the promising growth of Ethernet. Industrial Ethernet has grown faster than traditional field buses during the last few years and has overtaken field buses.

- This demand has been augmented by the growing need for faster internet speeds, seamless integration of factory installations, the adoption of IoT, and industrial controls. Such trends have been instrumental in driving the demand for data acquisition systems.

- Moreover, the adoption of factory automation and smart manufacturing across the world is a major growth driver of the data acquisition market. These include tracking multiple system parameters and monitoring many data sources while exchanging data in real-time, including PLCs, databases, maintenance applications, and existing data acquisition systems, to gain greater visibility of the machine and floor operations.

- Although North America dominated the market for data acquisition systems, good government reforms, strong industrial automation adoption, and smart manufacturing initializes are expected to boost the market in the European region to attain a more significant market share over the forecast period. This development is anticipated to be backed by the economies of Germany and the United Kingdom, which are adopting the next generation of industrial solutions.

- Additionally, advances in electronic technologies led to inexpensive sensing and monitoring capabilities. An Open-Source Hardware project called Arduino has been used, along with low-cost sensors, to develop several inexpensive, automated sensing and data logging systems for research purposes. This is suggestive of potential yet increased open-source DAQ software investment for developing the advanced system in the future.

- The pandemic forced a transition for several industries and enterprises and primed the market for a switch into fully monitored operations and the increased prescience obtained through well-designed systems. Most critical systems began implementing data acquisition systems to improve their efficacies.

Data Acquisition Market Trends

Aerospace and Defense Accounts for Significant Share in the Market

- The development of efficient space exploration devices elevates the demand for data acquisition systems that enable safer and better-managed journeys. Startups in the sector, such as SpaceX and BlueOrigin, have been consistent with work in the establishment of efficient, interconnected systems. In August 2021, SpaceX acquired the satellite data startup Swarm Technologies to consolidate their 120 SpaceBee satellites in orbit, furthering their data acquisition initiatives and expanding their star-link infrastructure.

- The DDS was employed to present data from the P&V system, 32 IP cameras, eight microphones, and the DAS to observe the test in progress. GUIs are used complementarily to view real-time progress or retrieve past test data. The tandem operations of the three systems allow engineers to replicate real-world scenarios and encourage more detailed simulation of capabilities needed to complete early-stage structural tests.

- Not all collaborations in aerospace have been dedicated to space exploration. Increasing sensitivity of sensors and data analysis systems have projected the growth of Space Observation initiatives. In July 2021, Spire Global announced the continuation of its participation in NASA's Commercial Small-sat Data Acquisition (CSDA) program with a USD 6 million contract extension. The contract includes Task Order 6 (TO6), a subscription data solution that provides for radio occultation (RO) data, soil moisture, precise orbit determination (POD) data, grazing angle GNSS-RO, total electron content (TEC) data, ocean surface wind speed GNSS-Reflectometry data, and magnetometer data acquisition. The data is made available to all federal agencies, NASA-funded researchers, and all US government-funded researchers for scientific purposes.

- NASA stated the positives that the Spire data has enabled, primarily its GEOS Atmospheric Data Assimilation System, which utilizes space-based data to analyze the earth's atmosphere and integrate it into its earth observation systems. Furthermore, NASA has employed Spire data in research on water and sea ice levels in the polar regions, the Planetary Boundary Layer's height (PBL) height, and the day-to-day variability of thermospheric density at flight level.

North America Presently Holds the Largest Market Share

- The North American market for data acquisition has been growing significantly, with players such as National Instruments, Keysight, Tektronix, and Siemens, accounting for over 35% of the market. However, increasing demand for intelligent manufacturing through Industrial Internet of Things (IIoT) architectures has been made achievable by selecting the appropriate hardware and software. The region is highly depictive of adopting faster means of production with errorless outcomes.

- On average, the manufacturers spent nearly 80% of their time handling the architecture and data acquisition. With the remaining 20% left for data analysis, adopting IIoT can help lower the time spent on data acquisition. This requires a mainstream adoption of IIoT in the region. To build an IIoT ecosystem, the vendors have taken several measures. For instance, National Instruments with Cisco, Intel, and others created an IIoT Lab. Additionally, IoT is significant throughout supply chains.

- Moreover, the United States has been one of the leading automotive markets in the world and is home to over 13 major automobile manufacturers. The automotive manufacturing industry has been one of the largest revenue generators for the country in the manufacturing sector.

- Industrial automation is the primary driving factor expected to drive the demand for DAQ systems. The increasing adoption of controlling processes without human interference relies heavily on data to provide instructions. Hence, any minor misdirection may lead to drastic losses to the industry.

- Efficient data acquisition has become a core component of any vehicle to provide accurate data regarding its working to ensure compliance with any regulation and maintain a sense of oversight over any operations. Since the Volkswagen scandal regarding its emissions, user needs have emerged from a reliability standpoint, and compliance with other systems and system functions, such as DCSs and operation and monitoring functions, has become a priority.

Data Acquisition Industry Overview

The Data Acquisition Market is fragmented. The major companies operating in the market try to eliminate the competition and improve their capabilities utilizing either acquisition or strategic mergers. Some key players in the market include ABB Ltd, Advantech Co. Ltd, Agilent Technologies, Campbell Scientific Inc., Data Translation Inc., Schneider Electric SE, Honeywell International, Siemens AG, Rockwell Automation Inc., MathWorks Corporation, General Electric Ltd, Omron Corporation, Yokogawa Electric Co., and Emerson Electric Co.

Some key developments in the market include:

- April 2021- The global customer experience platform Piano entered into a partnership with ID5, InfoSum, LiveRamp, and Usercentrics to extend its First-Party Data Acquisition solution, that integrates its data management, identity, and customer journey orchestration capabilities and provides one system and one view that collects, unifies and activates user data across the entire digital ecosystem, preventing data leakage and poor ad performance while improving customer experience.

- April 2021 - An automated external data platform, Explorium, announced the launch of its data acquisition product, Signal Studio, for advanced analytics and machine learning that allows the data and business analyst teams to quickly find and integrate the most relevant external data signals into their analytics pipeline.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Growing Adoption of Industrial Ethernet Solutions

- 4.3.2 Increasing Complexity in Manufacturing Establishments is Driving Operators Towards Adoption of DAQ for Design Validation and Testing

- 4.3.3 Technological Advancements Such as Edge Computing and TSN

- 4.4 Market Restraints

- 4.4.1 Cost Implications and Saturation in Key Markets Could Hinder Growth Over the Forecast Period

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Distribution Channel Analysis (Distributors, System Integrators and Direct Sales)

- 4.8 Technology Snapshot

- 4.8.1 Evolution of DAQ Connectivity Technologies

- 4.8.2 Anticipated Impact of the Adoption of TSN and Edge Computing

- 4.8.3 Analysis of the Growing Shift Towards Integrated Platforms

5 MARKET SEGMENTATION

- 5.1 Channel

- 5.1.1 Less than 32

- 5.1.2 32-128

- 5.1.3 Greater than 128

- 5.2 Type

- 5.2.1 Hardware

- 5.2.2 Software

- 5.3 End-User Vertical

- 5.3.1 Water and Waste Treatment

- 5.3.2 Power & Energy

- 5.3.3 Automotive

- 5.3.4 Education and Research

- 5.3.5 Aerospace & Defense

- 5.3.6 Paper and Pulp

- 5.3.7 Chemicals

- 5.3.8 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share Analysis - Global and Regional

- 6.2 Company Profiles

- 6.2.1 Advantech Co. Ltd

- 6.2.2 Spectris PLC (HBM and Bruel & Kjaer and Omega)

- 6.2.3 National Instruments Corporation

- 6.2.4 Schneider Electric SE

- 6.2.5 ABB Ltd

- 6.2.6 Honeywell International

- 6.2.7 Siemens AG

- 6.2.8 Rockwell Automation Inc.

- 6.2.9 Keysight Technologies

- 6.2.10 General Electric Ltd

- 6.2.11 Omron Corporation

- 6.2.12 Yokogawa Electric Co.

- 6.2.13 Tektronix

- 6.2.14 AMETEK (VTI Instruments)

- 6.2.15 Bustec

- 6.2.16 Emerson Electric Co.

- 6.2.17 Curtiss-Wright Corporation

- 6.2.18 DAQ Systems Co, Limited

- 6.2.19 Imc Dataworks, LLC

- 6.2.20 ADLINK Technology, Inc.

- 6.2.21 Beijing GEMOTECH Intelligent Technology

- 6.2.22 DATAQ Instruments

7 INVESTMENT ANALYSIS

- 7.1 Key Competitive Factors and Strategies of Major Vendors in DAQ Hardware and Software Segments

- 7.2 Major Mergers and Acquisitions