|

市场调查报告书

商品编码

1432992

可程式 ASIC:市场占有率分析、产业趋势与统计、成长预测(2024-2029 年)Programmable ASIC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

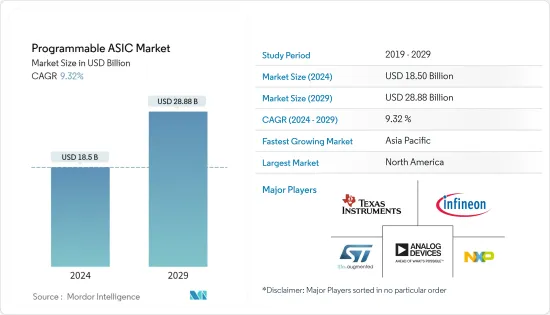

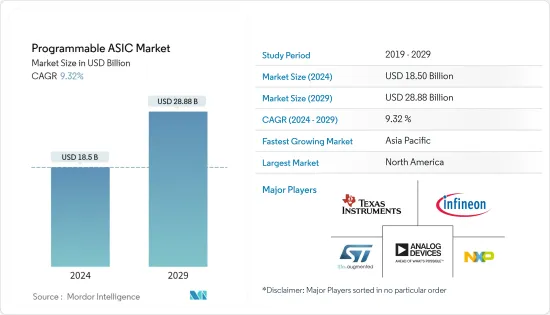

可程式ASIC市场规模预计在2024年为185亿美元,预计到2029年将达到288.8亿美元,在预测期内(2024-2029年)复合年增长率为9.32%,预计将会增长。

全球对智慧型手机、平板电脑和其他行动装置的需求迅速增长,对消费性电子领域对可编程 ASIC 的需求产生了积极影响。

主要亮点

- 新产品开发步伐的加快、每功能成本的降低和 IC 功能的提高以及产品更换週期的缩短正在对市场成长产生积极影响。

- 对各种通讯应用(例如晶片系统(SoC)应用)的需求不断增长,预计将在未来几年增加市场收益。此外,专用积体电路在消费性电子产品以及各种工业和汽车应用中的使用越来越多,预计将进一步提振市场。

- 推动市场的另一个因素是物联网设备的出现。专用积体电路也用于环境监测、汽车排放控制和个人数位助理等应用。专用积体电路可以整合模拟和逻辑功能,使得在单一晶片上形成完整的机製成为可能,预计将推动市场成长。

- 可程式 ASIC 市场的主要限制之一是相关的高设计成本。设计和开发过程需要大量的资源和时间投资,这对中小型企业来说成本过高。例如,采用5奈米製程设计的苹果A14 Bionic晶片的设计和开发成本估计约为4亿美元。

- 在可程式 ASIC 设计中使用第三方智慧财产权 (IP) 可能会导致授权问题和法律纠纷。例如,2020年,英伟达和Arm Holdings因在英伟达产品中使用Arm的智慧财产权而捲入法律纠纷。这场纠纷可能会影响英伟达产品未来的开发和可用性。

- COVID-19 大流行对全球供应链造成了重大干扰,影响了可程式化 ASIC 的生产和交货。疫情导致产品发布延迟,并影响了可编程 ASIC 市场的企业收益。例如,赛灵思因疫情而面临 2020 年 Versal ACAP 产品线延迟上市的情况,影响了其 2021 年的收益。

- 世界各国政府为半导体产业提供支持,以减轻疫情的影响。例如,根据《经济时报》报道,在美国,作为《美国晶片法案》的一部分,政府将在 2021 年提供 520 亿美元资金支持半导体产业。这笔资金预计将支持新兴国家可程式 ASIC 的开发和生产。俄罗斯和乌克兰之间的战争也正在影响整个包装生态系统。

可程式ASIC市场趋势

消费性电子产业需求的成长推动市场

- 製造商正在将人工智慧 (AI)、机器学习 (ML) 和物联网 (IoT) 等最尖端科技融入消费性电子产品中。可程式 ASIC 提供支援这些技术所需的处理能力和弹性,使其成为消费性电子製造商的最佳解决方案。

- 为了最大限度地延长电池寿命,家用电器应消耗尽可能少的电量。可程式 ASIC 旨在消耗更少的功率,使其成为消费性电子设备的理想选择。

- 人工智慧和机器学习在消费性电子产品中变得越来越重要,尤其是智慧型手机和智慧扬声器。可程式 ASIC 提供支援这些技术所需的运算能力,使其成为消费性电子製造商的理想选择。

- 在消费性电子领域,物联网设备的使用正在迅速增加。可程式 ASIC 是希望製造物联网设备的消费性电子製造商的最佳选择,因为它们可以满足物联网设备的连接和处理需求。

亚太地区正在经历高速成长

- 在亚太地区,消费性电子市场不断成长,可程式 ASIC 越来越多地在这些产品中使用。例如,三星在 2021 年宣布开发出全新的可程式 ASIC,用于 5G 装置。这款新处理器可提供更高的资料传输速度和更高的能源效率,使其成为 5G 装置的理想选择。

- 亚太地区汽车产业正在实施 ADAS 等最尖端科技,并需要可编程 ASIC 等高效能运算选项。例如,领先的可程式 ASIC 製造商赛灵思 (Xilinx) 在 2021 年宣布与中国汽车製造商上汽集团合作开发新的 ADAS 平台。该平台利用 Xilinx 的可程式 ASIC 提供最先进的安全功能,例如车道偏离警告和自动紧急煞车。

- 亚太地区半导体产业持续获得大量投资。例如,2021年,台湾政府承诺在未来五年内以3.34亿美元开发可程式ASIC等最尖端科技。这项投资将帮助台湾保持其作为该地区最大半导体生产商的地位。

- 半导体产业的成长持续得到亚太地区政府的支持。例如,印度政府于 2021 年推出了针对半导体产业的生产挂钩奖励(PLI) 计画。该计划为半导体製造商,特别是製造可编程 ASIC 的製造商提供经济奖励,鼓励他们在印度建立和发展业务。

- 云端运算和其他数位技术的日益普及导致亚太地区对资料中心的需求大幅增加。根据中国顶级云端服务供应商阿里云的公告,一款名为X-Engine的全新云端基础可程式ASIC平台已于2021年推出。该平台利用可程式 ASIC 提供更快、更有效率的处理效能,使其成为资料中心应用的理想选择。

可程式专用积体电路 (ASIC) 产业概述

可程式专用积体电路(ASIC)市场竞争适中,许多主要供应商活跃于国内和国际市场。市场被认为适度集中,进入适度竞争阶段,主要企业采取产品创新、合资、合作、併购等策略。该市场的主要参与者包括 Analog Devices, Inc.、Infineon Technologies AG、STMicroElectronics 和 Texas Instruments Inc.。

- 2022 年 9 月 - 全球先进记忆体技术领导者三星电子现实用化开发出业界首款 512 GB 的 Compute Express Link (CXL) DRAM。与三星之前的 CXL 产品相比,新型 CXL DRAM 的记忆体容量提高了四倍,系统延迟降低了五倍,并且采用专用集成电路 (ASIC) CXL 控制器构建。

- 2022 年 7 月 - ASIC 设计服务和 IP 的领先製造商之一智原科技公司 (Faraday Technology Corporation) 宣布推出 FPGA-Go-ASIC原型製作平台。客户可以利用 Faraday 的 SoCreative! 解决方案驱动的 SoC 平台和可选的 FPGA原型製作平台快速进入电路创建和系统检验流程。结合广泛的FPGA-Go-ASIC解决方案,智原不仅能帮助客户提升晶片效能,还能加速产品开发并降低成本。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 电子产业需求增加

- 各种应用对微电子的需求不断成长

- 市场挑战

- 小批量生产相对昂贵

第五章市场区隔

- 按最终用户

- 消费性电子产品

- 通讯

- 车

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 世界其他地区

- 北美洲

第六章 竞争形势

- 公司简介

- AT&T Inc.

- Verizon Communications Inc.

- Vodafone Group Plc

- T-Mobile US Inc.(Sprint Corporation)

- Telstra Corporation Ltd

- Telefonica SA

- China Telecommunications Corporation

- Deutsche Telekom

- IDEMIA

- Nippon Telegraph and Telephone

第七章 投资分析

第八章 市场机会及未来趋势

The Programmable ASIC Market size is estimated at USD 18.5 billion in 2024, and is expected to reach USD 28.88 billion by 2029, growing at a CAGR of 9.32% during the forecast period (2024-2029).

The rapidly rising demand for smartphones, tablets, and other mobile devices across the globe is positively impacting the programmable ASIC demand in the consumer electronics segment.

Key Highlights

- The increased pace of new product development, declining cost per function of ICs, and their increasing functionality, and shortened product replacement cycles are some of the factors that are positively influencing the growth of the market.

- The growing demand for various telecommunications applications such as system-on-chip (SoC) applications is expected to boost the revenue of the market in the coming years. Additionally, the growing use of application-specific integrated circuits in consumer electronics and various industrial and automotive applications is further expected to drive the market forward.

- Another factor driving the market is the emergence of IoT devices. These circuits are also used in applications such as environmental monitoring, automotive emission control, and personal digital assistants among others. As the application-specific integrated circuits are capable of integrating both analog and logic functions, hence they enable the formation of a complete mechanism on a single chip, which is expected to boost the growth of the market.

- One of the major restraints in the Programmable ASIC market is the high design cost associated with it. The design and development process requires a significant investment in terms of resources and time, which may be prohibitive for small and medium-sized enterprises. For instance, Apple's A14 Bionic chip, which was designed on a 5nm process, is estimated to have cost around $400 million in design and development.

- The use of third-party intellectual property (IP) in Programmable ASIC design can lead to licensing issues and legal disputes. For instance, in 2020, Nvidia and Arm Holdings were involved in a legal dispute over the use of Arm's IP in Nvidia's products. This dispute could potentially impact the development and availability of Nvidia's products in the future.

- The COVID-19 pandemic led to significant disruptions in the global supply chain, which impacted the production and delivery of Programmable ASICs. The pandemic led to delays in product launches, which impacted the revenue of companies in the Programmable ASIC market. For instance, Xilinx faced delays in the release of its Versal ACAP product line in 2020 due to the pandemic, which impacted its revenue in the fiscal year 2021.

- Governments across the world provided support to the semiconductor industry to mitigate the impact of the pandemic. For instance, as per Economic times, in the United States, the government provided USD 52 billion in funding to support the semiconductor industry in 2021 as part of the CHIPS for America Act. This funding is expected to support the development and production of Programmable ASICs in the country. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

Programmable Application Specific Integrated Circuit (ASIC) Market Trends

Increasing Demand from Consumer Electronics Segment to Drive the Market

- Manufacturers are incorporating cutting-edge technology such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) into their consumer electronics products. Programmable ASICs are the greatest solution for consumer electronics manufacturers because they provide the processing power and flexibility required to support these technologies.

- To maximize battery life, consumer electronics gadgets must consume as little electricity as possible. Programmable ASICs are designed to consume less power, making them an excellent choice for consumer electronics gadgets.

- AI and machine learning are becoming increasingly important in consumer electronics, particularly in smartphones and smart speakers. Programmable ASICs provide the computing power required to support these technologies, making them the ideal choice for consumer device manufacturers.

- In the consumer electronics sector, the use of IoT devices is rapidly increasing. Programmable ASICs are an excellent choice for consumer electronics manufacturers looking to produce IoT devices because they can meet the connectivity and processing needs of IoT devices.

Asia-Pacific to Witness High Growth

- In the Asia Pacific region, there is a growing market for consumer electronics, and programmable ASICs are being employed in more and more of these products. For instance, Samsung declared that it had created a brand-new Programmable ASIC for usage in its 5G devices in 2021. The new processor is the best option for 5G handsets since it delivers higher data transfer rates and increased power efficiency.

- The Asia Pacific region's automobile industry is implementing cutting-edge technologies like ADAS, which need for high-performance computing options like Programmable ASICs. For instance, a top producer of programmable ASICs, Xilinx, revealed in 2021 that it had teamed up with Chinese carmaker SAIC Motor to create a new ADAS platform. The platform offers cutting-edge safety features including lane departure warnings and autonomous emergency braking thanks to Xilinx's Programmable ASICs.

- Asia Pacific continues to see tremendous investment in the semiconductor sector. For instance, the Taiwanese government declared in 2021 that it will spend USD 334 million over the following five years on the development of cutting-edge technologies, such as Programmable ASICs. The investment will help Taiwan maintain its position as the region's top producer of semiconductors.

- The growth of the semiconductor sector has continued to get assistance from governments in the Asia Pacific area. The Production-Linked Incentive (PLI) scheme for the semiconductor industry, for instance, was introduced by the Indian government in 2021. The programme offers financial incentives to semiconductor manufacturers, particularly those working on Programmable ASICs, to entice them to establish or grow their operations in India.

- The increasing usage of cloud computing and other digital technologies is fueling a significant increase in demand for data centres throughout the Asia Pacific region. A new cloud-based Programmable ASIC platform named X-Engine was created in 2021, according to an announcement made by Alibaba Cloud, one of China's top cloud service providers. The platform leverages Programmable ASICs to give processing performance that is faster and more effective, making it the perfect option for data centre applications.

Programmable Application Specific Integrated Circuit (ASIC) Industry Overview

The programmable application-specific integrated circuit (ASIC) market is moderately competitive owing to the presence of many large vendors operating in domestic as well as international markets. The market appears to be moderately concentrated moving towards the moderately competitve stage with the major players adopting strategies like product innovation, joint ventures, partnerships, and mergers and acquisitions. Some of the major players in the market are Analog Devices, Inc., Infineon Technologies AG, STMicroelectronics, and Texas Instruments Inc. among others.

- September 2022 - In a significant step towards the commercialization of CXL, which will enable extremely high memory capacity with low latency in IT systems, Samsung Electronics Co., Ltd., the world leader in advanced memory technology, today announced its development of the industry's first 512 gigabytes (GB) Compute Express Link (CXL) DRAM. The new CXL DRAM, which boasts four times the memory capacity and a fifth of the system latency compared to the prior Samsung CXL offering, is constructed using an application-specific integrated circuit (ASIC) CXL controller.

- July 2022 - The FPGA-Go-ASIC prototyping platform was introduced by Faraday Technology Corporation, one of the top producers of ASIC design services and IP. Customers can quickly enter the circuit creation and system verification process with the help of Faraday's SoCreative! SoC platforms and optional FPGA prototyping platforms with this solution. In conjunction with its extensive FPGA-Go-ASIC solution, Faraday can assist clients in improving chip performance as well as hastening and reducing the cost of product development.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Rising Demand from the Electronics Industry

- 4.3.2 Growing Demand for Microelectronics in Several Applications

- 4.4 Market Challenges

- 4.4.1 Comparatively Expensive if Manufactured in Small Quantity

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Consumer Electronics

- 5.1.2 Telecommunication

- 5.1.3 Automotive

- 5.1.4 Other end user

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AT&T Inc.

- 6.1.2 Verizon Communications Inc.

- 6.1.3 Vodafone Group Plc

- 6.1.4 T-Mobile US Inc. (Sprint Corporation)

- 6.1.5 Telstra Corporation Ltd

- 6.1.6 Telefonica SA

- 6.1.7 China Telecommunications Corporation

- 6.1.8 Deutsche Telekom

- 6.1.9 IDEMIA

- 6.1.10 Nippon Telegraph and Telephone