|

市场调查报告书

商品编码

1433011

气体分析仪:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Gas Analyzer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

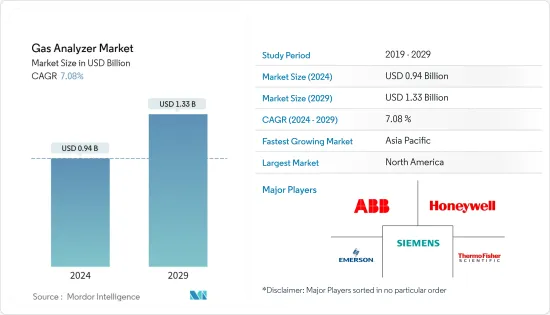

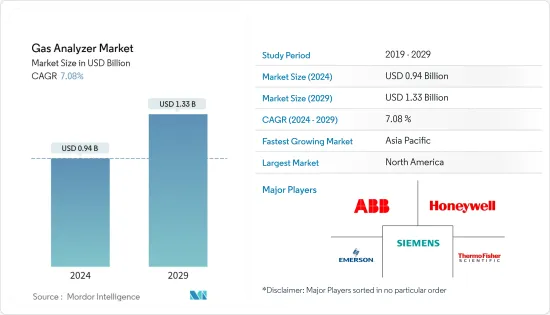

气体分析仪市场规模预计到2024年为9.4亿美元,预计到2029年将达到13.3亿美元,预测期内(2024-2029年)复合年增长率为7.08,预计将增长%。

气体分析仪市场对长寿命、免维护和成本竞争力的需求很高。此外,高价格敏感度、对可靠产品的需求以及高度的技术创新预计将影响预测期内的市场研究。

气体分析仪是一种分析设备,旨在测量气体混合物中特定气态化合物的质量或浓度。这些设备用于多种行业,包括製造业、农业和废弃物管理,可帮助使用者在工作时监测气体浓度,并确定这些数值对于产品或流程的品质或安全是否重要员工和人员。这有助于确保其在可接受的范围内。

由于页岩气和緻密油探勘活动的增加,有助于防止天然气管道腐蚀和气体洩漏,以及各行业有害气体排放安全管理规定的收紧,预计该市场将继续增长。研究市场的成长。

手持式仪器的普及也推动了气体分析仪领域的创新,大大扩展了多个最终用户细分市场的应用范围。一些知名公司开发了气体分析仪领域,用于临床测试、环境排放控制、爆炸物检测、农业储存、出货和职场危险监测。

例如,2022 年 1 月,压缩气体安全和控制製造商 SuperFlash LLC 宣布推出其最新的移动式紧凑型气体分析仪,名为 GA300。据该公司称,新产品能够对混合气体进行精确分析,并提供额外的好处,例如记录、记录和将功能整合到品质保证流程中。此外,GA300 采用最先进的感测器技术和软体解决方案,利用热导率原理提供准确的分析。

此外,与气体洩漏和爆炸相关的致命事故的增加也提高了各个最终用户群体的安全意识。为此,许多劳工组织和监管机构提倡使用带有气体检测仪和分析仪的感测器设备组件。

此外,根据世界卫生组织《环境(室外)空气污染报告》,全球几乎 99% 的人口生活在不符合世界卫生组织空气品质标准的地区。各国政府对改善空气品质指数(AQI)的日益关注也将推动气体分析仪在世界各地各行业的采用。

然而,气体分析仪设计和操作的复杂性是限制所研究市场成长的主要因素之一。新兴市场的认知度低也是市场成长的问题。

总体而言,该行业受到各国封锁措施的负面影响,而石油天然气、化学品和石化等关键终端用户行业则因需求减少而放缓,导致对气体分析仪的需求有所下降。类似的影响。然而,在大流行期间,对血气分析仪的需求大幅增加,因为它们是可以测量血氧、酸碱平衡和肺气体交换有效性等数据的宝贵仪器。此外,大流行后时期预计将推动所研究市场的成长,因为预计将推动所有主要最终用户行业的需求。

气体分析仪市场趋势

石油和天然气业务占主要份额

保护加压管道免受洩漏和腐蚀并最大限度地减少停机时间是石油和天然气行业的主要职责之一。根据 NACE(美国腐蚀工程师协会)的数据,腐蚀对全球石油和天然气产业造成了约 16 亿美元的损失。降低这些高成本是在石油和天然气行业采用气体分析仪进行预防措施的主要原因。

例如,气体分析仪可以透过有效检测此类气体的存在来帮助监测洩漏并延长管道系统的使用寿命。此外,石油和天然气产业正在向 TDL 技术(可调谐二极体雷射)过渡。 TDL 技术的高解析度可实现高精度检测,并避免传统分析仪中常见的干扰。

根据 OPEC 预测,全球石油需求预计将达到 101.9 mb/d,比现在增加约 2 md/d。由于硫化氢和二氧化碳的检测和监测在天然气加工中非常重要,因此石油和天然气需求和消耗的增加预计将推动气体分析仪的全球普及。

此外,气体样品中的氧气决定了加压管路系统的洩漏。连续且未被发现的洩漏会使情况恶化,同时影响管道的运作效率。此外,当管道系统中存在硫化氢(H2S)和二氧化碳(CO2)等气体时,它们会与氧气反应并结合,形成具有腐蚀性和破坏性的混合物,从而损坏管道壁,并可能导致内部劣化。

该联盟由公司、组织和国家组成,旨在减少石油和天然气行业的甲烷排放。据联合国称,24% 的人为甲烷排放是由石油和天然气生产系统洩漏造成的。许多国家加入了全球联盟,承诺到2025年甲烷排放至少减少45%,到2030年减少60%至75%,或甲烷强度目标「接近零」。

亚太地区实现显着成长

亚太地区是近年来石油和天然气产业产能成长的主要地区。 EIA称,2022年至2023年期间,该地区计划开展各种精製计划,仅中国就将增加112万桶/日的精製能力。

印度、中国和日本等新兴国家对低成本、高精度产品的需求不断增加,预计将推动市场成长。此外,中国、日本和韩国收紧的政府法规正在鼓励企业投资先进的气体分析仪。因此,企业宁愿投资安全系统也不愿面对灾难。

该地区的政府机构正在采取积极措施,强制在潜在危险场所使用气体分析仪。气体分析仪广泛应用于化学、工业、医疗、汽车等行业,用于监测空气品质和检测可燃性气体,当气体浓度异常升高时,各行业可以采取紧急措施,是激活的重要装备。

采矿业是面临许多工人安全问题的行业之一。采矿和选矿过程中产生的有害气体需要持续监测。印度的采矿业价值极高,监管严格,而且成长迅速,因为许多产业都依赖它来获取重要资源。采矿业对可携式气体分析仪的需求是市场成长的驱动力。

此外,气体分析仪也用于分析整个城市的污染程度。在中国和印度等污染水平达到历史最高水平的国家,已经引入气体分析仪来监测和控制污染水平。例如,芝加哥大学报告称,99%的中国人口生活在年平均颗粒物污染超过世界卫生组织指导值的地区。印度、中国和日本等国家的工业部门正在迅速发展,预计将推动对气体分析仪的需求。

气体分析仪产业概况

由于存在多个参与者,全球气体分析仪市场竞争非常激烈。主要市场参与者专注于进一步扩大消费群。主要市场参与者包括 ABB Ltd.、霍尼韦尔国际公司、艾默生电气公司和赛默飞世尔科技公司。这些公司正在采取创新策略,透过推出新产品和建立多种合作伙伴关係来增加市场占有率,从而在预测期内获得竞争优势。

2023 年 1 月,环保产品製造商 QED Environmental Systems Inc. 推出了 Landtec Biogas 3000 固定式气体分析仪,这是一种下一代系统,可对整个气体生产过程进行连续监控。据该公司称,自足式紧凑的 Biogas 3000 系统提供经济高效的线上监测,非常适合沼气监测、厌氧消化和垃圾掩埋沼气监测应用。

2022年12月,气体检测和安全监测解决方案提供商CO2Meter Inc.推出了新型可携式CO2焊接气体分析仪。 CM-1650气体分析仪旨在检查焊接气体混合物中正确的CO2浓度,测量搅拌机中的混合气体或混合气瓶气体,确保气体准确性和焊接纯度。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对气体分析仪市场的影响

第五章市场动态

- 市场驱动因素

- 感测器技术的技术发展

- 替代传统气体分析仪的创新分析仪

- 市场挑战

- 技术挑战和成本因素

第六章市场区隔

- 依产品类型

- 固定式

- 可携式的

- 依技术

- 电化学公式

- 顺磁性的

- 氧化锆 (ZR)

- 非色散红外线 (NDIR)

- 其他技术

- 按行业分类

- 油和气

- 化工/石化

- 用水和污水

- 製药

- 公用事业

- 食品与饮品

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- ABB Ltd

- Honeywell International Inc.

- Emerson Electric Co.

- Servomex(Spectris PLC)

- Teledyne Advanced Pollution Instrumentation(TAPI)

- Thermo Fisher Scientific Inc.

- Siemens AG

- Gasera

- Yokogawa Electric Corporation

- Testo SE & Co. KGaA

- California Analytical Instruments, Inc.

- Enotec GmbH

- Cambridge Sensotec Limited

第八章投资分析

第9章市场的未来

The Gas Analyzer Market size is estimated at USD 0.94 billion in 2024, and is expected to reach USD 1.33 billion by 2029, growing at a CAGR of 7.08% during the forecast period (2024-2029).

The need for a longer lifespan, maintenance-free products, and cost competitiveness are the primary needs of the gas analyzer market. In addition, high price sensitivity, demand for highly reliable products, and a higher degree of innovation are expected to influence the market studied during the forecast period.

Gas analyzers are analytical devices designed to measure the quality or concentration of a specific gaseous compound within a mixture of multiple gases. These devices are used across various industries, including manufacturing, agriculture, and waste management, to help the users keep an eye on gas levels in their operations to ensure the numbers are within the acceptable range for the quality of products and processes and the safety of employees/people.

The continued growth of the market is anticipated owing to the increase in shale gas and tight oil explorations activities as these analyzers can help in preventing corrosion and gas leakage in natural gas pipeline infrastructure, tighter safety control regulations about the emission of harmful gases across various industries also drive the growth of the studied market.

The proliferation of handheld devices has also led to driving innovations in the field of gas analyzers, which has considerably widened the scope of application across multiple end-user segments. Some prominent companies are developing the gas analyzer segment with clinical assays, environmental emission control, explosive detection, agricultural storage, shipping, and workplace-hazard monitoring applications.

For instance, in January 2022, SuperFlash LLC, a manufacturer of compressed gas safety and management, announced the launch of their latest mobile and compact gas analyzer named GA300. According to the company, this new product allows for precision analysis of gas mixtures and provides further advantages such as the ability to record, document, and integrate into the quality assurance process. Furthermore, the GA300 utilizes state-of-the-art sensor technology and software solutions to perform exact analysis using the thermal conductivity principle.

Additionally, safety awareness is rising across various end-user segments due to the increasing number of fatal accidents related to gas leakages and explosions. This leads to many worker's associations and regulatory authorities insisting on using sensor device components equipped with gas detectors and analyzers.

Moreover, according to a report by WHO on Ambient (outdoor) air pollution, almost 99% of the global population lived in areas where air quality standards set by the WHO were not met. The growing focus of the governments on improving the air quality index (AQI) will also drive the adoption of gas analyzers across various verticals globally.

However, gas analyzers' design and operational complexities are among the major restraining factors for the studied market's growth. A lower awareness among developing regions also challenges the studied market's growth.

Although the industry, in general, was negatively impacted due to widespread lockdown imposed across various countries, major end-user industries such as oil & gas, chemical, and petrochemical witnessed a slowdown owing to reduced demand which had a similar impact on the demand for gas analyzers. However, during the pandemic, the demand for blood gas analyzers increased significantly as they provided valuable measures of blood oxygenation, acid-base balance, and the lungs' efficacy in gas exchange. Moreover, the post-pandemic period is anticipated to drive the studied market's growth as the demand is expected to gain traction across all the major end-user industries.

Gas Analyzer Market Trends

Oil and Gas Segment to Hold Significant Share

Protecting a pressurized pipeline from leaks and corrosion while minimizing downtime are some of the key responsibilities in the oil and gas industry. According to NACE (National Association for Corrosion Engineers), corrosion costs about USD 1.6 billion to the global oil and gas industry. Mitigating such expensive costs is among the major propellers for adopting gas analyzers for preventive actions in the industry.

For instance, a gas analyzer helps monitor leaks, extending the life of pipeline systems by effectively detecting the presence of such gases. Additionally, the oil and gas industry is moving toward the TDL technique (Tunable Diode Laser), which enables the reliability of detecting with precision because of its high-resolution TDL technique and avoids interferences common with traditional analyzers.

According to OPEC, global oil demand is expected to reach 101.9mb/d, an increase of about 2 md/d above current levels. As the detection and monitoring of hydrogen sulfide and carbon dioxide are pertinent in natural gas processing, the increasing oil and gas demand and consumption are estimated to drive the adoption of gas analyzers globally.

Furthermore, oxygen in the gas sample determines leakage in the pressurized pipeline system. The continuous and undetected leak may worsen the situation while impacting on operational flow efficiency of the pipeline. Moreover, the presence of gases, such as hydrogen sulfide (H2S) and carbon dioxide (CO2), in the pipeline system reacting with oxygen can combine and form a corrosive and destructive mixture that can deteriorate the pipeline wall inside out.

The alliances formed by the companies, organizations, and countries aim to reduce methane emissions within the oil and gas industry. According to the United Nations, 24% of all manmade methane emissions are caused by leakages in oil and gas production systems. Many countries are joining the global alliance to commit to methane emission reduction targets of at least 45% by 2025 and 60%-75% by 2030 or to a 'near-zero' methane intensity target.

Asia-Pacific to Witness a Significant Growth

Asia-Pacific is the key region to register capacity growth in the oil and gas industry in recent years. According to EIA, various refining projects are scheduled in the region between 2022 and 2023, through which 1,120 thousand barrels per day of refining capacity will be added by China alone.

The demand for low-cost, high-precision products across developing countries, such as India, China, and Japan, is expected to boost the market's growth. Furthermore, the increased enforcement of government regulations from China, Japan, and South Korea has encouraged companies to invest in sophisticated gas analyzers. Thus, companies are willing to invest in safety systems rather than facing disasters.

Government agencies in the region have been taking proactive measures to enforce the use of gas analyzers in potentially hazardous locations. They are a vital cog for triggering emergency procedures across industries in case of an abnormal rise in the concentration of gases actively used to monitor the air quality and detect combustible gases, majorly in the chemical, industrial, medical, and automotive industries.

Mining is one of the challenging industries regarding worker safety. Several hazardous gases are the products of mining and mineral processing that must be continuously monitored. India's mining sector is extremely valuable and growing faster as the industry is heavily regulated, and many industries rely on this industry for essential sources. The propelling demand for portable gas analyzers in the mining industry drives market growth.

Furthermore, gas analyzers are also being used to analyze the pollution levels across a city. In countries like China and India, pollution levels are at an all-time high, leading to gas analyzers being deployed to monitor and control pollution levels. For instance, according to a report by the University of Chicago, 99% of China's population lives in areas where the annual average of particulate pollution exceeds the WHO guideline. As the industrial sector in countries like India, China, and Japan is developing faster, this factor is expected to drive the demand for gas analyzers.

Gas Analyzer Industry Overview

The Global Gas Analyzer Market is very competitive owing to the presence of several players. Key market players are focusing on further expanding their consumer base globally. Some significant market players include ABB Ltd, Honeywell International Inc., Emerson Electric Co., Thermo Fisher Scientific Inc., and many more. These companies are adopting innovative strategies to increase their market share by introducing new products and forming multiple partnerships to earn a competitive edge during the forecast period.

In January 2023, QED Environmental Systems Inc., a manufacturer of environmental products, launched the Landtec Biogas 3000 fixed gas analyzer, a next-generation system offering continuous monitoring of the complete gas production process. According to the company, the self-contained, compact Biogas 3000 system offers cost-effective online monitoring, ideal for biogas monitoring, anaerobic digestion, and landfill gas monitoring applications.

In December 2022, CO2Meter Inc., a gas detection and safety monitoring solutions provider, launched its new portable CO2 welding gas analyzer. Designed to verify correct CO2 concentrations in welding gas mixes, the CM-1650 gas analyzer measures blended or mixed cylinder gas at a mixer to ensure the accuracy of the gas and purity of the welds.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Gas Analyzer Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Developments in Sensor Technologies

- 5.1.2 Innovative Analyzers Replacing Traditional Gas Analyzers

- 5.2 Market Challenges

- 5.2.1 Technical Issues and Cost Factors

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Fixed

- 6.1.2 Portable

- 6.2 By Technology

- 6.2.1 Electrochemical

- 6.2.2 Paramagnetic

- 6.2.3 Zirconia (ZR)

- 6.2.4 Non-dispersive IR (NDIR)

- 6.2.5 Other Technologies

- 6.3 By End-user Vertical

- 6.3.1 Oil and Gas

- 6.3.2 Chemical and Petrochemical

- 6.3.3 Water and Wastewater

- 6.3.4 Pharmaceutical

- 6.3.5 Utility

- 6.3.6 Food and Beverage

- 6.3.7 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Honeywell International Inc.

- 7.1.3 Emerson Electric Co.

- 7.1.4 Servomex (Spectris PLC)

- 7.1.5 Teledyne Advanced Pollution Instrumentation (TAPI)

- 7.1.6 Thermo Fisher Scientific Inc.

- 7.1.7 Siemens AG

- 7.1.8 Gasera

- 7.1.9 Yokogawa Electric Corporation

- 7.1.10 Testo SE & Co. KGaA

- 7.1.11 California Analytical Instruments, Inc.

- 7.1.12 Enotec GmbH

- 7.1.13 Cambridge Sensotec Limited