|

市场调查报告书

商品编码

1433013

仓库熏蒸剂:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Warehouse Fumigants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

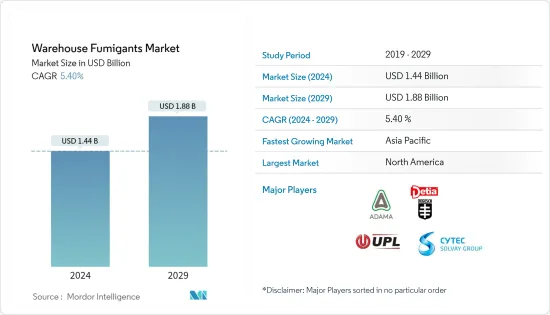

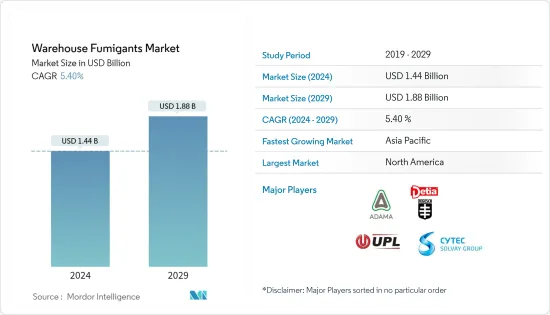

仓库熏蒸剂市场规模预计2024年为14.4亿美元,预计到2029年将达到18.8亿美元,预测期内(2024-2029年)复合年增长率为5,预计将以40%的速度增长。

2018年,北美是受访市场最大的区域部分,约占全球市占率的33.8%。按类型划分,磷化氢熏蒸剂产品领域在 2018 年占据了最大的市场占有率,为 26.3%,预计在预测期内仍将是成长最快的领域。

亚太地区被认为是仓库熏蒸剂市场尚未开发潜力最大的地区。该市场受到多种因素的推动,包括该行业技术的快速进步、对收穫后损失的日益担忧以及先进农业实践的转变导致产量增加。在植物中引入熏蒸剂将有助于使疾病远离根部并提高产量。

仓库熏蒸剂市场趋势

害虫防治的需求日益增加

在害虫防治产业中,对粮食安全储存和分配的最大自然威胁是虫害。然而,熏蒸等工具对于害虫防治来说比建筑物和仓库熏蒸更有效且更有效。由于气候变化,包括气温上升,预计未来昆虫数量将会增加,从而导致对熏蒸剂使用的依赖增加。熏蒸是消除家庭用品和出口材料中害虫的常用方法,在新兴经济体广泛采用。在全球范围内,磷化氢和溴甲烷是两种常用的用于保护储存产品的熏蒸剂。

北美主导世界市场

2018年,北美地区对全球仓库熏蒸剂消费量贡献巨大,份额为33.8%,其中美国和加拿大约占该地区市场的80%。北美是农业熏蒸剂的主要市场,有超过250种许可产品在主要国家销售:美国和加拿大。在该地区仓库和土壤中使用熏蒸剂的主要作物包括玉米、水稻、大麦、马铃薯、番茄、小麦、草莓和捲心菜。由于古巴、多明尼加共和国、哥斯达黎加和牙买加等国家的出口和储存能力非常低,在监管禁令或对仓库熏蒸剂使用的严格规定生效之前,增长率和市场占有率预计将保持不变。完成了。

仓库熏蒸剂产业概况

自2016年以来,全球仓库熏蒸剂市场已变得碎片化,而且这个过程很可能会持续下去。收购、联盟和扩张占领先企业所采取策略的一半以上。如此活跃的併购活动背后的主要原因是为了整合两家公司的新技术,为市场开发技术先进且易于使用的熏蒸剂。重大收购和产业联盟旨在进行前向和后向整合,以加深市场渗透和定位。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

市场区隔

- 类型

- 溴甲烷

- 硫酰氟

- 膦

- 磷酸镁

- 磷化铝

- 其他的

- 目的

- 产品储存保护

- 形状

- 固体的

- 液体

- 气体

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 荷兰

- 波兰

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- ADAMA Agricultural Solutions Ltd

- UPL Group

- Cytec Solvay Group

- Degesch America Inc.

- Douglas Products and Packaging Products LLC

- BASF SE

- Corteva Agriscience

- Reddick Fumigants, LLC

- Ikeda Kogyo Co., Ltd.

- Industrial Fumigation Company LLC

- Lanxess

- Nippon Chemical Industrial Co. Ltd

- Vietnam Fumigation Joint Stock Company

- Fumigation Services Pvt. Ltd

第七章 市场机会及未来趋势

The Warehouse Fumigants Market size is estimated at USD 1.44 billion in 2024, and is expected to reach USD 1.88 billion by 2029, growing at a CAGR of 5.40% during the forecast period (2024-2029).

In 2018, North America was the largest geographical segment of the market studied and accounted for a share of around 33.8% of the global market.By type, the phosphine-based fumigant product segment had the largest market share of 26.3% in 2018 and is expected to remain the fastest-growing segment during the forecast period.

Asia-Pacific has been identified as the region, which is yet to reach its maximum potential in the warehouse fumigant market. The market is driven by several factors, like rapid technological advancement in the sector, growing concerns over the post-harvest loss, and the shift in advance farming practices that led to increased yield. The introduction of fumigants to plants helps them keep the diseases away from their roots and to produce a better yield.

Warehouse Fumigants Market Trends

Increased Need for Pest Control

The largest natural threat to the safe storage and distribution of grains is insect infestation in the pest control industry. However, tools like fumigation are more effective in controlling pest infestations and are more effective, as compared to structural and warehouse fumigation. It is anticipated that due to climate changes, like an increase in temperature, the insect population is going to increase in the future, leading to increased dependence on the usage of fumigants. In order to control insects in commodities and export materials, fumigation is one of the general methods, which is adopted widely across emerging countries. Globally, phosphine and methyl bromide are the two common fumigants, which are used for stored product protection.

North America Dominates the Global Market

North America contributes a significant share of global warehouse fumigant consumption with a 33.8% share in 2018, with the United States and Canada accounting for around 80% of the regional market. North America is a major market for agriculture fumigants, with over 250 authorized products available in the main countries of the United States and Canada. The major commodities using fumigants for both warehouse and soil applications in the region are, corn, rice, barley, potato, tomato, wheat, strawberry, cabbage, etc. Due to very low export and storage capacities of countries like including Cuba, the Dominican Republic, Costa Rica, Jamaica and others, the growth rate, and market share are expected to remain constant until regulatory ban or stringent regulations on the usage of warehouse fumigants are brought into effect.

Warehouse Fumigants Industry Overview

The global warehouse fumigantsmarket has been getting into a fragmented shape since 2016, and this process is likely to continue in the future as well. Acquisitions, partnerships, and expansions account for more than half of the share among the strategies adopted by leading players. The main reason behind such intensive M&A activities, is the collaboration of new technology of the two companies, in order to develop technologically advanced and user-friendly fumigants for the market. The major acquisitions and industrial collaborations taking place are targeted toward forward and backward integration for deeper penetration and positioning in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Methyl Bromide

- 5.1.2 Sulfuryl Fluoride

- 5.1.3 Phosphine

- 5.1.4 Magnesium Phosphide

- 5.1.5 Aluminium Phosphide

- 5.1.6 Others

- 5.2 Application

- 5.2.1 Structural Fumigation

- 5.2.2 Commodity Storage Protection

- 5.3 Form

- 5.3.1 Solid

- 5.3.2 Liquid

- 5.3.3 Gas

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Poland

- 5.4.2.8 Italy

- 5.4.2.9 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 ADAMA Agricultural Solutions Ltd

- 6.3.2 UPL Group

- 6.3.3 Cytec Solvay Group

- 6.3.4 Degesch America Inc.

- 6.3.5 Douglas Products and Packaging Products LLC

- 6.3.6 BASF SE

- 6.3.7 Corteva Agriscience

- 6.3.8 Reddick Fumigants, LLC

- 6.3.9 Ikeda Kogyo Co., Ltd.

- 6.3.10 Industrial Fumigation Company LLC

- 6.3.11 Lanxess

- 6.3.12 Nippon Chemical Industrial Co. Ltd

- 6.3.13 Vietnam Fumigation Joint Stock Company

- 6.3.14 Fumigation Services Pvt. Ltd