|

市场调查报告书

商品编码

1641828

显示面板-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Display Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

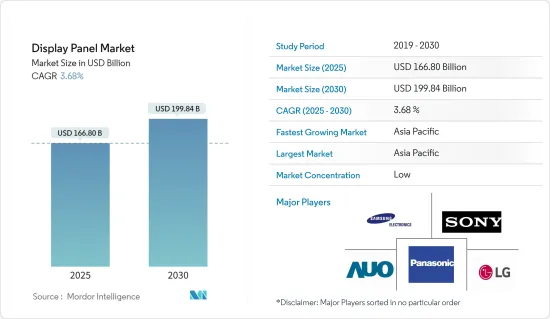

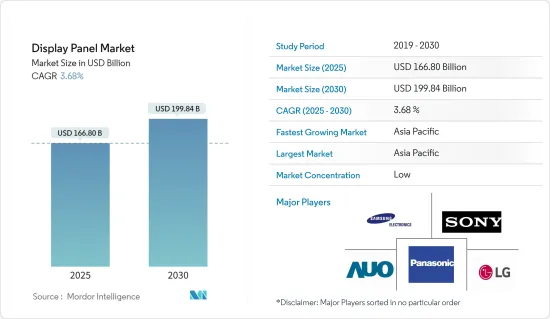

预计2025年显示面板市场规模为1,668亿美元,到2030年将达到1998.4亿美元,预测期间(2025-2030年)的复合年增长率为3.68%。

显示器技术透过技术发展逐年进步,实现了高解析度、低功耗。奈米粒子在电子电路和透明感测器中的发展正在推动透明显示器市场的进步。在当前情况下,柔性显示器正在被开发来取代刚性方形面板,这对消费者来说更具互动性。预计这将为透明显示器市场的成长提供巨大的机会。

显示器市场受到对 OLED 和 PMOLED 等增强型显示器、扩展显示器和可捲曲透明显示器等日益增长的需求的推动。 OLED技术可实现明亮、高效、纤薄的显示器和照明面板。 OLED 目前广泛应用于许多行动装置、电视和照明设备。 OLED 显示器提供比 LCD 或电浆显示器更好的影像质量,并且可以做得透明和灵活。

此外,显示器的一个重要应用领域是抬头显示器装置。这些设备在 AR/VR、军事/国防和汽车市场需求强劲,推动了显示面板市场的发展。具有透明显示器的装置比视讯扩增实境具有更高的解析度并且显示更逼真的扩增实境实境。

氧化物TFT的需求不断成长,促使企业提高产能以补充市场需求。例如,2021年12月,TCL集团旗下的中国显示面板製造商华星光电科技(CSOT)宣布安装8.6G氧化物TFT-LCD生产线,该生产线将于2023年第一季投产. 已安排。

从硬体销售来看,头戴式显示器占据了市场主导地位。这是因为对更高品质 HMD 的需求不断增长,以支援对高品质内容和改进功能的持续需求,并为消费者提供透明显示器可以提供的更好的沉浸式体验。预计这将推动市场发展。

Nvidia 的 DriveAR 平台采用仪表板安装的显示器,该显示器使用透明显示器迭加来自汽车周围影像的图形。系统会指出沿途的一切危险和历史地标。由于该平台的成功,奥迪、宾士、特斯拉、丰田和沃尔沃等主要汽车製造商已与该公司签订合同,共同开发该技术。

2023 年 4 月,三星宣布将为法拉利车型供应下一代高阶显示面板。这使得该公司的业务范围超越了电视和智慧型手机,进入了跑车市场。

受新冠疫情影响,人员跨境流动受限,索尼难以派遣工程师前往中国和东南亚国家製造地推出新产品并提供製造指导,这对SONY的业务产生了影响。此外,它还受到全球封锁和零售店关闭的影响。

显示面板趋势

OLED显示面板将发挥重要作用

OLED有望取代显示生态系中的现有技术。为此,不少厂商开始大力投入OLED相关的研发。由于头戴式显示器 (HMD) 供应商的需求不断增加,OLED 透明显示器正在获得市场渗透率。

例如,2023年4月,三星宣布将在韩国投资30亿美元用于笔记型电脑和平板电脑的OLED面板。同样,2022 年 4 月,三星宣布了其未来电视的新计划。该计划旨在使量子点(QD)-OLED面板比现在更薄。这使得三星将捲屏电视视为其电视产品线的一个新可能性。新的面板类型还可降低生产成本。

由于在电池寿命方面取得成功,LG Display 于 2022 年 2 月赢得一份合同,为苹果公司提供基于低温多晶氧化物 (LTPO) 技术的有机发光二极体面板,用于 2022 年下半年发布的 iPhone 14 系列。

此外,一些领先的製造商正专注于推出具有 OLED 显示器的产品,以带来创新并获得竞争优势。例如,2023年5月,三星宣布将在SID显示器週上推出带有感应器的OLED显示器。此显示器将指纹扫描器整合到 OLED 萤幕中,因此无需智慧型手机品牌安装萤幕下指纹扫描器模组。

此外,2023 年 1 月,LG Display 在 CES 2023 上发布了第三代 OLED 电视面板。该公司最新的采用「META 技术」的 OLED 电视面板可提供极致的画质。该公司最新的 OLED 显示器比传统 OLED 显示器提供的影像亮度提高 60%、视角提高 30%,同时更节能。该公告旨在加强该公司在大型OLED面板产业的地位。

印度预计在亚太地区实现强劲成长

在印度,可支配收入的提高推动了个人消费的扩张,随着足球迷数量的增加,对电视的需求也激增。因此,印度电视製造商正在推出配备先进技术的更大萤幕,这可能会在预测期内促进该国市场的成长。

此外,电视连接行为的变化预计将推动市场成长。随着 Netflix 和 Amazon Prime 等订阅服务现已在智慧电视和 Android 电视上推出,需求日益增长,从而推动了市场成长。

根据IBEF预测,到2025年连网智慧电视数量预计将达到约4,000万至5,000万台。该萤幕上消费的内容的 30% 将是社交媒体、游戏和短影片。

例如,2022 年 5 月,LG 宣布将重点关注 OLED(有机发光二极体)电视,因为它计划在印度不断增长的高端电视领域扩大其影响力。如今,许多消费者对购买更大萤幕的产品感兴趣。消费者越来越倾向于高阶电视,LG 希望透过其最新的 OLED 电视系列来抓住这一机会。

同样,2022 年9 月,三星印度宣布推出其模组化MicroLED“Wall All-In-One”,这将彻底改变显示器的未来,以及“Flip Pro”,这是一款互动式显示器,将把教育体验提升到一个新的水平。 Wall All-in-One 有 110 吋和 146 吋两种尺寸可供选择,针对公司办公室进行了最佳化。

三星还将在印度德里郊区建立其首家智慧型手机显示器製造厂。根据向公司註册处(RoC)提交的申请,这家韩国公司将向位于诺伊达的工厂投资超过 350 亿印度卢比。该工厂将生产行动电话和 IT 显示屏,之后可能扩展到笔记型电脑和电视。

此外,为了巩固其地位,印度政府正在为晶片和显示器製造提供激励措施,进一步推动显示面板市场的成长。例如,2022 年 9 月,印度政府宣布将根据一项 100 亿美元的计画扩大对半导体製造设备和显示器设备的财政诱因。

显示面板行业概览

全球显示面板市场竞争激烈。由于市场参与企业众多,有大有小,因此市场呈现细分化。所有主要参与者都拥有相当大的市场占有率,并致力于扩大其全球消费群。市场的主要企业包括友达光电、日本京东方、群创光电、LG 电子、三星电子和松下公司。为了在预测期内获得竞争优势,公司正在建立多种伙伴关係并投资推出新产品以增加市场占有率。

2023年5月,HTC宣布推出HTC U23 Pro。 U23 Pro 配备全高清+ 有机发光二极体萤幕、Snapdragon 7 Gen 1 晶片组等。支援 5G 的 Android 智慧型手机配备专用的 microSD 卡插槽,可用于扩充板载储存。

2023年1月,联想宣布将发表有机发光二极体笔记型电脑Yoga Book 9i。这是联想最新的折迭式笔记型电脑,搭载第 13 代英特尔酷睿 i7-U15 处理器,搭配英特尔 Iris X 集成显示卡和 16GB LPDDR5X RAM。该公司预计 Yoga Book 9i 将于 2023 年 6 月发售。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 对显示面板市场的影响

第五章 市场动态

- 市场驱动因素

- 电视对超高清显示面板的需求不断增加

- 家用电子电器市场需求不断成长

- 市场问题

- 消费性产品实施成本高昂

第六章 市场细分

- 按显示类型

- LCD

- 有机发光二极体

- 其他显示器类型(AMOLED、MicroLED 等)

- 按决议

- 8K

- 4K

- 高清(高清、WQHD、FHD)

- 按应用

- 智慧型手机和平板电脑

- 个人电脑和笔记型电脑

- 电视机

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- AUO Corporation

- BOE Japan Co. Ltd

- Innolux Corporation

- LG Electronics

- Samsung Electronics Co. Ltd

- Panasonic Corporation

- Sharp Corporation

- Hisense International

- Sony Corporation

- Japan Display Inc.

第八章投资分析

第九章:市场的未来

The Display Panel Market size is estimated at USD 166.80 billion in 2025, and is expected to reach USD 199.84 billion by 2030, at a CAGR of 3.68% during the forecast period (2025-2030).

Display technologies, aided by technological developments, have evolved over the years to offer higher resolution and lower power consumption. The developments in nanoparticles and transparent sensors in the electronic circuit have boosted the progression of the transparent display market. In the present scenario, development is progressing on replacing hard square panels with flexible displays that are more interactive to the consumer. This is expected to provide a substantial opportunity for the growth of the transparent display market.

The display market is driven by the growing demand for enhanced displays, such as OLED and PMOLED, augmented displays, and rollable transparent displays. OLED technology enables bright, efficient, and thin displays and lighting panels. They are currently used in numerous mobile devices, TVs, and lighting fixtures. OLED displays provide better image quality than LCD or Plasma displays - and can be made transparent and flexible.

Moreover, a significant application area of displays has been the heads-up display devices. These devices have witnessed strong demand from AR/VR, military and defense, and automotive markets, thereby driving the market for display panels. A device with a transparent display has a much higher resolution and displays much more realistic augmented reality than video augmented reality.

The growing demand for oxide TFT has encouraged players to increase their production capacity to compensate for the market demand. For instance, in December 2021, China Star Optoelectronics Technology (CSOT), a China-based display panel maker belonging to the TCL Group, announced setting up an 8.6G oxide TFT-LCD production line, with production scheduled to begin in first-quarter 2023.

Out of the hardware sales, head-mounted displays dominated the market. This results from the rising demand for higher-quality HMDs to support the ongoing demand for high-quality content and functionality improvements and provide an improved immersive experience to consumers, which can be achieved through transparent displays. This is expected to drive the market.

DriveAR platform from Nvidia uses a dashboard-mounted display overlaying graphics based on camera footage around the car, using a transparent display. This system points out everything from hazards to historic landmarks along the way. Following the platform's success, automotive manufacturing giants like Audi, Mercedes-Benz, Tesla, Toyota, and Volvo have signed up with the company to work with the technology.

In April 2023, Samsung announced to supply premium, next-generation display panels to Ferrari models. Through this, the company aims to expand beyond television and smartphones and target the fastest automotive market.

Due to the COVID-19 pandemic, Sony's business was impacted by factors such as restrictions on the movement of people across national borders, making it difficult for the company to send engineers to manufacturing hubs such as China and countries in Southeast Asia to help with new product launches or give instructions on manufacturing. Moreover, sales of Sony's products were also affected by global lockdowns and retailer closings.

Display Panel Market Trends

OLED Type of Display Panel to Hold a Significant Position

OLEDs are expected to replace existing technologies in the display ecosystem. Owing to this, many vendors started investing heavily in R&D related to OLED. OLED transparent displays are penetrating the market due to increasing demand for these displays from head-mounted display (HMD) vendors.

For instance, in April 2023, Samsung announced to invest USD 3 billion in OLED panels for laptops and tablets in South Korea. Similarly, in April 2022, Samsung announced a new project underway for future TV offerings. The project aims to make its quantum dot (QD)-OLED panels thinner than they are now. With this, the company will be eyeing a new possibility for its TV lineup - rollable screen TVs. The new panel types will also help cut down production costs.

Owing to success over battery life, in February 2022, LG Display won the contract to supply OLED panels based on low-temperature poly-crystalline oxide (LTPO) technology to Apple for the iPhone 14 series, which will be launched in the second half of 2022.

Moreover, several leading manufacturers focus on launching products with OLED displays to bring innovation and gain a competitive advantage. For instance, in May 2023, Samsung announced to release sensor OLED display at the SID Display Week. The display integrates the fingerprint scanner into the OLED screen, eliminating the need for smartphone brands to install a separate fingerprint scanner module under the screen.

Furthermore, in January 2023, LG Display announced releasing its third-generation OLED TV panel at CES 2023. Based on 'META Technology,' the company's newest OLED TV panel delivers the ultimate picture quality. The company's latest OLED displays achieve 60 percent brighter images and 30 percent wider viewing angles than conventional OLED displays, on top of improved energy efficiency. This release aims to strengthen its position in the large OLED panel industry.

India in the Asia Pacific region is Expected to Witness Significant Growth

Consumer spending in India is increasing, due to rising disposable income, due to which the demand for televisions is witnessing a high spike owing to the rising soccer fan base in countries such as India. As a result, the TV makers in India are launching larger screens with advanced technologies, which, in turn, is likely to boost the market growth in the country over the forecast period.

Furthermore, the changing behavior in TV connections is expected to drive market growth. Subscriptions, such as Netflix and Amazon Prime, have been made available for Smart and Android TVs, owing to which the demand is gaining high traction, thereby propelling the market growth.

According to IBEF, connected smart televisions are expected to reach approximately 40-50 million by 2025. 30% of the content viewed on this screen will be social media, gaming, and short video.

For instance, in May 2022, LG announced that the company is eyeing heavily OLED (organic light-emitting diode) Televisions as it plans to increase its footprint in India's growing premium Television segment. These days, many consumers are interested in buying bigger screens, especially after the pandemic when there is a limitation to cinema halls. Consumers increasingly gravitate toward premium TVs, and LG aims to grab the opportunity with the updated OLED TV range.

Similarly, in September 2022, Samsung India announced the launch of Wall All-In-One, a modular MicroLED that will revolutionize the future of displays, and Flip Pro, an interactive display that will take the educational experience to the next level. Available in 110" and 146" sizes, the wall all-in-one is optimized for corporate offices.

Also, Samsung is setting up India's first smartphone display manufacturing unit on the outskirts of Delhi. The South Korean company is investing over Rs 3,500 crore in this facility in Noida, per a regulatory filing with the Registrar of Companies (RoC). The plant would produce displays of mobile phones and IT displays and could later extend it to laptops and televisions.

Moreover, the government of India is offering incentives for chips and display unit manufacturing to strengthen its position, further supporting the display panel market growth. For instance, in September 2022, the Indian government announced increased financial incentives for setting up semiconductor manufacturing units and displays under USD 10 billion plan.

Display Panel Industry Overview

The Global Display Panel Market is very competitive. The market is fragmented due to various small and large players. All the major players account for a large market share and focus on expanding their worldwide consumer base. Some significant players in the market are AUO Corporation, BOE Japan Co. Ltd, Innolux Corporation, LG Electronics, Samsung Electronics Co. Ltd, Panasonic Corporation, and many more. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

In May 2023, HTC announced to release HTC U23 Pro. The U23 Pro packs a Full HD+ OLED Screen, Snapdragon 7 Gen 1 Chipset, and much more. It is a 5 G-enabled Android smartphone with a dedicated microSD card slot for expanding onboard storage.

In January 2023, Lenovo announced to launch a dual-screen OLED Laptop, the Yoga Book 9i. It is Lenovo's latest foldable laptop and comes with 13th Gen Intel Core i7-U15 processors inside, with Intel Iris X integrated graphics and 16GB of LPDDR5X RAM inside. The company expects the Yoga Book 9i to be available in June 2023.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Display Panel Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for UHD Display Panels for TVs

- 5.1.2 Increasing Demand in the Consumer Electronics Market

- 5.2 Market Challenges

- 5.2.1 Expensive Deployments in Consumer Products

6 MARKET SEGMENTATION

- 6.1 By Type of Display

- 6.1.1 LCD

- 6.1.2 OLED

- 6.1.3 Other Type of Displays (AMOLED, MicroLED, etc.)

- 6.2 By Resolution

- 6.2.1 8K

- 6.2.2 4K

- 6.2.3 HD (HD, WQHD, and FHD)

- 6.3 By Application

- 6.3.1 Smartphones and Tablets

- 6.3.2 PC and Laptop

- 6.3.3 Television

- 6.3.4 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AUO Corporation

- 7.1.2 BOE Japan Co. Ltd

- 7.1.3 Innolux Corporation

- 7.1.4 LG Electronics

- 7.1.5 Samsung Electronics Co. Ltd

- 7.1.6 Panasonic Corporation

- 7.1.7 Sharp Corporation

- 7.1.8 Hisense International

- 7.1.9 Sony Corporation

- 7.1.10 Japan Display Inc.