|

市场调查报告书

商品编码

1433488

产品资讯管理:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Product Information Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

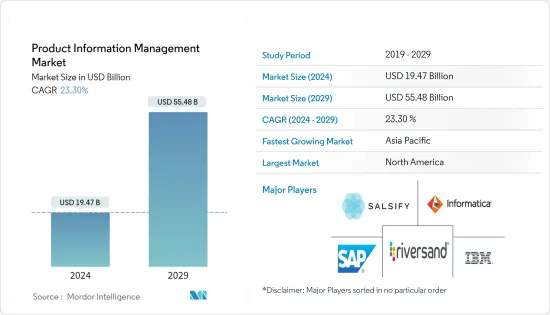

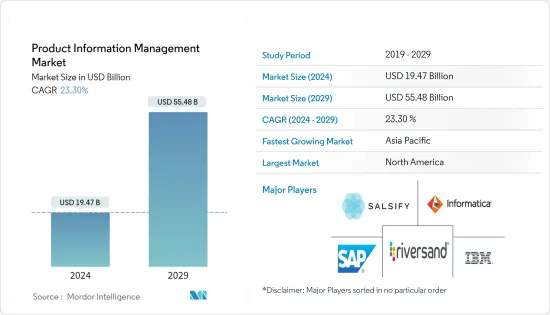

产品资讯管理市场规模预计到2024年为194.7亿美元,预计到2029年将达到554.8亿美元,在预测期内(2024-2029年)增长23.30%,预计复合年增长率为

产品资讯管理 (PIM) 解决方案是整合和管理公司产品资讯的流程和工具,以确保产品资料的单一、准确视图。 PIM 提供了一个集中平台,可以经济高效地收集有关公司产品和服务的资料。 PIM 有助于为所有客户维护一致、高品质的产品资料和资讯。

主要亮点

- PIM 系统被各种组织用来收集核心产品资料(产品名称、标题、描述)、产品属性(SKU、成本、定价)、产品规格(尺寸、保固、包装资讯等)、产品相关指标、全方位用于整合从多个资讯来源收集的各种产品讯息,如通路产品资讯(如手机文案)、扩展通路资讯(如Google/Amazon/Shopify)、商店特定资讯(POS收银机和产品目录)。 。

- 随着资料生成的显着增加,资料和资讯已成为组织和企业的支柱。近年来,由于对更好的客户体验的需求不断增长,越来越多的专业人士开始关注产品资讯管理(PIM)系统。

- PIM软体因其在零售和电子商务行业的不断扩大的应用而受到广泛关注。我们帮助线下零售商在数位领域发展,并支持 Amazon Go 等利用客户资料来建立产品的新概念。随着零售和电子商务业务的扩展以及必须管理的产品资料量的增加,PIM 系统被越来越多地引入。

- 最近,对SaaS(软体即服务)版本的业务应用程式的需求显着增加。云端基础的PIM 在那些喜欢轻鬆部署和协作、经济实惠和可扩展性的组织中越来越受欢迎。

- 在COVID-19期间,以前透过实体店严格控制零售市场并依赖电子商务合作伙伴进行销售的垂直整合品牌和製造商发现自己突然失去了对零售体验的洞察力。我看到了亲眼所见。与实体店相比,您没有相同程度的可见度或控制力。为了避免在电子商务巨头亚马逊上进行零售,品牌商正在专注于 Shopify 等电子商务平台,这些平台允许製造商直接向消费者销售产品,同时维护品牌和客户资料。

产品资讯管理市场趋势

零售业预计将推动市场成长

- 由于零售和电子商务领域越来越注重改善客户体验以及引入人工智慧和零售分析工具,预计零售和电子商务行业的产品资讯管理 (PIM) 采用率最高。我是。

- 数位化使客户能够从各种来源获取产品资讯。随着电子商务的显着成长,客户的偏好和行为发生了巨大的变化。行动性和人工智慧的世界与智慧资料分析相结合,使世界各地的零售商能够体验有助于其业务的准确分析。

- 例如,印度品牌资产基金会 (IBEF) 表示,印度政府的「数位印度」计画旨在到 2025 年推动印度成为价值数兆美元的线上经济。这导致成立了一个新的指导小组来审查和分析政府电子商务平台的发展。

- IBEF 预计,到 2024 年,线上零售普及预计将达到 10.7%,高于 2019 年的 4.7%。同样,到2025年,印度的网路买家数量预计将达到2.2亿。根据 Payoneer 的报告,印度电子商务产业的跨国成长在全球排名第九。印度的电子商务预计将从 2020 年占食品、杂货、时尚和消费性电子产品总销售额的 4% 增长到 2025 年的 8%。预计此类发展将推动研究市场。

- 因此,客户转换是零售商面临的关键挑战。他们竞相透过提供获取产品资讯的综合解决方案来吸引有能力的消费者,从而加强资讯供应链。产品资讯管理解决方案管理这些资讯并为公司提供竞争优势。 PIM 也用于管理由于行销管道数量不断增加而从各种来源产生的资料。

北美获得主要收益占有率

由于越来越多地采用先进技术来减少该地区企业的体力劳动和简化工作流程,北美已成为一个重要的 PIM 市场。电子商务的成长也促进了市场的成长。该地区拥有强大的产品资讯管理 (PIM) 供应商立足点,推动了整体市场的成长。其中包括 IBM Corporation、Oracle Corporation、Riversand Technologies Inc. 和 Informatica LLC。

美国的电子商务销售额也在成长。根据美国商务部统计数据的 Digital Commerce 360 分析,北美电子商务零售总额将在 2022 年成长,达到 1.3 兆美元。

网路购物销售额的激增与新冠肺炎 (COVID-19) 有关,该病毒导致数百万人出于健康和安全原因留在家里,避免在商店购物。随着零售和电子商务业务的扩展及其管理的产品资料量的增加,该地区越来越多地采用 PIM 解决方案。

Orgill Inc. 是全球最大的独立分销商之一,为美国和 60 多个国家的零售商提供超过 75,000 种产品和行业领先的零售服务。

Orgill 实施了 PIM 解决方案来管理公司的所有产品资讯并建立各种产品目录、目录和行销材料。产品资讯也用于推广公司的线上产品目录。 PIM 解决方案支持 Orgill 的使命,即提供无与伦比的零售商支援和服务。

过去,加拿大领先的户外和体育用品零售商 SAIL 选择 inRiver PIM 来组织、管理和行销其跨所有管道的广泛产品系列。该公司选择 PIM 来减少手动资料输入、强大地存储大量供应商资料并加快产品上市时间。

产品资讯管理产业概况

由于区域和国际参与者的存在,产品资讯管理市场竞争非常激烈。市场集中度适度,在激烈的竞争中,企业纷纷采取併购、产品创新等策略来维持市场地位。市场的最新发展包括:

- 2023 年 2 月:Lumavate 推出产品资讯管理 (PIM) 解决方案。负责人可以使用 Lumavate 的 PIM 在中央位置轻鬆建立和管理产品资料和数位资产。

- 2022 年 10 月:Agilis 和 SpecialChem 宣布建立合作伙伴关係,将专为化学产业设计的云端基础的PIM 系统推向市场。 ionicPIM 是一款新产品,旨在帮助化学品製造商和分销商维护所有产品资料和文件的单一来源。 ionicPIM 针对化学品进行了预先配置,使其易于实施和使用。生产商和经销商还可以连结PIM以共用产品资讯。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产品资讯管理市场的影响

- 市场驱动因素

- 改善客户服务的需求不断增加

- 对集中式资料管理工具的需求不断增长

- 市场限制因素

- 资料外洩案例增加

第五章市场区隔

- 部署

- 云

- 本地

- 奉献

- 解决方案

- 服务

- 最终用户产业

- BFSI

- 媒体娱乐

- 零售

- 能源/公共产业

- 卫生保健

- 资讯科技/通讯

- 运输/物流

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争形势

- 公司简介

- SAP SE

- Salsify Inc.

- Syndigo LLC

- Informatica LLC

- inRiver AB

- Stibo Systems Inc.

- EnterWorks Acquisition Inc.(Winshuttle Software)

- Agility Multichannel Limited

- IBM Corporation

- Pimcore USA

- Akeneo SAS

- Plytix Limited

- Riversand Technologies Inc.

第七章 投资分析

第八章 市场机会及未来趋势

The Product Information Management Market size is estimated at USD 19.47 billion in 2024, and is expected to reach USD 55.48 billion by 2029, growing at a CAGR of 23.30% during the forecast period (2024-2029).

Product information management (PIM) solutions are processes and tools that unify and manage a business' product information to secure a single, accurate view of product data. PIM offers a centralized platform to collect data on a business's products and services cost-effectively. PIM promotes the maintenance of consistent and quality product data and information for all customers.

Key Highlights

- A PIM system helps various organizations integrate various product information collected from multiple information sources, like core product data (product name, title, and description), product attributes (SKU, cost, and pricing), product specifications (e.g., dimensions, warranty, and packaging info), product-related metrics, omnichannel product information (e.g., mobile copy), extended channel information (Google/Amazon/Shopify/etc.), and store-specific information (POS registers and product catalogs).

- With the massive growth in data generation, data and information have become the backbone of organizations and businesses. Recently, more professionals have begun to pay attention to product information management (PIM) systems due to the growing demand for a better customer experience.

- The PIM software gained strong traction due to its growing application in the retail and e-commerce industries. It is helping offline retail outlets grow in digital spaces and assisting new concepts, like Amazon Go, leveraging customer data to build their product. With the expansion of retail and e-commerce businesses and the growing amount of product data to be managed, the adoption of PIM systems is on the rise.

- The demand for software-as-a-service (SaaS) versions of business applications has recently increased dramatically. Cloud-based PIM is becoming more popular among organizations that prefer the ease of deployment and collaboration, affordability, and the ability to scale.

- Amid COVID-19, vertically integrated brands and manufacturers that previously exercised tight control over the retail market with their brick-and-mortar stores witnessed a sudden loss of insight into the retail experience as they depended on e-commerce partners for sales. They do not have the same levels of visibility and control as they are used to when compared to a brick-and-mortar store. To avoid retailing on the e-commerce giant Amazon, brands have been focusing on e-commerce platforms, such as Shopify, which allow manufacturers to sell direct-to-consumer while maintaining their brand and customer data.

Product Information Management Market Trends

Retail Industry is Expected to Drive Market Growth

- The adoption of product information management (PIM) is expected to be the highest in the retail and e-commerce industry due to the growing focus on enhancing customer experience and the adoption of artificial intelligence and retail analytics tools in the retail and e-commerce sector.

- Due to digitization, customers can access product information through various sources. With the massive growth in e-commerce, customer preferences and behaviors have changed drastically. As the world of mobility and artificial intelligence combines intelligent data analytics, retailers worldwide can experience accurate analytics that is useful for their business.

- For instance, according to the India Brand Equity Foundation (IBEF), the Indian government's Digital India effort aims to drive it into an online economy worth trillions by 2025. It has led to the formation of a new steering group to review and analyze the development of an e-commerce platform for the government.

- According to IBEF, by 2024, online retail penetration will reach 10.7%, up from 4.7% in 2019. Likewise, by 2025, India's internet buyers will number 220 million. According to a Payoneer report, India's e-commerce sector is ranked 9th in the world for cross-border growth. E-commerce in India is expected to grow from 4% of total food and groceries, fashion, and consumer electronics retail sales in 2020 to 8% by 2025. Such developments are expected to drive the studied market.

- Hence, customer conversion is a significant challenge for retailers. They are competing to engage the empowered consumer by providing a comprehensive solution for accessing product information, thereby enhancing the information supply chain. Product information management solutions maintain a tab on this information and offer enterprises a competitive advantage. PIM is also used for managing data generated from various sources, owing to the increasing number of marketing channels.

North America to Acquire Major Revenue Share

North America is a prominent PIM market due to the growing adoption of advanced technologies to reduce manual tasks and streamline workflows among the region's enterprises. The growth in e-commerce also contributes to the market's growth. The region has a strong foothold on product information management (PIM) vendors, which drives the overall market's growth. Some include IBM Corporation, Oracle Corporation, Riversand Technologies Inc., and Informatica LLC.

E-commerce sales in the United States are also increasing. According to a Digital Commerce 360 analysis of US Department of Commerce figures, total e-commerce retail sales in North America climbed in 2022, reaching USD 1.03 trillion.

The surge in online shopping sales is related to COVID-19, which has caused millions of people to stay home for health and safety reasons and avoid in-store purchases. With the expansion of the retail and e-commerce businesses and the increasing amount of product data to be managed, the PIM solution's adoption is on the rise in the region.

Orgill Inc. is one of the world's largest independently owned hardlines distributors, providing retailers across the United States and over 60 countries with access to over 75,000 products and industry-leading retail services.

Orgill implemented the PIM solution to manage all the company's product information and produce its various product catalogs, directories, and marketing materials. The product information is also used to drive the company's online product catalog. PIM solution supports Orgill's mission to provide unparalleled retailer support and service.

In the past, SAIL, a large outdoor and sporting goods retailer based in Canada, selected inRiver PIM to organize, manage, and market its extensive product range for all its channels. The company chose PIM to reduce manual data entry, contain large quantities of supplier data powerfully, and cut down the time-to-market for their products.

Product Information Management Industry Overview

The product information management market is highly competitive due to the presence of regional and international players. The market appears to be moderately concentrated, with players adopting strategies like mergers and acquisitions and product innovations to maintain their position in the market, which holds an intense rivalry among the competitors. Some of the recent developments in the market are:

- February 2023: Lumavate launched its product information management (PIM) solution. Marketers can easily create and manage their product data and digital assets in a centralized location using Lumavate's PIM.

- October 2022: Agilis and SpecialChem announced a collaboration to bring a cloud-based PIM system designed specifically for the chemical industry to market. ionicPIM is a new product designed for chemical producers and distributors to help them maintain a single source for all product data and documents. Because ionicPIM is preconfigured for chemicals, it is simple to implement and use. It also enables producers and distributors to link their PIMs in order to share product information.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Product Information Management Market

- 4.4 Market Drivers

- 4.4.1 Growing Demand for Better Customer Service

- 4.4.2 Growing Demand for Centralized Data Management Tools

- 4.5 Market Restraints

- 4.5.1 Increasing Data Breaching Cases

5 MARKET SEGMENTATION

- 5.1 Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 Offering

- 5.2.1 Solution

- 5.2.2 Services

- 5.3 End-user industry

- 5.3.1 BFSI

- 5.3.2 Media and Entertainment

- 5.3.3 Retail

- 5.3.4 Energy and Utilities

- 5.3.5 Healthcare

- 5.3.6 IT and Telecommunications

- 5.3.7 Transportation and Logistics

- 5.3.8 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SAP SE

- 6.1.2 Salsify Inc.

- 6.1.3 Syndigo LLC

- 6.1.4 Informatica LLC

- 6.1.5 inRiver AB

- 6.1.6 Stibo Systems Inc.

- 6.1.7 EnterWorks Acquisition Inc. ((Winshuttle Software)

- 6.1.8 Agility Multichannel Limited

- 6.1.9 IBM Corporation

- 6.1.10 Pimcore USA

- 6.1.11 Akeneo SAS

- 6.1.12 Plytix Limited

- 6.1.13 Riversand Technologies Inc.