|

市场调查报告书

商品编码

1433504

低功耗 WAN - 市场占有率分析、产业趋势与统计、成长预测(2024 年 - 2029 年)Low-Power WAN - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

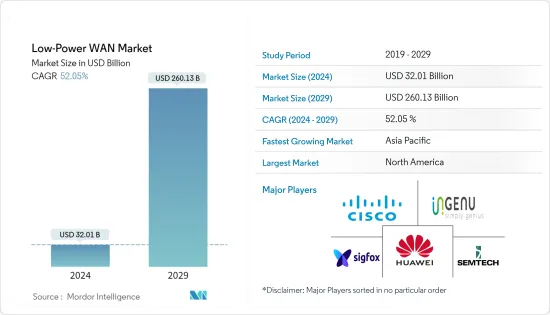

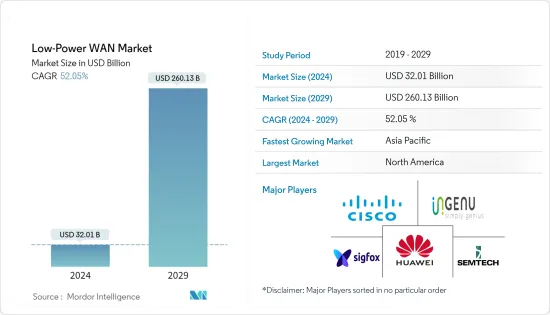

低功耗广域网路市场规模预计到 2024 年为 320.1 亿美元,预计到 2029 年将达到 2,601.3 亿美元,在预测期内(2024-2029 年)CAGR为 52.05%。

低功耗 WAN (LPWAN) 无线广域网路以低位元率远距离连接低频宽、电池供电的装置。

主要亮点

- 在预测期内,物联网(IoT)应用对低功耗广域连接的需求不断增长,预计将推动整个市场的成长。

- 应用上述功能可提高生产力两倍,并有助于追踪作物发育。在该行业中,LPWAN 有助于长距离传输少量资料,预计这将在整个预测期内对市场成长产生积极影响。

- 车队管理、GPS 追踪、智慧电錶、智慧电网管理、家庭自动化、废弃物管理、製程监控以及温度监控只是 LPWAN 关键应用的一小部分。

- 未来的覆盖范围和可扩展性、技术共存和即时通讯只是该技术可能阻碍其广泛采用和商业化的几个问题。此外,网路安全性不如将资料传回端点可靠,也可能容易受到干扰。

- 在COVID-19期间辅助医疗诊断和治疗最有帮助的技术是5G,而这一趋势至今仍然强劲。由于网路的高容量和低延迟允许传输高清镜头进行处理和分析,因此医疗保健行业从部署 5G 中获益最多。借助此工具,医疗保健提供者可以识别出行为与平均水平不同的患者、刚经历过跌倒等事件或对自己或他人构成危险的患者。

低功耗广域网路市场趋势

5G技术推动市场成长

- 新一代行动网路技术(即 5G)能够透过无缝覆盖、高资料速度、减少延迟、卓越的效能和有效的通讯来提供增强的最终用户体验。

- 5G 连接将影响的众多领域之一是手机世界。例如,4G的下载速度差和延迟高一直是物联网(IoT)和机器对机器(M2M)基础设施发展的障碍。随着越来越多的设备连接到网路并相互通信,任何延迟的累积影响将变得更加明显和明显。

- 由于其本地供应链的先进研发、国内政府对基础设施能力的早期大力支持,以及消费者对汽车内外未来技术的兴趣,中国有望引领 5G 的早期部署汽车。采用过程变得更加简单,因为这些汽车只会在中国庞大的国内市场销售,而这些市场很可能会统一应用 5G 基础设施和标准。

- 此外,5G将显着增强智慧城市对公共安全的服务。对公共场所视讯记录的即时分析与生物识别软体相结合,将能够识别危险情况,并在发生车祸或恐怖袭击等情况时自动迅速向当局发出警报。与现有的闭路电视系统不同,资料管理平台将连接各种服务,支援 5G 的装置将能够透过无线方式获得更多更新。

北美预计将占据主要份额

- 随着智慧城市和工业物联网的兴起,北美成为这项正在发展的物联网技术的集中地。这些是 LPWAN 在该地区扩展的一些主要原因。

- 该地区在智慧城市的扩张方面取得了巨大进展。预计这些将进一步提高该地区 LPWAN 的使用。

- 此外,由于对更好的车队管理解决方案的需求不断增加,机场、购物中心和其他行业的数位或智慧基础设施发展预计将在预测期内推动整个地区的市场扩张。

- 智慧电錶、家庭能源管理、楼宇自动化和安全照明等 LPWAN 不断增长的应用领域是需求成长的重要推动力。 LPWAN 是一种提供实用解决方案的技术,可确保资料在未经许可的频段(例如 1 GHz 以下或 3 GHz 以下范围)上传输,任何人都可以使用这些频段来开发自己的网路。这一点很重要,因为人们越来越担心物联网 (IoT) 设备的安全性以及该地区对加密通讯通道的需求。

低功耗广域网路产业概述

低功耗广域网路市场适度分散。随着物联网生态系统的不断壮大,LPWAN等各种技术也不断发展,这推动了参与者对市场的投资。此外,随着技术升级,玩家正在逐步进入市场。一些主要参与者包括思科系统公司、Sigfox SA、AT&T Inc.、沃达丰集团 PLC、Semtech Corporation、华为技术公司和 Ingenu Inc.。

2023 年 3 月,Semtech 公司率先发布了来自 Browan、Deviceroy、HSB 的 Meshify 和 New Cosmos 的产品,并且基于 Semtech 的 LoRa 技术。首批获得 Sidewalk 认证的产品将成为安全共享网路的一部分,帮助设备在家庭和社区中更好地工作,包括 Browan 的运动和二氧化碳感测器、Deviceroy 的太阳能装置智慧调製解调器、HSB 的 Meshify 水感测器、和New Cosmos DeNova Detect 天然气警报器。

2023 年 3 月,iWire Global 宣布在土耳其成立其最新子公司 Una-IoT,该公司是由 Sigfox 0G 技术支援的 0G 网路的独家营运商。 Una-IoT 是 iWire Global 和 IoT NET Bilisim 之间的合资企业,IoT NET Bilisim 是一家位于安卡拉的专门从事物联网服务和解决方案的土耳其公司。此举预计将推动土耳其物联网产业的成长,以满足市场对大规模物联网解决方案不断增长的需求,包括智慧公用事业计量、物流、智慧城市和资产管理。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场动态

- 市场驱动因素

- 设备之间远端连线的需求不断增长

- 5G技术推动市场成长

- 市场限制

- 隐私和安全问题

第 6 章:市场细分

- 按类型

- 洛拉万

- 窄频物联网

- LTE-M

- 其他类型(Sigfox、Weightless 等)

- 按服务

- 专业服务

- 託管服务

- 按最终用户

- 油和气

- 消费性电子产品

- 卫生保健

- 工业製造

- 物流与旅游

- 其他最终用户

- 按应用

- 智慧城市

- 智慧家庭/建筑

- 智慧农业

- 其他应用

- 按地理

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

第 7 章:竞争格局

- 公司简介

- Semtech Corporation

- Sigfox SA

- Huawei Technologies Co. Ltd.

- Ingenu Inc.

- Cisco Systems Inc.

- AT&T Inc.

- Vodafone Group PLC

- Loriot AG

第 8 章:投资分析

第 9 章:市场机会与未来趋势

The Low-Power WAN Market size is estimated at USD 32.01 billion in 2024, and is expected to reach USD 260.13 billion by 2029, growing at a CAGR of 52.05% during the forecast period (2024-2029).

A low-power WAN (LPWAN) wireless wide area network connects low-bandwidth, battery-operated devices at low bit rates over large distances.

Key Highlights

- Over the forecast period, it is predicted that the growing need for low-power wide-area connectivity in the Internet of Things (IoT) applications will propel the growth of the entire market.

- Applying the abovementioned capabilities increases productivity twofold and aids in tracking crop development. In this industry, LPWAN facilitates the transmission of small amounts of data across long distances, which is anticipated to positively affect market growth throughout the forecast period.

- Fleet management, GPS tracking, smart meters, smart grid management, home automation, waste management, process monitoring and control, and temperature monitoring are just a few of the critical applications of LPWAN.

- Future coverage and scalability, technological coexistence, and real-time communication are only a few of the issues with this technology that could hinder its widespread adoption and commercialization. In addition, network security, which is less reliable than transmitting data back to endpoints, might also be vulnerable to interference.

- The most helpful technology for assisting medical diagnosis and treatment during COVID-19 was 5G, and the trend is still going strong today. Since the network's high capacity and low latency allow the transmission of high-definition footage for processing and analytics, the healthcare sector, for example, has profited the most from deploying 5G. With this tool, healthcare providers can recognize patients acting differently than average, having just undergone an incident like a fall, or becoming a danger to themselves or others.

Low-Power WAN Market Trends

5G Technology to Drive the Market Growth

- The following generation of mobile networking technologies, or 5G, is equipped to deliver an enhanced end-user experience with seamless coverage, high data speeds, reduced latency, superior performance, and effective communications.

- One of many areas that 5G connection will affect is the world of cell phones. For example, the poor download speeds and high latency of 4G have long been a barrier to infrastructure developments in the Internet of Things (IoT) and machine-to-machine (M2M). As more devices are linked to a network and conversing with one another, the cumulative effect of any latency will become more substantial and perceptible.

- Because of its advanced research and development from the local supply chain, early and significant backing from the domestic government in infrastructure capacities, and consumers' interest in future technologies inside and outside the vehicle, China is expected to lead the early deployment of 5G-capable vehicles. The adoption process is made much more straightforward because these cars will only be sold in China's sizable domestic market, where 5G infrastructure and standards are likely to be uniformly applied.

- In addition, 5G will significantly enhance smart city services for public safety. Real-time analytics of video recordings from public locations paired with biometric software would be able to recognize risky situations and automatically alert authorities quickly in cases like a car accident or terrorist strike. Data management platforms will connect various services, and 5G-enabled equipment will be able to get more updates wirelessly, unlike present CCTV systems.

North America Expected to Occupy a Major Share

- With the rise of smart cities and the Industrial Internet of Things, North America has a significant concentration of this developing IoT technology. These are some of the leading causes behind the expansion of LPWAN in the area.

- The region has seen a lot of progress toward the expansion of smart cities. These are anticipated to boost LPWAN usage in the area even further.

- Additionally, due to an increased need for better fleet management solutions, digital or smart infrastructure development across airports, shopping centers, and other industries is anticipated to fuel market expansion throughout the region during the projection period.

- The rising application fields for LPWAN, such as smart meters, home energy management, building automation, and security lighting, are significant drivers of demand growth. LPWANs are a technology that offers a practical solution and ensures that data is transmitted over unlicensed spectrum bands like the sub-1 GHz or sub-3 GHz range, which anyone can use to develop their network. This is important because there are growing concerns about the security of Internet of Things (IoT) devices and the need for encrypted communication channels around the area.

Low-Power WAN Industry Overview

The low-power WAN market is moderately fragmented. With the increase in the IoT ecosystem, various technologies, such as LPWAN, are also evolving, which drives the players to invest in the market. Moreover, the players are entering the market gradually with technological upgradation. Some key players include Cisco Systems Inc., Sigfox SA, AT&T Inc., Vodafone Group PLC, Semtech Corporation, Huawei Technologies Co. Ltd, and Ingenu Inc.

In March 2023, Semtech Corporation, the first third-party announcement Products from Browan, Deviceroy, HSB's Meshify, and New Cosmos are currently available and based on Semtech's LoRa technology. Some of the first Sidewalk-qualified products to be a part of the secure, shared network that helps devices work better around the home and in the community include Browan's motion and carbon dioxide sensors, Deviceroy's smart modem for solar installations, HSB's Meshify water sensor, and New Cosmos DeNova Detect natural gas alarm.

In March 2023, iWire Global announced the establishment of its newest subsidiary, Una-IoT, the exclusive operator of the 0G Network, powered by Sigfox 0G technology, in Turkey. Una-IoT was established as a venture between iWire Global and IoT NET Bilisim, a Turkish firm specializing in IoT services and solutions based out of Ankara. This move is expected to fuel the growth of the IoT sector in Turkey to meet the growing market demands for massive IoT solutions, including smart utility metering, logistics, smart cities, and asset management.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Need of Long Range Connectivity Between Devices

- 5.1.2 5G Technology to Drive the Market Growth

- 5.2 Market Restraints

- 5.2.1 Privacy and Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 LoRaWAN

- 6.1.2 NB-IoT

- 6.1.3 LTE-M

- 6.1.4 Other Types (Sigfox, Weightless, etc.)

- 6.2 By Service

- 6.2.1 Professional Service

- 6.2.2 Managed Service

- 6.3 By End-user

- 6.3.1 Oil and Gas

- 6.3.2 Consumer Electronics

- 6.3.3 Healthcare

- 6.3.4 Industrial Manufacturing

- 6.3.5 Logistics and Travelling

- 6.3.6 Other End-users

- 6.4 By Application

- 6.4.1 Smart Cities

- 6.4.2 Smart Homes/Buildings

- 6.4.3 Smart Agriculture

- 6.4.4 Other Applications

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Semtech Corporation

- 7.1.2 Sigfox SA

- 7.1.3 Huawei Technologies Co. Ltd.

- 7.1.4 Ingenu Inc.

- 7.1.5 Cisco Systems Inc.

- 7.1.6 AT&T Inc.

- 7.1.7 Vodafone Group PLC

- 7.1.8 Loriot AG