|

市场调查报告书

商品编码

1550318

LoRa 和 LoRaWAN 物联网连接:市场占有率分析、行业趋势和统计、成长预测(2024-2029 年)LoRa And LoRaWAN IoT Connectivity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

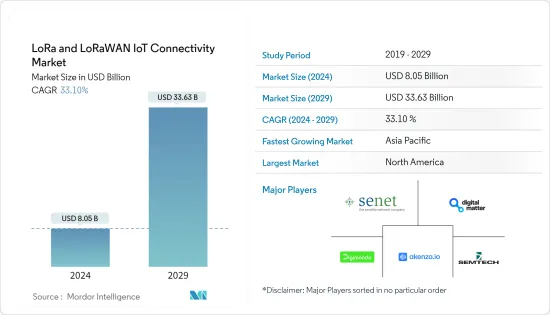

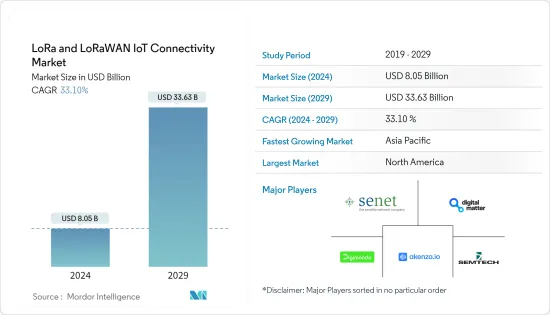

LoRa和LoRaWAN物联网连接市场规模预计到2024年为80.5亿美元,预计到2029年将达到336.3亿美元,在预测期内(2024-2029年)复合年增长率预计为33.10%。

LoRa 和 LoRaWAN 技术在物联网市场中越来越受欢迎,主要是因为它们的经济性和扩充性。 LoRa 简单的硬体需求和高效的通讯协定使其成为开发经济实惠的物联网设备和感测器的绝佳选择。这种负担能力将扩大物联网解决方案的采用,并增加各行业的可近性。这种可访问性对于预算和资源有限的部门尤其有利。

LoRaWAN 的架构因其无缝可扩展性而受到讚誉,能够部署数千到数百万台设备的物联网网路。这种可扩展性对于需要广泛覆盖的物联网应用尤其重要,例如智慧城市、工业自动化和供应链管理领域。经济高效的设备开发和网路可扩展性相结合,使 LoRa 和 LoRaWAN 成为物联网采用的关键推动者,推动各个领域的采用。

沙乌地阿拉伯正在建设的 NEOM City 有望成为先进的智慧城市。到 2030 年,预计将容纳 2 亿个物联网设备。 2023 年 7 月,NEOM 认知技术部门 TONOMUS 宣布推出第一个数位通讯中心。该中心旨在支援以软体为中心的网路和安全的私有云端,为约 1,800 栋建筑和 60 个地点提供服务。 NEOM 雄心勃勃的计画包括到 2025 年容纳约 30 万名建筑工人,到 2030 年容纳超过 2 亿个物联网设备。

LoRa和LoRaWAN技术在工业IoT领域极为重要。 LoRa和LoRaWAN技术在工业IoT领域至关重要,可让大型工业领域快速适应、降低营运成本、提高工人安全并加强环境和社会管治。这种适应性对于这些产业在日益数位化的环境中生存和发展至关重要。在 LoRaWAN 设定中,网关策略性地放置在现场。单一网关可以覆盖适量的设备,并与数以万计的物联网感测器结合使用,形成一个强大的网路。这种网路所有权使 IT 部门能够对其参数进行无与伦比的控制。此外,使用 LoRa 和 LoRaWAN 执行良好的无线部署可确保基础设施无缝扩展和重新部署,同时将对营运的干扰降至最低。

LoRa 技术对于低资料速率应用非常有效,但与无线技术相比具有频宽限制。这种限制给需要高资料吞吐量的应用程式带来了挑战。在 LoRaWAN 和其他无线网路人口密集的地区,可能会发生干扰和拥塞,从而损害设备到设备通讯的可靠性和效能。

LoRaWAN 路由面临许多挑战。主要问题源自于端节点和网关之间的通讯范围仅限于一跳这一事实。在网路覆盖不稳定或讯号接收不良的地区,这种限制尤其麻烦。此外,扩展链路还面临阻碍资料包接收的障碍和干扰的风险。此外,确保资料安全和隐私是 LoRaWAN 技术广泛接受的关键障碍。

LoRa 和 LoRaWAN 物联网连接市场趋势

数位转型与工业自动化驱动市场

- 与 5G 和 NB IoT 等同类技术相比,LoRaWAN 技术的能耗显着降低,高达 5 倍。这种效率使得 LoRaWAN 对于资料需求不大或没有即时需求的应用程式特别有利。 LoRaWAN 设备的电池寿命可达 5 至 15 年,视资料量和传输频率而定。对于管理远端位置资产或处理大量连接设备的行业来说,如此长的使用寿命非常宝贵,从而节省大量维护成本和时间。

- LoRaWAN 应用程式使公共和私人营业单位能够收集智慧城市中的关键资料,使它们更加永续性和居住。这些应用程式促进了各种功能,从监控废弃物水平和控制路灯,到追踪能源消耗、二氧化碳水平等环境指标和停车位占用。印度雄心勃勃,倡议在 2023 年 9 月之前竞标210 亿美元的计划,开发 100 多个智慧城市,这将大大促进全国范围内基于 LoRaWAN 的物联网解决方案的采用。

- LoRaWAN 可在机场和港口等广阔环境中实现准确的资产追踪。它可以准确提供货柜、堆高机、卡车和其他设备的位置,精度仅为几公尺。对于在开放区域需要更高精确度的应用,LoRaWAN 可以与 GPS 结合使用。整合 LoRaWAN 等物联网技术的「智慧机场」趋势正在蓬勃发展,重点是增强基础设施、自动化、即时分析和预测工具,以实现更好的决策。

- 工业 4.0 应用对于自动化生产和推动欧洲工业数位化至关重要。监控温度、湿度和振动等关键参数的感测器可确保通讯协定合规性并促进预测性维护。

- 例如,根据德国贸易投资局 (GTAI) 的资料,光是德国在五年内就为工业 4.0 计画投入了超过 100 亿欧元。此外,西门子于2023年7月宣布将在德国投资10亿欧元,为纽伦堡大都会打造工业元宇宙蓝图。

製造业带动市场

- 工业IoT透过对遗留流程和设备进行数位化、增加利润、降低成本和提高效率来改变业务。支援 LoRa 的设备和感测器即时传输资料,为预测性维护、机器健康状况、效率和最大限度地减少停机时间提供重要见解。

- 在汽车产业,LoRaWAN 解决方案主要防止负载载体和运输货物的遗失。汽车製造商从层级供应商采购的引擎和变速箱等零件具有巨大价值,通常成本在 500 至 2000 欧元之间。专用货运设备是一种可比较的高价值资产。值得注意的是,在物流过程中,可能会出现5-15%的损失率。透过利用 LoRaWAN 应用程序,公司可以提高整个供应链的透明度。

- 例如,2024年1月,全球物联网解决方案领导者移远无线发布了其最新创新产品KG200Z模组。这款LoRa技术模组专为优先考虑可靠性、超低功耗和成本效率的物联网计划量身定制。 KG200Z 具有强大的连接能力,在城市环境中的覆盖范围为 2-5 公里,在郊区环境中的覆盖范围为 10-15 公里。 12.0mm x 12.0mm x 1.8mm LGA 封装的紧凑尺寸使其成为希望将物联网解决方案无缝整合到其设备中的製造商和开发人员的多功能选择。

- 2024年3月,以其LoRaWAN物联网解决方案而闻名的移远通讯宣布与Things Industries建立策略合作伙伴关係。此次合作使移远通讯的 KG200Z LoRaWAN 模组能够预先配备「Works with The Things Stack」和「Secured by The Things Stack」认证,以增强安全功能。透过与 The Things Industries 合作,移远通讯的客户将能够将 KG200Z 模组无缝整合到他们的设备设计中,并获得一套附加服务。此次合作凸显了移远通讯对端对端加密和金钥管理的承诺,同时利用其在模组化技术方面的丰富经验。

- 工业 4.0 将重塑企业产品设计、製造和分销的方式。企业和政府都在进行大量投资,以适应这项变革。例如,马里兰州政府已拨款 100 万美元,帮助二十多家製造商采用工业 4.0 技术。透过马里兰州製造 4.0倡议,马里兰州的 26 家小型企业获得了津贴,以强调推动工业创新。工业 4.0 投资的激增将加强研究市场,尤其是推动 LoRA 和 LoRAWAN 领域的发展。

LoRa 和 LoRaWAN 物联网连接产业概述

LoRa 和 LoRaWAN 物联网连接市场本质上是分散的。 Senet、Semtech Corporation、Digimondo GmbH、Akenza AG 和市场上其他主要企业进行了调查。市场上的公司正在采取合作伙伴关係、协议、创新和收购等策略来增强其服务产品并获得永续的竞争优势。

- 2024 年 4 月,AWS 在其西班牙公共网路上引入了对 LoRaWAN 的支援。这意味着西班牙的 Amazon Web Services (AWS) 客户现在可以将其低功耗、远距LoRaWAN 设备无缝连结到 AWS 云端服务。透过适用于 LoRaWAN 的 AWS IoT Core(完全託管的网路伺服器),客户可以轻鬆地将利用 LoRaWAN通讯协定的无线设备整合到 AWS 云端中。该服务简化了流程,并消除了客户在本地维护 LoRaWAN 伺服器的需要,使他们能够灵活地建立私人 LoRaWAN 网路。

- 2024 年 1 月,安富利将增强由 AWS 提供支援的 IoTConnect,并支援 LoRaWAN 和 Amazon Sidewalk。原始设备製造商 (OEM) 现在可以利用目的地最新的 IoTConnect 更新在 Amazon Web Services (AWS) 上快速建立智慧物联网 (IoT) 设备。这个全面的版本不仅将 LoRaWAN 闸道器与装置的本机支援整合在一起,而且还扩展了对支援 Amazon Sidewalk 的装置的支援。 Amazon Sidewalk 是远距、低频宽网络,专为安全互连数十亿个物联网设备而客製化。安富利的 IoTConnect 以其连网型解决方案的简单性、安全性和扩充性而闻名,它提供了统一的「单窗格」体验,可以轻鬆安装和连结这些新颖的设备。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 宏观经济情境分析(景气衰退、俄罗斯/乌克兰危机等)

第五章市场动态

- 市场驱动因素

- 收集资料和控制事物的连网型设备的普及

- 数位转型和工业自动化

- 市场限制因素

- 需要特定技术的技能和意识

- 网路安全风险增加

- 深入了解 LoRa 和 LoRaWAN 物联网连接

- 定价模式及定价分析

- LoRa 和 LoRaWAN 物联网连接的主要使用案例

- 智慧城市

- 智慧建筑

- 连网型的医疗设备

- 智慧车队管理和追踪

- 智慧农业

- 环境监测和警报

- 全球各地与 LoRa 和 LoRaWAN 相关的政府法规

第六章 市场细分

- 副产品

- 硬体

- 物联网软体/平台

- 按服务

- 按公司规模

- 小型企业

- 大公司

- 按行业分类

- 卫生保健

- 运输/物流

- 政府/公共机构

- 零售/电子商务

- 製造业

- 能源/公共产业

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- The Things Networks

- Senet

- MachineQ(Comcast)

- LorIoT AG

- ChirpStack.io

- Actility

- Semtech Corporation

- Digimondo GmbH

- Digital Matter

- Akenza AG

- Netmore Group

- LoRa and LoRaWAN IoT Product Benchmarking Analysis

第八章 市场机会及未来趋势

The LoRa And LoRaWAN IoT Connectivity Market size is estimated at USD 8.05 billion in 2024, and is expected to reach USD 33.63 billion by 2029, growing at a CAGR of 33.10% during the forecast period (2024-2029).

LoRa and LoRaWAN technologies are gaining traction in the IoT market, primarily due to their affordability and scalability. LoRa's simple hardware requirements and efficient communication protocols make it a standout choice for developing affordable IoT devices and sensors. This affordability expands the adoption of IoT solutions, enhancing their accessibility across various industries. Such accessibility is particularly beneficial for sectors constrained by budget or resources.

LoRaWAN's architecture is lauded for its seamless scalability, enabling the deployment of IoT networks ranging from thousands to millions of devices. This scalability is crucial for IoT applications requiring extensive coverage, notably in smart cities, industrial automation, and supply chain management sectors. The combination of cost-effective device development and the ability to scale networks positions LoRa and LoRaWAN as key enablers of IoT adoption, driving their penetration across diverse sectors.

NEOM City, under construction in Saudi Arabia, is poised to become a leading smart city. By 2030, it's projected to accommodate 200 million IoT devices. In July 2023, TONOMUS, NEOM's cognitive technology arm, unveiled its inaugural digital communications hub. This center is designed to support a software-centric network and a secure private cloud, catering not only to 60 locations but also to around 1,800 structures. It's a crucial infrastructure, especially given NEOM's ambitious plans, which include hosting an estimated 300,000 construction personnel by 2025 and those above 200 million IoT devices by 2030.

LoRa and LoRaWAN technologies are pivotal in the realm of Industrial IoT. They empower large industrial segments to swiftly adapt, reduce operational costs, enhance worker safety, and bolster environmental and social governance. This adaptability is crucial for these industries to survive and grow in an increasingly digital landscape. In the LoRaWAN setup, gateways are strategically placed on-site. A single gateway can cover a modest terminal, and when combined with tens of thousands of IoT sensors, they form a robust network. This network ownership grants the IT department unparalleled control over its parameters. Moreover, a well-executed wireless deployment using LoRa and LoRaWAN ensures seamless infrastructure expansion or redeployment, minimizing operational disruptions.

LoRa technology, though effective for low data rate applications, faces bandwidth constraints compared to its wireless counterparts. This limitation proves challenging for applications demanding high data throughput. In areas densely populated with LoRaWAN or other wireless networks, interference and congestion can arise, potentially hampering the reliability and performance of device-to-gateway communications.

LoRaWAN routing encounters numerous challenges. A primary issue arises from its restricted one-hop communication range between end nodes and gateways. This limitation is especially troublesome in regions with spotty internet coverage or radio-hostile environments. Additionally, extended links face the risk of obstacles and interference, potentially hampering packet reception. Furthermore, ensuring data security and privacy is a pivotal hurdle in the widespread acceptance of LoRaWAN technologies.

LoRa And LoRaWAN IoT Connectivity Market Trends

Digital Transformation and Industrial Automation to Drive the Market

- LoRaWAN technologies, compared to counterparts like 5G or NB IoT, boast significantly lower energy consumption, up to five times less. This efficiency makes LoRaWAN especially lucrative for applications with modest data needs or no real-time demands. With data volume and transfer frequency as variables, LoRaWAN devices can have a battery life ranging from five to 15 years. Such longevity proves invaluable for industries managing assets in remote areas or dealing with a high volume of connected devices, leading to substantial cost and time savings on maintenance.

- LoRaWAN applications empower public and private entities to gather crucial data in smart cities, enhancing urban sustainability and livability. These applications facilitate various functions, from monitoring waste container levels and controlling street lighting to tracking energy consumption, environmental metrics like CO2 levels, and parking space occupancy. India's ambitious initiative to develop over 100 smart cities, with projects valued at USD 21 billion tendered by September 2023, is poised to significantly boost the adoption of LoRaWAN-based IoT solutions nationwide.

- LoRaWAN enables precise asset tracking in expansive environments like airports and seaports. It can accurately provide the location of containers, forklifts, trucks, and other equipment with an accuracy of just a few meters. For applications demanding even greater precision in open areas, LoRaWAN can be paired with GPS. The trend towards 'smart airports,' integrating IoT technologies like LoRaWAN, is gaining momentum, focusing on enhanced infrastructure, automation, real-time analytics, and predictive tools for better decision-making.

- Industrial 4.0 applications are pivotal in automating production and driving digitalization in the European industry. Sensors monitoring vital parameters like temperature, humidity, and vibration ensure adherence to protocols and facilitate predictive maintenance.

- For instance, data from GTAI - the German Trade and Invest Agency, reveals that Germany alone poured over EUR 10 billion into Industry 4.0 initiatives over five years. Furthermore, in July 2023, Siemens announced it would spend EUR 1 billion in Germany to create a blueprint for an industrial metaverse in the Nuremberg metropolitan region.

Manufacturing to Drive the Market

- Industrial IoT transforms operations by digitizing legacy processes and equipment, boosting profits, cutting costs, and enhancing efficiencies. Devices and sensors enabled with LoRa transmit real-time data, offering crucial insights into predictive maintenance, machine health, efficiency, and minimizing downtime.

- Within the automotive industry, LoRaWAN solutions primarily prevent the loss of load carriers and transported goods. Components like engines and transmissions, sourced by car manufacturers from Tier 1 suppliers, hold significant value, typically priced between EUR 500 and 2000. Specialized cargo equipment represents a comparably high-value asset. It's worth noting that logistics processes can experience loss rates ranging from 5 to 15%. By leveraging LoRaWAN applications, businesses can achieve heightened transparency throughout their supply chains.

- For instance, in January 2024, Quectel Wireless Solutions, a global leader in IoT solutions, unveiled its latest innovation, the KG200Z module. This LoRa technology module is tailor-made for IoT projects, prioritizing reliability, ultra-low power consumption, and cost efficiency. The KG200Z promises robust connectivity, with an impressive reach of 2-5 kilometers in urban environments and 10-15 kilometers in suburban settings. Its compact dimensions, at 12.0 mm x 12.0 mm x 1.8 mm in an LGA package, make it a versatile choice for manufacturers and developers looking to integrate IoT solutions into their devices seamlessly.

- In March 2024, Quectel, a prominent player in LoRaWAN IoT solutions, unveiled a strategic partnership in collaboration with Things Industries. This alliance ensures that Quectel's KG200Z LoRaWAN module is pre-equipped with "Works with The Things Stack" and "Secured by The Things Stack" certifications, bolstering its security features. By teaming up with The Things Industries, Quectel enables its customers to integrate the KG200Z module into their device designs seamlessly and grants them access to a suite of additional services. This partnership underscores a commitment to end-to-end encryption and key management while harnessing Quectel's extensive experience in module technology.

- Industry 4.0 reshapes how businesses approach product design, manufacturing, and distribution. Both companies and governments are making significant investments to align with this transformative shift. For instance, the Maryland Government allocated a substantial sum of USD 1 million to aid over two dozen manufacturers in adopting Industry 4.0 technologies. Through the Maryland Manufacturing 4.0 initiative, 26 small and mid-sized companies in Maryland have secured grant funding, emphasizing the push for industry innovation. This surge in Industry 4.0 investments is poised to bolster the studied market, particularly propelling the LoRA and LoRAWAN sectors.

LoRa And LoRaWAN IoT Connectivity Industry Overview

The LoRA and LoRAWAN Markets are fragmented in nature. Senet, Semtech Corporation, Digimondo GmbH, Akenza AG, and other major players in the market studied. Players in the market are adopting strategies such as partnerships, agreements, innovations, and acquisitions to enhance their service offerings and gain sustainable competitive advantage.

- In April 2024, AWS introduced support for LoRaWAN on its public network in Spain. This means Amazon Web Services (AWS) clients in Spain can now seamlessly link their low-power, long-range LoRaWAN devices to AWS's cloud services. Through AWS IoT Core for LoRaWAN, a fully managed Network Server, customers can effortlessly integrate their wireless devices, utilizing the LoRaWAN protocol, with the AWS cloud. This service streamlines the process and eliminates customers' need to maintain their LoRaWAN servers on-premises, offering the flexibility to establish private LoRaWAN networks.

- In January 2024, Avnet Enhances IoTConnect, Powered by AWS, with LoRaWAN and Amazon Sidewalk Support. Original Equipment Manufacturers (OEMs) can now swiftly craft smart Internet of Things (IoT) devices on Amazon Web Services (AWS) with Avnet's latest IoTConnect update. This comprehensive release not only integrates native backing for LoRaWAN gateways and devices but also extends support to Amazon Sidewalk-enabled devices. Amazon Sidewalk, a long-range, low-bandwidth network, is tailored to interlink billions of IoT devices securely. Avnet's IoTConnect, known for its simplicity, security, and scalability in connected solutions, now offers a unified "single pane of glass" experience for effortlessly onboarding and linking these novel devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Analysis of Macro-Economic Scenarios (Recession, Russia-Ukraine Crisis, etc.)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Connected Devices Gathering Data and Controlling Things

- 5.1.2 Digital Transformation and Industrial Automation

- 5.2 Market Restraints

- 5.2.1 Need for Technology-specific Skillset and Awareness

- 5.2.2 Increase Cybersecurity Risks

- 5.3 Insights on LoRa and LoRaWAN IoT Connectivity

- 5.4 Analysis of Pricing Models and Pricings

- 5.5 Key Use Cases of LoRa and LoRaWAN IoT Connectivity

- 5.5.1 Smart Cities

- 5.5.2 Smart Buildings

- 5.5.3 Connected Medical Devices

- 5.5.4 Smart Fleet Management and Tracking

- 5.5.5 Smart Agriculture

- 5.5.6 Environmental Monitoring and Alerts

- 5.6 LoRa and LoRaWAN-related Government Regulations Across the Globe

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Hardware

- 6.1.2 IoT Software/Platform

- 6.1.3 Services

- 6.2 By Size of Enterprise

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Industry Vertical

- 6.3.1 Healthcare

- 6.3.2 Transportation and Logistics

- 6.3.3 Government and Public Sector

- 6.3.4 Retail and E-commerce

- 6.3.5 Manufacturing

- 6.3.6 Energy and Utilities

- 6.3.7 Other Industry Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 The Things Networks

- 7.1.2 Senet

- 7.1.3 MachineQ (Comcast)

- 7.1.4 LorIoT AG

- 7.1.5 ChirpStack.io

- 7.1.6 Actility

- 7.1.7 Semtech Corporation

- 7.1.8 Digimondo GmbH

- 7.1.9 Digital Matter

- 7.1.10 Akenza AG

- 7.1.11 Netmore Group

- 7.2 LoRa and LoRaWAN IoT Product Benchmarking Analysis