|

市场调查报告书

商品编码

1641957

数位流程自动化:市场占有率分析、产业趋势与成长预测(2025-2030 年)Digital Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

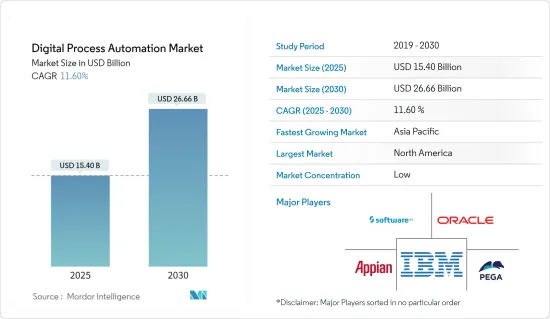

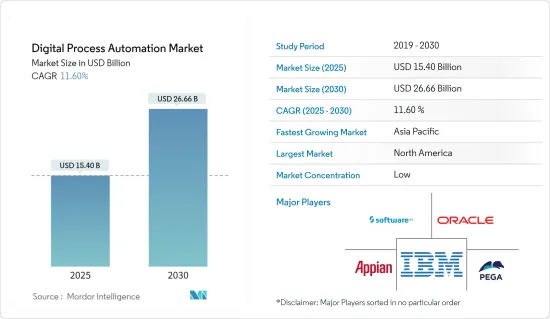

数位化流程自动化市场规模预计在 2025 年为 154 亿美元,预计到 2030 年将达到 266.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.6%。

随着新技术的不断流行和加速,虚拟世界和实体世界的融合正在创造新的经营模式。製造商正在实施新的经营模式来销售数位服务和产品,例如数位双胞胎。

关键亮点

- 提高业务效率和简化业务流程是各行各业的首要任务。由此推断,对效率的关注正在推动对 DPA 解决方案的需求。透过自动化和优化手动和重复任务,公司可以减少错误,消除瓶颈并提高流程效率。透过自动化工作流程和标准化流程,公司可以实现更快的交货时间、提高生产力并降低成本。随着企业寻求改善客户体验、推动卓越营运并在不断变化的市场中保持竞争力,对 DPA 解决方案的需求预计会增加。

- DPA 解决方案的另一个关键市场驱动力是企业的持续数位转型。推论是,企业正在加速采用数位技术来转变业务、改善消费者体验并获得竞争优势。 DPA 透过帮助组织实现基本业务活动的数位化和自动化,在这一转变中发挥着至关重要的作用。 DPA 解决方案透过自动执行手动任务、连接系统和应用程式以及提供流程效能的即时可见性,实现端到端流程自动化和灵活性。对 DPA 的需求源自于企业希望利用数位技术并在营运中实现数位成熟度。

- 旧有系统和复杂的 IT 环境可能是采用 DPA 解决方案的主要障碍。推论是,许多组织现有的系统、应用程式和技术并非设计为能够轻鬆与 DPA 平台整合。这些旧有系统缺乏与 DPA 解决方案无缝连接所需的应用程式介面 (API) 和现代架构,导致整合困难且耗时。此外,一些组织拥有大量客製化或专有软体,可能与市售的 DPA 工具不相容。

- 疫情促使许多产业更多采用DPA解决方案,但也导致一些组织面临预算限制和优先事项转变。推论是,受到疫情严重影响的公司可能已经转移资源来应对眼前的挑战,例如削减成本的措施和专注于必要的业务。这可能导致DPA解决方案实施延迟或计划计划延迟。此外,资金紧张的组织可能没有足够的预算来投资新技术,包括 DPA。俄乌战争也对整个包装生态系统产生了影响。

数位流程自动化市场趋势

业务流程管理 (BPM) 的日益普及可望加速小型企业的发展

- 采用 BPM 解决方案有助于组织更了解其现有业务流程并确定需要改进的领域。推论是,随着组织采用 BPM倡议,他们将越来越认识到流程自动化和最佳化的好处。当组织意识到需要自动化流程来提高效率、生产力和灵活性时,这种意识产生了对 DPA 解决方案的需求。

- BPM 解决方案通常作为数位转型倡议的基石,帮助公司整合和简化跨多个部门和平台的业务。推论是,随着公司采用 BPM,他们开始更加意识到完整流程协作和自动化的好处。这种洞察将推动对可以轻鬆与 BPM 平台连结的 DPA 系统的需求,扩展自动化功能并让公司能够存取整个自动化生态系统。

- BPM倡议通常涉及扩展和调整流程以满足不断变化的小型企业需求和市场动态。推论是,企业正在意识到可扩展且灵活的自动化解决方案对于支援其 BPM 计画的重要性。 DPA 解决方案提供了自动化从简单到复杂的各种流程所需的可扩展性和灵活性,以满足不断变化的业务需求。 BPM 的采用推动了对可扩展且适应性强的 DPA 解决方案的需求,以满足组织日益增长的自动化需求

- BPM 培育了一种持续流程改善的文化,鼓励组织定期评估和改进其流程。推论是,随着组织采用 BPM,他们将寻求自动化解决方案来支援其持续改善工作。 DPA 解决方案支援监控、分析和优化自动化流程,以提高效率并改善长期效能。 BPM 的采用将推动对 DPA 解决方案的需求,这些解决方案有助于持续改善流程并为资料主导的决策提供分析和见解。

- 在新型冠状病毒(COVID-10)疫情爆发期间,全球展览公司取消了2020年和2021年的一些线下活动,优先探索数位化形式。根据 2021 年 6 月进行的一项调查,全球 80% 的展览场馆正在采用数位服务和产品来补充其现有的展品。同时,45%的服务供应商对于将其内部程序和工作流程转变为数位化流程持怀疑态度。

北美占据很大市场份额

- 由于北美地区拥有大型数位流程自动化供应商,预计该地区将为市场扩张做出重大贡献。推动该地区数位流程自动化市场成长的关键趋势包括多样化包装,这推动了对先进感测技术的需求,从而直接影响自动化产品的兴起。

- 由于技术的进步和全球供应链/物流的精简,美国正在经历显着的成长。这些国际物流网络的出现意味着美国製造商现在可以有效率、有效地将成品和原材料运送到世界任何地方。

- 该地区正经历合作、併购的激增,以利用这一潜力。这些投资的根本驱动力是新技术和部署选项的持续成长。

- Sigma Solve 将于 2022 年 8 月上市,这是一家技术咨询和软体开发公司,致力于指导客户实现数位化、收入成长、系统整合和业务流程自动化的愿景,将综合数位能力和创新带到北美各地的企业伙伴关係。 Sigma Solve 的数位转型方法与 Liferay 的 DXP 平台完美整合。

- 这一趋势大大增加了美国製造商和国际竞争对手的经济机会。机器人流程自动化 (RPA) 是使企业能够跟上所有业务领域快速变化步伐的关键技术之一。 RPA 描述了自动执行复杂工作任务、流程和工作流程的虚拟代理程式。

数位流程自动化行业概览

数位过程自动化市场是分散的。推出新产品并专注于持续创新是主要企业所采用的一些策略。主要参与企业包括 IBM Corporation、Pegasystems Inc.、Appian Corporation 和 Oracle Corporation。近期市场发展趋势如下:

- 2023 年3 月- 埃及领先的网路供应商埃及电信(TE) 正在与IBM 合作整合智慧自动化技术,为其跨移动、固定和核心网路的所有营运支援系统(OSS) 提供统一的解决方案。提供计划包括使用在 Red Hat OpenShift 上运作的IBM Cloud Pak for Watson AIOps 以及与 TE 一起实施 IBM 机器人流程自动化 (RPA) 解决方案。此解决方案旨在让 TE整体情况整个IT基础设施,帮助公司更快地创新,降低营运成本,并缩短排除故障和解决网路相关事件的时间。

- 2022年2月-诺基亚与Atos启动全球合作,为企业提供业界领先的4/5G无线网路专网解决方案及相关数位服务,并共同开发前沿新服务。透过促进新的工作方式,两家公司的合作将帮助企业提高业务效率。该整合产品託管在 Atos 或诺基亚伺服器上,结合了边缘和云端运算领域两大产业领导者的优势,支援企业向 4.0 工业革命过渡。此次伙伴关係将Atos AI 电脑视觉平台与诺基亚数位自动化云端相结合,Atos AI 电脑视觉平台最近因Atos 收购AI 先驱Ipsotek 及其无与伦比的IP 和软体能力而得到加强,诺基亚数位自动化云是一个工业级私人无线连接和应用平台。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

- 市场驱动因素

- 业务流程自动化对高效能后端流程的需求不断增加

- 更多地采用低程式码自动化来提高可访问性

- 市场限制

- 技术纯熟劳工短缺

第五章 市场区隔

- 按组件

- 解决方案

- 按服务

- 按部署

- 一经请求

- 本地

- 按组织规模

- 中小企业

- 大型企业

- 按最终用户

- 银行和金融服务保险(BFSI)

- 製造业

- 资讯科技/通讯

- 航太和国防

- 医疗

- 零售和消费品

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- IBM Corporation

- Bizagi Group Limited

- Pegasystems Inc.

- Appian Corporation

- Oracle Corporation

- Software AG

- DST Systems Inc.

- OpenText Corporation

- Newgen Software Technologies Ltd.

- TIBCO Software Inc.

第七章投资分析

第 8 章:市场的未来

The Digital Process Automation Market size is estimated at USD 15.40 billion in 2025, and is expected to reach USD 26.66 billion by 2030, at a CAGR of 11.6% during the forecast period (2025-2030).

As new technologies are trending and accelerating, merging the virtual and physical worlds creates new business models. Manufacturers are introducing new business models under which they sell digital services and products, such as digital twins.

Key Highlights

- Improving operational effectiveness and simplifying business processes are top priorities for organizations across all industries. According to inference, this emphasis on efficiency drives the demand for DPA solutions. By automating and optimizing manual and repetitive tasks, firms may lower errors, get rid of bottlenecks, and boost process efficiency. Organizations can achieve faster turn-around times, increased productivity, and cost savings by automating workflows and standardizing processes. The need for DPA solutions is anticipated to increase as companies look to enhance client experiences, drive operational excellence, and maintain their competitiveness in a changing market.

- Another significant market driver for DPA solutions is organizations' continual digital transformation path. According to inference, businesses are embracing digital technology at a faster rate to revolutionize their operations, improve consumer experiences, and gain a competitive advantage. By enabling organizations to digitize and automate their fundamental business activities, DPA plays a crucial part in this shift. DPA solutions enable organizations to achieve end-to-end process automation and agility by automating manual operations, linking systems and applications, and offering real-time visibility into process performance. The need for DPA is fueled by organizations' need to utilize digital technology and attain operational digital maturity.

- Legacy systems and complex IT environments can pose a significant restraint on the adoption of DPA solutions. Inference suggests that many organizations have existing systems, applications, and technologies in place that are not designed to easily integrate with DPA platforms. These legacy systems may lack the necessary APIs (Application Programming Interfaces) or modern architecture to seamlessly connect with DPA solutions, making integration challenging and time-consuming. Additionally, organizations may have heavily customized or proprietary software that is not easily compatible with off-the-shelf DPA tools.

- While the pandemic drove increased adoption of DPA solutions in many sectors, it also introduced budget constraints and shifting priorities for some organizations. Inference suggests that businesses heavily impacted by the pandemic may have diverted resources to address immediate challenges, such as cost-cutting measures or focusing on essential operations. This could have slowed down the adoption of DPA solutions or led to delays in planned projects. In addition, organizations that experienced financial difficulties may have limited budgets for investing in new technologies, including DPA. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

Digital Process Automation Market Trends

Small Enterprises are expected to grow at a higher pace on back of growing adoption of Business Process Management (BPM)

- The adoption of BPM solutions helps organizations gain a better understanding of their existing business processes and identifies areas for improvement. Inference suggests that as organizations implement BPM initiatives, they become more aware of the benefits of process automation and optimization. This awareness creates a demand for DPA solutions as organizations recognize the need to automate their processes to achieve greater efficiency, productivity, and agility.

- BPM solutions frequently act as the cornerstone for digital transformation initiatives, helping businesses to integrate and streamline their operations across many divisions and platforms. Inference implies that when businesses embrace BPM, they become more aware of the benefits of complete process orchestration and automation. This insight increases demand for DPA systems that can easily link with BPM platforms, extending automation capabilities and giving businesses access to a whole automation ecosystem.

- BPM initiatives often involve scaling and adapting processes to meet changing small business needs and market dynamics. Inference suggests that organizations recognize the importance of scalable and flexible automation solutions to support their BPM efforts. DPA solutions offer the scalability and flexibility required to automate a wide range of processes, from simple to complex, and accommodate evolving business requirements. The adoption of BPM drives the demand for DPA solutions that can scale and adapt to support the organization's growing automation needs.

- BPM fosters a culture of continuous process improvement, encouraging organizations to regularly evaluate and enhance their processes. Inference suggests that as organizations embrace BPM, they seek automation solutions that support their continuous improvement efforts. DPA solutions enable organizations to monitor, analyze, and optimize their automated processes, driving efficiency gains and performance improvements over time. The adoption of BPM fuels the demand for DPA solutions that facilitate ongoing process improvement and provide analytics and insights for data-driven decision-making.

- During the coronavirus (COVID-19) epidemic, exhibition companies globally stopped some in-person events in 2020 and 2021 in favor of exploring digital formats. According to research conducted in June 2021, 80 percent of global exhibition venues incorporated digital services or products to complement their existing displays. Meanwhile, 45 percent of service provider organizations questioned converting internal procedures and workflows into digital processes.

North America to Account for a Significant Market Share in the Market

- Due to the region's large digital process automation vendors, North America is expected to contribute significantly to market expansion. The major trends responsible for the growth of the digital process automation market in the region include the diverse packaging that increases demand for advanced sensing technology, which will directly impact the increase of automated products.

- The United States is significantly growing due to improved technology and streamlined global supply chains/logistics. This emergence of international logistics networks means that United States manufacturers can now efficiently and effectively deliver the finished products and raw materials anywhere around the world.

- The region has witnessed a surge of partnerships, mergers, and acquisitions to capitalize on these possibilities. The fundamental driver of these investments has been the continued growth of new technologies and deployment options.

- In August 2022, Sigma Solve, a technology consulting and software development company that guides clients' visions for digitization, sales growth, system integration, and business process automation, has formed a strategic partnership with Liferay DXP, which will provide a feature-rich platform that puts integrated digital capabilities and innovation in the hands of businesses across North America. Sigma Solve's digital transformation approach integrates perfectly with Liferay's DXP platform.

- This trend has massively increased the economic opportunities of US manufacturers and international competitors. Robotic process automation (RPA) is one key technology enabling companies to address the fast pace of change across all business areas. RPA provides virtual agents to automate tasks, processes, and workflows for complex work.

Digital Process Automation Industry Overview

The digital process automation market is fragmented. New product launches and focuses on continuous technology innovations are some strategies adopted by the major players. Key players are IBM Corporation, Pegasystems Inc., Appian Corporation, Oracle Corporation, etc. Recent developments in the market are

- March 2023 - Leading network provider in Egypt, Telecom Egypt (TE), announced that it is collaborating with IBM to integrate intelligent automation technologies to provide a unified solution for all of its operations support systems (OSS) across mobile, fixed, and core networks. The use of IBM Cloud Pak for Watson AIOps running on RedHat OpenShift and the implementation of IBM Robotic Process Automation (RPA) solutions by TE are both planned. The solution will be created to give TE a complete picture of its whole IT infrastructure and to assist them in fast innovating, lowering operational costs, and reducing the amount of time needed to troubleshoot and resolve network-related events.

- February 2022 - A global cooperation between Nokia and Atos was launched to offer enterprises industry-leading 4/5G private wireless networking solutions, along with related digital services, and to collaborate on the creation of new, cutting-edge services. By facilitating new working methods, our cooperation will assist businesses in achieving increased operational efficiency. The combined product, which is hosted on servers from Atos or Nokia, combines the strengths of the two industry leaders in edge and cloud computing to support businesses as they transition to the 4.0 industrial revolution. The partnership makes use of the Atos AI computer vision platform, which has recently been strengthened by Atos' acquisition of the AI pioneer Ipsotek and its unmatched IP and software capabilities, as well as the industrial-grade private wireless connectivity and application platform Nokia Digital Automation Cloud (DAC).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

- 4.4 Market Drivers

- 4.4.1 Increase Demand of Automating Business Process for Efficient Back-end process

- 4.4.2 Increase Adoption of Low Code Automation for Greater Accessibility

- 4.5 Market Restraints

- 4.5.1 Lack of Skilled Workforce

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solution

- 5.1.2 Service

- 5.2 By Deployment

- 5.2.1 On-demand

- 5.2.2 On-premise

- 5.3 By Organization Size

- 5.3.1 Small- and Medium-sized Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End User

- 5.4.1 Banking, Financial Services, and Insurance (BFSI)

- 5.4.2 Manufacturing

- 5.4.3 IT and Telecommunication

- 5.4.4 Aerospace and Defense

- 5.4.5 Healthcare

- 5.4.6 Retail and Consumer Goods

- 5.4.7 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Bizagi Group Limited

- 6.1.3 Pegasystems Inc.

- 6.1.4 Appian Corporation

- 6.1.5 Oracle Corporation

- 6.1.6 Software AG

- 6.1.7 DST Systems Inc.

- 6.1.8 OpenText Corporation

- 6.1.9 Newgen Software Technologies Ltd.

- 6.1.10 TIBCO Software Inc.