|

市场调查报告书

商品编码

1433762

锂离子电池回收:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Lithium-ion Battery Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

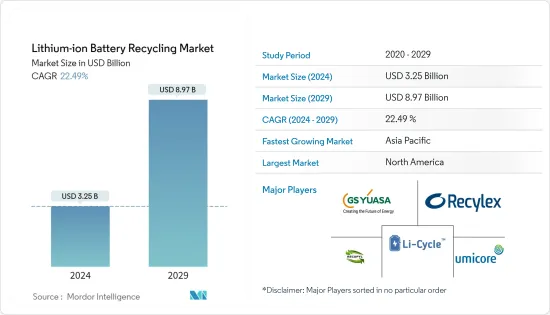

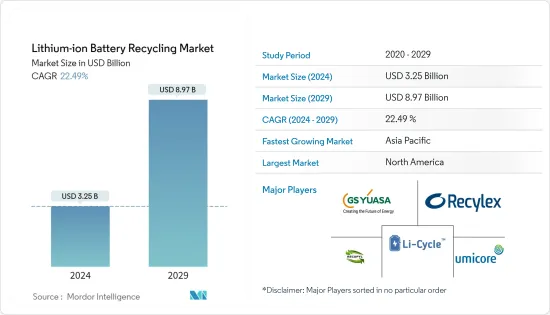

预计2024年全球锂离子电池回收市场规模将达32.5亿美元,2024-2029年预测期间复合年增长率为22.49%,预计2029年将达到89.7亿美元。

在各类电池回收技术中,锂离子电池回收市场预计将在预测期内下半年主导全球电池回收市场。此外,对电池废弃物处理的日益关注和严格的政府政策,加上锂离子电池价格的下降以及电动车的普及导致锂离子电池的使用量增加,将在预测期间推动锂离子电池回收市场的发展期间。我想它会被拖走。然而,虽然製造锂离子电池的原料成本低廉,但回收成本高。除了高成本之外,缺乏健全的供应链以及与电池回收相关的低产量比率可能会限制预测期内电池回收市场的成长。

主要亮点

- 随着政策层面推动可再生能源发电和电动车的大规模采用,电力产业正在经历显着成长,需要能源储存解决方案。

- 电池技术的进步导致製造商开发出技术先进的电池,这可以为电池回收公司投资和引导资源创造突破性的电池回收技术创造重大机会。这是高度性感的。

- 由于製造业、可再生能源和电动车需求的成长,预计亚太地区在预测期内将引领锂离子电池回收市场。

锂离子电池回收市场趋势

电力产业需求增加

- 过去十年里,锂离子电池的价格大幅下降。 2018年,锂离子电池价格为每度电176美元。锂离子电池价格持续下降,2018年价格较2017年下降17.75%。锂离子电池用于与电力产业相关的各种应用,例如 ESS,并可能推动电力产业市场的发展。

- 成本大幅降低的两个主要原因是:

- 透过持续的研究和开发,电池性能稳步提高,旨在改进电池材料,减少惰性材料的用量和材料成本,改善电池设计和生产产量比率,并提高生产率。

- 以中国为中心的电力产业终端用户的产量增加,有助于实现锂离子电池製造的规模经济,而大规模产能的增加则加剧了製造商之间的竞争(价格进一步下跌)。製造商的盈利被牺牲)。

- 这些趋势将导致成本快速持续降低,使锂离子电池成为所有储能和电力行业市场的首选电池化学材料,包括电网规模、用户侧储能、住宅储能和微电网。这将有助于它的建立。

- 此外,预计锂离子电池的平均价格将继续下降,到2025年将达到约100美元/kWh。这一趋势将增加锂离子电池在令人兴奋的新市场中的应用,例如在预测期内与太阳能、风能和水力发电等可再生能源相结合的能源储存系统(ESS),用于住宅和商业应用。预计两者都会增加。

- 因此,随着价格下降,锂离子电池在电力行业的使用预计将会增加。为了使此类电池的采用更加永续和环保,预计在预测期内回收这些电池的需求也会加速。

亚太地区主导市场

- 锂离子电池传统上主要用于行动电话、笔记型电脑和个人电脑等家用电子电器,但电动车对环境的影响较小,因为它们不会排放二氧化碳和氮氧化物等温室气体。它们现在正在重新设计,以用作混合动力汽车和全电动汽车(EV)的动力来源。

- 电动车和能源储存系统(ESS) 等令人兴奋的新市场的出现正在推动商业和住宅应用对锂离子电池的需求。此外,ESS与风能、太阳能和水力发电等自然能源相结合,对于提高电网稳定性在技术和商业性都是必要的,因此正在推动锂离子电池产业的发展。

- 目前,中国是电动车最大的市场,约占全球销售量的40%。随着中国努力降低国内空气污染水平,电动车销量预计将创下高成长率,从而导致对锂离子电池的高需求。

- 目前,中国是最大的电动车锂离子电池生产国。中国锂产量从2017年的6,800吨增加到2018年的8,000吨。由于电池总是与环境问题联繫在一起,中国政府制定了回收设施政策,因此产业必须根据需要建立回收设施。

- 此外,2018 年 8 月,印度政府宣布为印度混合动力汽车和电动汽车快速采用和製造 (FAME) 计划第二阶段拨款 550 亿卢比,以鼓励电动汽车的采用和锂离子电池的本地生产。 。因此,包括亚马逊和Amara Raja Batteries在内的多家印度汽车零件製造商以及电力和能源解决方案供应商都宣布生产计画锂离子电池,以利用该国蓬勃发展的绿色汽车市场。

- 此外,该地区政府对技术开拓的研发投资将有助于降低迴收过程中产生的成本,激励回收公司采用回收材料製造新产品并增加市场价值。因此,近期趋势预计将在预测期内推动锂离子电池回收市场。

锂离子电池回收产业概况

由于技术复杂,锂离子电池回收市场较为分散,企业发展该行业的公司很少。市场的主要企业包括Glencore、GS Yuasa Corporation、Li-Cycle Technology、Recupyl Sas、Umicore、Metal Conversion Technologies等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 市场规模与需求预测,10 亿美元(~2025 年)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 抑制因素

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 按行业分类

- 车

- 海洋

- 电力

- 其他的

- 科技

- 湿式冶金工艺

- 火法冶金工艺

- 物理/机械过程

- 地区

- 北美洲

- 亚太地区

- 欧洲

- 南美洲

- 中东/非洲

第六章 竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Glencore PLC

- Green Technology Solutions, Inc.

- Li-Cycle Technology

- Recupyl Sas

- Umicore SA

- Metal Conversion Technologies LLC

- Retriev Technologies Inc.

- Raw Materials Company

- TES-AMM Pte Ltd.

- American Manganese

第七章 市场机会及未来趋势

The Lithium-ion Battery Recycling Market size is estimated at USD 3.25 billion in 2024, and is expected to reach USD 8.97 billion by 2029, growing at a CAGR of 22.49% during the forecast period (2024-2029).

Among different types of battery recycling technology, the lithium-ion battery (LIB) recycling market is expected to dominate the global battery recycling market in the latter part of the forecast period, majorly due to the demand for lithium-ion batteries and its ability such as favorable capacity-to-weight ratio. Moreover, Rising concerns over battery waste disposal and stringent government policies clubbed with the increase in usage of lithium-ion battery due to the declining lithium-ion battery prices and growing adoption of electric vehicles, are likely to drive the lithium-ion battery recycling market during the forecast period. However, the raw materials for the manufacturing of lithium-ion batteries are available at a low cost, whereas a high cost is incurred in recycling. The high cost, along with the lack of a strong supply chain and low yield related to battery recycling, is likely to restrain the growth of the battery recycling market during the forecast period.

Key Highlights

- The power sector witnessing significant growth owing to requirement for energy storage solutions in the wake of policy-level initiatives to promote renewable power generation and massive deployment of electric vehicles.

- Advancements in battery technologies leading to the creation of technologically advanced batteries being developed by manufacturers are likely to create a massive opportunity for the battery recycling companies to invest and redirect their resources to make a breakthrough battery recycling technology.

- Asia-Pacific is expected to lead the lithium-ion battery recycling market, during the forecast period, due to the growth of the manufacturing sector, renewables power and the EV demand.

Lithium-Ion Battery Recycling Market Trends

Increasing Demand In Power Industry

- The price of lithium-ion batteries has fallen steeply over the past 10 years. In 2018, the lithium-ion battery price was USD 176 per kWh. Lithium-ion battery prices are falling continuously, and the price decreased by 17.75% in 2018 compared to the price in 2017. The lithium-ion battery used in various application related to power sector such as ESS and other, which in turn likely to drive the market in power sector.

- The two principal reasons for the drastic cost decline are:

- The steady improvement of battery performance achieved through sustained R&D, aimed at improving battery materials, reducing the amount of non-active materials and the cost of materials, improving cell design and production yield, and increasing production speed.

- Increase in production volume for end user in power industry, particularly in China, which helped in achieving the economies of scale in lithium-ion battery manufacturing, and the large capacity additions, which increased the competition among manufacturers (further declining the prices, but at the expense of the profitability of the manufacturers).

- These trends result in sharp and sustained cost reduction which is expected to help cement lithium-ion as the battery chemistry of choice in all energy storage, power industry markets, including grid-scale, behind-the-meter storage, residential storage, and micro-grids.

- Furthermore, the decline in average lithium-ion battery prices is expected to continue and reach approximately USD 100/kWh by 2025, in turn, making it much more cost-competitive than other battery types. The trend is expected to result in an increased application of lithium-ion batteries in new and exciting markets, such as energy storage systems (ESS), paired with renewables, like solar, wind, or hydro, for both residential and commercial applications, during the forecast period.

- Hence, with declining prices, the use of lithium-ion batteries is expected to rise in power industry. The need for recycling these batteries is also expected to gain pace during the forecast period, in order to make the adoption of such batteries more sustainable and eco-friendlier.

Asia-Pacific to Dominate the Market

- Lithium-ion batteries have traditionally been used mainly in consumer electronic devices, such as mobile phones, notebook, and PCs, but are now increasingly being redesigned for use as the power source of choice in hybrid and the complete electric vehicle (EV) range, owing to factors, such as low environmental impact, as EV does not emit any CO2, nitrogen oxides, or any other greenhouse gases.

- The emergence of the new and exciting markets, such as electric vehicle and energy storage systems (ESS), for both the commercial and residential applications, is driving the demand for LIB. Moreover, ESS, coupled with renewables, such as wind, solar, or hydro, is technically and commercially necessary for increasing grid stability, consequently, driving the LIB segment.

- Currently, China is the largest market for electric vehicles, as the country accounts for around 40% of the global sale. China is making efforts to reduce the air pollution level in the country, and it is expected to register a high growth rate in the electric vehicle sales, consequently, leading to the high demand for LIB.

- Currently, China is the largest manufacturer of lithium-ion battery majorly for electric vehicles. In China, lithium production in the country, increasing from 6,800 metric tons in 2017 to 8,000 metric tons in 2018. As batteries are always related to environmental concerns, the government of china presents a policy for recycling facilities that the industry must set up as required.

- Furthermore, in August 2018, the Government of India directed an outlay of INR 5,500 crore for the second phase of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) India Scheme, for encouraging the adoption of EVs and local manufacturing of lithium-ion batteries. Thus, several automobile component manufacturers and power and energy solution providers in India, such as Amazon and Amara Raja Batteries, have put forth plans for manufacturing lithium-ion batteries locally, to leverage the booming green vehicles market in the country.

- Additionally, the R&D investment by the government in the region on developing technologies can help decrease the cost incurred for the recycling process, which can motivate the recycling companies to take up recycled material for manufacturing a new product, and thereby, helping the growth of the market. Hence the recent trends are expected to propel the lithium-ion battery recycling marketduring the forecast period.

Lithium-Ion Battery Recycling Industry Overview

The lithium-ion battery recycling market is moderately fragmented due to few companies operating in the industry because of the complex technology. The key players in this market include Glencore, GS Yuasa Corporation, Li-Cycle Technology, Recupyl Sas,Umicore, Metal Conversion Technologies, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD billion, until 2025

- 4.3 Recent Trends and Developments

- 4.4 Government Policies & Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Industry

- 5.1.1 Automotive

- 5.1.2 Marine

- 5.1.3 Power

- 5.1.4 Others

- 5.2 Technology

- 5.2.1 Hydrometallurgical Process

- 5.2.2 Pyrometallurgy Process

- 5.2.3 Physical/Mechanical Process

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Glencore PLC

- 6.3.2 Green Technology Solutions, Inc.

- 6.3.3 Li-Cycle Technology

- 6.3.4 Recupyl Sas

- 6.3.5 Umicore SA

- 6.3.6 Metal Conversion Technologies LLC

- 6.3.7 Retriev Technologies Inc.

- 6.3.8 Raw Materials Company

- 6.3.9 TES-AMM Pte Ltd.

- 6.3.10 American Manganese