|

市场调查报告书

商品编码

1433783

温度控管技术:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Thermal Management Technologies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

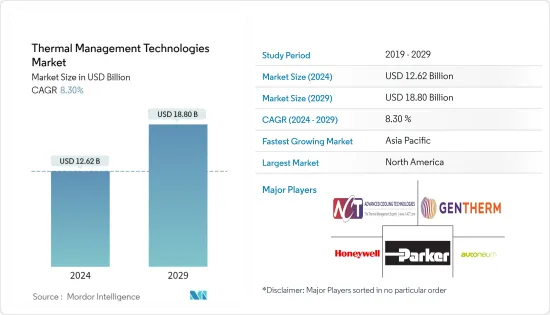

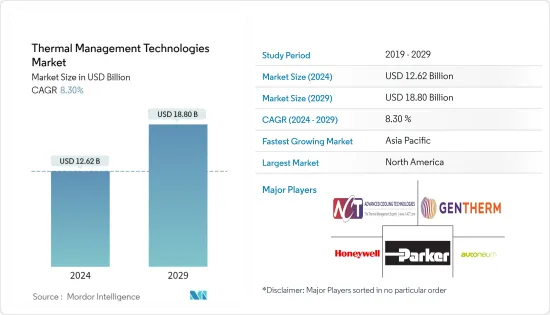

温度控管技术市场规模预计到2024年热感126.2亿美元,到2029年达到188亿美元,在市场估计和预测期间(2024-2029年)复合年增长率为8.30%。

电子封装的趋势带来了性能的提高和产品尺寸的缩小。因此,功耗显着增加,需要温度控管来消除电子设备产生的高热通量,从而实现卓越的系统性能和可靠性。

主要亮点

- 全球电子产业的显着成长是推动市场成长的关键因素之一。随着消费性电子产品製造技术的进步,对具有更高功率密度的较小设备的需求正在增加。这对温度控管技术的需求产生了积极影响,以最大限度地减少这些设备产生的高热通量。

- 在过去的几年中,晶片冷却解决方案不断发展以适应不断增加的热通量。许多製造商正在致力于开发基于多相传热技术的先进冷却解决方案。射流衝击机制、冷板和热蒸汽室等技术彻底改变了这些系统的未来。

- 可再生能源的日益普及也是推动能源储存市场的主要因素。此外,全球快速工业化和对持续供电的需求不断增加也有利于预测期内整体热能能源储存市场的成长。

- 然而,由于使用的电晶体种类繁多,温度控管的复杂性,特别是电子设备中使用的组件的设计,限制了市场的成长。

- 温度控管技术最常见的应用之一是消费性电子产品。疫情爆发之初,消费性电子产业因供应链中断而面临重大阻力。然而,随着疫情带来的虚拟学习、远距工作和媒体消费需求增加,平板电脑、笔记型电脑等众多消费性电子设备的需求近期大幅增加,市场需求可望加速。

温度控管技术的市场趋势

消费性电子产品需求不断成长推动市场成长

- 电子产业的发展正在增加更小、更聪明的产品的推出。这些行业进步推动了对创新温度控管技术的需求,这些技术可以消除设备产生的热量并提高系统性能和可靠性。

- 智慧型手机和平板电脑材料市场在过去十年中经历了可观的成长。由于重量和成本敏感性,预计市场将更依赖先进材料来提供冷却解决方案,而不是辅助散热器。

- 此外,随着物联网(IoT)的日益普及,连接设备是使用互联网和IP通讯协定实现物与物之间或物与人之间通讯的技术,其数量近年来迅速增加。例如,据思科称,到 2023 年,连网设备数量将达到 293 亿台。

- 大多数物联网设备(穿戴式装置、智慧家庭系统等)的外形尺寸较小,导致它们无法实施主动式温度控管策略(冷却风扇或液体冷却)。对于这些产品,在基板级实施被动式温度控管技术与电路最佳化并行是防止关键组件过热的关键。

- 此外,随着近年来5G的普及,对智慧型手机等5G相容设备的需求不断增加。此类设备在较小的空间内具有更高密度和更高功率的组件。这种增加的功耗需要消耗更多的能量并产生更多的热量。因此,这些设备对温度控管的需求日益增长。

北美占有很大份额

- 由于各领域对技术创新的投资不断增加以及温度控管技术的采用,北美地区预计将占据最大的市场占有率。该市场的知名企业总部均设在该地区,包括 Parker-Hannifin Corp.、Advanced Cooling Technologies Inc.、Honeywell International Inc. 和 Gentherm Inc.。

- 该地区消费电子产业的成长是推动市场成长的主要因素之一。根据 CTA 最近的预测,美国消费科技产业的零售收入预计将首次超过 5,050 亿美元。这项预测意味着 2021 年营收将成长 2.8%,高于 2020 年令人印象深刻的 9.6% 成长。该组织表示,对智慧型手机、汽车技术、健康设备和串流媒体服务的强劲需求将推动大部分预计收益。

- 汽车产业向电动的转型也正在推动市场需求。配备电池的 EV(电动车)的温度控管至关重要,因为它会影响这些车辆的性能、可靠性和稳健性。

- 美国是最大的电动车市场之一,近年来电动车销量快速成长。例如,美国能源局宣布,2020年至2021年电动车销量成长85%,插电式混合电动车(PHEV)2021年成长一倍多,与前一年同期比较成长138%。

- 此外,近年来,日本实施了许多法规来促进电动车的普及。例如,2021 年 4 月,纽约州立法机关通过了一项法案,实际上要求到 2035 年该州销售的所有新小客车都采用电力驱动。此外,美国也制定了2030年该国销售的汽车一半为电动车的目标。

温度控管技术产业概况

温度控管技术市场高度分散,没有一家公司占据重要的市场占有率。此外,市场上的本地参与者数量不断增加,竞争加剧。

2022 年 1 月,派克汉尼汾 (Parker Hannifin) 旗下部门 Parker Lord 扩大了产品系列,添加了新型导热黏剂和单组分 (1K) 低密度间隙填充剂,以温度控管。我们支持该规定封装、黏剂和间隙填充剂。

2021 年 6 月,Gentherm 宣布成为以色列 Carrar 种子轮融资的主要投资者,Carrar 是一家为电动车市场提供先进温度控管系统的技术开发商。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究结果和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力——波特五力

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 市场驱动因素

- 提高车辆能源效率和性能

- 温度控管技术普及

- 市场挑战

- 零件设计复杂性

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场区隔

- 依产品类型

- 软体

- 硬体

- 基材

- 介面

- 按用途

- 电脑

- 消费性电子产品

- 汽车电子产品

- 通讯

- 可再生能源

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争形势

- 公司简介

- Parker-Hannifin Corp.

- Advanced Cooling Technologies Inc.

- Honeywell International Inc.

- Gentherm Inc.

- Autoneum Holding AG

- Sapa Extrusions Inc.

- AllCell Technologies

- Thermacore Inc.

- Laird Technologies Inc.

- Pentair Thermal Management

- Outlast Technologies LLC

第七章 投资分析

第八章市场的未来

The Thermal Management Technologies Market size is estimated at USD 12.62 billion in 2024, and is expected to reach USD 18.80 billion by 2029, growing at a CAGR of 8.30% during the forecast period (2024-2029).

The electronic packaging trend has resulted in increased performance and reduced product sizing. This has led to a significant increase in power consumption, which, in turn, demands thermal management for good system performance and reliability by removing the high heat flux generated by electronic devices.

Key Highlights

- Significant growth in the electronics industry worldwide is one of the key factors driving market growth. There is an increasing demand for miniaturized devices with enhanced power densities, with improvements in the manufacturing technologies of consumer electronics. This, in turn, positively impacts the demand for thermal management technologies to minimize the high heat flux generated by these devices.

- Over the past few years, chip-cooling solutions have evolved to accommodate the increase in heat flux. Many manufacturers are working on the development of advanced cooling solutions based on multi-phase heat transfer technologies. Technologies like jet impingement mechanisms, cold plates, and heat vapor chambers have transformed the future of these systems.

- Also, the increasing adoption of renewable energy resources is the major factor driving the thermal energy storage market. In addition, rapid industrialization across the world has increased the need for continuous power supply, which positively leads to the overall thermal energy storage market growth during the forecast period.

- However, due to the use of various transistors, the design complexities in components used in thermal management, specifically in electronic devices, are restraining the market's growth.

- One of the most common applications of thermal management technologies is in consumer electronics. At the onset of the pandemic, the consumer electronics industry faced a heavy headwind due to supply chain disruptions. However, with an increase in demand for virtual learning, remote work, and media consumption brought about by the pandemic, the demand for many consumer electronics devices, such as tablets and laptops, has experienced significant growth in recent times, which is expected to accelerate the market demand.

Thermal Management Technologies Market Trends

Increasing Demand for Consumer Electronics will Enhance the Market Growth

- Due to developments in the electronics industry, the introduction of smaller and smarter products are increasing. These advancements in the industry have led to an increased need for innovative thermal management technologies to improve system performance and reliability by eliminating the heat generated by devices.

- The smartphone and tablet material market has witnessed considerable growth in the past decade. Due to the sensitivity toward weight and costs, the said market is expected to rely mostly on advanced materials for cooling solutions rather than secondary heat sinks.

- Further, owing to the increasing adoption of the Internet of things (IoT), the technology that enables the communication between things or between things and people using the Internet and IP-enabled protocols, the number of connected devices has been rising rapidly in recent years. For instance, as per Cisco, there will be 29.3 billion networked devices by 2023.

- Most IoT devices (wearables, smart home systems, etc.) carry such small form factors that active thermal management strategies (cooling fans or liquid cooling) cannot be implemented. In these products, implementing passive thermal management techniques at the board level alongside circuit optimization is key to preventing overheating of critical components.

- Further, with the increasing penetration of 5G in recent years, the demand for 5G-enabled devices, such as smartphones, is increasing. Such devices contain a greater density of high-power components in smaller spaces. This increased power requires more energy consumption, which generates more heat. As a consequence, there is an increased need for thermal management in such devices.

North America to Hold Major Share

- The North American region is expected to account for the largest market share, attributed to the increasing investments in technological innovation and adoption of thermal management technologies by various domains. Some of the prominent players in the market, such as Parker-Hannifin Corp, Advanced Cooling Technologies Inc., Honeywell International Inc., and Gentherm Inc., are headquartered in this region.

- The proliferating consumer electronics industry in the region is one of the primary factors driving the market's growth. According to a recent forecast from CTA, the consumer technology industry in the United States is projected to generate over USD 505 billion in retail sales revenue for the first time. The projection represents a 2.8% revenue increase from the impressive growth of 9.6% in 2021 over 2020. As per the organization, strong demand for smartphones, automotive tech, health devices, and streaming services will help propel a significant portion of the projected revenue.

- The automotive industry's transition toward electrification is also fueling the demand for the market. Thermal management in EVs (electric vehicles) powered by batteries is essential as it affects the performance, reliability, and robustness of these vehicles.

- The United States is one of the largest markets for electric vehicles, and the country has also recorded rapid growth in EV sales in recent years. For instance, as per the United States Department of Energy, EV sales grew by 85% from 2020 to 2021, while plug-in hybrid electric vehicles (PHEVs) more than doubled in 2021, with an increase of 138% over the previous year.

- Many regulations have also been implemented in recent years to promote the use of electric vehicles in the country. For instance, in April 2021, New York state lawmakers passed a bill that would essentially mandate that all new passenger cars sold in the state run on electric power by 2035. Moreover, the United States has set a target to ensure half of the vehicles sold in the country are electric by 2030.

Thermal Management Technologies Industry Overview

The thermal management technologies market is significantly fragmented, with no player accounting for a significant market share. Also, the number of local players is increasing in this market, resulting in increasing competition.

In January 2022 - Parker Lord, a division of Parker Hannifin, expanded its portfolio of products for electric vehicle manufacturers to include new thermally conductive adhesives and one-component (1K) low-density gap fillers to support their product offering of thermal management encapsulants, adhesives, and gap fillers.

In June 2021 - Gentherm announced that it had emerged as the lead investor in a seed round of financing in Israel-based Carrar, a technology developer of advanced thermal management systems for the electric mobility market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Market Drivers

- 4.3.1 Increase in Vehicle Energy Efficiency and Performance

- 4.3.2 Thermal Management Technology Proliferation

- 4.4 Market Challenges

- 4.4.1 Design Complexities in Components

- 4.5 Industry Value Chain Analysis

- 4.6 Assessment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Software

- 5.1.2 Hardware

- 5.1.3 Substrate

- 5.1.4 Interface

- 5.2 By Application

- 5.2.1 Computers

- 5.2.2 Consumer Electronics

- 5.2.3 Automotive Electronics

- 5.2.4 Telecommunication

- 5.2.5 Renewable Energy

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Parker-Hannifin Corp.

- 6.1.2 Advanced Cooling Technologies Inc.

- 6.1.3 Honeywell International Inc.

- 6.1.4 Gentherm Inc.

- 6.1.5 Autoneum Holding AG

- 6.1.6 Sapa Extrusions Inc.

- 6.1.7 AllCell Technologies

- 6.1.8 Thermacore Inc.

- 6.1.9 Laird Technologies Inc.

- 6.1.10 Pentair Thermal Management

- 6.1.11 Outlast Technologies LLC