|

市场调查报告书

商品编码

1642018

殭尸网路侦测:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Botnet Detection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

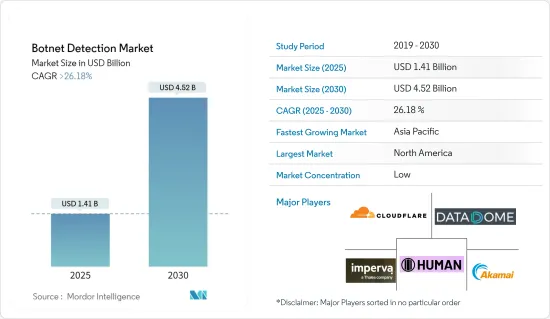

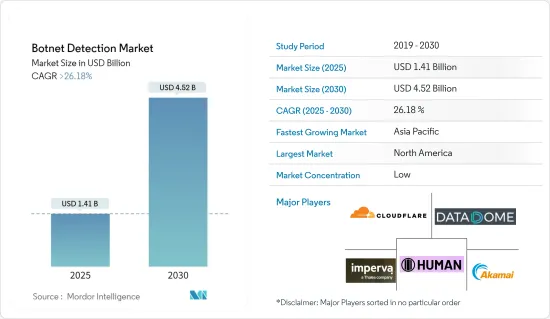

殭尸网路侦测市场规模预计在 2025 年为 14.1 亿美元,预计到 2030 年将达到 45.2 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 26.18%。

主要亮点

- 世界各地的网路安全专家和科技公司正在加强侦测殭尸网路。随着世界各地技术的进步,滥用的风险也随之增加。殭尸网路攻击侵犯了用户的隐私并允许第三方控制个人电脑。随着网路犯罪分子的能力越来越强,殭尸网路已成为能够渗透到全球所有网路连线装置的主要威胁。

- 物联网 (IoT) 技术的近期爆炸性成长为潜在攻击者提供了更多的端点。这种不断发展的情况使得新的分散式阻断服务 (DDoS) 机器人更加频繁地出现。

- 行动装置和云端处理成为主要攻击面,使得恶意机器人更容易隐藏其活动。骇客传统上使用这些机器人来获取经济利益,但现在它们的用途已扩展到工业间谍和选举操纵。因此,公司正在深入地分类和分析这些攻击,以製定有效的对策。

- 实体安全与IP网路的融合扩大了网路犯罪分子的攻击面。这些犯罪分子已经进化,从针对个人使用者帐户和特定地区转向控制整个网路实体。

- 儘管取得了进展,但公司仍必须解决一个严重的弱点:缺乏熟练的网路安全专业人员来阻止此类攻击。作为回应,公司不仅僱用和培训新的网路安全专家来了解殭尸网路和侦测软体的发展。我们也正在寻求与更大的公司合併,以加强我们的服务和产品阵容。

- 在新冠肺炎疫情期间,人们迅速转向远距工作,同时对数位工具的依赖增加,无意中为网路犯罪分子创造了机会。这种转变导致网路威胁显着增加,特别是针对远端工作人员、易受攻击的端点和线上基础设施的主导网路攻击。

殭尸网路侦测市场的趋势

BFSI 领域将成为最大的终端使用者产业

- 处理敏感财务资料的 BFSI 组织对于网路犯罪分子来说是有吸引力的目标,他们试图窃取有价值信息,例如信用卡号、银行凭证、个人识别资讯 (PII) 等。网路犯罪分子经常部署殭尸网路来渗透这些系统并窃取敏感资料。

- 殭尸网路策划金融诈骗,包括帐户接管、身份盗窃和非法贸易。因此,侦测和减轻殭尸网路活动对于防止财务损失和维护客户信任至关重要。

- BFSI 组织涵盖多种管道,包括网路银行平台、行动应用程式、ATM 和传统分店。殭尸网路侦测解决方案必须透过这些管道提供全面的保护,以保持一致的安全态势并防止多供应商攻击。

- 随着数位科技和线上金融服务的兴起,BFSI 部门面临网路威胁的脆弱性也日益增加。行动银行、数位付款管道和线上交易的兴起为殭尸网路侦测带来了新的挑战,并凸显了对打击诈骗、资料外洩和其他网路风险的先进解决方案的需求。

- 网路攻击的频率日益增加,以及它们可能对 BFSI 组织造成的潜在财务和声誉损害,推动了殭尸网路侦测解决方案的采用。这些解决方案是主动措施,旨在降低风险、确保法规遵循并维护客户信心和业务连续性。 IBM 的报告显示,在主要产业中,金融和保险业占全球网路攻击的 18%。

北美占有最大市场占有率

- 在北美,尤其是美国,许多网路攻击针对各个行业,包括政府机构、医疗保健组织和金融机构。殭尸网路是这些攻击的核心,因此该地区的组织迫切需要强大的殭尸网路侦测解决方案。

- 根据身分盗窃资源中心的资料,2023 年美国发生了 3,205 起资料外洩事件。当年,有超过 3.53 亿个人遭受这些违规行为的影响,包括洩密、曝光和揭露。

- 加拿大对网路犯罪急剧增加感到担忧。根据加拿大通讯安全局(CSE)2023年8月发布的报告显示,加拿大共发生7,0878起网路诈骗案件,造成超过3.9亿美元的损失。随着网路威胁、勒索软体攻击和资料外洩变得越来越频繁和复杂,加拿大组织越来越希望受到殭尸网路侦测解决方案的保护。

- 北美殭尸网路侦测市场受到多方面的威胁情势、严格的法规、技术进步和不断增加的网路安全投资的影响。随着各组织努力保护资料、资产和声誉,该地区对先进的殭尸网路侦测解决方案的需求预计将增加。

- 2023财年,美国政府为网路安全拨款108.9亿美元预算,较上年度增加。这些联邦网路安全基金支持一项加强政府安全并加强对关键基础设施和关键技术的保护的全面战略。

殭尸网路侦测领域的市场领导者

由于全球参与者和小型参与者的存在,殭尸网路侦测市场变得分散。主要参与者包括 Imperva Inc.、PerimeterX Inc.(HUMAN Security Inc. 的子公司)、Akamai Technologies Inc.、Cloudflare Inc. 和 DATADOME Group。这些参与者越来越多地透过伙伴关係和收购来增强其产品供应并获得永续的竞争优势。

随着组织扩大采用殭尸网路侦测解决方案,这些服务的需求将会激增。市场参与者正在利用策略联盟来增加市场占有率和盈利。企业也积极收购专注于企业网路设备技术的新兴企业,以增强产品能力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 连网设备数量不断增加

- 组织对殭尸网路安全的需求日益增加

- 在线业务中 API 的使用增加

- 市场限制

- 缺乏使用者教育和工具采用率低

- 使用传统的机器人保护方法,例如验证码和帐户创建

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 技术概述

第五章 市场区隔

- 按组件

- 解决方案

- 服务

- 依部署类型

- 本地

- 云

- 按组织规模

- 中小企业

- 大型企业

- 按行业

- 零售

- BFSI

- 旅游与饭店

- 资讯科技和电信

- 媒体与娱乐

- 其他行业(教育、医疗、房地产)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司简介

- Imperva Inc.

- PerimeterX Inc.(HUMAN Security Inc.)

- Akamai Technologies Inc.

- Cloudflare Inc.

- DATADOME Group

- Reblaze Technologies Ltd

- Radware Ltd

- Oracle Corporation

- Intechnica Ltd(Netacea Ltd)

- Barracuda Networks Inc.

第七章投资分析

第八章 市场机会与未来趋势

The Botnet Detection Market size is estimated at USD 1.41 billion in 2025, and is expected to reach USD 4.52 billion by 2030, at a CAGR of greater than 26.18% during the forecast period (2025-2030).

Key Highlights

- Cybersecurity professionals and technology firms worldwide are increasingly focusing on botnet detection. As global technology advances, the risk of its misuse also increases. Botnet attacks infringe on user privacy, allowing third parties to control individual computers. With the rising capabilities of cybercriminals, botnets have emerged as a primary threat, capable of infiltrating any internet-connected device worldwide.

- The recent Internet of Things (IoT) technology surge has introduced more endpoints for potential attackers. This evolving landscape has led to a more frequent emergence of new distributed denial of service (DDoS) bots.

- With the rise of mobile devices and cloud computing as prime attack surfaces, malicious bots have found it easier to conceal their activities. While hackers have traditionally employed these bots for financial gain, their current uses have expanded to include industrial espionage and even election manipulation. Consequently, companies are intensively cataloging and analyzing these attacks to devise effective counter-strategies.

- The integration of physical security with IP networks has broadened the attack surface for cybercriminals. These criminals have evolved, shifting from targeting individual user accounts or specific regions to dominating entire internet entities.

- Despite these advancements, companies must grapple with a significant vulnerability: a shortage of skilled cybersecurity professionals to thwart such attacks. In response, companies are not only hiring and training new cybersecurity experts to understand the evolving nature of botnets and detection software. Still, they are also pursuing mergers with major market players to bolster their service offerings and product range.

- The rapid shift to remote work during the COVID-19 pandemic, along with increased reliance on digital tools, has inadvertently created opportunities for cybercriminals. This change has resulted in a noticeable increase in cyber threats, especially botnet-driven attacks aimed at remote workers, vulnerable endpoints, and online infrastructures.

Botnet Detection Market Trends

The BFSI Segment to be the Largest End-user Industry

- BFSI organizations handling sensitive financial data are prime targets for cybercriminals aiming to steal valuable information like credit card numbers, banking credentials, and personally identifiable information (PII). Cybercriminals often deploy botnets to infiltrate these systems and exfiltrate sensitive data.

- Botnets orchestrate financial frauds, including account takeovers, identity theft, and fraudulent transactions. Thus, detecting and mitigating botnet activity is crucial for preventing financial losses and maintaining customer trust.

- BFSI organizations span multiple channels: online banking platforms, mobile apps, ATMs, and traditional branches. Botnet detection solutions must offer comprehensive protection across these channels to maintain a consistent security posture and guard against multi-vendor attacks.

- As digital technologies and online financial services increase, the BFSI segment's vulnerability to cyber threats has widened. The growth of mobile banking, digital payment platforms, and online transactions presents new challenges for botnet detection, underscoring the need for advanced solutions to counter fraud, data breaches, and other cyber risks.

- The rising frequency of cyberattacks and the potential financial and reputational fallout for BFSI organizations propel the adoption of botnet detection solutions. These solutions are proactive measures to mitigate risks, ensure regulatory compliance, and uphold customer trust and operational continuity. IBM reports that the finance and insurance sectors account for 18% of global cyberattacks among leading industries.

North America Holds Largest Market Share

- In North America, especially in the United States, many cyberattacks target diverse industries, spanning government agencies, healthcare entities, financial institutions, and beyond. Central to these assaults are botnets, underscoring the urgent need for robust botnet detection solutions among regional organizations.

- Data from the Identity Theft Resource Center highlights that in 2023, the United States recorded 3,205 data compromise incidents. That year, over 353 million individuals faced repercussions from these compromises, encompassing breaches, leakages, and exposures.

- Canada is witnessing a concerning surge in cybercrime. An August 2023 report by the Communications Security Establishment (CSE) noted 70,878 cyber fraud incidents in Canada, resulting in losses exceeding USD 390 million. With cyber threats, ransomware attacks, and data breaches becoming more frequent and sophisticated, Canadian organizations increasingly turn to botnet detection solutions for protection.

- The North American botnet detection market is shaped by a multifaceted threat landscape, stringent regulations, technological advancements, and heightened cybersecurity investments. As organizations endeavor to safeguard their data, assets, and reputations, the demand for sophisticated botnet detection solutions in the region is poised to rise.

- In fiscal year 2023, the US government allocated a budget of USD 10.89 billion for cybersecurity, marking an increase from the prior year. These federal cybersecurity funds underpin a comprehensive strategy to fortify government security and bolster the protection of critical infrastructure and vital technologies.

Botnet Detection Market Leaders

The botnet detection market is fragmented due to the presence of both global players and small and medium-sized enterprises. Key players include Imperva Inc., PerimeterX Inc. (a part of HUMAN Security Inc.), Akamai Technologies Inc., Cloudflare Inc., and DATADOME Group. These players increasingly turn to partnerships and acquisitions, bolstering their product offerings and carving out a sustainable competitive edge.

The demand for these services surges as organizations ramp up their adoption of botnet detection solutions. Market players capitalize on strategic collaborations to boost their market share and profitability. Also, companies are actively acquiring startups specializing in enterprise network equipment technologies, enhancing their product capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Number of Connected Devices

- 4.3.2 Increasing Need For Security against Botnet in Organizations

- 4.3.3 Increasing Usage of APIs By Online Businesses

- 4.4 Market Restraints

- 4.4.1 Lack of Education among Users and Low Usage of Tools

- 4.4.2 Use of Conventional BOT Protection Methods, Such as Captcha Or Create Account

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Overview

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solution

- 5.1.2 Service

- 5.2 By Deployment Type

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By Organization Size

- 5.3.1 SMEs

- 5.3.2 Large Enterprise

- 5.4 By End-user Vertical

- 5.4.1 Retail

- 5.4.2 BFSI

- 5.4.3 Travel and Hospitality

- 5.4.4 IT and Telecom

- 5.4.5 Media and Entertainment

- 5.4.6 Other End-user Verticals (Education, Healthcare, and Real Estate)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.3 Asia

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.4 Australia and New Zealand

- 5.5.5 Latin America

- 5.5.6 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Imperva Inc.

- 6.1.2 PerimeterX Inc. (HUMAN Security Inc.)

- 6.1.3 Akamai Technologies Inc.

- 6.1.4 Cloudflare Inc.

- 6.1.5 DATADOME Group

- 6.1.6 Reblaze Technologies Ltd

- 6.1.7 Radware Ltd

- 6.1.8 Oracle Corporation

- 6.1.9 Intechnica Ltd (Netacea Ltd)

- 6.1.10 Barracuda Networks Inc.