|

市场调查报告书

商品编码

1433828

采购软体 - 市场占有率分析、产业趋势与统计、成长预测(2024 年 - 2029 年)Sourcing Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

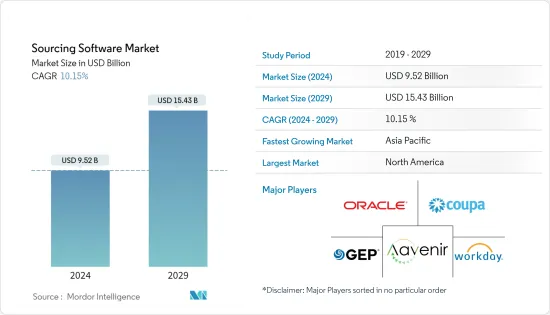

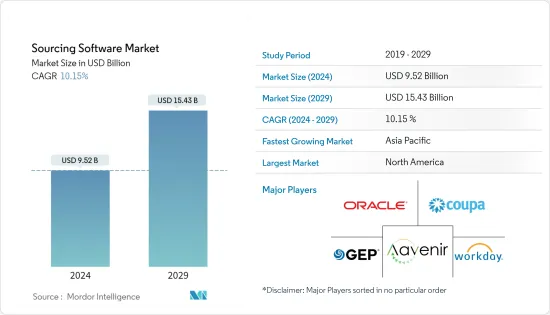

采购软体市场规模预计到 2024 年为 95.2 亿美元,预计到 2029 年将达到 154.3 亿美元,在预测期内(2024-2029 年)CAGR为 10.15%。

随着网路购物的增加和消费者购买模式的重大转变,过去几年不同的趋势正在塑造各行业。在激烈的竞争中,各行业努力维持库存并寻找获利能力以采取防御立场。

主要亮点

- 公司使用采购软体的一个重要原因是为了省钱。由于供应链系统的复杂性和人为错误的增加,采购经理很难有效地管理采购流程。

- 组织可以从采购软体中受益,因为它可以轻鬆地让供应商参与竞争性投标活动,减少采购费用,并使供应链多样化。它还将完成产品和服务购买所需的时间缩短了几週。该采购软体透过策略性地采购商品和服务并利用与所选供应商更快的线上投标来简化采购程序。自动化使采购公司能够消除手动任务,从而节省金钱。

- 有利于市场的其他趋势是云端迁移和选择云端服务,这是由快速转向远端工作推动的,这导致组织调整其基础设施和软体以连接员工。通常,此类组织希望扩大资源规模,并纳入具有独特技能、诉诸软体采购的开发人员。灵活的选择(其中之一是专门的团队模式)的存在,利用了有利于已开发国家公司的成本效益。

- 例如,2021 年 4 月,随着其平台驱动的电子采购解决方案的推出,基于云端的软体公司 Eka 希望改变广泛的业务活动和行业中基于传统的供应链运营。使用过时的系统管理供应商营运有时需要团队花费数小时交换电子邮件和电话交谈以及使用电子表格更新资料,从而导致可见性受限和错误,从而带来额外的风险。 Eka 的电子采购解决方案是一种平台驱动的云端解决方案,可识别并解决采购业务中的关键弱点来源,同时提高供应链的稳健性。

- 然而,管理数百个不同的类别和产品线对于实现最佳价值采购可能具有挑战性。采购软体透过高效、易于使用且直觉的采购工具,可以轻鬆找到合适的业务供应商。它使同事能够跨办公室和地理进行协作,以评估供应商、撰写新的 RFP 和授予合约。它增加了供应市场的潜力,使用户的支出价值最大化。

- COVID-19 大流行对该行业产生了相当大的影响。由于多个供应商的材料有限而无法保持工厂满载运转,随后的后果主要是对组织履行交付承诺的能力造成了前所未有的影响。

采购软体市场趋势

零售业将占据重要份额

- 零售业供应链的数位转型预计将推动零售采购市场。数位技术的进步正在改善供应链管理,并将改变采购为零售商提供价值的方式。

- 近年来,线上购买的增加和消费者购买模式的显着转变塑造了多个行业。例如,根据印度品牌资产基金会的数据,到 2024 年,线上零售渗透率预计将达到 10.7%,而 2019 年为 4.7%。此外,到 2025 年,印度线上购物者预计将达到 2.2 亿。

- 此外,根据 Oberlo 的预测,到 2021 年,数位买家数量将达到 21.4 亿,占全球 77.4 亿人口的 27.6%。换句话说,超过四分之一的人是网路购物者。

- 随着网路购物的兴起和消费者购买模式的重大转变,过去几年不同的趋势正在塑造零售业。据 Tidio 称,全球有 910 万家线上零售商。在激烈的竞争中,零售商努力维持库存并寻找获利能力以采取防御立场。

- 此外,随着人工智慧(AI)、区块链和机器人技术等数位技术的出现,供应商和零售商的库存可见度将会提高,透明度也会提高。区块链使零售商能够透过维护采购资料、监管链资讯和支援自主交易来赢得客户信任。

亚太地区将见证显着成长

- 采购软体透过高效、易于使用且直觉的采购工具,可以轻鬆找到合适的业务供应商。它使同事能够跨办公室和跨地区协作来评估供应商。

- 该地区政府正在采取措施支持软体采购的成长,这将加速对采购软体市场的需求。 2022 年 5 月,澳洲、印度、日本和美国宣布了加强新兴技术和网路安全合作的措施。各国同意制定政府软体采购标准,以改善电脑紧急应变小组 (CERT) 之间的资讯共享。

- 此外,随着采购软体需求的增加,市场上出现了一些知名产业参与者对先进技术的投资和扩张。

- 2022 年 9 月,采购管理软体 Procol 宣布已筹集 5.1 亿卢比资金。筹集的资金将透过 Procol 的采购软体和 B2B 市场建立和增强印度采购问题的解决方案。

采购软体产业概述

全球采购软体市场竞争适度。随着采购软体和解决方案需求的增加,不同的供应商正在与各种技术领导者建立策略合作伙伴关係,将其产品与最新技术或采购自动化相结合。

- 2022 年 1 月 - Absolut 选择 GEP Software 来改造其欧洲采购到合约流程。位于斯德哥尔摩的 Absolut 将使用 GEP Software 来增强其在整个欧洲的采购、合约管理和供应商管理。该公司还宣布了最近与杂货商 Tesco 和机械製造商 Netzsch 的客户专案。 Tesco 将利用 GEP Smart 处理其在英国和爱尔兰的采购付款 (PTP) 流程,包括非转售产品和服务的请购、订购、供应商 ASN 和发票活动。

- 2021 年 10 月 - 全球智慧采购优化和自动化解决方案供应商 Keelvar 宣布第三季新增 11 家新客户,并将进一步扩展到全球供应链驱动型组织。这源自于该公司2021年上半年创纪录的成长。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 市场驱动因素

- 对改善供应商发现和关係管理的需求不断增长

- 越来越多地采用先进的零售采购和采购解决方案

- 市场挑战

- 与现有系统整合和供应商入职的复杂性

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争激烈程度

- COVID-19 对全球采购软体市场的影响评估

第 5 章:相关用例与案例研究

第 6 章:市场细分

- 按部署

- 本地部署

- 云

- 按企业规模

- 大型企业

- 中小企业

- 按最终用户产业

- 零售

- 製造业

- 运输与物流

- 卫生保健

- 其他最终用户产业

- 按地理

- 北美洲

- 欧洲

- 亚太

- 世界其他地区

第 7 章:竞争格局

- 公司简介

- Oracle Corporation

- Coupa Software Inc.

- GEP Corporation

- Aavenir

- Workday Inc.

- Jaggaer Inc.

- Corcentric Inc.

- Ivalua Inc.

- Promena

- Zycus Inc.

第 8 章:投资分析

第 9 章:市场机会与未来趋势

The Sourcing Software Market size is estimated at USD 9.52 billion in 2024, and is expected to reach USD 15.43 billion by 2029, growing at a CAGR of 10.15% during the forecast period (2024-2029).

With the increasing internet shopping and significant shifts in consumer buying patterns, different trends are shaping the industries in the last few years. With aggressive competition, industries struggle to maintain their inventory and find profitability to take a defensive position.

Key Highlights

- One significant reason firms use sourcing software is to save money. Due to increased complexities and manual errors in supply chain systems, procurement managers have difficulty effectively managing the sourcing process.

- Organizations benefit from sourcing software because it easily engages suppliers in competitive bidding events, reduces sourcing expenses, and diversifies their supply chains. It also shortens the time it takes to complete the purchase of products and services by several weeks. The sourcing software simplifies the sourcing procedures by strategically acquiring goods and services and leveraging faster online bidding with their chosen suppliers. Automation allows sourcing firms to eliminate manual tasks and, as a result, save money.

- Other trends in favor of the market are cloud migration and opting for cloud services, fueled by a rapid shift to remote work, which led organizations to adjust their infrastructure and software to connect workers. Often, such organizations look to scale up resources and include developers with unique skills that resort to software sourcing. The presence of flexible options, one being the dedicated team model, leverages cost-effectiveness in favor of firms in developed countries.

- For instance, in April 2021, with the launch of its platform -driven e -sourcing solution, cloud-based software company Eka hopes to alter legacy-based supply chain operations across a wide range of business activities and industries. Managing supplier operations with outdated systems sometimes necessitates teams spending hours exchanging emails and phone conversations and updating data using spreadsheets, resulting in restricted visibility and mistakes that pose an additional risk. Eka's E -Sourcing solution is a platform-driven cloud solution that identifies and tackles critical sources of weakness in sourcing operations while improving supply chain robustness.

- However, managing hundreds of different categories and lines can be challenging to achieve best-value sourcing. Sourcing software makes it easy to find suitable suppliers for business through efficient, easy-to-use, and intuitive sourcing tools. It enables coworkers to collaborate across offices and geographies to evaluate suppliers, author new RFPs, and award contracts. It increases the potential of supply markets to maximize the value of the user's spending.

- The COVID-19 pandemic has affected the industry considerably. The subsequent fallout owing to the constrained materials with multiple suppliers unable to keep the plants operating at total capacity has primarily led to an unprecedented impact on the organizations' ability to meet their delivery commitments.

Sourcing Software Market Trends

Retail Industry to Hold Significant Share

- The digital transformation in the retail industry supply chain is anticipated to drive the retail sourcing and procurement market. Advancements in digital technologies are revamping supply chain management and are poised to change how procurement delivers value to retailers.

- Increasing online buying and prominent shifts in consumer purchasing patterns have shaped several industries in recent years. For instance, according to India Brand Equity Foundation, online retail penetration is expected to reach 10.7% by 2024, compared with 4.7% in 2019. Moreover, online shoppers in India are expected to reach 220 million by 2025.

- Further, according to Oberlo, in 2021, the number of digital buyers will be 2.14 billion, making 27.6% of the 7.74 billion people in the world. In other words, more than one out of every four people is an online shopper.

- With the rise of internet shopping and significant shifts in consumer buying patterns, different trends are shaping the retail industry in the last few years. According to Tidio, there are 9.1 million online retailers in the world. With aggressive competition, retailers struggle to maintain their inventory and find profitability to take a defensive position.

- Further, with the advent of digital technologies such as artificial intelligence (AI), blockchain, and robotics, there will be increased stock visibility for both vendors and retailers and greater transparency. Blockchain enables retailers to gain customer trust by maintaining sourcing data, chain-of-custody information, and supporting autonomous transactions.

Asia-Pacific to witness Significant Growth

- Sourcing software makes it easy to find suitable suppliers for business through efficient, easy-to-use, and intuitive sourcing tools. It enables coworkers to collaborate across offices and geographies to evaluate suppliers.

- The government in the region is taking initiatives to support the growth of software procurement, which will accelerate the need for the sourcing software market. In May 2022, Australia, India, Japan, and the USA revealed initiatives to strengthen collaboration on emerging technologies and cybersecurity. The nations agreed to set a standard for government software procurement, to improve information sharing among Computer Emergency Response Teams (CERT).

- Moreover, with the increase in demand for sourcing software, the market is witnessing several investments in advanced technologies and expansions by prominent industry players.

- In September 2022, Procurement management software Procol announced that it had raised Rs 51 crore in funding. The capital raised will build and enhance solutions for India's procurement problems through Procol's procurement software and B2B marketplace.

Sourcing Software Industry Overview

The global sourcing software market is moderately competitive. With the increase in the need for sourcing software and solutions, different vendors are forming strategic partnerships with various technology leaders to combine their products with the latest technologies or some automation in sourcing.

- January 2022 - Absolut chose GEP Software to transform its European source-to-contract process. Absolut, situated in Stockholm, will use GEP Software to enhance its sourcing, contract management, and supplier management across Europe. The firm also announced recent client projects with grocer Tesco and machinery manufacturer Netzsch. Tesco will utilize GEP Smart to handle its purchase-to-pay (PTP) process in the UK and Ireland, including requisitioning, ordering, supplier ASN, and invoice activities for non-resale products and services.

- October 2021 - Keelvar, a global provider of intelligent sourcing optimization and automation solutions, announced the addition of 11 new customers in the third quarter and even more expansion into global supply chain-driven organizations. This comes from the company's record-breaking growth in the first half of 2021.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Improving Supplier Discovery and Relationship Management

- 4.2.2 Growing Adoption of Advanced Retail Sourcing and Procurement Solutions

- 4.3 Market Challenges

- 4.3.1 Complexity Regarding Integration with Existing System and Supplier Onboarding

- 4.4 Industry Attractiveness-Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of Impact of COVID-19 on the Global Sourcing Software Market

5 RELEVANT USE CASES & CASE STUDIES

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Enterprise Size

- 6.2.1 Large Enterprise

- 6.2.2 Small and Medium Enterprises

- 6.3 By End-user Industry

- 6.3.1 Retail

- 6.3.2 Manufacturing

- 6.3.3 Transportation and Logistics

- 6.3.4 Healthcare

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle Corporation

- 7.1.2 Coupa Software Inc.

- 7.1.3 GEP Corporation

- 7.1.4 Aavenir

- 7.1.5 Workday Inc.

- 7.1.6 Jaggaer Inc.

- 7.1.7 Corcentric Inc.

- 7.1.8 Ivalua Inc.

- 7.1.9 Promena

- 7.1.10 Zycus Inc.