|

市场调查报告书

商品编码

1433868

即时支付 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Real-Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

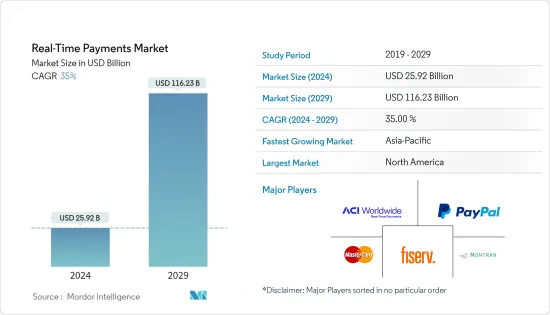

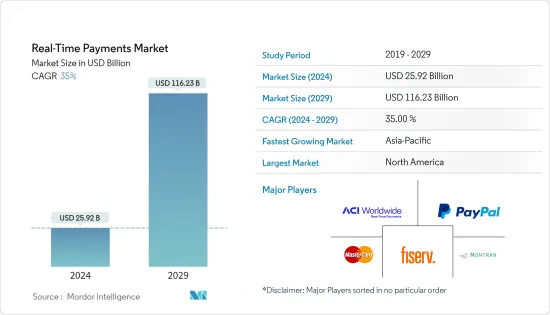

即时支付市场规模预计到 2024 年为 259.2 亿美元,预计到 2029 年将达到 1162.3 亿美元,在预测期内(2024-2029 年)CAGR为 35%。

即时支付通常集中在低价值零售支付系统(RPS);它们不同于即时全额结算系统(RTGS)和分散式帐本支付系统。除了满足需求和期望之外,即时支付还引起了监管机构、竞争主管机构和支付服务提供者的兴趣。监管机构认为,即时支付将扩大银行服务范围、支持经济成长、提供 Visa/Mastercard 网路的替代方案并减少现金和支票的使用。

主要亮点

- 全球即时支付 (RTP) 生态系统快速成长,企业和政府意识到实施更快、更有效率的支付系统的好处。根据ACI Worldwide 2023年3月的报告,目前六大洲70多个国家支持即时支付,今年交易额达1,950亿美元,较去年同期成长63%。

- 智慧型设备的日益普及和全球线上零售商务的蓬勃发展正在推动即时支付的快速采用。当需要向商家、帐单商、同业和其他人付款时,越来越多挑剔的消费者开始使用智慧型手机。

- 金融科技领域越来越注重使用先进技术和新业务模式,例如使用行动应用程式的开放 API 支援的即时支付系统,促进了市场成长。根据 Finastra 去年的一项研究,Baas(银行即服务)预计在未来三年内成长 25%,为系统中嵌入的用户提供各种功能,如即时支付、零售银行业务等,市场上86% 的参与者计划采用开放API 来启用可用的银行功能。

- COVID-19 大流行导致全球数位支付的使用增加。根据 2021 年全球 Findex 资料库,在中低收入经济体(不包括中国),超过 40% 使用银行卡、电话或网路进行店内或线上支付的成年人是为了自 COVID-19 爆发以来首次。

- 然而,随着即时支付的广泛采用,诈欺风险显着增加。对于大多数付款类型,客户都可以在处理之前撤回错误的付款。然而,即时支付在几秒钟内完成,且不可撤销,付款人无法取消交易。这些因素增加了打击即时支付诈欺的挑战。

即时支付市场趋势

P2B细分市场是推动市场的关键

- P2B 支付是指企业与顾客之间(往来)的货币交易。行动交易和电子商务的强劲成长是推动该领域发展的关键因素。

- 线上购物和电子商务销售的持续成长预计将推动该领域的发展。 P2B 支付使企业能够提高客户满意度。 P2B结构随着监管改革的变化而加快步伐。线上和店内帐单支付预计将带来下一波大额支付,以保持即时成本比卡片更便宜。

- 此外,成本较低的 P2B 交易为企业提供了新水准的现金管理,这些企业可以从即时流动性中受益,因为即时结算以及与交易状态即时通知相关的消费者服务水准的提高。

- 在零工经济中,劳动市场的特征是暂时的。构成(准时劳动力)的工作范例包括送餐服务、叫车服务(例如 Uber 或 Bolt)、家庭保母和遛狗者。即时支付使零工经济工人受益匪浅,因为工人的工资很快就能得到,使他们能够更好地规划自己的财务,而不必担心与现金相关的交易。

- 基于云端的即时支付解决方案的成长趋势可归因于它们为零售商提供即时支付洞察的灵活性。全球大型零售商店越来越多地采用数位支付方式,预计将在预测期内推动市场发展。

亚太地区将成为成长最快的市场

- 对新兴国家的即时交易成长预测将是将市场提升到新水平的关键,印度等国家将领先并超越已开发国家。世界各地启用即时方案的政府正在透过为企业和消费者提供更快、更便宜、更有效率的支付方式来推动繁荣和经济成长。

- 联合支付介面 (UPI) 改变了印度人的支付方式,使他们能够快速地将资金从一个银行帐户即时转移到另一个银行帐户:从客户到企业或个人之间。根据万事达卡 2022 年新支付指数,印度消费者是亚太地区消费者中最愿意使用新兴无现金支付方式的消费者,93% 的人可能在前一年进行过此类支付。

- 根据 CEBR 的数据,印度在全球企业中即时支付量最高,去年全年所有此类支付中超过 40% 源自该国。印度去年进行了 486 亿笔即时支付,大约是中国的 2.6 倍,中国以 185 亿笔即时交易位居第二。

- 根据CEBR的数据,中国即时支付为企业和消费者带来的净收益达到153.97亿美元,即时交易占全部交易的5.7%。根据中国目前的即时采用水平,即时支付透过缩短浮动时间,去年每天的交易总额达到1708.00亿美元。该营运资金在同年促进了约 124.11 亿美元的业务产出。

- 根据 CEBR 的数据,去年香港的即时支付份额为 7.3%,预计将增加两倍(到 2026 年将达到 22.8%)。强烈预测即时支付将使消费者和企业收益在 2026 年达到 2.6 亿美元。去年使用即时支付的宏观经济效益估计为经济产出 3.4 亿美元(占正式 GDP 的 0.09%) ,相当于3,355名工人的产出。

即时支付行业概览

即时支付市场的竞争程度较高,因为该市场由许多大型供应商组成,除了拥有完善的分销网络外,这些供应商还占据显着的市场份额。随着消费者偏好的快速变化,即时支付市场已成为利润丰厚的选择,因此吸引了巨额投资。服务提供者正在建立合作伙伴关係以促进产品创新。市场上一些知名的供应商包括 ACI Worldwide Inc.、Fiserv Inc.、Paypal Holdings Inc. 和 Mastercard Inc.。

2022 年6 月,ACI Worldwide 宣布推出全新行动互动平台ACI Smart Engage,使世界各地的商家能够利用语音、位置和影像辨识技术直接向消费者的智慧型手机提供服务和商品库存,从而实现线上购物。迈上新台阶。

此外,2022 年 4 月,Fiserv 为金融机构推出了 Appmarket,金融机构可以在其中存取一套精选的金融科技解决方案,帮助他们更有效率地运作、吸引新客户并更有效地竞争。 AppMarket 将为 Fiserv 金融机构客户提供支持,并解决新兴的零工经济银行和加密金融机会、中小企业 (SMB) 贷款和其他优先事项。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争激烈程度

- 评估 COVID-19 对市场的影响

第 5 章:市场动态

- 市场驱动因素

- 智慧型手机普及率提高

- 轻鬆便利

- 对传统银行业务的依赖下降

- 市场挑战

- 付款诈欺

- 现有对现金的依赖

- 市场机会

- 鼓励使用数位支付的政府政策预计将有助于即时支付方式的成长

- 数位支付产业的主要法规和标准

- 主要案例研究和用例分析

- 对实际支付交易占所有交易的份额进行分析,并按交易量对主要国家进行区域细分

- 实际支付交易占非现金交易的比例分析,并按交易量对主要国家进行区域细分

第 6 章:市场细分

- 按付款方式

- 对等

- 点对点

- 按地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 西班牙

- 瑞典

- 芬兰

- 欧洲其他地区

- 亚太

- 中国

- 印度

- 韩国

- 泰国

- 日本

- 亚太其他地区

- 拉丁美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 中东和非洲其他地区

- 北美洲

第 7 章:竞争格局

- 公司简介

- ACI Worldwide Inc.

- Fiserv Inc.

- Paypal Holdings Inc.

- Mastercard Inc.

- Montran Corporation

- Temenos AG

- Volante Technologies Inc.

- Wirecard AG

- FIS Global

- Visa Inc.

- Finastra

第 8 章:投资分析

第 9 章:市场的未来

The Real-Time Payments Market size is estimated at USD 25.92 billion in 2024, and is expected to reach USD 116.23 billion by 2029, growing at a CAGR of 35% during the forecast period (2024-2029).

Real-time payments typically focus on low-value retail payment systems (RPS); they differ from real-time gross settlement systems (RTGS) and distributed ledger payment systems. In addition to meeting the demands and expectations, real-time payments have generated interest from regulators, competition authorities, and payment service providers. Regulators believe that instant payments will expand access to banking services, support economic growth, provide alternatives to Visa/Mastercard networks and reduce the use of cash and cheques.

Key Highlights

- There is rapid growth in the global Real-Time Payment (RTP) ecosystem, with businesses and governments realizing the benefits of implementing faster, more efficient payment systems. Currently, over 70 countries on six continents support real-time payments, with USD 195 billion in transaction volume this year, presenting a year-on-year growth of 63%, according to ACI Worldwide's March 2023 report.

- The growing penetration of smart devices and booming online retail commerce across the world are driving the rapid adoption of real-time payments. Increasingly, demanding consumers are turning to their smartphones when they need to pay merchants, billers, peers, and others.

- The increasing focus on using advanced technologies and new business models in the Fintech sector, like open API-enabled real-time payment systems using mobile applications, has contributed to market growth. As per a study by Finastra last year, Baas (Banking as a Service) is expected to grow by 25% over the next three years, providing various features to users embedded in the system like real-time payment, retail banking, etc., and 86% players in the market are planning to adopt open APIs to enable available banking capabilities.

- The COVID-19 pandemic resulted in increased use of digital payments across the world. According to the Global Findex Database 2021, in low and middle-income economies (excluding China), more than 40% of adults who made merchant in-store or online payments by using a card, phone, or through the internet did so for the first time since the start of COVID-19.

- However, with real-time payments gaining widespread adoption, there is a significant increase in the risk of fraud. With most payment types, a customer has the ability to recall a payment made in error before it is processed. However, an instant payment is completed in a few seconds, and as it is irrevocable, the payer cannot cancel the transaction. Such factors increase the challenges in combating fraud in the case of real-time payments.

Real Time Payments Market Trends

P2B Segment Holds the Key to Drive the Market

- P2B payments refer to monetary transactions between (to or from) businesses and customers. The unabated growth of mobile-based transactions and e-commerce is a key factor driving the development of the segment.

- The continuous growth of online shopping and e-commerce sales is expected to drive the development of the segment. P2B payments allow businesses to improve customer satisfaction. The P2B structure has been picking up the pace with the change in regulatory reforms. Online and in-store bill payments promise the next wave of huge volumes needed to keep real-time costs cheaper than cards.

- Also, lower-cost P2B transactions offer a new level of cash management to businesses that can benefit from real-time liquidity owing to instant settlement along with the added level of service to the consumer related to the instant notification of the status of the transaction.

- In the gig economy, the labor markets are characterized temporarily. Examples of jobs that comprise the (just-in-time workforce) include food delivery services, ride-hailing services (such as Uber or Bolt), house sitters, and dog walkers. Real-time payments make it big and beneficial to gig economy workers because workers are paid quickly, allowing them to better plan their finances without worrying about cash-related transactions.

- The increasing trends for cloud-based real-time payment solutions can be attributed to their flexibility in providing real-time payment insights to retailers. The growing adoption of digital payment methods in big retail stores across the globe is anticipated to drive the market in the forecasted period.

Asia Pacific will be the Fastest Growing Market

- Real-time transaction growth forecasts for emerging countries will be the key to taking the market to a new level, with countries like India leading and outpacing developed nations. Governments around the world that enable real-time schemes are driving prosperity and economic growth by providing businesses and consumers with faster, cheaper, and more efficient payment methods.

- United Payments Interface (UPI) has transformed how Indians make payments, allowing them to quickly transfer money instantly from one bank account to another: from a customer to a business or between individuals. According to Mastercard's 2022 New Payments Index, Indians are the most willing of any consumers in the Asia-Pacific region to use emerging cashless payment methods, with 93% likely to have made such a payment in the previous year.

- As per the CEBR, India accounted for the highest volume of real-time payments among businesses globally, with over 40% of all such payments made throughout last year originating in the country. India made 48.6 billion real-time payments last year, which was around 2.6 times higher than China, which was in second place with 18.5 billion real-time transactions.

- According to the CEBR, net benefits for businesses and consumers of real-time payments hit USD 15.397 billion in China, supported by real-time accounting for 5.7% of all transactions. Based on current real-time adoption levels in China, instant payments unlocked a total transaction value of USD 170.800 billion per day last year through a reduced float time. This working capital facilitated an estimated USD 12.411 billion in business output in the same year.

- In Hong Kong, real-time payments share was recorded at 7.3% last year, which is estimated to triple (22.8% by 2026), as per CEBR. The strongly predicted real-time uptake will result in consumer and business benefits reaching USD .26 billion in 2026. The macroeconomic benefits of using real-time payments were an estimated USD .34 billion of economic output (0.09% of formal GDP) last year, equivalent to the output of 3,355 workers.

Real Time Payments Industry Overview

The competitive rivalry in the Real-Time Payments Market is moderately high, as the market comprises many large vendors that command a prominent market share besides having access to well-established distribution networks. With consumer preferences changing rapidly, the Real-Time Payments Market has become a lucrative option and, thus, has attracted huge investments. The service providers are engaging in partnerships to promote product innovation. Some of the prominent vendors in the market include ACI Worldwide Inc., Fiserv Inc., Paypal Holdings Inc., and Mastercard Inc.

In June 2022, ACI Worldwide announced its new mobile engagement platform ACI Smart Engage, enabling merchants worldwide to serve up their inventory of services and goods directly to consumers' smartphones using voice, location, and image recognition technology, taking shopping-on-the-go to a new level.

Furthermore, in April 2022, Fiserv launched Appmarket for financial institutions, where they can access a curated set of fintech solutions to help them operate more efficiently, reach new customers, and compete more effectively. AppMarket would empower Fiserv financial institution clients and address emerging gig economy banking and crypto finance opportunities, small and mid-size business (SMB) lending and other priorities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Smartphone Penetration

- 5.1.2 Ease of Convenience

- 5.1.3 Falling Reliance on Traditional Banking

- 5.2 Market Challenges

- 5.2.1 Payment Fraud

- 5.2.2 Existing Dependence on Cash

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Usage of Digital Payment is Expected to Aid the Growth of Real-Time Payment Methods

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.5 Analysis of Major Case Studies and Use-cases

- 5.6 Analysis of Real Payments Transactions as a Share of all Transactions with a Regional Breakdown of Key Countries by Transaction Volume

- 5.7 Analysis of Real Payments Transactions as a Share of Non-Cash Transactions with a Regional Breakdown of Key Countries by Transaction Volume

6 MARKET SEGMENTATION

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 Spain

- 6.2.2.4 Sweden

- 6.2.2.5 Finland

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 South Korea

- 6.2.3.4 Thailand

- 6.2.3.5 Japan

- 6.2.3.6 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Colombia

- 6.2.4.4 Mexico

- 6.2.4.5 Rest of Latin America

- 6.2.5 Middle-East and Africa

- 6.2.5.1 United Arab Emirates

- 6.2.5.2 South Africa

- 6.2.5.3 Nigeria

- 6.2.5.4 Rest of Middle-East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ACI Worldwide Inc.

- 7.1.2 Fiserv Inc.

- 7.1.3 Paypal Holdings Inc.

- 7.1.4 Mastercard Inc.

- 7.1.5 Montran Corporation

- 7.1.6 Temenos AG

- 7.1.7 Volante Technologies Inc.

- 7.1.8 Wirecard AG

- 7.1.9 FIS Global

- 7.1.10 Visa Inc.

- 7.1.11 Finastra