|

市场调查报告书

商品编码

1642111

硬体即服务 (HaaS):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Hardware-as-a-Service (HaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

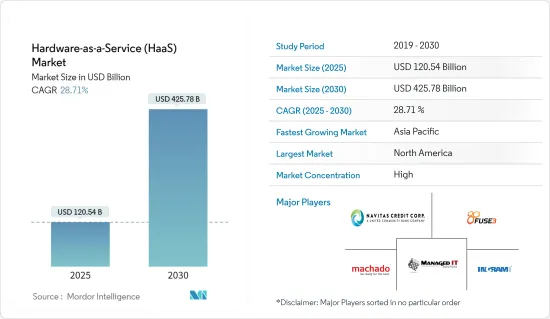

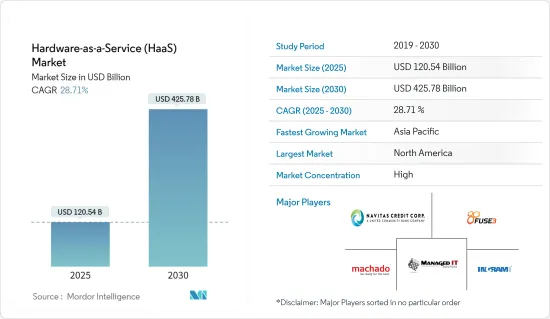

硬体即服务 (HaaS) 市场规模预计在 2025 年为 1,205.4 亿美元,预计到 2030 年将达到 4,257.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 28.71%。

影响硬体即服务 (HaaS) 市场成长的一些关键因素包括:引入新 IT 解决方案的需求不断增长、数位化的进步、小型、中型和大型企业对硬体即服务 (HaaS) 硬体和服务的投资不断增加、技术进步和产品创新以及云端基础设施负载不断增加。

主要亮点

- 哈斯模式之所以受欢迎,是因为公司在竞争激烈的市场中寻求新的方式为客户提供服务,从而获取技术,且不会对其财务运营造成压力。对于不断维修和升级设备的公司来说,Haas 方法更具成本效益。该服务提供经济实惠的託管解决方案,并将维护和支援作为租赁协议的一部分。在客户处安装硬体由客户和託管服务提供者 (MSP) 商定,客户每月支付服务费。

- 随着云端平台变得越来越流行,硬体即服务 (HaaS) 市场预计将成长。硬体即服务 (HaaS) 解决方案也适合中小型企业,因为它们非常实惠。因此,预计它将促进全球硬体即服务 (HaaS) 领域的扩张。

- 按需服务(XaaS)正在多个行业取代所有权。云端处理服务也吸引了对该研究领域的投资,因为资料储存伺服器和主动运算设备构成了向消费者远端提供的服务。

- 采用硬体即服务 (HaaS) 模式的一个根本障碍以及其扩展的限制因素是缺乏对硬体即服务 (HaaS) 方法所提供的好处的了解。印度、中国、巴西和印尼等开发中国家的企业不太可能采用这种服务模式,因为他们不知道这样做的好处,例如降低更新、维护和更换硬体的成本。

- 由于新冠疫情爆发,服务业尤其接受了在家工作的文化。这导致租赁笔记型电脑的需求激增,主要是各种类型的笔记型电脑。然而,由于供应链和生产活动完全中断,硬体组件的供需出现巨大不匹配,产生了市场额外需求。硬体即服务 (HaaS) 预计将在未来几季成为常态,因为它降低了在发生 COVID-19 疫情等不可预见的事件时业务彻底停止的风险。

硬体即服务 (HaaS) 市场趋势

零售/批发部门占据最大的市场份额

- 硬体即服务 (HaaS) 的采用因行业而异。在所有组织中,零售/批发组织发现更大程度地采用硬体即服务(HaaS)模式,其次是教育和金融服务业。零售和批发企业在全球拥有数百甚至数千家商店,这使得内部 IT 团队难以为偏远地区提供服务。

- Spiceworks 对来自北美和欧洲组织的 1,100 多名 IT 决策者进行了调查,以了解硬体即服务模式在职场的流行程度。调查发现,大约 31% 的零售/批发公司已经在使用硬体即服务 (HaaS) 模式(针对一台或多台装置)。此外,其余 7% 的零售商计划在未来两年内采用硬体即服务 (HaaS)。零件更换、硬体支援和故障排除是此模式下最常用的服务。

- 在疫情期间,零售业在许多国家被视为必不可少的业务,即使在其他行业被迫关闭的情况下,零售业仍被允许继续营业。由于零售商、批发商、超级市场和百货公司对大量硬体系统的需求不断增长,预计该行业将占据重要地位。

- 零售业近年来获得了大量的投资和发展。零售科技公司为零售业提供数位分类帐、库存管理、付款解决方案以及物流和履约工具等服务,推动对硬体即服务 (HaaS) 产品的需求。

亚太地区的需求预计将推动成长

- 亚洲拥有一些成长最快的经济体,其中包括印度和中国。由于 IT 和通讯业拥有大量劳动力,预计许多公司将增加对硬体即服务 (HaaS) 模式的需求。

- 此外,预计在预测期内,生命科学和零售组织、中小型企业数量的增加以及硬体即服务 (HaaS) 意识的提高将推动市场的发展。

- 预计亚太地区将在预测期内实现最高成长率,因为中国大陆、台湾、韩国、印度和日本拥有大量中小型企业,而硬体即服务 (HaaS) 模式是最佳利用资讯科技硬体的一种经济有效的方法。此外,该地区在硬体市场上拥有几家重要的供应商,从而推动了对硬体即服务 (HaaS) 的需求。

- 硬体即服务(HaaS)透过实现硬体和软体的及时升级和维护来减轻企业的IT负担。

- IT 和通讯业引入硬体即服务 (HaaS),使企业能够透过以合理的价格租用硬体、减少停机时间以及提供安全性和软体服务来妥善管理设备,从而减少 IT 预算。

硬体即服务 (HaaS) 产业概览

目前,硬体即服务 (HaaS) 市场由少数产品主导,全球市场预计将整合。受访的主要企业包括 Navitas Lease Corporation、FUSE3 Communications、Ingram Micro Inc.、Design Data Systems Inc.、Phoenix NAP LLC、Machado Consulting、Managed IT Solutions、富士通有限公司、联想集团有限公司、亚马逊公司和戴尔公司。谷歌、IBM 和微软等产业科技巨头也正在与新兴企业合作提供这些服务,以在这个即服务市场上竞争。

2022年9月,英迈国际(Ingram Micro Inc.)报告称,其数位体验平台生态系统已在美国和德国两个主要市场按计划启动,并确认世界其他地区的「上运作」时间表为2023年初。与会者看到了 Xvantage 技术的实际应用,并了解到 Xvantage 目前正在拉丁美洲进行初步部署。

2022 年 4 月,Ingram Micro India 与 Digitate 签订了分销协议。 Digitate 的 Ignio 支援从传统 IT 营运到自主 IT 营运的转变,提供更好的业务成果、弹性、提高灵活性和改善客户服务。 Ingram Micro India 将提供整个 Digitate 产品组合,为端到端自主企业提供支持,该企业利用尖端的机器学习 (ML) 和人工智慧 (AI) 功能为 IT 营运提供情境智慧。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响评估

- 市场驱动因素

- 扩大云端平台的采用

- 吸引更多投资

- 市场挑战

- 缺乏对硬体即服务 (HaaS) 模式优势的认识

第五章 市场区隔

- 按服务

- 硬体模型

- Platform-as-a-Service

- Desktop/PC-as-a-Service

- Infrastructure-as-a-Service

- Device-as-a-Service

- 专业服务

- 硬体模型

- 按最终用户产业

- 零售/批发

- 教育

- BFSI

- 製造业

- 卫生保健

- 资讯科技/通讯

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 世界其他地区

- 北美洲

第六章 竞争格局

- 公司简介

- Navitas Lease Corporation

- FUSE3 Communications

- Ingram Micro Inc.

- Design Data Systems, Inc.

- Phoenix NAP, LLC

- Machado Consulting

- Managed IT Solutions

- Fujitsu Ltd.

- Lenovo Group Ltd.

- Dell Inc.

- Microsoft Corporation

第七章投资分析

第八章 市场机会与未来趋势

The Hardware-as-a-Service Market size is estimated at USD 120.54 billion in 2025, and is expected to reach USD 425.78 billion by 2030, at a CAGR of 28.71% during the forecast period (2025-2030).

The increasing need to adopt new IT solutions, increased digitization, increasing investment of small and large-scale enterprises in HaaS hardware and services, technical advancements and product innovation, and increasing load on cloud infrastructure are significant factors influencing the growth of the HaaS market.

Key Highlights

- The Haas model is becoming popular for companies searching for new ways to service clients in a cutthroat market to acquire technology with little strain on their financial operations. The Haas approach is more cost-effective when it comes to firms that constantly repair or upgrade their gear. This service offers inexpensive managed solutions and includes maintenance and support as part of the leasing agreement. The hardware installation at the customer's location is agreed upon between the client and managed service provider (MSP), for which the client either pays a monthly charge for the service.

- The hardware as a service (HaaS) market is anticipated to develop as cloud platform penetration increases. The solutions are highly affordable, making them appropriate for small businesses. As a result, it will aid in expanding the worldwide HaaS (hardware as a service) sector.

- On-demand services (XaaS) are replacing ownership in several industries. As data storage servers and active computing gear make up a remotely provided service for consumers, cloud computing services also draw more investment in the sector under study.

- A fundamental barrier to the adoption of the HaaS model and a constraint on its expansion is a lack of understanding of the advantages provided by the hardware-as-a-service approach. As they are unaware of the advantages like lowering the cost of updating, maintaining, and replacing hardware, businesses in developing nations like India, China, Brazil, and Indonesia are less likely to adopt this service model.

- With the outbreak of COVID-19, service firms, particularly, have embraced the work-from-home culture. This has led to a spike in demand for laptops, mainly leased ones of every kind. But, with the complete disruption of the supply chain and production activities, there is a massive mismatch between the demand and supply of hardware components and a need for more in the market. With the situation normal in the coming few quarters, HaaS is expected to grow as it mitigates the risk of a complete business shutdown during unforeseen circumstances like the Covid-19 pandemic.

Hardware as-a Service Market Trends

Retail/Wholesale Sector Holds Largest Share in the Market

- The adoption of HaaS varies from industry to industry. Among all organizations, retail/wholesale organizations are found to have adopted the HaaS model to a more significant extent, followed by Education and Financial services sector. Retail/wholesale organizations have hundreds or thousands of stores spread worldwide, making it difficult for internal IT teams to service more remote areas.

- Spiceworks surveyed more than 1,100 IT decision-makers in organizations across North America and Europe to understand the penetration of the hardware-as-service model in the workplace. The survey showed that around 31% of retail/wholesale organizations already use the HaaS model (one or more types of devices). An additional 7% of the remaining retail businesses plan to adopt HaaS within the next two years. Part replacement, hardware support, and troubleshooting are some of this model's most commonly used services.

- During the pandemic, the retail sector was one of the deemed essential businesses in many countries that were allowed to stay open when other industries had to shut their doors. Due to the growing need for numerous hardware systems among retailers, wholesalers, supermarkets, and department stores, this industry is predicted to hold a significant position.

- The retail sector has seen a lot of investments and developments recently. Retail tech companies supporting the retail industry with services such as digital ledgers, inventory management, payments solutions, and logistics and fulfillment tools enhance the need for HaaS services.

Demand from Asia-Pacific is expected to Drive the Growth

- Asia is home to some of the fastest-growing economies, such as India and China. A large IT and Telecommunication industry workforce and many enterprises are expected to boost the demand for the hardware-as-a-service model.

- Furthermore, several life sciences and retail organizations, the rising number of small and medium-sized enterprises, and the increasing awareness of HaaS are expected to drive the market over the forecast period.

- With many small or mid-sized businesses in China, Taiwan, South Korea, India, and Japan, the Asia-Pacific region is expected to experience the highest growth rate during the forecast period since the HaaS model is a cost-effective method for optimal utilization of information technology hardware. Moreover, the region enjoys the presence of several significant vendors in the hardware market, thus driving the demand for HaaS.

- Hardware-as-a-service enables timely upgrade and maintenance of hardware and software, allowing companies to reduce IT burdens; moreover, it helps avoid technological obsolescence, ultimately enhancing productivity.

- Implementing hardware-as-a-service in the IT and telecommunication industries helps companies reduce IT budgets by providing reasonable rates for renting hardware, decreasing downtime, and adequately managing devices by giving security and software services.

Hardware as-a Service Industry Overview

Few players with their product offerings currently dominate the HaaS market, and the global market is expected to be consolidated. Navitas Lease Corporation, FUSE3 Communications, Ingram Micro Inc., Design Data Systems Inc., Phoenix NAP LLC, Machado Consulting, Managed IT Solutions, Fujitsu Ltd, Lenovo Group Ltd, Amazon.com Inc., and Dell Inc. are some of the major players present in the market studied. Industry tech giants such as Google, IBM, and Microsoft also offer these services collaborating with startups to compete in this as-a-service market.

In September 2022, Ingram Micro Inc. reported that its digital experience platform ecosystem has launched on schedule in its two major markets, the United States and Germany, and it confirmed that the global "go live" schedule for the rest of the globe is early 2023. Participants saw the technology in use and learned that the Xvantage initial deployment is now taking place across Latin America.

In April 2022, Ingram Micro India won the distribution agreement with Digitate. Ignio from Digitate supports the transition from traditional IT operations to autonomous IT operations, providing better business outcomes, increased resilience, agility, and greater customer service. To assist end-to-end autonomous enterprises that leverage cutting-edge Machine Learning (ML) and Artificial Intelligence (AI) capabilities to deliver contextual intelligence to IT operations, Ingram Micro India will offer Digitate's whole portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Assessment of the impact of COVID-19 on the Market

- 4.6 Market Drivers

- 4.6.1 Growing Deployment of Cloud Platform

- 4.6.2 Increase attraction of Investments

- 4.7 Market Challenges

- 4.7.1 Lack of Awareness of benefits from HaaS Model

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Hardware Model

- 5.1.1.1 Platform-as-a-Service

- 5.1.1.2 Desktop/PC-as-a-Service

- 5.1.1.3 Infrastructure-as-a-Service

- 5.1.1.4 Device-as-a-Service

- 5.1.2 Professional Services

- 5.1.1 Hardware Model

- 5.2 By End-User Industry

- 5.2.1 Retail/Wholesale

- 5.2.2 Education

- 5.2.3 BFSI

- 5.2.4 Manufacturing

- 5.2.5 Healthcare

- 5.2.6 IT and Telecommunication

- 5.2.7 Other End-User Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Navitas Lease Corporation

- 6.1.2 FUSE3 Communications

- 6.1.3 Ingram Micro Inc.

- 6.1.4 Design Data Systems, Inc.

- 6.1.5 Phoenix NAP, LLC

- 6.1.6 Machado Consulting

- 6.1.7 Managed IT Solutions

- 6.1.8 Fujitsu Ltd.

- 6.1.9 Lenovo Group Ltd.

- 6.1.10 Dell Inc.

- 6.1.11 Microsoft Corporation